Auto Coverage Insurance

Welcome to this comprehensive guide on Auto Coverage Insurance, a crucial aspect of vehicle ownership that provides financial protection and peace of mind. In today's fast-paced world, having adequate insurance coverage is not just a legal requirement but also a smart decision to safeguard your assets and ensure you're prepared for unexpected events. This article will delve into the intricacies of auto coverage, exploring its various facets, benefits, and real-world implications.

Understanding Auto Coverage Insurance

Auto coverage insurance, often simply referred to as car insurance, is a contract between you (the policyholder) and an insurance provider. This contract promises to provide financial protection against potential losses, damages, or liabilities arising from operating a vehicle. It serves as a vital safety net, offering compensation for various incidents that may occur while you’re on the road.

The primary goal of auto coverage insurance is to mitigate the financial risks associated with owning and driving a vehicle. These risks can range from minor fender benders to severe accidents, theft, or even natural disasters that might damage your car. By having the right insurance coverage, you can ensure that you're not left with overwhelming financial burdens in the face of such unforeseen circumstances.

Key Components of Auto Coverage

Auto coverage insurance typically comprises several key components, each designed to address specific risks and scenarios. Here’s a breakdown of the essential elements:

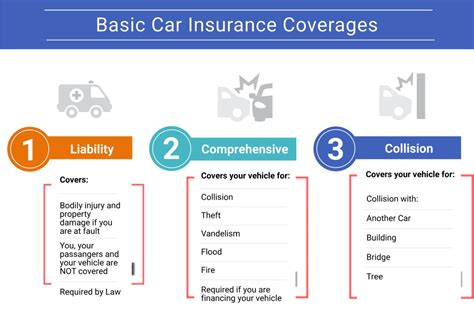

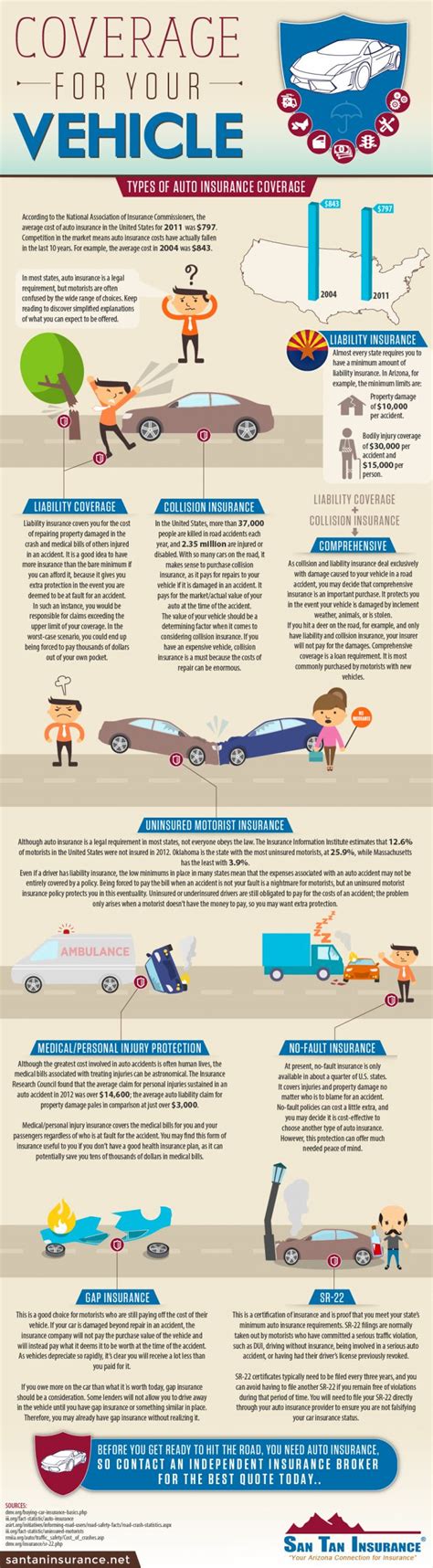

- Liability Coverage: This is a fundamental aspect of auto insurance, protecting you against claims for bodily injury or property damage caused to others as a result of an accident you're at fault for. It covers medical expenses, lost wages, and property repair or replacement costs.

- Collision Coverage: As the name suggests, this coverage takes care of damages to your vehicle in the event of a collision with another vehicle or object. It's particularly beneficial for covering repairs or replacements, even if you're at fault.

- Comprehensive Coverage: This broad coverage protects against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It ensures that your vehicle is protected against a wide range of unforeseen incidents.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of you and your passengers, regardless of who is at fault in an accident. It provides quick and easy access to medical care, ensuring prompt treatment without the hassle of liability determination.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages. It safeguards you from financial loss in such situations.

Each of these components can be tailored to your specific needs and budget, allowing you to create a customized auto coverage plan that offers the right balance of protection and affordability.

The Importance of Adequate Coverage

Having adequate auto coverage insurance is more than just a legal obligation; it’s a responsible choice that can significantly impact your financial well-being and peace of mind. Here’s why it’s crucial to ensure you have the right coverage:

Financial Protection

Auto coverage insurance acts as a financial safety net, shielding you from potentially devastating costs associated with vehicle-related incidents. Whether it’s repairing your car after a collision, covering medical expenses for injuries sustained in an accident, or dealing with property damage claims, insurance can significantly reduce your out-of-pocket expenses.

Legal Compliance

In most jurisdictions, having a minimum level of auto insurance is mandatory by law. Failure to comply can result in severe penalties, including fines, license suspension, or even legal consequences. By ensuring you have the required coverage, you avoid these legal pitfalls and maintain a good standing with the authorities.

Peace of Mind

Knowing that you’re adequately insured provides a sense of security and peace of mind. It allows you to focus on your daily activities without constantly worrying about the financial implications of potential accidents or incidents. With the right coverage, you can rest assured that you’re protected, no matter what the road throws your way.

Customized Protection

Auto coverage insurance is highly customizable, allowing you to choose the level of protection that suits your needs and budget. Whether you opt for comprehensive coverage or prefer a more basic plan, you can tailor your insurance to fit your unique circumstances, ensuring you’re not paying for coverage you don’t need.

Real-World Benefits of Auto Coverage

Auto coverage insurance has proven its worth time and again in various real-world scenarios. Here are some tangible benefits that highlight the importance of having the right insurance:

Accident Scenarios

In the event of an accident, auto coverage insurance steps in to provide immediate assistance. Whether it’s coordinating repairs, covering medical expenses, or handling liability claims, insurance companies work to resolve the situation efficiently. For example, imagine being involved in a collision where your vehicle sustains significant damage. With comprehensive coverage, your insurance provider will work with you to get your car repaired or replaced, ensuring you’re back on the road as soon as possible.

Theft and Vandalism

If your vehicle is stolen or vandalized, comprehensive coverage can offer financial relief. Insurance companies will work to replace your vehicle or provide you with a suitable alternative, minimizing the impact of such unfortunate events. For instance, if your car is stolen from a parking lot, comprehensive coverage will cover the cost of a replacement, helping you get back to your daily routine without incurring substantial financial losses.

Natural Disasters

In the face of natural disasters like floods, hurricanes, or wildfires, auto coverage insurance can be a lifeline. It provides compensation for damages caused by these events, ensuring that your vehicle is protected even in the most unpredictable circumstances. For instance, if your car is damaged by a hurricane, comprehensive coverage will cover the repairs, allowing you to focus on other recovery efforts without added financial strain.

Roadside Assistance

Many auto coverage insurance policies include roadside assistance benefits. This means that if your vehicle breaks down or runs out of fuel, you can call for help, and the insurance provider will dispatch a service team to assist you. This added layer of protection ensures that you’re never stranded and can continue your journey with minimal disruptions.

Comparative Analysis: Different Coverage Levels

When it comes to auto coverage insurance, different levels of coverage are available, each offering a unique set of benefits and considerations. Here’s a comparative analysis to help you understand the key differences:

Liability-Only Coverage

Liability-only coverage is the most basic level of auto insurance, providing protection against claims for bodily injury and property damage caused to others. It’s the minimum requirement in most states and offers a cost-effective option for budget-conscious drivers. However, it doesn’t cover damages to your own vehicle, leaving you vulnerable to substantial out-of-pocket expenses in the event of an accident.

Standard Coverage

Standard coverage, also known as full coverage, includes liability coverage, collision coverage, and comprehensive coverage. It offers a comprehensive level of protection, ensuring that you’re covered for a wide range of incidents, including accidents, theft, and natural disasters. Standard coverage is ideal for those who want peace of mind and protection for their vehicles.

High-End Coverage

High-end coverage goes beyond the standard, offering additional benefits and enhanced protection. This type of coverage may include higher liability limits, rental car coverage, gap insurance, and other specialized add-ons. It’s tailored for those who want the utmost protection and are willing to invest in comprehensive coverage.

| Coverage Level | Liability | Collision | Comprehensive | Additional Benefits |

|---|---|---|---|---|

| Liability-Only | ✔ | ❌ | ❌ | None |

| Standard | ✔ | ✔ | ✔ | Basic |

| High-End | ✔ | ✔ | ✔ | Enhanced |

Performance Analysis: Real-World Scenarios

To understand the true performance of auto coverage insurance, let’s delve into a few real-world scenarios and explore how different coverage levels would play out:

Scenario 1: Minor Collision

Imagine you’re driving on a busy street and accidentally bump into the car in front of you. The damage is minor, but you’re at fault. With liability-only coverage, you’d be responsible for the repairs to the other vehicle, potentially costing you thousands of dollars. However, with standard coverage, your insurance provider would cover these expenses, saving you from a significant financial burden.

Scenario 2: Severe Accident

In a more severe accident, where multiple vehicles are involved, and you’re not at fault, liability-only coverage might not be sufficient. You’d need to rely on the at-fault driver’s insurance, which may not fully cover your medical expenses and vehicle repairs. With standard coverage, your insurance provider would step in, providing comprehensive assistance and ensuring you’re not left financially strained.

Scenario 3: Natural Disaster

Consider a scenario where a hurricane causes extensive damage to your vehicle. With liability-only coverage, you’d be responsible for the repairs, which could be prohibitively expensive. However, with comprehensive coverage, your insurance provider would cover the costs, allowing you to replace your vehicle or make the necessary repairs without incurring substantial financial losses.

Future Implications: Evolving Trends in Auto Coverage

The world of auto coverage insurance is constantly evolving, influenced by technological advancements, changing consumer needs, and shifting regulatory landscapes. Here are some key trends and future implications to consider:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data analytics, is transforming the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, are becoming increasingly popular. These policies use telematics to monitor driving behavior, offering discounts to safe drivers and providing real-time feedback on driving habits. As this technology advances, we can expect more personalized and data-driven insurance options.

Connected Car Insurance

With the rise of connected car technology, insurance providers are exploring new ways to offer coverage. Connected car insurance policies leverage the data generated by vehicle sensors and infotainment systems to provide more accurate risk assessments. This technology can offer benefits like discounted rates for safe driving habits, automatic accident reporting, and even real-time assistance in the event of a breakdown.

Autonomous Vehicles and Insurance

As autonomous vehicles become a reality, the insurance landscape will need to adapt. Liability questions will shift from individual drivers to vehicle manufacturers and software developers. Insurance providers will need to develop new coverage models to address the unique risks associated with self-driving cars, ensuring that consumers are protected in this evolving automotive landscape.

Environmental Considerations

With growing environmental concerns, insurance providers are exploring ways to promote sustainable practices. This includes offering incentives for electric and hybrid vehicles, as well as developing coverage options that address the unique risks and maintenance needs of these eco-friendly cars. As the green movement gains momentum, we can expect more eco-conscious insurance offerings.

Conclusion: Making Informed Choices

Auto coverage insurance is a vital component of responsible vehicle ownership, offering financial protection and peace of mind. By understanding the different coverage options, real-world benefits, and future trends, you can make informed choices that align with your needs and budget. Remember, having the right insurance coverage is not just a legal requirement but a wise decision to safeguard your assets and ensure a secure future on the road.

What is the difference between liability-only and standard coverage in auto insurance?

+Liability-only coverage is the most basic level of auto insurance, providing protection against claims for bodily injury and property damage caused to others. It’s the minimum requirement in most states. Standard coverage, on the other hand, includes liability coverage, collision coverage, and comprehensive coverage, offering a more comprehensive level of protection.

How does usage-based insurance work, and what are its benefits?

+Usage-based insurance, or pay-as-you-drive policies, use telematics technology to monitor driving behavior. Insurance providers offer discounts to safe drivers and provide real-time feedback on driving habits. This personalized approach allows for more accurate risk assessments and can lead to lower insurance premiums for safe drivers.

What are the key considerations when choosing auto coverage insurance for electric or hybrid vehicles?

+When choosing auto coverage for electric or hybrid vehicles, it’s important to consider their unique maintenance needs and potential risks. Some insurance providers offer incentives for eco-friendly vehicles, such as discounted rates or specialized coverage options. It’s also crucial to ensure that your insurance covers battery replacement or repairs, as these can be costly.