Types Of Insurance Policy

Insurance policies are a fundamental aspect of financial planning and risk management, offering individuals and businesses a safety net against unforeseen circumstances. With a myriad of options available, understanding the different types of insurance policies is crucial to make informed decisions and secure the right coverage for your needs. This article will delve into the diverse world of insurance, exploring the key categories, their specific features, and real-world examples to help you navigate the complex landscape of insurance products.

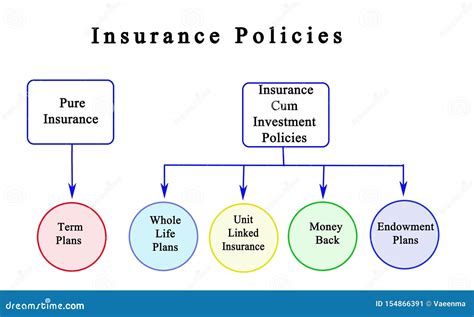

Life Insurance Policies

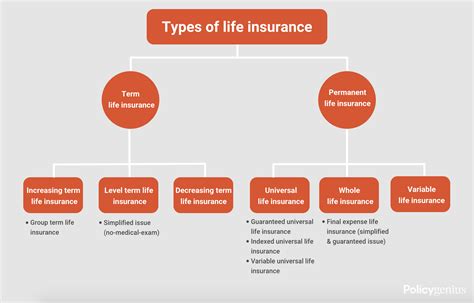

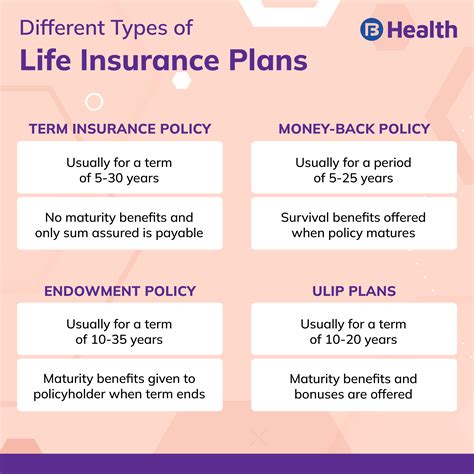

Life insurance policies are designed to provide financial protection to your loved ones in the event of your untimely demise. These policies offer a lump-sum payment, known as the death benefit, to your beneficiaries, helping them cope with the financial burden that may arise after your passing. Life insurance comes in two primary forms: term life insurance and permanent life insurance, each with distinct features and benefits.

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It is a straightforward and affordable option, ideal for individuals seeking temporary coverage during key life stages, such as raising a family or paying off a mortgage. The policy pays out the death benefit only if the insured individual passes away during the term of the policy. One of the notable advantages of term life insurance is its flexibility, as you can easily adjust the coverage amount and term to suit your changing needs over time.

For instance, consider a young couple with two children. They opt for a 20-year term life insurance policy, with a coverage amount of $1 million. This policy ensures that, should either parent pass away during this period, the surviving spouse will receive the death benefit, which can be used to cover funeral expenses, pay off debts, and provide for the children's education and overall well-being.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the insured individual’s entire life, offering a more comprehensive and long-term solution. This type of policy typically includes a savings or investment component, known as a cash value, which grows over time and can be accessed by the policyholder through loans or withdrawals. Permanent life insurance includes whole life insurance, universal life insurance, and variable life insurance.

Whole life insurance is a classic form of permanent coverage, featuring a fixed premium and guaranteed death benefit. The policy builds cash value over time, which can be used to cover the cost of premiums or accessed for various financial needs. Universal life insurance, on the other hand, offers more flexibility in terms of premium payments and death benefit amounts, allowing policyholders to adjust their coverage based on their changing financial circumstances.

A real-life example of the benefits of permanent life insurance can be seen in the story of Mr. Johnson, a successful businessman who purchased a whole life insurance policy when he started his family. Over the years, the cash value of his policy grew significantly, providing him with a substantial financial buffer in his retirement years. Additionally, the death benefit ensured that his family would be well taken care of should he pass away unexpectedly.

Health Insurance Policies

Health insurance policies are essential for protecting individuals and families from the financial strain of medical expenses. These policies cover a wide range of healthcare services, from routine check-ups and preventive care to hospitalization and prescription medications. Health insurance is a vital component of overall financial well-being, ensuring access to quality healthcare without the burden of high out-of-pocket costs.

Individual Health Insurance

Individual health insurance policies are designed for people who are not covered by an employer-sponsored group plan. These policies offer a range of coverage options, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Exclusive Provider Organization (EPO) plans. HMO plans typically have lower premiums but may require you to choose a primary care physician and obtain referrals for specialist care. PPO plans offer more flexibility, allowing you to visit any healthcare provider without a referral, although out-of-network care may be more expensive.

For example, Ms. Smith, a freelance writer, opted for an individual PPO health insurance plan. This plan provided her with the freedom to choose her healthcare providers and offered coverage for a wide range of medical services, including regular doctor's visits, specialist consultations, and prescription medications. The plan's flexibility and comprehensive coverage gave Ms. Smith peace of mind, knowing that her healthcare needs were well-protected.

Group Health Insurance

Group health insurance plans are typically offered by employers as part of their benefits package. These plans are often more affordable than individual plans due to the larger pool of participants, which spreads the risk and keeps premiums lower. Group health insurance plans may offer a variety of coverage options, including HMO, PPO, and EPO plans, as well as additional benefits such as dental and vision coverage.

Imagine a large corporation that offers its employees a group health insurance plan with a PPO option. This plan provides comprehensive coverage for a wide range of medical services, including specialist care, hospitalization, and prescription drug coverage. The plan's network of healthcare providers ensures that employees have access to quality care, and the group nature of the plan keeps premiums affordable for both the employer and employees.

Property and Casualty Insurance

Property and casualty insurance policies provide protection for your assets and belongings, covering a range of potential risks and liabilities. These policies are essential for safeguarding your financial well-being in the event of damage, loss, or liability claims.

Homeowners Insurance

Homeowners insurance is a critical policy for individuals who own a home. This type of insurance provides coverage for the structure of your home, as well as your personal belongings, against a variety of perils, including fire, theft, and natural disasters. Additionally, homeowners insurance typically includes liability coverage, which protects you against claims arising from accidents or injuries that occur on your property.

Mr. and Mrs. Green, recent homeowners, invested in a comprehensive homeowners insurance policy. This policy covered their home and its contents against fire, storm damage, and theft. Additionally, the liability coverage provided peace of mind, ensuring that they would be protected if someone were to get injured on their property and pursue a legal claim.

Renters Insurance

Renters insurance is designed for individuals who rent their living space, whether it’s an apartment, condo, or house. This policy provides coverage for your personal belongings and offers liability protection, similar to homeowners insurance. Renters insurance is an affordable way to protect your valuables and ensure that you are not left financially vulnerable in the event of a loss or accident.

Sarah, a young professional renting an apartment in a bustling city, recognized the importance of renters insurance. Her policy provided coverage for her furniture, electronics, and other valuable possessions, giving her peace of mind that her belongings were protected against theft or damage. Additionally, the liability coverage ensured that she would be financially protected if a guest were to get injured in her apartment.

Auto Insurance

Auto insurance is a mandatory policy for vehicle owners, providing coverage for damage to your vehicle, as well as liability protection in the event of an accident. Auto insurance policies typically include collision coverage, which covers damage to your vehicle in an accident, and comprehensive coverage, which covers damage caused by non-collision events, such as theft, vandalism, or natural disasters.

John, a cautious driver, ensured he had comprehensive auto insurance coverage. His policy included collision coverage, which provided peace of mind when he was involved in a minor fender bender. The comprehensive coverage also came in handy when his car was damaged in a hailstorm, as it covered the cost of repairs, allowing him to get back on the road quickly.

Business Insurance

Business insurance policies are tailored to protect businesses of all sizes and industries from various risks and liabilities. These policies ensure that businesses can continue operating and mitigate financial losses in the face of unforeseen circumstances.

General Liability Insurance

General liability insurance is a fundamental policy for businesses, providing coverage for a wide range of liability risks. This type of insurance protects businesses against claims arising from accidents, injuries, or property damage that occur on their premises or as a result of their operations. General liability insurance is essential for businesses to maintain their financial stability and protect their reputation.

A small bakery, known for its delicious pastries, invested in general liability insurance. This policy protected the bakery from potential claims arising from accidents, such as a customer slipping and falling on their premises. The insurance coverage ensured that the bakery could continue operating without the financial burden of a costly lawsuit.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect professionals, such as lawyers, doctors, accountants, and consultants, from claims arising from negligence, errors, or omissions in their work. This type of insurance is crucial for professionals to maintain their credibility and financial stability, as it provides coverage for legal expenses and potential damages arising from professional mistakes.

Dr. Lee, a renowned surgeon, understood the importance of professional liability insurance. Her policy provided coverage for any claims arising from medical errors or misdiagnoses, ensuring that she could continue practicing medicine without the fear of financial ruin due to a malpractice lawsuit.

Business Interruption Insurance

Business interruption insurance is a vital policy for businesses to protect against financial losses during periods of forced closure or reduced operations due to events such as natural disasters, fires, or other unforeseen circumstances. This insurance provides coverage for lost income and ongoing expenses, helping businesses stay afloat during challenging times.

A popular restaurant in a coastal town invested in business interruption insurance. When a severe storm caused significant damage to the restaurant, forcing it to close temporarily, the insurance policy kicked in. The coverage provided the restaurant with the financial support it needed to pay its employees, maintain its lease, and cover other essential expenses until it could reopen its doors.

Travel Insurance

Travel insurance policies are designed to protect travelers from various risks and uncertainties that may arise during their journeys. These policies provide coverage for trip cancellations or interruptions, medical emergencies while abroad, and loss or damage to luggage and personal effects.

Trip Cancellation and Interruption Insurance

Trip cancellation and interruption insurance is a valuable policy for travelers who want to protect their investment in a trip. This insurance covers non-refundable expenses if a trip is canceled or interrupted due to unforeseen circumstances, such as severe weather, illness, or family emergencies. It provides reimbursement for prepaid expenses, such as flights, hotels, and tours, ensuring that travelers do not incur significant financial losses.

Emily, an avid traveler, purchased trip cancellation and interruption insurance for her upcoming European vacation. Unfortunately, a family emergency forced her to cancel her trip at the last minute. The insurance policy reimbursed her for the non-refundable costs of her flight and accommodation, allowing her to plan a new trip without the financial burden.

Medical Travel Insurance

Medical travel insurance is crucial for travelers heading abroad, as it provides coverage for medical emergencies and unexpected healthcare costs. This insurance typically includes coverage for emergency medical treatment, hospital stays, and medical evacuation, ensuring that travelers can access quality healthcare without incurring astronomical expenses.

Mr. and Mrs. Wilson, retired travelers, always purchased medical travel insurance for their global adventures. During one of their trips to Southeast Asia, Mr. Wilson suffered a sudden illness and required hospitalization. The medical travel insurance policy covered the cost of his treatment and evacuation to a nearby specialized medical facility, providing him with the care he needed and peace of mind for his concerned wife.

Baggage and Personal Effects Insurance

Baggage and personal effects insurance is a useful policy for travelers who want to protect their belongings while on the move. This insurance covers loss, theft, or damage to luggage and personal items, ensuring that travelers are not left financially vulnerable in the event of an unfortunate incident. It provides reimbursement for the cost of replacing lost or damaged items, giving travelers the confidence to travel with peace of mind.

David, a frequent business traveler, invested in baggage and personal effects insurance. During one of his trips, his checked luggage was lost by the airline. The insurance policy covered the cost of replacing his business attire, laptop, and other essential items, allowing him to continue his business meetings without any disruption.

Specialty Insurance

Specialty insurance policies are designed to cater to unique and specific needs, offering tailored coverage for specialized risks. These policies provide protection for a wide range of scenarios, from pet ownership to liability for rental properties.

Pet Insurance

Pet insurance is a valuable policy for pet owners, providing coverage for veterinary expenses, including routine check-ups, illnesses, and accidents. This insurance helps pet owners manage the financial burden of unexpected medical costs, ensuring that their furry friends receive the best possible care without straining their budgets.

The Smith family, proud owners of a lively Labrador, invested in pet insurance. When their dog suffered a sudden injury, the insurance policy covered the cost of emergency surgery and follow-up care, allowing the family to focus on their pet's recovery without worrying about the financial implications.

Rental Property Insurance

Rental property insurance is a crucial policy for landlords and property owners who rent out their properties. This insurance provides coverage for a range of risks associated with rental properties, including damage to the building, loss of rental income due to tenant vacancy or damage, and liability protection in the event of accidents or injuries on the property.

Ms. Johnson, a real estate investor, ensured that her rental properties were protected with comprehensive rental property insurance. The policy covered the cost of repairs after a tenant caused significant damage to one of her properties. Additionally, the loss of rental income coverage provided financial support during the time it took to find a new tenant and make the necessary repairs.

Umbrella Insurance

Umbrella insurance is a specialized policy that provides additional liability coverage beyond the limits of your primary insurance policies. This insurance is particularly useful for individuals or businesses with significant assets, as it offers an extra layer of protection against large liability claims or lawsuits. Umbrella insurance can be added to homeowners, renters, auto, and business insurance policies to increase liability coverage limits.

John, a successful entrepreneur, recognized the importance of umbrella insurance. His business had grown significantly, and he wanted to ensure that his personal assets were protected in the event of a large liability claim. The umbrella insurance policy provided an additional $5 million in liability coverage, giving him peace of mind and financial security.

The Importance of Insurance Policies

Insurance policies play a vital role in our lives, providing a safety net against unforeseen events and protecting our financial well-being. From life insurance to protect our loved ones to health insurance to ensure access to quality healthcare, each type of insurance policy serves a unique purpose. By understanding the diverse range of insurance options available, individuals and businesses can make informed decisions to secure the coverage they need, ensuring peace of mind and financial stability in an uncertain world.

What are the key factors to consider when choosing an insurance policy?

+When selecting an insurance policy, it’s essential to consider your specific needs and circumstances. Evaluate factors such as the coverage amount, policy term, premium costs, and any additional benefits or exclusions. Seek advice from insurance professionals and compare multiple policies to find the best fit for your requirements.

How do insurance premiums work, and what factors influence them?

+Insurance premiums are the regular payments you make to maintain your insurance coverage. The cost of premiums is influenced by various factors, including the type of insurance, the level of coverage, your age, health status, location, and the insurance company’s assessment of risk. Premiums can vary significantly between different providers and policies.

What happens if I need to make a claim on my insurance policy?

+If you need to make a claim on your insurance policy, you’ll typically need to notify your insurance provider and provide relevant documentation and details about the incident. The claims process can vary depending on the type of insurance and the specific circumstances. It’s important to review your policy’s terms and conditions to understand the claims process and any potential exclusions or limitations.