What Is The Difference Between Whole And Term Life Insurance

Understanding the Differences: Whole Life vs. Term Life Insurance

In the realm of financial planning and risk management, life insurance is a cornerstone strategy. It provides a safety net for individuals and their families, ensuring financial stability in the face of unexpected events. However, the world of life insurance is not a one-size-fits-all scenario; it offers a range of options, each with its unique features and benefits. Among these, Whole Life and Term Life insurance stand out as two of the most popular choices. Let's delve into the nuances that set them apart, helping you make an informed decision for your future.

Whole Life Insurance: A Comprehensive Lifetime Cover

Whole Life insurance, as the name suggests, is a policy designed to cover an individual for their entire life, provided premiums are paid. This makes it an attractive option for those seeking long-term, guaranteed protection. Here's a closer look at its key features and advantages:

Guaranteed Coverage

Whole Life policies offer a guaranteed death benefit, ensuring that the policyholder’s beneficiaries will receive a specified amount upon the insured’s death, regardless of when it occurs. This provides a sense of security and peace of mind, knowing that financial protection is in place for life.

Cash Value Accumulation

One of the standout features of Whole Life insurance is its cash value component. A portion of each premium payment goes towards building up cash value within the policy. This cash value grows on a tax-deferred basis and can be accessed through policy loans or withdrawals. It acts as a savings account, offering potential financial flexibility in the future.

| Key Feature | Description |

|---|---|

| Premium Stability | Whole Life policies typically have level premiums that remain unchanged throughout the policyholder's life. |

| Dividends | Some Whole Life policies offer dividend payments, which can further enhance the policy's cash value. |

| Flexible Premiums | While level premiums are common, some policies allow for premium adjustments based on the policyholder's needs and financial situation. |

Term Life Insurance: Temporary Protection with a Focus on Affordability

Term Life insurance, on the other hand, provides coverage for a specific period or "term." It is often seen as a more affordable option, making it an attractive choice for those seeking temporary coverage or those with limited budgets. Here's an in-depth look at Term Life insurance and its unique characteristics:

Coverage Period

Term Life policies are typically offered in set terms, such as 10, 20, or 30 years. The policyholder selects the term based on their specific needs and financial goals. If the insured passes away during the term, the beneficiaries receive the death benefit. However, if the insured outlives the term, the coverage ends, and no death benefit is paid.

Affordability

One of the primary advantages of Term Life insurance is its cost-effectiveness. Premiums are generally much lower compared to Whole Life policies, making it an accessible option for a wider range of individuals. This makes Term Life an excellent choice for those seeking short-term protection, such as covering mortgage payments or providing financial support for children until they become independent.

Renewability and Convertibility

Many Term Life policies offer the option to renew the coverage at the end of the term, often at a higher premium due to the increased age of the policyholder. Additionally, some policies allow for conversion to a Whole Life or Permanent Life policy, ensuring continued coverage without the need for a medical exam.

| Key Feature | Description |

|---|---|

| Level Premiums | Like Whole Life, Term Life policies often have level premiums, ensuring stable and predictable costs. |

| Increasing Term Options | Some Term Life policies offer the option of increasing the death benefit over time, providing additional protection as financial needs change. |

| Riders and Add-Ons | Term Life policies may offer additional riders or add-ons, such as accidental death benefits or waiver of premium in case of disability, enhancing the policy's flexibility. |

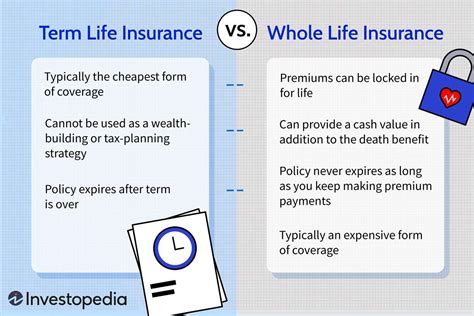

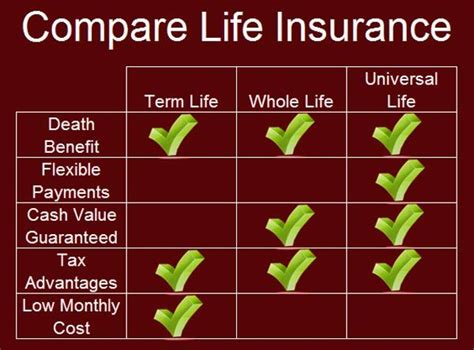

Comparative Analysis: Which One Suits Your Needs Best?

The choice between Whole Life and Term Life insurance largely depends on individual circumstances and financial goals. Here's a brief comparison to help you make an informed decision:

Whole Life Insurance:

- Pros: Provides lifetime coverage, builds cash value, offers guaranteed death benefit.

- Cons: Higher premiums, less flexibility in terms of coverage period.

- Suitable For: Those seeking long-term financial protection, individuals with significant financial responsibilities, and those looking to build cash value.

Term Life Insurance:

- Pros: More affordable, offers flexibility in coverage period, provides temporary protection.

- Cons: Coverage ends at the end of the term, no cash value accumulation.

- Suitable For: Individuals with budget constraints, those seeking short-term protection, and families with specific financial goals during a particular life stage.

In Conclusion

Both Whole Life and Term Life insurance policies have their unique advantages and cater to different financial needs and circumstances. Understanding these differences is crucial in making an informed decision about your financial future. It's always advisable to consult with a financial advisor or insurance professional to determine which type of life insurance best aligns with your goals and ensures the financial security of your loved ones.

Frequently Asked Questions

Can I switch from Term Life to Whole Life insurance?

+

Yes, many Term Life policies offer a conversion option, allowing you to switch to a Whole Life or Permanent Life policy without a medical exam. This can be beneficial if your financial circumstances change and you require long-term coverage.

What happens if I stop paying premiums for my Whole Life policy?

+

If you stop paying premiums, your Whole Life policy may enter a grace period, after which it could lapse. However, the cash value accumulated in the policy can be used to pay for a reduced amount of coverage, known as paid-up insurance. This ensures that some level of protection is maintained.

Are there any tax implications with Whole Life insurance’s cash value?

+

Yes, while the cash value grows tax-deferred within the policy, withdrawals or loans may be subject to taxes. It’s important to consult with a tax advisor to understand the potential tax implications.

Can I cancel my Term Life policy and get a refund?

+

Term Life policies typically do not offer refunds upon cancellation. However, some policies may have a free look period, allowing you to cancel and receive a full refund within a certain timeframe after purchase.

Is Whole Life insurance suitable for retirement planning?

+

Yes, the cash value accumulation in Whole Life policies can be a valuable asset for retirement planning. It provides a potential source of funds for retirement expenses, offering financial flexibility and security.