Aarp Insurance Rates Life Insurance

AARP, or the American Association of Retired Persons, is a well-known organization that offers a wide range of services and benefits to its members. Among their offerings is the AARP Life Insurance Program, which provides insurance coverage tailored to the needs of older adults. In this comprehensive article, we will delve into the world of AARP insurance rates for life insurance, exploring the factors that influence these rates, the unique features of AARP's life insurance plans, and how individuals can make informed decisions when considering coverage options.

Understanding AARP Insurance Rates for Life Insurance

Life insurance rates, in general, are determined by a variety of factors, and AARP's life insurance program is no exception. The rates for AARP insurance plans take into account the individual's age, health status, and lifestyle choices. Here's a closer look at these key considerations:

Age and Health Assessment

When applying for AARP life insurance, one of the primary factors is the applicant's age. As with most life insurance policies, younger individuals tend to receive more favorable rates. However, AARP's program is designed to cater to older adults, and their rates are structured accordingly. The insurance provider takes into account the applicant's current health status, including any pre-existing conditions, medical history, and lifestyle habits.

For instance, an applicant with a history of cardiovascular disease or diabetes may face higher premiums compared to someone with a clean bill of health. AARP works closely with its insurance partners to assess each individual's health and provide tailored coverage options.

| Health Condition | Potential Impact on Rates |

|---|---|

| Cardiovascular Disease | Higher premiums due to increased risk. |

| Diabetes | Potential rate adjustments based on severity and management. |

| Smoking | Smokers often face higher rates due to health risks. |

Lifestyle and Habits

In addition to health conditions, AARP insurance rates also consider an individual's lifestyle choices. For example, smokers may be subject to higher premiums due to the increased health risks associated with smoking. Similarly, individuals with a history of high-risk activities, such as extreme sports or hazardous occupations, may also see an impact on their insurance rates.

However, AARP understands that older adults lead diverse lives, and their program aims to offer coverage that is both comprehensive and affordable. By providing a range of coverage options and allowing individuals to choose the plan that best suits their needs, AARP strives to make life insurance accessible to a wide demographic.

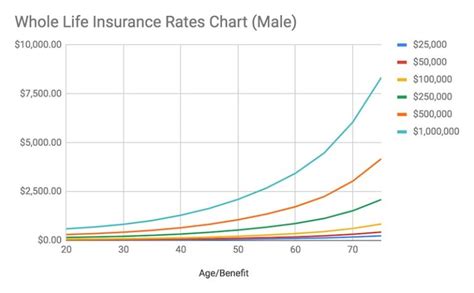

Term Length and Coverage Amount

The length of the insurance term and the desired coverage amount are other crucial factors that influence AARP insurance rates. Generally, longer-term policies and higher coverage amounts result in higher premiums. It's important for individuals to carefully consider their financial goals and needs when selecting a policy to ensure they receive adequate coverage without paying for unnecessary benefits.

AARP offers a variety of term lengths, including 10-year, 15-year, and 20-year terms, allowing individuals to choose a plan that aligns with their life expectancy and financial planning.

The Unique Features of AARP Life Insurance Plans

AARP's life insurance program stands out for its commitment to serving the needs of older adults. Here are some key features that set AARP's life insurance plans apart:

Guaranteed Acceptance

One of the most attractive aspects of AARP's life insurance plans is their guaranteed acceptance policy. This means that individuals, regardless of their health status or medical history, are guaranteed coverage without the need for a medical exam. While this convenience comes at a cost, it provides peace of mind to those who may have difficulty securing traditional life insurance due to pre-existing conditions.

Simplified Issue Plans

In addition to guaranteed acceptance, AARP offers simplified issue plans. These plans require a minimal health assessment, often involving a few simple health questions and possibly a urine sample. Simplified issue plans provide a balance between the convenience of guaranteed acceptance and the cost-effectiveness of traditional life insurance.

Flexible Coverage Options

AARP understands that the needs of older adults are diverse, and as such, they offer a range of coverage options. Individuals can choose from term life insurance, which provides coverage for a specified period, or permanent life insurance, which offers lifelong coverage. AARP's permanent life insurance plans include whole life insurance and universal life insurance, each with its own set of benefits and features.

Whole life insurance provides a fixed death benefit and accumulates cash value over time, making it a popular choice for individuals seeking long-term financial security. Universal life insurance, on the other hand, offers more flexibility in terms of premiums and coverage amounts, allowing policyholders to adjust their coverage as their needs change.

Affordable Rates for Members

AARP strives to make life insurance affordable for its members. By partnering with reputable insurance companies, AARP is able to negotiate competitive rates. Additionally, AARP members may be eligible for exclusive discounts and benefits, further reducing the cost of their life insurance policies.

Making Informed Decisions: A Step-by-Step Guide

Navigating the world of life insurance can be daunting, especially when considering AARP insurance rates. Here's a step-by-step guide to help individuals make informed decisions when selecting an AARP life insurance plan:

Step 1: Assess Your Needs

Start by evaluating your financial goals and the purpose of your life insurance coverage. Are you looking to provide financial security for your family in the event of your passing? Do you need coverage for a specific period, such as until your children become independent adults? Understanding your needs will help you choose the right type of life insurance and determine the appropriate coverage amount.

Step 2: Compare AARP Plans

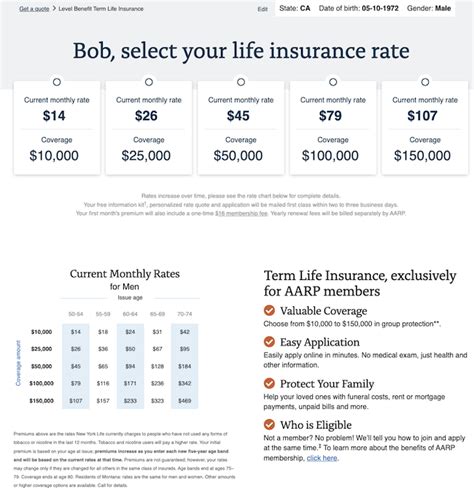

AARP offers a range of life insurance plans, each with its own set of features and benefits. Take the time to compare the different options available. Consider factors such as term length, coverage amounts, and any additional benefits or riders offered. Understanding the distinctions between the plans will help you select the one that aligns best with your needs and budget.

Step 3: Evaluate Your Health and Lifestyle

As mentioned earlier, AARP insurance rates are influenced by an individual's health and lifestyle. Assess your current health status and consider any pre-existing conditions or lifestyle choices that may impact your premiums. Being transparent about your health will ensure that you receive accurate quotes and avoid surprises down the line.

Step 4: Obtain Quotes

Once you have a good understanding of your needs and the available AARP life insurance plans, it's time to obtain quotes. AARP provides an easy-to-use online quote tool that allows you to input your personal information and receive customized quotes for various plans. Take the time to review these quotes, considering the coverage, premiums, and any additional fees or charges.

Step 5: Review and Compare

After receiving your quotes, carefully review the details of each plan. Compare the coverage amounts, term lengths, and any unique features or benefits. Consider your financial situation and long-term goals to determine which plan offers the best value and meets your specific needs. Don't hesitate to seek advice from financial professionals or insurance experts if you have any questions or concerns.

Step 6: Enroll and Maintain Your Coverage

Once you've made your decision, the final step is to enroll in your chosen AARP life insurance plan. Follow the enrollment process provided by AARP, ensuring that you understand the terms and conditions of your policy. Regularly review your coverage and make adjustments as your life circumstances change. Staying informed and proactive will help you maintain adequate coverage throughout your golden years.

Conclusion

AARP's life insurance program offers a range of coverage options tailored to the needs of older adults. By understanding the factors that influence AARP insurance rates and exploring the unique features of their plans, individuals can make informed decisions when selecting life insurance coverage. With guaranteed acceptance, simplified issue plans, and flexible coverage options, AARP strives to make life insurance accessible and affordable for its members.

FAQ

Can I get AARP life insurance if I have pre-existing health conditions?

+

Yes, AARP offers guaranteed acceptance life insurance, ensuring coverage for individuals with pre-existing health conditions. However, it’s important to note that guaranteed acceptance plans typically come with higher premiums.

Are there any age restrictions for AARP life insurance?

+

AARP life insurance is primarily designed for older adults, and the program caters to individuals aged 50 and above. However, the exact age eligibility may vary depending on the specific plan and the insurance provider.

Can I add additional benefits or riders to my AARP life insurance plan?

+

Yes, AARP life insurance plans often allow policyholders to add optional riders or benefits to their coverage. These may include accelerated death benefits, waiver of premium riders, or even long-term care insurance riders. It’s important to review the available options and select the riders that align with your specific needs.