Gap Insurance For Car

When it comes to purchasing a new car, many individuals prioritize factors such as brand, model, and features. However, one crucial aspect that often gets overlooked is the need for adequate insurance coverage. In particular, gap insurance for cars is a type of protection that can provide significant financial relief in certain situations. This comprehensive guide aims to delve into the world of gap insurance, exploring its purpose, benefits, and how it can be a valuable addition to your automotive insurance portfolio.

Understanding Gap Insurance

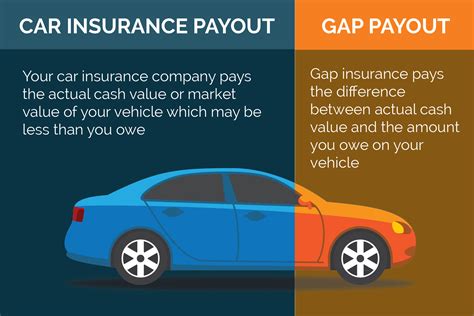

Gap insurance, short for Guaranteed Asset Protection, is an optional form of insurance coverage that addresses a specific gap in traditional auto insurance policies. This gap arises when the value of your vehicle decreases over time, leading to a situation where the insurance payout may not cover the entire amount you still owe on your car loan or lease.

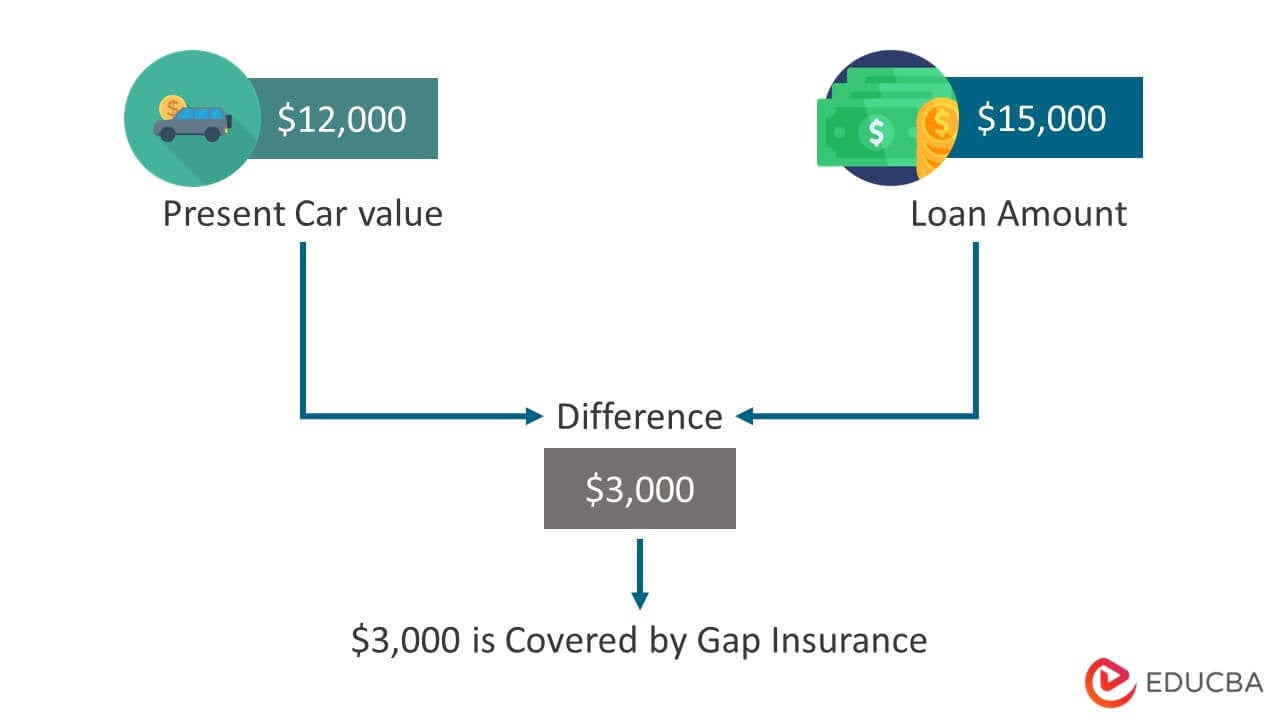

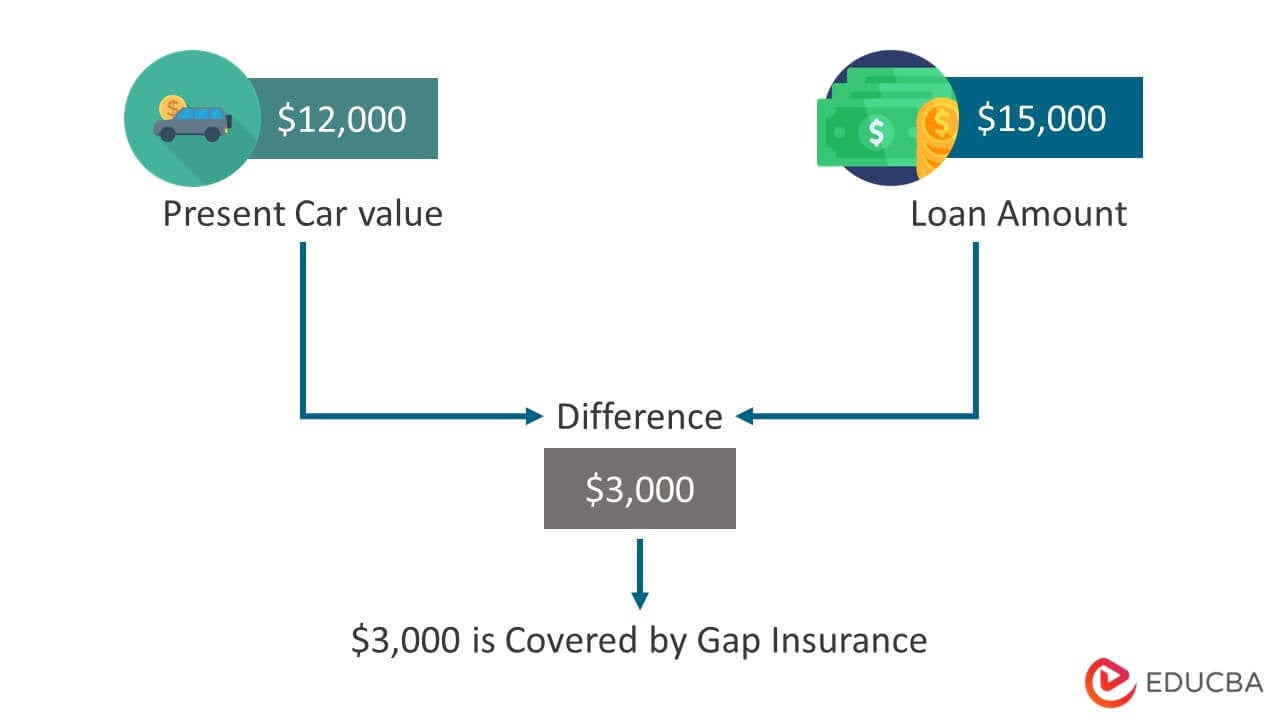

To illustrate, imagine purchasing a new car for $30,000 with a loan of the same amount. Over the course of a year, the value of your car depreciates by 20%, leaving it worth $24,000. If you were to total your car in an accident during this period, your comprehensive insurance would provide a payout based on the current market value, which is $24,000. However, you would still owe the full $30,000 to your lender, resulting in a financial gap of $6,000.

This is where gap insurance steps in. By adding this coverage to your policy, you can ensure that you're not left with a substantial financial burden in the event of a total loss or theft of your vehicle. Gap insurance covers the difference between the actual cash value of your car and the amount you owe, effectively bridging the gap and protecting your financial stability.

The Benefits of Gap Insurance

Gap insurance offers several advantages that make it an appealing choice for car owners:

Financial Protection

The primary benefit of gap insurance is the financial security it provides. By covering the gap between your vehicle’s value and the outstanding loan amount, you can avoid being responsible for paying off a car you no longer own. This is especially crucial during the early years of a car loan when depreciation rates are typically steep.

Peace of Mind

Owning a car comes with inherent risks, and accidents or theft can happen unexpectedly. With gap insurance, you can drive with peace of mind, knowing that you’re protected against potential financial losses. It takes away the worry of being stuck with a large bill if your car is deemed a total loss.

Lease Protection

Gap insurance is particularly beneficial for individuals who lease their vehicles. In a lease agreement, you’re typically responsible for any excess mileage charges or excessive wear and tear. If your leased car is totaled, gap insurance can cover these additional costs, ensuring you’re not on the hook for unexpected expenses.

Affordable Coverage

Gap insurance is generally quite affordable, especially when compared to the potential financial risks it mitigates. Most providers offer gap insurance as an add-on to your existing auto insurance policy, making it a cost-effective way to enhance your coverage.

When to Consider Gap Insurance

While gap insurance is an excellent option for many car owners, it’s essential to assess your specific circumstances to determine if it’s the right choice for you.

New or Recently Purchased Vehicles

Gap insurance is most beneficial for individuals who have recently purchased a new or used car. During the initial years of ownership, vehicles depreciate rapidly, making gap insurance a valuable safeguard against financial loss.

Large Loan Amounts

If you’ve taken out a substantial loan to finance your vehicle, gap insurance can provide crucial protection. The larger the loan amount, the greater the potential financial gap in the event of a total loss, making gap insurance a wise investment.

Lease Agreements

As mentioned earlier, gap insurance is highly recommended for individuals who lease their vehicles. It ensures that you’re not left responsible for paying off a lease on a car that no longer exists.

High-Value Vehicles

Owners of high-value vehicles, such as luxury cars or specialty models, may find gap insurance particularly beneficial. These vehicles often depreciate at a slower rate, which means they may retain a higher value over time. However, if an accident occurs, the gap between the vehicle’s value and the loan amount can still be significant, making gap insurance a prudent choice.

How Gap Insurance Works

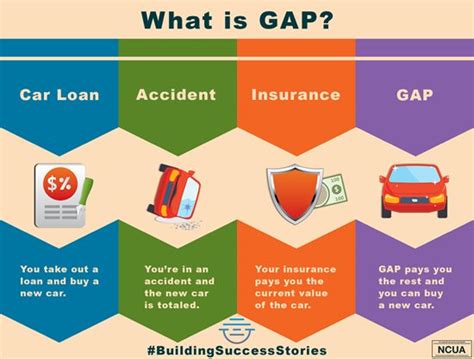

Understanding how gap insurance operates is crucial to maximizing its benefits. Here’s a step-by-step breakdown of how gap insurance works:

-

Purchase Gap Insurance: You can typically add gap insurance to your existing auto insurance policy. It's essential to carefully review the terms and conditions of the coverage to ensure it meets your specific needs.

-

Total Loss or Theft: In the unfortunate event of a total loss or theft of your vehicle, you'll need to file a claim with your insurance provider. This process usually involves providing documentation, such as police reports and repair estimates.

-

Payout Determination: Your insurance provider will assess the value of your vehicle at the time of the incident and determine the payout based on the actual cash value (ACV). The ACV is calculated by considering factors like the vehicle's age, mileage, and condition.

-

Gap Coverage: If the ACV payout is insufficient to cover the outstanding loan or lease balance, gap insurance steps in. It provides coverage for the difference, ensuring you're not left with a financial deficit.

-

Claim Settlement: Once the gap insurance coverage is applied, you'll receive a settlement amount that covers the remaining loan or lease balance. This ensures that you're not responsible for any outstanding debt related to the totaled or stolen vehicle.

Gap Insurance vs. Other Coverage Options

When considering insurance options for your vehicle, it’s essential to understand how gap insurance differs from other types of coverage:

Comprehensive Insurance

Comprehensive insurance provides coverage for non-collision-related incidents, such as theft, vandalism, and natural disasters. While it does offer protection against total losses, it may not fully cover the amount you owe on your loan or lease, which is where gap insurance becomes crucial.

Collision Insurance

Collision insurance covers damage to your vehicle resulting from collisions with other vehicles or objects. Similar to comprehensive insurance, it may not always provide sufficient coverage for the outstanding loan or lease balance, highlighting the importance of gap insurance.

Loan/Lease Payoff Coverage

Some insurance providers offer loan/lease payoff coverage as an add-on to comprehensive or collision insurance. This coverage pays off the remaining balance on your loan or lease if your vehicle is totaled or stolen. However, it may have limitations or exclusions, making gap insurance a more comprehensive option.

Tips for Maximizing Gap Insurance Benefits

To make the most of your gap insurance coverage, consider the following tips:

-

Review Policy Details: Carefully read through your gap insurance policy to understand the specific terms, conditions, and exclusions. This ensures you're aware of any limitations or requirements that may impact your coverage.

-

Maintain Regular Payments: Keeping up with your car loan or lease payments is crucial. Gap insurance typically applies when there's a financial gap, so ensuring your payments are up to date helps maximize the benefits of this coverage.

-

Stay Informed: Stay updated on the value of your vehicle. If your car's value decreases significantly, consider refinancing your loan or exploring other options to reduce the financial gap.

-

Compare Providers: Shop around and compare gap insurance policies from different providers. Ensure you understand the coverage limits, deductibles, and any additional benefits or exclusions.

Real-World Scenarios and Case Studies

To further illustrate the impact of gap insurance, let’s explore a few real-world scenarios and case studies:

Scenario 1: Total Loss of a New Car

John purchased a new car for 35,000 and financed it with a loan of the same amount. After six months, he was involved in a severe accident, totaling his car. The insurance company assessed the value of his vehicle at 28,000, which was the current market value. Without gap insurance, John would have been responsible for paying off the remaining $7,000 of his loan. However, with gap insurance in place, the insurance provider covered the entire loan amount, leaving John financially protected.

Scenario 2: Theft of a Leased Vehicle

Sarah leased a luxury SUV for three years. After two years, her vehicle was stolen. The lease agreement had an outstanding balance of $15,000. Without gap insurance, Sarah would have been liable for the full amount. However, with gap insurance coverage, the insurance provider paid off the remaining lease balance, saving Sarah from a significant financial burden.

Case Study: High-Value Sports Car

A car enthusiast named Michael purchased a high-end sports car for 120,000. Due to the car's luxury brand and performance, it retained its value relatively well over time. However, when Michael was involved in an accident, the insurance company assessed the vehicle's value at 105,000. Without gap insurance, Michael would have had to pay the difference of $15,000 out of pocket. With gap insurance, he received a payout that covered the entire loan amount, ensuring he wasn’t financially impacted by the accident.

Industry Insights and Expert Advice

To gain further insights into gap insurance, we consulted industry experts and financial advisors. Here are some key takeaways from their advice:

Financial Advisor Insights: "Gap insurance is an essential consideration for anyone who wants to protect their financial stability. It's a relatively low-cost way to ensure that you're not left with a large debt in the event of a total loss or theft. Make sure to review your policy regularly and assess your vehicle's value to ensure the coverage remains adequate."

The experts also emphasized the importance of researching and comparing different insurance providers to find the best coverage and value for your specific needs.

The Future of Gap Insurance

As the automotive industry continues to evolve, so too will the landscape of insurance coverage. Here are some potential future developments and trends in gap insurance:

Enhanced Digital Integration

With the rise of digital technologies, gap insurance providers are likely to enhance their online platforms and mobile apps. This will enable policyholders to easily manage their coverage, file claims, and access real-time updates on their policy status.

Personalized Coverage Options

Insurance providers may offer more tailored gap insurance options based on individual driving behaviors and vehicle usage patterns. This could include discounts for safe driving or incentives for using eco-friendly vehicles.

Increased Collaboration with Automotive Brands

Some insurance companies may partner with automotive brands to offer exclusive gap insurance packages. These collaborations could provide additional benefits, such as discounted rates or extended coverage periods.

Integration with Telematics

Telematics technology, which tracks driving behavior and vehicle performance, could be integrated with gap insurance policies. This integration could lead to more accurate risk assessments and potentially lower insurance premiums for safe drivers.

Conclusion

Gap insurance is an essential component of comprehensive automotive insurance coverage. By understanding the benefits and implications of gap insurance, car owners can make informed decisions to protect their financial well-being. Whether you’re purchasing a new car, leasing a vehicle, or driving a high-value asset, gap insurance provides a crucial layer of protection against unforeseen circumstances.

As the automotive industry evolves, so too will the options and innovations in gap insurance. By staying informed and proactive, you can ensure that your vehicle and financial stability are adequately protected.

Can I add gap insurance to my existing auto insurance policy?

+Yes, gap insurance is typically offered as an add-on to your existing auto insurance policy. Contact your insurance provider to inquire about adding gap coverage to your existing plan.

Is gap insurance necessary for all car owners?

+Gap insurance is most beneficial for individuals who have recently purchased a new or used car, have large loan amounts, or are leasing a vehicle. It’s a personal decision based on your specific circumstances and financial goals.

How much does gap insurance cost?

+The cost of gap insurance varies depending on several factors, including the value of your vehicle, the term of your loan or lease, and the coverage limits you choose. On average, gap insurance can range from 200 to 600 per year.

Does gap insurance cover all types of vehicles?

+Gap insurance is primarily designed for cars, trucks, and SUVs. However, some providers may offer gap insurance for motorcycles, boats, and other types of vehicles. It’s best to check with your insurance provider for specific coverage options.

What happens if I sell my car before the gap insurance expires?

+If you sell your car before the gap insurance expires, you may be eligible for a partial refund. The refund amount will depend on the terms and conditions of your specific policy. Contact your insurance provider to understand the refund process and eligibility.