Health Insurance Providers

Health insurance is an essential aspect of modern healthcare systems, offering individuals and families financial protection and access to vital medical services. With a wide array of providers operating in the market, understanding the landscape and the specific offerings of each company is crucial for making informed decisions about your health coverage.

Navigating the Health Insurance Landscape

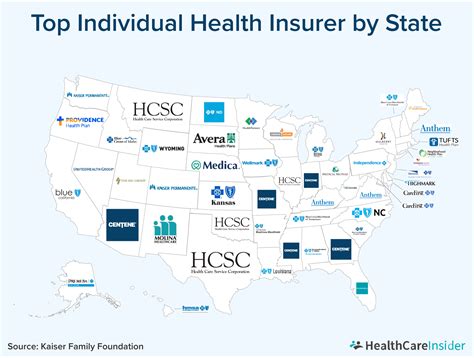

The health insurance industry is diverse, with numerous providers offering a range of plans and benefits. From major national carriers to regional and specialty insurers, each brings a unique set of strengths and advantages to the table. In this article, we’ll explore the key players, their specialties, and the value they bring to consumers.

Major National Carriers: Comprehensive Coverage, Nationwide Reach

Major national health insurance providers, such as UnitedHealthcare, Aetna, and Blue Cross Blue Shield, are well-known for their extensive networks and comprehensive coverage options. These carriers often have a presence in multiple states, offering a wide range of plans that cater to various needs.

For instance, UnitedHealthcare provides individual, family, and employer-sponsored plans, with a focus on personalized care and wellness programs. Their Navigating Cancer Care program, for example, offers specialized support for individuals facing cancer, including access to clinical trials and second opinions.

Similarly, Aetna boasts a robust network of healthcare providers and a strong emphasis on digital tools and resources. Their Aetna Navigator platform allows members to easily manage their benefits, find in-network providers, and access personalized health information.

While these national carriers offer a broad spectrum of coverage, it's important to note that plan availability and benefits may vary by state and region. Additionally, some carriers may have more specialized offerings, such as Medicare Advantage plans or dental and vision coverage.

Regional Insurers: Local Expertise, Personalized Service

Regional health insurance providers, like Kaiser Permanente and Highmark Health, often focus on delivering tailored services to specific geographic areas. These companies understand the unique healthcare needs and preferences of their local communities, allowing them to offer more personalized and responsive coverage.

Kaiser Permanente, for example, is known for its integrated healthcare model, which brings together hospitals, medical offices, and laboratories under one roof. This integration streamlines care and enhances coordination between specialists, resulting in more efficient and effective treatment.

Highmark Health, on the other hand, offers a range of plans with a focus on preventive care and wellness. Their Highmark Healthy High Five initiative promotes five key behaviors for a healthier lifestyle, providing members with resources and incentives to adopt healthier habits.

Regional insurers often have stronger relationships with local providers, which can lead to more flexible and customized plans. However, their services may be limited to specific states or regions, and plan availability may be more restricted compared to national carriers.

Specialty Insurers: Targeted Solutions for Unique Needs

Specialty health insurance providers cater to specific segments of the population or offer coverage for specialized medical needs. These insurers fill unique gaps in the market, providing tailored solutions for individuals with complex conditions or specific healthcare requirements.

For instance, Oscar Health is a digital-first insurer that focuses on simplifying the healthcare experience. Their Oscar App allows members to easily manage their benefits, find providers, and access personalized health guidance. Oscar Health also offers innovative programs like Oscar Concierge, which provides members with a dedicated support team to navigate their healthcare journey.

Cigna, another specialty insurer, is known for its emphasis on behavioral health and well-being. They offer a range of programs, such as Cigna Mindful Leadership, which helps individuals manage stress and improve mental health. Cigna also provides resources for employers to promote a culture of well-being in the workplace.

Specialty insurers often bring unique value propositions to the table, such as innovative technologies, specialized networks, or focused wellness programs. However, their services may be more limited in scope and may not be suitable for all individuals or families.

Performance and Value Analysis

When evaluating health insurance providers, it’s essential to consider their performance and the value they deliver to their members. Here’s a closer look at some key factors:

Network Strength and Accessibility

A strong network of healthcare providers is crucial for ensuring members have access to the care they need. Insurance companies with robust networks can offer more choices and potentially better rates for services. However, it’s important to verify that your preferred providers are included in the network to avoid unexpected out-of-network costs.

| Provider | Network Size (in-network providers) |

|---|---|

| UnitedHealthcare | Over 1.3 million |

| Aetna | Over 1 million |

| Kaiser Permanente | Over 680,000 |

Coverage Options and Benefits

The range of coverage options and benefits is a key differentiator among health insurance providers. Some insurers may offer more comprehensive plans with lower out-of-pocket costs, while others may focus on specific benefits like vision or dental coverage. It’s crucial to assess your personal healthcare needs and choose a plan that aligns with those requirements.

| Provider | Key Coverage Highlights |

|---|---|

| UnitedHealthcare | Wide range of plans, including Medicare Advantage, dental, and vision options. Focus on wellness and personalized care. |

| Aetna | Comprehensive plans with a focus on digital tools and resources. Offers a variety of specialty health programs. |

| Kaiser Permanente | Integrated healthcare model with strong emphasis on preventive care. Provides specialized programs for chronic conditions. |

Member Satisfaction and Experience

Understanding how satisfied members are with their insurance provider can provide valuable insights. Factors such as ease of claim processing, customer service responsiveness, and overall member experience can significantly impact your satisfaction with your health plan.

While specific data on member satisfaction may be limited, it's worth noting that many health insurance providers have made significant investments in improving their digital platforms and member support systems. This focus on member experience is an important consideration when choosing a health insurance provider.

Future Trends and Implications

The health insurance industry is continually evolving, driven by technological advancements, changing consumer preferences, and shifts in healthcare policies. Here are some key trends and their potential implications for the future:

Digital Transformation and Telehealth

The rise of digital technologies and telehealth services has transformed the way healthcare is delivered and accessed. Health insurance providers are increasingly embracing digital platforms to enhance member engagement, streamline processes, and improve access to care. This trend is likely to continue, with insurers investing in innovative technologies to provide more convenient and personalized healthcare experiences.

Focus on Preventive Care and Wellness

There is a growing emphasis on preventive care and wellness initiatives among health insurance providers. By encouraging healthy behaviors and early intervention, insurers aim to reduce the incidence of chronic diseases and lower healthcare costs. This trend is expected to drive the development of more comprehensive wellness programs and incentives, shifting the focus from reactive to proactive healthcare.

Partnerships and Integrations

Health insurance providers are forming strategic partnerships and collaborations to enhance their offerings. These partnerships can range from integrating with healthcare technology platforms to partnering with wellness brands or even retail giants. By leveraging these partnerships, insurers can provide more holistic health solutions and improve member engagement.

Regulatory Changes and Policy Shifts

The healthcare industry is subject to ongoing regulatory changes and policy shifts, which can significantly impact health insurance providers. From changes in healthcare legislation to evolving reimbursement models, insurers must adapt to stay compliant and competitive. Staying abreast of these changes is crucial for understanding the future landscape of health insurance.

Conclusion

The health insurance landscape is dynamic, offering a wide range of providers and plans to meet the diverse needs of individuals and families. By understanding the strengths and specialties of different insurers, consumers can make more informed choices about their health coverage. As the industry continues to evolve, staying informed about emerging trends and advancements will be essential for navigating the changing healthcare landscape.

How do I choose the right health insurance provider for my needs?

+When selecting a health insurance provider, consider your specific healthcare needs, the strength of the provider’s network in your area, and the range of coverage options offered. Assess the provider’s reputation for member satisfaction and evaluate their digital tools and resources. It’s also crucial to understand the plan’s benefits, out-of-pocket costs, and any exclusions or limitations.

What are some key factors to consider when comparing health insurance plans?

+When comparing health insurance plans, focus on the plan’s network of providers, coverage limits, and out-of-pocket costs. Also, consider any additional benefits or programs offered, such as wellness initiatives or specialized health services. Don’t forget to evaluate the insurer’s reputation for member satisfaction and claim processing.

How do health insurance providers handle pre-existing conditions?

+Health insurance providers are required by law to cover pre-existing conditions without exclusions or waiting periods. However, the specific coverage and benefits for pre-existing conditions can vary depending on the plan and insurer. It’s important to carefully review the plan’s summary of benefits and coverage to understand how pre-existing conditions are handled.

Can I switch health insurance providers if I’m not satisfied with my current plan?

+Yes, you have the right to switch health insurance providers if you’re not satisfied with your current plan. Open enrollment periods typically occur once a year, but special enrollment periods may be available if you experience certain life events, such as marriage, birth of a child, or loss of other coverage. Be sure to review the specific enrollment periods and requirements for your state.