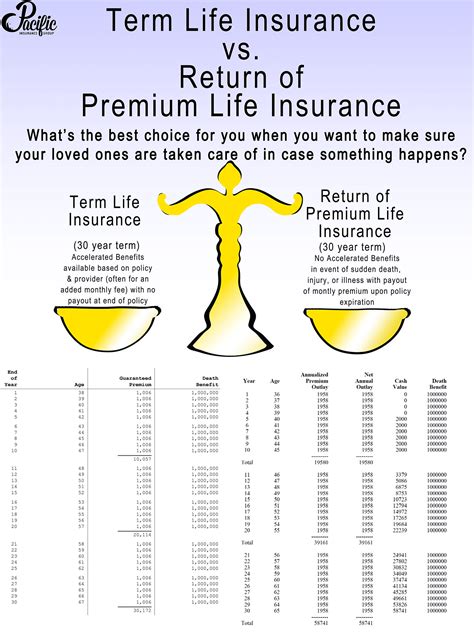

Term Life Insurance Premiums

Term life insurance is a popular and cost-effective way for individuals to secure financial protection for their loved ones during a specified period, often ranging from 10 to 30 years. The premiums for term life insurance are generally more affordable compared to permanent life insurance policies, making them an attractive option for those seeking temporary coverage. However, the cost of premiums can vary significantly based on various factors, and understanding these influences is crucial for anyone considering this type of insurance.

Factors Influencing Term Life Insurance Premiums

The price of term life insurance premiums is determined by a multitude of factors, each playing a unique role in shaping the overall cost. From the basic demographic information to intricate health and lifestyle factors, every aspect contributes to the final premium amount. Let’s delve into these influencing factors to gain a comprehensive understanding.

Age and Gender

Age is one of the primary factors that insurance providers consider when determining term life insurance premiums. In general, younger individuals are offered lower premiums due to their reduced risk of developing serious health conditions or passing away during the policy term. As individuals age, the premiums tend to increase, reflecting the higher likelihood of health complications and the need for greater coverage.

Gender also plays a role in premium calculation. Historically, men have paid higher premiums than women due to statistical data indicating a higher propensity for risk-taking behaviors and a shorter life expectancy. However, with changing societal trends and improved healthcare, this gap is narrowing, and some providers now offer gender-neutral premiums.

Health and Lifestyle

The state of an individual’s health is a critical factor in determining term life insurance premiums. Insurance companies carefully assess an applicant’s medical history, current health status, and any existing health conditions. Those with pre-existing medical conditions or a history of serious illnesses may face higher premiums or even be denied coverage altogether. On the other hand, individuals with a clean bill of health can expect more competitive rates.

Lifestyle choices also significantly impact premium costs. Habits such as smoking, excessive alcohol consumption, and participation in high-risk activities like skydiving or motor racing can increase premiums. Conversely, leading a healthy lifestyle, maintaining a healthy weight, and engaging in regular exercise can lead to lower premiums.

Policy Term and Coverage Amount

The length of the policy term and the amount of coverage desired also affect the cost of term life insurance premiums. Longer policy terms generally result in higher premiums, as the risk of a claim increases over time. Similarly, higher coverage amounts require higher premiums to provide adequate financial protection for beneficiaries.

Occupation and Hobbies

An individual’s occupation and hobbies can influence their term life insurance premiums. High-risk occupations, such as those in the construction or mining industries, or hobbies like extreme sports, can increase premiums due to the higher likelihood of accidents or injuries. Conversely, individuals with low-risk occupations or hobbies may enjoy more affordable premiums.

Family History

Insurance providers also consider an applicant’s family history when assessing term life insurance premiums. A history of certain hereditary diseases or conditions within the family can increase the risk of the applicant developing similar health issues, leading to higher premiums.

How to Get the Best Term Life Insurance Premiums

Understanding the factors that influence term life insurance premiums is the first step towards securing the best rates. Here are some strategies to consider when aiming for the most competitive premiums:

Shop Around

Don’t settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers to find the most suitable policy at the best price. Online comparison tools can be particularly helpful in this process.

Consider Term Length

While longer policy terms may seem appealing, they can also result in higher premiums. Assess your needs and consider a shorter term if it aligns better with your financial goals and circumstances. This can help keep your premiums more manageable.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle is not only beneficial for your overall well-being but can also lead to more affordable term life insurance premiums. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve your health and reduce the risk of serious health conditions, resulting in lower premiums.

Be Honest and Transparent

When applying for term life insurance, it’s crucial to provide accurate and honest information about your health and lifestyle. Misrepresenting yourself can not only lead to higher premiums but may also invalidate your policy in the event of a claim. Be transparent and disclose all relevant information to ensure you receive a fair premium.

Review and Adjust Coverage

As your life circumstances change, your term life insurance coverage may need to be adjusted. Regularly review your policy to ensure it aligns with your current needs and financial situation. If your circumstances have changed, consider adjusting your coverage amount or policy term to keep your premiums as low as possible.

Consider Group or Employer-Sponsored Plans

Group term life insurance plans, often offered through employers or professional organizations, can provide more affordable coverage than individual plans. These plans typically offer standardized coverage and simplified underwriting processes, making them a convenient and cost-effective option for many individuals.

The Future of Term Life Insurance Premiums

The landscape of term life insurance is constantly evolving, influenced by advancements in technology, changes in societal trends, and shifts in the insurance industry. Here are some key trends and predictions that may impact term life insurance premiums in the future:

Increased Use of Telemedicine

The rise of telemedicine and remote healthcare services is expected to play a significant role in shaping the future of term life insurance premiums. These technologies allow for more efficient and cost-effective health assessments, making it easier for insurance providers to accurately assess an applicant’s health status and potentially reducing the need for in-person medical exams. This could lead to more streamlined underwriting processes and, in turn, lower premiums.

Advanced Data Analytics

The insurance industry is increasingly utilizing advanced data analytics and machine learning algorithms to assess risk and price policies. By analyzing vast amounts of data, including health records, lifestyle choices, and demographic information, insurance providers can more accurately predict an individual’s risk profile. This enhanced risk assessment capability could lead to more tailored and precise premium pricing, benefiting those with lower risk profiles.

Wearable Technology Integration

The integration of wearable technology, such as fitness trackers and health monitoring devices, is another emerging trend that could impact term life insurance premiums. These devices provide real-time health data, allowing insurance providers to gain a more comprehensive understanding of an individual’s health and lifestyle. Insurers may offer incentives or discounted premiums to policyholders who voluntarily share their health data, encouraging healthier lifestyles and more accurate risk assessment.

Increased Competition and Digitalization

The digitalization of the insurance industry, coupled with increased competition, is expected to drive down term life insurance premiums. Online insurance platforms and comparison websites are making it easier for consumers to compare policies and premiums, fostering a more competitive market. Additionally, the rise of insurtech startups is introducing innovative pricing models and streamlined processes, further contributing to a more affordable and accessible term life insurance market.

Focus on Preventative Care

The insurance industry is increasingly recognizing the importance of preventative care in managing long-term health risks. As a result, insurance providers may offer incentives or discounted premiums to policyholders who actively engage in preventative health measures, such as regular check-ups, vaccinations, and healthy lifestyle choices. This shift towards incentivizing preventative care could lead to improved public health outcomes and potentially lower term life insurance premiums over time.

Table: Average Term Life Insurance Premiums by Age

| Age | Average Annual Premium (for 500,000 coverage)</th> </tr> <tr> <td>25</td> <td>210 |

|---|---|

| 30 | 260</td> </tr> <tr> <td>35</td> <td>330 |

| 40 | 430</td> </tr> <tr> <td>45</td> <td>570 |

| 50 | 750</td> </tr> <tr> <td>55</td> <td>1,050 |

| 60 | 1,400</td> </tr> <tr> <td>65</td> <td>2,000 |

Frequently Asked Questions

How do term life insurance premiums compare to other types of life insurance?

+Term life insurance premiums are generally more affordable compared to permanent life insurance policies, such as whole life or universal life insurance. This is because term life insurance provides coverage for a specific period, often 10 to 30 years, whereas permanent life insurance offers lifelong coverage and accumulates cash value over time. As a result, the premiums for permanent life insurance are typically higher to account for the longer coverage period and the additional cash value component.

Can term life insurance premiums change during the policy term?

+Yes, depending on the type of term life insurance policy you have, the premiums can either remain level throughout the policy term or increase at specified intervals. Level term policies offer consistent premiums, providing budget predictability. On the other hand, increasing term policies start with lower premiums that gradually rise over time, reflecting the increasing risk of claim as the insured ages.

What happens if I miss a term life insurance premium payment?

+Missing a premium payment can have serious consequences for your term life insurance policy. If you fail to make a premium payment by the due date, your policy may enter a grace period, typically lasting 30 days. During this period, you can still make the payment without any disruption to your coverage. However, if you do not pay within the grace period, your policy may lapse, and you will lose your coverage. It’s crucial to stay on top of your premium payments to maintain continuous coverage.

Can I convert my term life insurance policy into a permanent life insurance policy?

+Yes, many term life insurance policies offer a conversion privilege, allowing policyholders to convert their term policy into a permanent life insurance policy, such as a whole life or universal life policy, without having to undergo a new medical exam or provide additional evidence of insurability. This option is particularly beneficial for individuals who initially opted for term life insurance but later decide they need lifelong coverage.