Verizon Phone Insurance Price

Verizon, one of the leading telecommunications companies in the United States, offers its customers a comprehensive insurance program for their mobile devices. With the constant advancements in technology and the increasing cost of smartphones, phone insurance has become a vital consideration for many individuals. Verizon's insurance plans provide peace of mind and financial protection against unexpected accidents, damage, or theft. In this comprehensive guide, we will delve into the details of Verizon's phone insurance, exploring its prices, coverage options, and the factors that influence the cost.

Understanding Verizon Phone Insurance

Verizon’s phone insurance program, known as Verizon Protect, offers two primary coverage plans: Verizon Protect Basic and Verizon Protect Total Equipment. These plans are designed to safeguard your device against various unforeseen circumstances, ensuring you can continue to stay connected without incurring significant repair or replacement costs.

Verizon Protect Basic

The Verizon Protect Basic plan is a cost-effective option that covers accidental damage, including cracks or liquid damage, as well as theft or loss. This plan is ideal for individuals who want basic protection for their devices. The pricing for this plan varies depending on the device and its value. For instance, a popular mid-range smartphone may have a monthly insurance premium of around 8.99</strong>, while a high-end flagship device could cost <strong>11.99 per month.

| Device Type | Monthly Premium |

|---|---|

| Mid-Range Smartphone | $8.99 |

| Flagship Smartphone | $11.99 |

Verizon Protect Total Equipment

For comprehensive coverage, Verizon offers the Verizon Protect Total Equipment plan. This plan includes all the benefits of the Basic plan, but it also extends to cover mechanical or electrical failures, natural disasters, and other unforeseen circumstances. It provides a more extensive level of protection, ensuring your device is covered for a wider range of potential issues.

The pricing for the Verizon Protect Total Equipment plan is slightly higher compared to the Basic plan. For a mid-range smartphone, the monthly premium could be around $11.99, while for a flagship device, it may cost $14.99 per month. This plan offers added peace of mind for individuals who want to ensure their devices are fully protected.

| Device Type | Monthly Premium |

|---|---|

| Mid-Range Smartphone | $11.99 |

| Flagship Smartphone | $14.99 |

Factors Influencing Phone Insurance Prices

The price of Verizon’s phone insurance plans can vary based on several factors. Understanding these factors can help you make an informed decision about the best plan for your needs and budget.

Device Value

The value of your device is a significant factor in determining the insurance premium. Higher-end smartphones and tablets generally have higher insurance costs due to their market value and repair or replacement expenses. For instance, the insurance premium for a flagship smartphone could be twice as much as that of a mid-range device.

Coverage Options

As mentioned earlier, Verizon offers two primary coverage plans with different levels of protection. The Verizon Protect Basic plan covers accidental damage and theft/loss, while the Verizon Protect Total Equipment plan provides more comprehensive coverage. The choice between these plans will directly impact the insurance price you pay.

Plan Duration

Verizon phone insurance plans are typically offered on a monthly basis, but the duration of your plan can influence the overall cost. Some plans may offer discounts if you opt for a longer-term commitment, such as a 12-month or 24-month plan. This can help reduce the monthly premium, making insurance more affordable over time.

Additional Benefits

Verizon may offer optional add-ons or additional benefits with their insurance plans. These can include features like expedited device replacement, extended warranty coverage, or even device trade-in programs. While these add-ons can enhance your insurance experience, they may also increase the overall cost of your plan.

Performance and Customer Experience

Verizon’s phone insurance plans have generally received positive feedback from customers. The plans provide a valuable service, offering financial protection and peace of mind against unexpected device issues. Many customers appreciate the ease of filing claims and the efficient processing of repairs or replacements.

However, it's important to note that insurance plans may not cover all scenarios. Some customers have reported exclusions or limitations in coverage, especially for certain types of damage or specific situations. It's crucial to carefully review the terms and conditions of your insurance plan to understand what is and isn't covered.

Tips for Maximizing Coverage

- Choose the right plan based on your device’s value and your specific needs.

- Consider the duration of your plan and explore potential discounts for long-term commitments.

- Read the fine print and understand the exclusions and limitations of your chosen plan.

- Take advantage of any available add-ons or benefits that align with your preferences.

- Regularly review your insurance coverage to ensure it aligns with your current device and usage.

Future Implications and Industry Insights

The demand for phone insurance is expected to remain strong as smartphones continue to play a central role in our daily lives. With the increasing complexity and cost of mobile devices, insurance provides an essential layer of protection for consumers. Verizon, as a leading telecommunications provider, is well-positioned to offer competitive insurance plans that cater to its customers’ needs.

Looking ahead, we can anticipate further advancements in insurance coverage. Verizon may introduce new plans or features to address evolving consumer needs, such as enhanced coverage for emerging technologies like foldable smartphones or extended warranties for specific device components. Additionally, the company may explore partnerships with device manufacturers to offer exclusive insurance benefits to their customers.

Industry Comparison

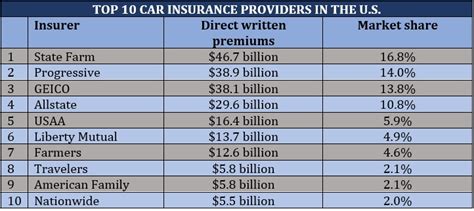

Verizon’s phone insurance plans are competitive within the industry. While pricing and coverage may vary slightly among carriers, Verizon’s plans offer a balanced approach, providing affordable options for basic coverage and more robust protection for those who require it. The company’s focus on customer satisfaction and its commitment to staying at the forefront of telecommunications make it a reliable choice for device insurance.

Final Thoughts

Verizon’s phone insurance plans, particularly the Verizon Protect series, offer a comprehensive and flexible approach to device protection. Whether you opt for the Verizon Protect Basic plan or the more extensive Verizon Protect Total Equipment plan, you can rest assured that your device is covered against a wide range of potential issues. By understanding the factors that influence insurance prices and carefully reviewing the available options, you can make an informed decision to safeguard your device and stay connected without financial worry.

Can I add multiple devices to my Verizon insurance plan?

+Yes, Verizon allows you to add multiple devices to your insurance plan. This can be a cost-effective solution if you have multiple devices in your household or if you want to ensure comprehensive coverage for all your devices.

What happens if I need to file a claim with Verizon’s insurance plan?

+Filing a claim with Verizon’s insurance plan is straightforward. You can start the process online or by calling their customer service. You’ll need to provide details about the incident and your device, and Verizon will guide you through the next steps, which may include sending your device for inspection or receiving a replacement.

Are there any exclusions or limitations I should be aware of with Verizon’s insurance plans?

+Yes, it’s important to review the exclusions and limitations outlined in your insurance plan. Common exclusions may include cosmetic damage, intentional damage, or damage caused by certain liquids (e.g., saltwater). Additionally, there may be limitations on the number of claims you can file within a certain period.