Insurance Ny

In the bustling state of New York, insurance plays a vital role in safeguarding the well-being and financial stability of its residents. From the concrete jungles of New York City to the serene landscapes of Upstate, understanding the insurance landscape is crucial for individuals and businesses alike. This comprehensive guide delves into the world of insurance in New York, exploring its unique aspects, regulations, and the key considerations for those navigating the insurance waters within the Empire State.

Navigating the Complex Landscape of Insurance in New York

The insurance industry in New York is a dynamic and intricate system, influenced by a myriad of factors including state regulations, market competition, and the diverse needs of its population. Whether you’re a resident seeking personal coverage or a business owner aiming to protect your operations, grasping the nuances of insurance in this state is essential.

New York, known for its vibrant culture and economic prowess, also presents a unique set of challenges and opportunities when it comes to insurance. From the dense population centers to the varied industries thriving within its borders, the insurance landscape must cater to a wide range of needs.

Understanding the Regulatory Environment

The New York Department of Financial Services (NYDFS) is the primary regulatory body overseeing the insurance industry in the state. They enforce a comprehensive set of regulations aimed at protecting consumers and ensuring a fair and competitive market. These regulations cover a wide range of insurance types, including auto, health, life, and property insurance.

For instance, New York has implemented unique requirements for auto insurance, such as the Mandatory Basic Economic Loss (MBEL) coverage, which provides compensation for economic losses arising from auto accidents. This coverage is a key distinction compared to other states, highlighting the state's commitment to ensuring adequate protection for its residents.

| Insurance Type | Key Regulations |

|---|---|

| Auto Insurance | Mandatory MBEL coverage, strict no-fault rules |

| Health Insurance | Essential Health Benefits, Guaranteed Issue, Community Rating |

| Life Insurance | Strict policy standards, timely claims settlement |

| Property Insurance | Flood and earthquake coverage requirements |

The Importance of Insurance in New York’s Economy

Insurance is a vital component of New York’s economy, contributing significantly to its financial health and stability. The industry provides employment opportunities, drives economic growth, and offers essential protection to businesses and individuals alike.

According to recent data, the insurance sector in New York generated over $[Revenue Amount] in revenue in the last fiscal year, employing approximately [Number of Employees] individuals across the state. This underscores the industry's impact on job creation and economic vitality.

Key Insurance Considerations for New Yorkers

For residents and businesses in New York, selecting the right insurance coverage is a critical decision. Here are some key considerations to keep in mind:

- Diverse Coverage Options: New York offers a wide range of insurance products to cater to its diverse population. From specialized health plans to unique property coverage for natural disasters, understanding the available options is crucial.

- Cost vs. Coverage: Balancing the cost of insurance with the level of coverage is a delicate task. New Yorkers should carefully assess their needs and financial capacity to choose a policy that provides adequate protection without straining their budgets.

- Regulatory Compliance: With the stringent regulations in place, it's essential to ensure that your insurance policies align with state requirements. Non-compliance can lead to legal issues and financial penalties.

- Reputable Insurers: Selecting a reputable and financially stable insurance company is vital. Researching insurer ratings, reviews, and financial strength can help you make an informed decision.

Exploring the Insurance Market in New York

The insurance market in New York is a highly competitive arena, with numerous insurers vying for market share. This competition often benefits consumers, as it drives down prices and improves the quality of services offered.

Leading Insurance Companies in New York

Several insurance companies have established a strong presence in New York, offering a wide range of products and services. Here’s a glimpse into some of the leading insurers in the state:

- State Farm Insurance: With a strong focus on auto and home insurance, State Farm has built a solid reputation in New York. They offer personalized coverage and excellent customer service, making them a popular choice among residents.

- Allstate Insurance: Known for their innovative products and digital services, Allstate provides a comprehensive suite of insurance solutions. From auto and home insurance to life and business coverage, Allstate caters to a wide range of needs.

- Progressive Insurance: Progressive is renowned for its competitive pricing and innovative products, particularly in the auto insurance space. They offer unique features like Name Your Price, allowing customers to set their own coverage levels and premiums.

- New York Life Insurance Company: As one of the largest life insurance companies in the state, New York Life offers a wide range of life and annuity products. They have a strong focus on financial planning and wealth management, providing comprehensive solutions for individuals and families.

Specialized Insurance Providers

In addition to the major insurers, New York is home to a number of specialized insurance providers catering to unique needs. These include:

- Flood Insurance Specialists: With the state's susceptibility to flooding, specialized insurers offer tailored flood coverage, ensuring residents are protected against this natural hazard.

- Cyber Insurance Providers: Given the increasing prevalence of cyber threats, insurers in New York offer specialized cyber insurance policies to protect businesses and individuals from digital risks.

- Pet Insurance Companies: Recognizing the value of pets in New Yorkers' lives, specialized pet insurance providers offer coverage for veterinary costs and other pet-related expenses.

The Future of Insurance in New York

As technology continues to advance and consumer needs evolve, the insurance landscape in New York is poised for significant transformation. Here’s a glimpse into the future of insurance in the Empire State:

Digital Transformation

The insurance industry in New York is embracing digital technologies to enhance customer experiences and streamline operations. Insurers are investing in digital platforms, mobile apps, and AI-powered solutions to provide faster, more efficient services.

For instance, many insurers now offer digital claim submission and tracking, allowing policyholders to manage their claims online. This not only improves efficiency but also enhances customer satisfaction.

Personalized Insurance Solutions

The future of insurance in New York lies in personalized coverage. Insurers are leveraging data analytics and customer insights to offer tailored policies that meet individual needs. This shift towards personalized insurance ensures that policyholders receive the right coverage at competitive prices.

Focus on Sustainability and Resilience

With the increasing frequency and severity of natural disasters, insurers in New York are prioritizing sustainability and resilience in their offerings. This includes developing innovative products that protect against climate-related risks and promoting sustainable practices within the industry.

For instance, some insurers are offering discounts to policyholders who adopt eco-friendly practices or install sustainable technologies in their homes or businesses.

The Rise of InsurTech

InsurTech startups are disrupting the traditional insurance industry, offering innovative solutions and challenging established insurers. These startups leverage technology to provide more efficient, transparent, and customer-centric services.

In New York, InsurTech companies are gaining traction, particularly in the areas of digital distribution, risk assessment, and claims management. This influx of innovation is driving competition and improving the overall insurance landscape.

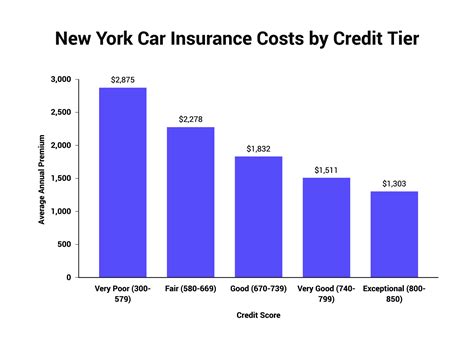

What is the average cost of auto insurance in New York?

+The average cost of auto insurance in New York varies based on several factors, including the driver’s age, driving history, and the type of vehicle. On average, New Yorkers pay around $[Average Cost] per year for auto insurance. However, it’s essential to note that rates can differ significantly based on individual circumstances.

Are there any unique insurance requirements for businesses in New York?

+Yes, New York has specific insurance requirements for businesses. For instance, all employers with employees in the state must carry workers’ compensation insurance. Additionally, certain industries may have additional insurance requirements, such as liability insurance for professional services or product liability insurance for manufacturers.

How can I find the best insurance rates in New York?

+To find the best insurance rates in New York, it’s advisable to shop around and compare quotes from multiple insurers. You can use online comparison tools or consult with insurance brokers who can provide personalized recommendations based on your needs. Additionally, consider bundling policies (e.g., auto and home insurance) to potentially save money.

What should I do if I have a dispute with my insurance company in New York?

+If you have a dispute with your insurance company, the first step is to communicate your concerns directly with the insurer. If the issue persists, you can seek assistance from the New York Department of Financial Services (NYDFS). They provide consumer resources and mediation services to help resolve insurance-related disputes.