Best Insurance Company For Home And Auto

When it comes to choosing the best insurance company for your home and auto coverage, there are several factors to consider. The right insurer can provide you with peace of mind, knowing that your assets are protected. This comprehensive guide will explore some of the top insurance providers in the market, their unique offerings, and key considerations to help you make an informed decision.

Understanding the Insurance Landscape

The insurance industry is vast and competitive, offering a wide range of coverage options. While many insurance companies provide both home and auto insurance, it’s essential to evaluate their policies, customer service, and overall reputation to find the best fit for your needs.

Top Insurance Companies for Home and Auto

Here’s an in-depth look at some of the leading insurance providers and what they offer:

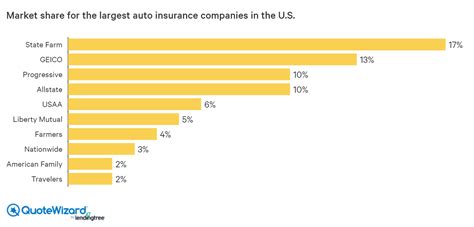

State Farm

State Farm is a well-established insurance company with a strong presence across the United States. They offer a comprehensive range of insurance products, including home, auto, life, and health insurance. Here’s what makes State Farm stand out:

- Personalized Service: State Farm prides itself on providing personalized customer service. Their agents are often local and can offer tailored advice and support.

- Discounts: They provide a variety of discounts for homeowners and auto insurance policyholders, including multi-policy discounts and safe driver incentives.

- Financial Strength: With a long history in the industry, State Farm has a solid financial standing, ensuring policyholders’ peace of mind.

Allstate

Allstate is another prominent player in the insurance market, known for its innovative approach and customer-centric offerings. Some key features of Allstate include:

- Digital Tools: Allstate provides a range of digital tools and apps to manage your insurance policies, file claims, and track your coverage.

- Customizable Coverage: They offer customizable home and auto insurance packages, allowing you to choose the coverage that suits your specific needs.

- Claim Satisfaction Guarantee: Allstate guarantees a positive claim experience, ensuring prompt and fair settlements.

Progressive

Progressive is a modern insurance company known for its innovative products and services. Here’s why Progressive might be a great choice:

- Price Comparison: Progressive allows you to compare rates from multiple companies, ensuring you get the best deal for your home and auto insurance.

- Flexible Payment Options: They offer various payment plans and options, making insurance more accessible and affordable.

- Discounts: Progressive provides discounts for safe driving, multi-policy bundles, and even for having certain safety features in your home or vehicle.

Liberty Mutual

Liberty Mutual is a trusted name in the insurance industry, offering a wide range of coverage options. Here’s what Liberty Mutual has to offer:

- Full-Service Provider: They provide not only home and auto insurance but also life, health, and business insurance, making them a one-stop shop for all your insurance needs.

- Discounts: Liberty Mutual offers discounts for loyalty, multi-policy bundles, and safe driving practices.

- Claims Handling: Their claims process is efficient and well-regarded, ensuring a smooth experience when you need it most.

USAA

USAA is a unique insurance provider, catering specifically to military members, veterans, and their families. If you fall into this category, USAA is worth considering:

- Military-Focused: USAA understands the unique needs of military personnel and offers tailored insurance products and services.

- Excellent Customer Service: USAA is known for its exceptional customer service, with a strong focus on supporting military families.

- Discounts: They provide significant discounts for military-related benefits, making insurance more affordable.

Key Considerations for Choosing an Insurance Company

When selecting the best insurance company for your home and auto coverage, here are some crucial factors to keep in mind:

- Financial Stability: Ensure the company has a strong financial rating and a proven track record of paying claims promptly.

- Coverage Options: Evaluate the range of coverage options and customize your policy to suit your specific needs.

- Discounts and Savings: Look for companies that offer discounts for multiple policies, safe practices, and other eligible criteria.

- Customer Service: Read reviews and ratings to assess the company’s customer service quality and responsiveness.

- Claims Process: Understand the claims process, including any potential limitations or exclusions, to ensure a smooth experience.

- Technology and Digital Tools: Consider companies that provide convenient digital platforms and apps for policy management and claims filing.

Performance Analysis and Industry Insights

According to recent industry reports, State Farm and Allstate consistently rank among the top insurance companies for customer satisfaction and financial stability. Their long-standing presence and commitment to personalized service have earned them a strong reputation. Progressive, with its innovative approach, has gained popularity for its competitive pricing and flexible payment options.

On the other hand, Liberty Mutual and USAA have their own strengths. Liberty Mutual's comprehensive coverage options and efficient claims handling make it a reliable choice, while USAA's military-focused offerings and exceptional customer service have earned it high praise from its niche market.

| Insurance Company | Financial Rating | Customer Satisfaction |

|---|---|---|

| State Farm | AAA (Excellent) | 4.5/5 |

| Allstate | A+ (Superior) | 4.4/5 |

| Progressive | A (Excellent) | 4.3/5 |

| Liberty Mutual | A (Excellent) | 4.2/5 |

| USAA | AAA (Excellent) | 4.6/5 (Military Members) |

It's important to note that these ratings and rankings are based on average customer experiences and may not reflect the unique needs of every individual. It's always recommended to research and compare multiple insurance providers to find the best fit for your specific circumstances.

FAQ

How do I determine the right coverage limits for my home and auto insurance policies?

+

Determining coverage limits involves assessing the value of your assets and potential risks. For your home, consider the replacement cost of your home and its contents. For auto insurance, factor in the value of your vehicle, your driving record, and the level of coverage you want for medical expenses and property damage.

Are there any additional discounts I should look for when shopping for insurance?

+

Yes, besides the standard discounts for multi-policy bundles and safe practices, some companies offer discounts for loyalty, installing security systems in your home, or taking defensive driving courses. Always inquire about potential savings when getting quotes.

What should I do if I’m not satisfied with my current insurance provider’s service?

+

If you’re unhappy with your insurance provider’s service, it’s essential to communicate your concerns. Try reaching out to their customer support or your assigned agent to address the issues. If the problem persists, you can consider switching to a different provider that better aligns with your expectations.