Travel Insurance International

Travel insurance, an essential companion for international travelers, offers a safety net against unexpected events and unforeseen medical emergencies. With the right coverage, travelers can explore the world with peace of mind, knowing they are protected against financial risks and unforeseen circumstances.

This comprehensive guide delves into the world of travel insurance, offering an in-depth analysis of its importance, coverage options, and key considerations for international travelers. By understanding the intricacies of travel insurance, travelers can make informed decisions to ensure a seamless and stress-free journey.

The Importance of Travel Insurance for International Journeys

Travel insurance is not just a luxury but a necessity for anyone embarking on an international adventure. It provides a crucial layer of protection against a wide range of unexpected situations that can arise during travel. From medical emergencies and trip cancellations to lost luggage and travel delays, travel insurance offers financial relief and peace of mind.

Consider the story of Sarah, an avid traveler who embarked on a solo trip to Europe. While hiking in the Swiss Alps, she slipped and injured her ankle, requiring immediate medical attention. With her travel insurance coverage, she was able to access quality healthcare and receive the necessary treatment without worrying about the financial burden. Travel insurance proved to be a lifeline, allowing her to continue her journey with minimal disruption.

Coverage Options: Tailoring Protection to Your Needs

Travel insurance policies offer a diverse range of coverage options to cater to the unique needs of international travelers. Understanding these options is key to selecting the right policy for your journey.

- Medical Coverage: This is perhaps the most crucial aspect of travel insurance. Medical coverage provides protection against unexpected illnesses or injuries sustained during your trip. It typically covers expenses such as doctor visits, hospitalization, emergency dental care, and even medical evacuations.

- Trip Cancellation and Interruption: These coverages reimburse you for non-refundable trip expenses if your journey is canceled or interrupted due to unforeseen circumstances like severe weather, natural disasters, or personal emergencies. This protection safeguards your investment and ensures you don't incur significant financial losses.

- Lost or Delayed Luggage: Travel insurance policies often include coverage for lost, stolen, or delayed luggage. This can provide reimbursement for essential items you may need to purchase while waiting for your luggage to arrive, as well as cover the cost of replacing lost items.

- Emergency Assistance Services: Many travel insurance policies offer 24/7 emergency assistance services. This can include help with finding medical care, arranging for lost passport replacement, providing interpreter services, and offering legal assistance in case of an emergency.

- Travel Delay Protection: This coverage reimburses you for additional expenses incurred due to travel delays caused by events like severe weather, mechanical issues, or other unforeseen circumstances. It can cover costs such as extra accommodation, meals, and transportation.

When selecting a travel insurance policy, it's essential to carefully review the coverage options and choose a plan that aligns with your specific needs and the nature of your trip. Consider factors such as the duration of your journey, the countries you'll be visiting, and any activities you plan to engage in.

Key Considerations for Choosing the Right Travel Insurance

Selecting the right travel insurance policy involves a careful evaluation of several key factors. Here are some crucial considerations to keep in mind:

Assessing Your Needs

Start by evaluating your specific needs and the potential risks associated with your trip. Consider factors such as the destination, the activities you plan to engage in, and any pre-existing medical conditions you may have. Tailor your insurance coverage to address these unique aspects of your journey.

Comparing Providers and Policies

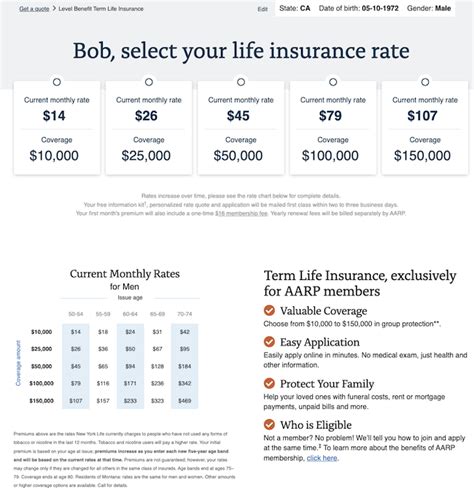

Research and compare different travel insurance providers and their policies. Look for reputable companies with a strong track record of providing comprehensive coverage and excellent customer service. Compare the scope of coverage, including limits and exclusions, to ensure you're getting the best value for your money.

| Provider | Policy Name | Medical Coverage Limit | Trip Cancellation Coverage | Luggage Coverage |

|---|---|---|---|---|

| InsureMe | Global Explorer | $500,000 | 100% | $2,000 |

| TravelGuard | Premium Plan | $1,000,000 | 75% | $3,000 |

| SafeTravels | Adventure Package | $800,000 | 50% | $1,500 |

Note: The table above is an example of a comparison between different travel insurance policies. Always conduct your own research and compare multiple providers to find the best fit for your needs.

Understanding Exclusions and Limitations

Carefully review the exclusions and limitations outlined in your travel insurance policy. These can vary widely between providers and policies. Be aware of any activities or circumstances that are not covered, such as certain adventure sports, pre-existing medical conditions, or political unrest in your destination country.

Reviewing Customer Reviews and Feedback

Seek out customer reviews and feedback to gauge the reputation and reliability of different travel insurance providers. Look for insights into their claim process, customer service responsiveness, and overall satisfaction levels. This can provide valuable insights into the quality of the coverage and the support you can expect.

The Impact of COVID-19 on Travel Insurance

The COVID-19 pandemic has significantly influenced the travel insurance landscape. Many travelers are now more aware of the importance of travel insurance, especially in light of the potential health risks and travel disruptions associated with the pandemic.

Travel insurance providers have adapted their policies to address COVID-19-related concerns. Some policies now offer specific coverage for COVID-19-related medical expenses, trip cancellations, and travel delays. However, it's crucial to carefully review the details of these policies, as they may have specific exclusions and limitations related to the pandemic.

Traveling During the Pandemic: Precautions and Considerations

When traveling internationally during the pandemic, it's essential to take extra precautions and consider the following:

- Check the entry requirements and COVID-19 regulations of your destination country. Some countries may require negative COVID-19 test results, proof of vaccination, or quarantine upon arrival.

- Ensure your travel insurance policy provides adequate coverage for COVID-19-related expenses, including medical treatment, testing, and quarantine costs.

- Stay informed about the latest travel advisories and health guidelines issued by your government and the World Health Organization (WHO). Be prepared to adapt your travel plans if necessary.

- Practice good hygiene and social distancing measures throughout your journey to minimize the risk of infection.

Expert Tips for Maximizing Your Travel Insurance Coverage

Here are some expert tips to help you make the most of your travel insurance coverage:

- Read your policy documents thoroughly to understand the scope of coverage and any specific exclusions. Familiarize yourself with the claim process and the necessary steps to take in case of an emergency.

- Keep all important documents, such as your insurance policy, travel itinerary, and contact information for your insurance provider, easily accessible during your trip. Consider storing digital copies in the cloud or on your smartphone for easy reference.

- If you engage in adventure sports or activities that may be considered high-risk, ensure your travel insurance policy covers these activities. Some policies have specific exclusions for certain activities, so it's important to clarify this beforehand.

- Consider purchasing additional coverage if you have valuable items or specialized equipment that may not be fully covered by your standard travel insurance policy.

- In case of an emergency, contact your insurance provider immediately. They can guide you through the necessary steps and provide support to help resolve the issue.

Frequently Asked Questions

Can I purchase travel insurance after I’ve already started my trip?

+

In most cases, travel insurance policies require you to purchase coverage before your trip begins. Some providers offer specific policies that allow for coverage during the trip, but these are often more limited and may not cover pre-existing conditions. It’s best to purchase travel insurance as soon as you book your trip to ensure comprehensive coverage.

What happens if I need to cancel my trip due to a family emergency or work obligations?

+

If you have trip cancellation coverage as part of your travel insurance policy, you may be reimbursed for non-refundable trip expenses in the event of a covered cancellation. However, it’s important to review the specific terms of your policy, as some providers may have restrictions or require documentation to support your claim.

Does travel insurance cover lost or stolen personal items other than luggage?

+

Travel insurance policies typically provide coverage for lost or stolen personal items, including valuables like jewelry, cameras, and electronics. However, there may be specific limits and deductibles associated with this coverage. It’s essential to review your policy’s details to understand the scope of protection.

Can I extend my travel insurance coverage if my trip is unexpectedly prolonged due to unforeseen circumstances?

+

Yes, some travel insurance providers offer the option to extend your coverage in case your trip duration changes unexpectedly. It’s important to contact your insurance provider as soon as you become aware of the need for an extension to ensure seamless coverage.

What should I do if I need to file a claim while traveling internationally?

+

In case of an emergency or if you need to file a claim, contact your insurance provider immediately. They will guide you through the necessary steps, which may include providing documentation, completing claim forms, and submitting receipts for eligible expenses. It’s crucial to follow their instructions to ensure a smooth claims process.