Health Insurance Estimate

In the realm of healthcare, understanding the costs and coverage of health insurance is crucial for individuals and families alike. Health insurance estimates provide a glimpse into the financial aspect of healthcare, offering insights into premiums, deductibles, and the overall affordability of medical care. This comprehensive guide aims to delve into the intricacies of health insurance estimates, shedding light on how they work, what factors influence them, and how to navigate the process effectively.

Understanding Health Insurance Estimates

Health insurance estimates serve as a preliminary tool for individuals to assess the financial implications of various health insurance plans. These estimates provide an approximate idea of the costs associated with different policies, enabling individuals to make informed decisions about their healthcare coverage. It is essential to recognize that these estimates are not fixed prices but rather a guide to understanding the potential financial commitments.

Health insurance estimates take into account several key factors, including age, location, smoking status, and the type of coverage desired. These estimates often present a range of costs, providing a realistic view of the potential premiums an individual might encounter. While they are not a definitive prediction of costs, they offer a valuable starting point for individuals to explore their options and make educated choices.

Key Components of Health Insurance Estimates

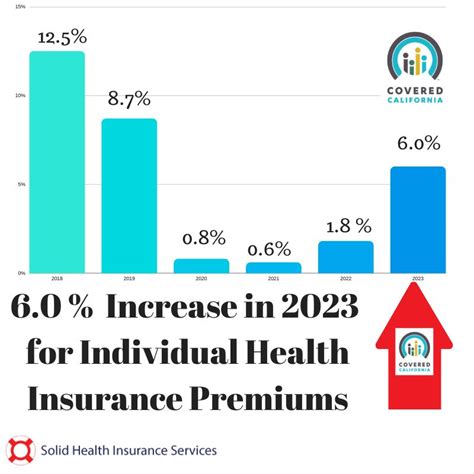

- Premiums: This is the regular payment made to maintain health insurance coverage. Premiums can vary based on age, location, and the level of coverage chosen. For instance, a younger individual might expect lower premiums compared to an older adult, and urban areas might have higher premiums due to increased healthcare costs.

- Deductibles: Deductibles represent the amount an insured individual must pay out of pocket before the insurance company starts covering costs. Higher deductibles often result in lower premiums, while lower deductibles can increase monthly premiums. The choice between a higher or lower deductible depends on an individual’s healthcare needs and financial preferences.

- Co-payments and Co-insurance: Co-payments are fixed amounts paid by the insured for specific services, such as doctor visits or prescription medications. Co-insurance, on the other hand, is a percentage of the cost shared between the insured and the insurance company. These factors impact the overall out-of-pocket expenses an individual can expect.

- Network Coverage: Health insurance estimates should also consider whether the plan covers in-network or out-of-network providers. In-network providers are typically more cost-effective, as they have negotiated rates with the insurance company. Out-of-network providers might incur higher costs, which could impact an individual’s overall healthcare expenses.

Factors Influencing Health Insurance Estimates

Several critical factors influence the estimates presented by health insurance providers. Understanding these factors can empower individuals to make more informed decisions and potentially negotiate better rates.

Age and Health Status

Age is a significant determinant of health insurance estimates. Younger individuals, generally considered healthier, often enjoy lower premiums. As individuals age, their healthcare needs tend to increase, leading to higher premiums. Additionally, pre-existing health conditions can impact estimates, with some insurers offering specialized plans for individuals with specific health needs.

Location and Regional Healthcare Costs

The cost of healthcare varies significantly across different regions. Urban areas, with their higher costs of living and more specialized medical facilities, often result in higher insurance premiums. Conversely, rural areas might offer more affordable insurance options due to lower overall healthcare expenses.

Lifestyle Factors

Lifestyle choices, such as smoking or participating in high-risk activities, can impact health insurance estimates. Insurers often consider these factors when determining premiums, as they can influence an individual’s overall health and the likelihood of requiring medical attention.

Plan Type and Coverage

The type of health insurance plan chosen significantly affects estimates. Plans can range from comprehensive coverage, offering a wide range of services, to more basic plans focusing on essential healthcare needs. The level of coverage desired will directly impact the estimated premiums.

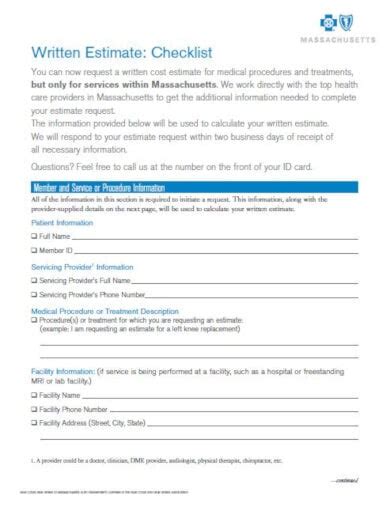

Obtaining Accurate Health Insurance Estimates

Securing accurate health insurance estimates requires a thoughtful approach. Here are some steps to follow:

- Research Multiple Providers: Compare estimates from different insurance companies to understand the range of costs and coverage options available.

- Provide Accurate Information: When requesting estimates, ensure that all personal details, including age, health status, and lifestyle choices, are accurately represented. Inaccurate information can lead to misleading estimates.

- Consider Different Plan Types: Explore various plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers unique benefits and coverage, so understanding these differences is crucial.

- Review Network Providers: Check the list of in-network providers to ensure access to preferred healthcare professionals and facilities. Out-of-network coverage should also be considered, especially if an individual frequently travels or prefers a specific provider.

- Understand the Fine Print: Read through the policy details to comprehend the exclusions and limitations of the coverage. This step is crucial to avoid surprises and ensure the plan aligns with individual healthcare needs.

Expert Insights: Navigating the Estimation Process

Customizing Health Insurance to Your Needs

Health insurance estimates provide a foundation for individuals to tailor their coverage to their specific needs. By understanding the factors influencing estimates, individuals can make informed decisions about their healthcare coverage.

Tailoring Coverage to Your Lifestyle

Health insurance plans can be customized to align with an individual’s lifestyle. For instance, individuals with chronic conditions might opt for plans with lower deductibles and more comprehensive coverage. Conversely, healthy individuals might prefer plans with higher deductibles and lower premiums, saving money in the short term.

Family Planning and Maternity Coverage

For families or individuals planning to start a family, health insurance estimates should consider maternity coverage. Some plans offer specialized maternity benefits, ensuring comprehensive care during pregnancy and childbirth. It is essential to review these benefits carefully to understand the associated costs and coverage.

Managing Pre-Existing Conditions

Individuals with pre-existing conditions should carefully evaluate health insurance estimates. Certain plans might offer specific coverage for these conditions, ensuring adequate care without financial strain. Understanding the plan’s approach to pre-existing conditions is crucial for effective healthcare management.

Future Implications of Health Insurance Estimates

Health insurance estimates have far-reaching implications, not just for individuals but also for the broader healthcare system.

Affordability and Access to Healthcare

Accurate health insurance estimates are vital for ensuring affordable and accessible healthcare. By providing transparent estimates, insurance companies enable individuals to make informed decisions, ultimately improving overall healthcare outcomes.

Impact on Healthcare Costs

Health insurance estimates can influence an individual’s healthcare choices, potentially reducing overall healthcare costs. With a clear understanding of the costs involved, individuals might opt for more cost-effective treatments or preventative care, leading to better health outcomes and reduced financial strain.

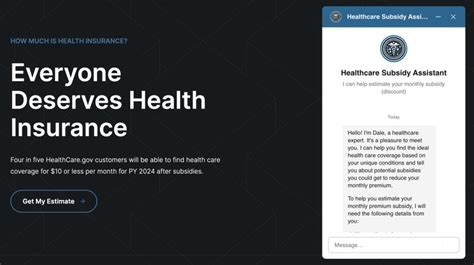

The Role of Technology in Health Insurance Estimates

Advancements in technology have revolutionized the way health insurance estimates are obtained. Online platforms and mobile applications now provide convenient access to estimates, allowing individuals to compare plans and make decisions quickly. Additionally, technology has improved the accuracy of estimates, ensuring a more reliable guide for healthcare coverage.

Conclusion: Empowering Healthcare Decisions

Health insurance estimates are a powerful tool for individuals to navigate the complex world of healthcare coverage. By understanding the factors influencing estimates and taking a proactive approach to obtaining accurate information, individuals can make informed choices about their healthcare. As the healthcare landscape evolves, staying informed and adapting to changing needs is essential for maintaining affordable and effective healthcare coverage.

How often should I review my health insurance estimates?

+It is advisable to review your health insurance estimates annually, especially during open enrollment periods. This allows you to stay updated with any changes in premiums, coverage, and benefits.

Can I negotiate health insurance estimates?

+While health insurance estimates are based on standard rates, some providers might offer flexibility, especially for group plans or specific policy types. It is worth inquiring about potential discounts or customized plans to suit your needs.

What if I have a pre-existing condition? Will it impact my health insurance estimates?

+Yes, pre-existing conditions can influence health insurance estimates. Some plans offer specific coverage for these conditions, ensuring adequate care. It is crucial to review these plans carefully to understand the associated costs and coverage.