Insurance Quotes For Small Businesses

In the world of small business ownership, understanding and navigating the complex landscape of insurance is crucial. It's not just about having coverage; it's about finding the right insurance quotes that fit your unique business needs and budget. This article aims to provide an in-depth guide to help small business owners make informed decisions when it comes to insurance quotes, offering a comprehensive breakdown of the process and highlighting key factors that can influence the quotes received.

Understanding the Basics of Small Business Insurance Quotes

Insurance quotes for small businesses are tailored estimates provided by insurance companies, outlining the cost of various coverage options. These quotes are influenced by several factors, including the industry, location, size, and specific risks associated with the business. For instance, a construction business will have different insurance needs and, consequently, different quotes compared to a retail store or an online service provider.

Small business insurance typically covers a range of potential risks, such as property damage, liability claims, worker injuries, and business interruption. The quotes will vary depending on the coverage limits and deductibles chosen, as well as any additional coverage options selected.

Key Factors Influencing Insurance Quotes

- Industry and Business Type: Different industries face unique risks. For example, a restaurant will need coverage for food safety and potential fire hazards, while a technology startup might prioritize cyber liability insurance.

- Location: The physical address of your business plays a significant role. Areas with higher crime rates or natural disaster risks often result in higher insurance quotes.

- Size and Revenue: Larger businesses with higher revenues generally face more exposure and may require more extensive coverage, leading to higher quotes.

- Claims History: A business’s past insurance claims can impact future quotes. Frequent or costly claims may result in higher premiums.

- Risk Management Practices: Implementing robust risk management strategies can lead to more favorable insurance quotes. This includes having comprehensive safety protocols, employee training, and effective security measures.

| Factor | Impact on Quote |

|---|---|

| Industry | High: Determines the specific risks and coverage needs. |

| Location | Moderate: Affects exposure to natural disasters and crime. |

| Size and Revenue | Moderate to High: Influences the scope of coverage required. |

| Claims History | Moderate: Can lead to higher premiums for frequent claims. |

| Risk Management | Moderate: Effective strategies may reduce quote costs. |

The Process of Obtaining Insurance Quotes for Small Businesses

Securing insurance quotes for your small business involves several steps, each requiring careful consideration and accurate information. Here’s a detailed breakdown of the process to help you navigate this crucial aspect of business ownership.

Step 1: Identify Your Insurance Needs

Before seeking quotes, it’s vital to understand the specific insurance needs of your business. This includes identifying potential risks and determining the level of coverage required. Common types of insurance for small businesses include general liability, property insurance, workers’ compensation, and professional liability. Additionally, consider any industry-specific insurance requirements.

For instance, a small tech startup might need cyber liability insurance to protect against data breaches, while a retail store might prioritize product liability insurance.

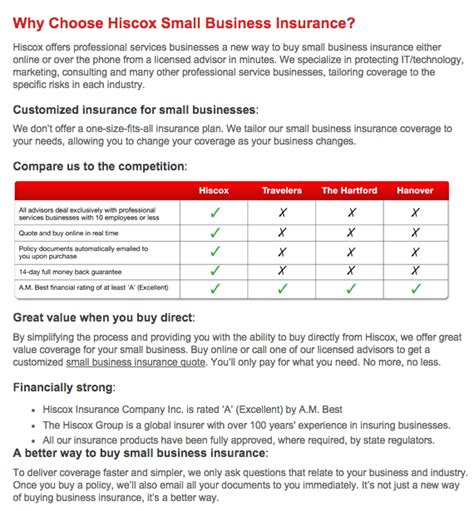

Step 2: Research Insurance Providers

Not all insurance providers offer the same coverage or rates. Researching and comparing different providers is crucial to finding the best fit for your business. Consider factors such as the provider’s reputation, financial stability, and customer service ratings. Online reviews and industry recommendations can provide valuable insights.

Step 3: Gather Required Information

To obtain accurate insurance quotes, you’ll need to provide detailed information about your business. This typically includes:

- Business name, address, and contact details

- Industry and nature of business operations

- Number of employees and their roles

- Annual revenue and projected growth

- Any previous insurance claims or incidents

- Safety and risk management practices

Step 4: Request Quotes

Once you’ve gathered the necessary information, you can request quotes from insurance providers. This can be done through their websites, over the phone, or by meeting with an insurance agent. Provide accurate and consistent information to ensure the quotes are tailored to your business’s needs.

Step 5: Compare and Analyze Quotes

After receiving quotes, it’s essential to compare and analyze them thoroughly. Look beyond just the premium costs. Consider the coverage limits, deductibles, and any exclusions or limitations. Evaluate the reputation and financial stability of the insurance providers, and consider the level of customer service and claim support they offer.

Additionally, be mindful of any add-on coverages or endorsements that might be necessary for your business. These can significantly impact the overall cost and effectiveness of your insurance policy.

Step 6: Negotiate and Finalize

If you’re seeking the best deal, negotiation is a crucial step. Many insurance providers are open to discussing rates and coverage options, especially if you’ve received competitive quotes from other companies. Don’t be afraid to ask for discounts or additional coverage at a reasonable cost.

Once you've negotiated and agreed on the terms, finalize the insurance policy. This typically involves signing the policy documents and paying the initial premium. Ensure you understand the policy's terms and conditions, including any renewal or cancellation processes.

Maximizing Your Insurance Coverage: Tips and Strategies

Obtaining insurance quotes is just the first step in safeguarding your small business. To ensure you’re getting the most out of your insurance coverage, consider these expert tips and strategies.

Tip 1: Understand Your Coverage Limits

Insurance policies come with coverage limits, which are the maximum amounts the insurer will pay for covered losses. It’s crucial to understand these limits and ensure they align with your business’s potential risks. For instance, if your business faces significant property damage risks, you’ll want to ensure your property insurance coverage limits are adequate.

Tip 2: Review and Update Your Coverage Regularly

Business environments are dynamic, and your insurance needs can change over time. Regularly review your insurance coverage to ensure it remains relevant and adequate. Update your coverage as your business grows, expands into new markets, or introduces new products or services.

Tip 3: Explore Bundle Options

Many insurance providers offer bundle packages that combine multiple coverages at a discounted rate. Bundling can be an effective way to save on insurance costs while ensuring comprehensive coverage. For example, you might bundle general liability, property, and business interruption insurance.

Tip 4: Implement Risk Management Strategies

Proactive risk management not only reduces the likelihood of incidents but can also lead to more favorable insurance quotes. Implement robust safety protocols, employee training programs, and effective security measures. By demonstrating a commitment to risk management, you may be eligible for reduced insurance premiums.

Tip 5: Utilize Technology for Better Risk Assessment

In today’s digital age, various technological tools can aid in risk assessment and management. Utilize software and apps that help identify and mitigate risks specific to your industry. For instance, there are apps that can track and manage inventory, reducing the risk of theft or loss.

Common Challenges and How to Overcome Them

Obtaining insurance quotes for your small business can present certain challenges. Understanding these challenges and knowing how to navigate them is crucial for a smooth and successful insurance journey.

Challenge 1: High Premiums

Small businesses, especially those in high-risk industries, often face high insurance premiums. This can be a significant financial burden, especially for startups or businesses with limited cash flow. To overcome this challenge, consider negotiating with insurance providers, exploring bundle options, and implementing risk management strategies to potentially reduce premiums.

Challenge 2: Complex Insurance Terminology

Insurance policies are filled with complex terminology that can be daunting for small business owners. Misunderstanding insurance terms can lead to inadequate coverage or unexpected costs. To address this, consider seeking guidance from insurance professionals or using resources that simplify insurance jargon.

Challenge 3: Finding the Right Coverage

Identifying the right insurance coverage for your unique business needs can be challenging. It requires a deep understanding of your business operations and potential risks. Work with insurance professionals who specialize in small business insurance to ensure you’re getting the coverage that’s truly tailored to your needs.

Challenge 4: Navigating the Claims Process

When it comes to filing insurance claims, the process can be complex and time-consuming. To navigate this challenge, familiarize yourself with your policy’s claims process and keep detailed records of any incidents. Additionally, choose insurance providers with a reputation for prompt and fair claim settlements.

The Future of Small Business Insurance: Trends and Innovations

The insurance landscape for small businesses is evolving, driven by technological advancements and changing market dynamics. Staying informed about these trends and innovations can help small business owners make more strategic insurance decisions.

Trend 1: Digital Transformation in Insurance

The insurance industry is increasingly embracing digital technologies, leading to more efficient and accessible insurance processes. From online quote comparisons to digital claim submissions, small business owners can now navigate the insurance landscape with greater ease. Keep an eye on digital insurance platforms that offer streamlined services and competitive rates.

Trend 2: Focus on Customized Coverage

Recognizing that small businesses have unique needs, many insurance providers are shifting towards offering customized coverage options. This trend allows small businesses to tailor their insurance policies to specific risks, ensuring more comprehensive and cost-effective coverage. Explore providers that offer flexible coverage options and can adapt to your business’s evolving needs.

Trend 3: Data-Driven Risk Assessment

Advanced analytics and big data are transforming how insurance risks are assessed. Insurers are leveraging data to identify patterns and trends, enabling more accurate risk assessment and pricing. As a small business owner, you can benefit from this trend by implementing data-driven risk management strategies, which may lead to more favorable insurance terms.

Trend 4: Increased Emphasis on Cyber Security

With the rise of digital businesses and remote work, cyber security risks have become a top concern for small businesses. Insurance providers are responding by offering more comprehensive cyber liability insurance coverage. Ensure your business is protected against cyber threats by investing in robust security measures and exploring specialized cyber insurance policies.

Conclusion

Navigating the world of insurance quotes for small businesses can be complex, but with the right knowledge and strategies, it becomes a manageable process. By understanding your insurance needs, researching providers, and negotiating for the best coverage, you can protect your business effectively while managing costs. Stay informed about industry trends and innovations to ensure your insurance strategy remains relevant and effective in the dynamic business landscape.

How often should I review my small business insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever your business undergoes significant changes, such as expansion, relocation, or introduction of new products or services.

Can I negotiate my insurance premiums?

+Absolutely! Negotiating insurance premiums is a common practice. You can leverage your strong risk management practices, claim history, or even bundle multiple policies to negotiate better rates.

What are some common mistakes to avoid when obtaining insurance quotes?

+Avoid rushing the process and not comparing quotes from multiple providers. Also, be cautious of policies with extremely low premiums, as they may have significant exclusions or limitations.