Wegovy Price With Insurance

Welcome to a comprehensive guide on understanding the cost of Wegovy, a medication often prescribed for weight management, and how insurance coverage can impact its price. This article aims to provide an in-depth analysis of the financial aspects associated with obtaining Wegovy, offering valuable insights for those considering this treatment option.

Understanding Wegovy and its Impact on Weight Management

Wegovy, known generically as semaglutide, is a prescription medication that has gained attention in the field of obesity and metabolic disorders. It belongs to a class of drugs called glucagon-like peptide-1 (GLP-1) receptor agonists, which work by mimicking the effects of a natural hormone in the body.

The primary mechanism of action for Wegovy is its ability to slow down the movement of food through the stomach, resulting in a feeling of fullness and reduced appetite. This can lead to significant weight loss for individuals struggling with obesity or those aiming to manage their weight more effectively. While the medication is not a quick fix, it offers a promising tool in the arsenal of weight management strategies.

However, the cost of Wegovy can be a significant concern for many. Let's delve into the financial aspects and explore how insurance coverage can make a difference.

The Financial Aspect of Wegovy Treatment

Wegovy is not an over-the-counter medication; it requires a prescription and is typically administered as a weekly injection. The cost of Wegovy can vary widely depending on several factors, including the country or region, the specific insurance plan, and the dosage prescribed.

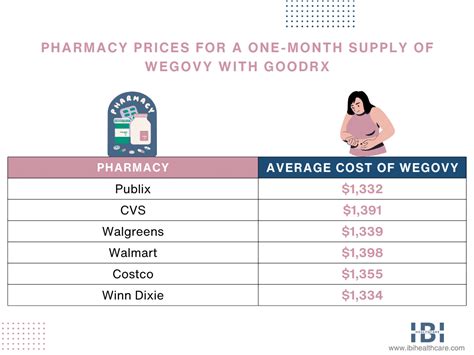

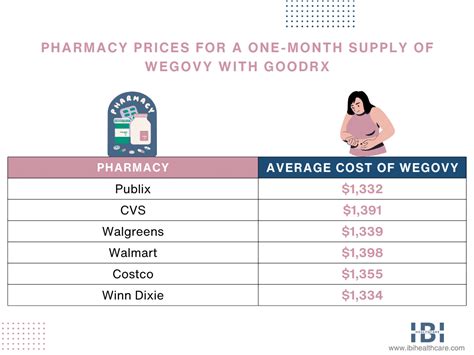

Without insurance coverage, the out-of-pocket cost for Wegovy can be substantial. For example, in the United States, the average price for a month's supply of Wegovy can range from $1,200 to $1,500. This price does not account for potential discounts or special offers that may be available through pharmacies or online retailers.

However, the financial burden can be significantly reduced with insurance coverage. Many insurance plans, especially those focused on health maintenance and prevention, offer coverage for weight management medications like Wegovy. The level of coverage can vary, but it often includes a combination of prescription drug benefits and specialty pharmacy benefits.

Insurance Coverage for Wegovy: A Deep Dive

Insurance coverage for Wegovy typically involves a few key components. Firstly, there is the prescription drug benefit, which covers a wide range of medications, including those for weight management. This benefit often comes with a co-pay or co-insurance, meaning you pay a portion of the medication’s cost while the insurance plan covers the rest.

| Insurance Plan | Co-Pay/Co-Insurance |

|---|---|

| Blue Cross Blue Shield | $40 co-pay for specialty medications |

| UnitedHealthcare | 20% co-insurance for brand-name drugs |

| Aetna | Tiered co-pays based on drug classification |

Secondly, insurance plans often include a specialty pharmacy benefit, which is designed to cover high-cost, complex medications like Wegovy. This benefit may have different rules and requirements compared to the standard prescription drug benefit. For instance, you might need to get prior authorization from your insurance provider before filling the prescription at a specialty pharmacy.

Additionally, insurance plans may have preferred pharmacy networks, which are a group of pharmacies that have negotiated lower prices with the insurance company. Using an in-network pharmacy can further reduce the cost of Wegovy, as these pharmacies often offer discounted prices.

Navigating Insurance Coverage for Wegovy

When considering Wegovy, it’s essential to understand your insurance coverage and how it applies to this specific medication. Here are some steps to navigate the process:

- Review your insurance plan's benefits summary or member handbook. Look for information on prescription drug coverage and specialty pharmacy benefits.

- Contact your insurance provider's customer service line. They can provide detailed information on your coverage for Wegovy, including any co-pays or co-insurance, and guide you through the process of obtaining prior authorization if required.

- Reach out to the specialty pharmacy recommended by your insurance provider. They can work with you and your healthcare provider to ensure a smooth process for obtaining and administering Wegovy.

- Consider using a prescription savings card or coupon if your insurance coverage is limited. These can help reduce the out-of-pocket cost for Wegovy, especially if you don't have coverage for specialty medications.

It's important to note that the process of obtaining insurance coverage for Wegovy may vary based on your specific insurance plan and individual circumstances. Always consult with your healthcare provider and insurance company to ensure you have the most accurate and up-to-date information.

Real-World Examples: Wegovy Cost with Insurance

To provide a clearer picture, let’s look at some real-world examples of how insurance coverage can impact the cost of Wegovy.

Example 1: Commercial Insurance Plan

Sarah, a 35-year-old with a commercial insurance plan through her employer, was prescribed Wegovy for weight management. Her insurance plan had a 40 co-pay for specialty medications. When she filled her prescription at an in-network specialty pharmacy, she paid 40 out of pocket for a month’s supply of Wegovy, while her insurance plan covered the remaining cost.

Example 2: Medicare Part D Plan

John, a 65-year-old on Medicare, was also prescribed Wegovy. His Medicare Part D plan had a 20% co-insurance for brand-name drugs. When he filled his prescription, he paid 20% of the medication’s cost, which came to $300 for a month’s supply, while Medicare covered the remaining 80%.

Example 3: Medicaid Coverage

Emily, a 40-year-old with Medicaid coverage, had her Wegovy prescription covered in full. Medicaid, being a publicly funded insurance program, often covers the cost of weight management medications like Wegovy without any out-of-pocket expenses for the patient.

Future Outlook: Access and Affordability of Wegovy

The landscape of weight management medications and their affordability is evolving. As more research is conducted and awareness grows, insurance companies are increasingly recognizing the importance of covering these medications. This trend is expected to continue, making treatments like Wegovy more accessible and affordable for those in need.

Additionally, pharmaceutical companies are working to make their medications more affordable. This includes offering patient assistance programs, copay cards, and discounts to reduce the financial burden for patients. These initiatives, combined with insurance coverage, can significantly improve access to weight management medications.

Expanding Access: The Role of Patient Advocacy Groups

Patient advocacy groups play a crucial role in advocating for increased access and affordability of weight management medications. These organizations work to raise awareness, educate policymakers, and influence insurance coverage decisions. Their efforts can lead to more inclusive insurance plans and improved coverage for medications like Wegovy.

Moreover, patient advocacy groups often provide resources and support for individuals navigating the healthcare system. This includes guidance on insurance coverage, assistance with prescription costs, and emotional support throughout the treatment journey.

Conclusion: Navigating the Cost of Wegovy

Understanding the financial aspects of Wegovy treatment is crucial for individuals considering this medication. While the out-of-pocket cost can be significant without insurance, coverage through various insurance plans can make Wegovy more affordable and accessible.

By reviewing your insurance benefits, consulting with your healthcare provider and insurance company, and utilizing available resources, you can navigate the process of obtaining Wegovy with confidence. Remember, the cost of the medication is just one aspect of a comprehensive weight management plan, and with the right support, achieving your weight goals can be a reality.

Can I get Wegovy covered by my insurance if it’s not specifically listed as a covered medication?

+Yes, it’s possible to get coverage for Wegovy even if it’s not explicitly listed in your insurance plan’s covered medications. Insurance plans often update their formularies based on new medications and medical advancements. You can request a prior authorization from your insurance provider, providing them with medical justification for the prescription. This process may involve your healthcare provider submitting additional information to support the request.

Are there any discounts or patient assistance programs available for Wegovy?

+Yes, there are several ways to reduce the cost of Wegovy. Pharmaceutical companies often offer patient assistance programs, which provide free or discounted medications to eligible individuals. Additionally, there are prescription savings cards and coupons available that can be used at pharmacies to lower the out-of-pocket cost. These programs and discounts can significantly reduce the financial burden of Wegovy treatment.

What if my insurance plan doesn’t cover Wegovy or has limited coverage?

+If your insurance plan doesn’t cover Wegovy or has limited coverage, there are still options to explore. You can discuss alternative medications with your healthcare provider that may be covered by your insurance. Additionally, some insurance plans offer appeals processes where you can challenge a coverage decision. Another option is to explore patient assistance programs or prescription savings cards, which can help reduce the cost even without insurance coverage.