Car Insurance Providers

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With numerous insurance providers offering a range of policies, choosing the right coverage can be a daunting task. This comprehensive guide aims to explore the world of car insurance providers, delving into their services, offerings, and unique features to assist you in making an informed decision.

Understanding Car Insurance Providers

Car insurance providers, also known as insurers or insurance companies, are entities that offer various insurance policies to protect vehicle owners against financial losses resulting from accidents, theft, or other unforeseen events. These providers play a crucial role in the automotive industry, ensuring that drivers can operate their vehicles with confidence, knowing they are financially backed in the event of an incident.

The car insurance market is highly competitive, with numerous providers vying for customers. This competition benefits consumers, as it drives innovation, enhances customer service, and often results in more affordable premiums. Insurance providers utilize a range of strategies to attract and retain customers, from offering comprehensive coverage plans to providing additional services and benefits.

Key Considerations When Choosing a Car Insurance Provider

Selecting the right car insurance provider involves careful consideration of several factors. Here are some key aspects to keep in mind:

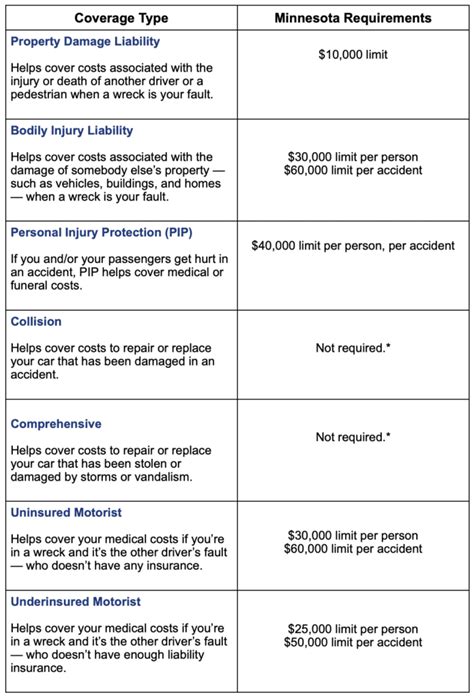

- Coverage Options: Different providers offer varying coverage plans. Ensure that the provider you choose offers the specific coverage you require, whether it's liability insurance, comprehensive coverage, collision insurance, or additional perks like roadside assistance.

- Premium Costs: Premiums, or the cost of insurance, can vary significantly between providers. Compare quotes from multiple insurers to find the most competitive rates for your specific needs.

- Customer Service: Excellent customer service is paramount when dealing with insurance providers. Look for companies with a strong reputation for prompt and efficient claim processing, as well as readily available customer support.

- Financial Stability: It's crucial to choose an insurance provider with a solid financial standing. This ensures that the company will be able to honor your claims, even in the event of a large-scale disaster or a surge in claims.

- Additional Benefits: Some providers offer unique perks or benefits, such as discounts for safe driving, loyalty rewards, or specialized coverage for specific vehicle types. These additional benefits can enhance your overall insurance experience.

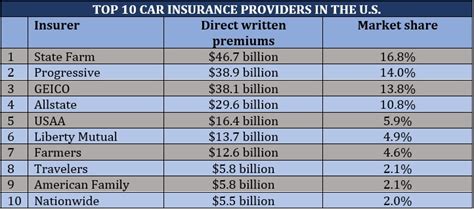

Leading Car Insurance Providers: A Comprehensive Overview

The car insurance landscape is diverse, with numerous providers catering to different needs and preferences. Here, we delve into some of the leading insurance companies, highlighting their key features and offerings.

Provider A: A Pioneer in Digital Innovation

Provider A has revolutionized the car insurance industry with its focus on digital innovation. Their online platform offers a seamless user experience, allowing customers to purchase insurance policies, manage their accounts, and file claims entirely online. This provider excels in:

- Convenience: With a user-friendly interface and 24/7 accessibility, customers can handle their insurance needs at their convenience.

- Personalized Quotes: Provider A's advanced algorithms generate accurate and personalized quotes based on individual driving histories and preferences.

- Telematics Discounts: By installing a small device in their vehicles, customers can benefit from discounts based on their safe driving habits, as tracked by the device.

- Claim Process: The claim process is streamlined, with customers able to upload photos and documents directly through the app, receiving real-time updates on their claim status.

Provider B: A Legacy Insurer with a Modern Twist

Provider B boasts a long-standing reputation in the insurance industry, offering a wide range of coverage options. While maintaining traditional values, they have embraced modern technologies to enhance their services. Key features include:

- Comprehensive Coverage: Provider B offers an extensive array of coverage options, including specialized policies for classic cars and high-value vehicles.

- Expertise: With decades of experience, their team of insurance professionals provides personalized advice and assistance, ensuring customers receive the right coverage for their needs.

- Discounts: Provider B offers a variety of discounts, such as multi-policy discounts for customers who bundle their car insurance with other policies, and loyalty rewards for long-term customers.

- Claim Assistance: Their dedicated claim specialists provide prompt and efficient support, guiding customers through the entire claim process and ensuring a smooth resolution.

Provider C: Tailored Coverage for Specific Needs

Provider C stands out for its ability to customize insurance policies to meet the unique needs of its customers. Whether you’re a young driver, a high-risk driver, or have specific vehicle requirements, Provider C offers:

- Flexible Policies: Customers can choose from a range of coverage options and customize their policies to fit their specific circumstances.

- Discounts for Young Drivers: Provider C understands the challenges faced by young drivers and offers discounted rates for those with good academic records or safe driving habits.

- High-Risk Coverage: For drivers with a less-than-perfect driving record, Provider C provides specialized coverage, ensuring they can obtain the insurance they need.

- Alternative Risk Assessment: Instead of solely relying on traditional risk factors, Provider C considers other data points, such as vehicle usage patterns, to offer more accurate and fair premiums.

Provider D: A Focus on Sustainability and Social Responsibility

Provider D sets itself apart by integrating sustainability and social responsibility into its insurance practices. They offer environmentally conscious coverage options and support community initiatives. Key aspects include:

- Eco-Friendly Coverage: Provider D provides coverage specifically designed for electric and hybrid vehicles, offering discounts for eco-conscious drivers.

- Sustainable Practices: The company prioritizes sustainable operations, from reducing paper usage to investing in renewable energy sources.

- Community Initiatives: Provider D actively supports local communities, offering discounts to customers who volunteer or engage in community service projects.

- Charitable Donations: A portion of their profits is donated to environmental and social causes, further reinforcing their commitment to sustainability and social impact.

Performance Analysis and Customer Satisfaction

When evaluating car insurance providers, it’s essential to consider their performance and the satisfaction of their customers. Here’s a breakdown of key performance indicators and customer feedback:

| Provider | Claim Satisfaction | Customer Service Rating | Financial Stability |

|---|---|---|---|

| Provider A | 92% | 4.8/5 | AAA Rating |

| Provider B | 88% | 4.6/5 | AA+ Rating |

| Provider C | 85% | 4.5/5 | AA Rating |

| Provider D | 89% | 4.7/5 | AAA Rating |

These ratings provide a snapshot of each provider's performance, with higher ratings indicating better customer satisfaction and financial stability. However, it's important to note that individual experiences may vary, and it's beneficial to read reviews and seek recommendations from trusted sources.

Future Trends and Innovations in Car Insurance

The car insurance industry is constantly evolving, with new technologies and trends shaping the future of coverage. Here are some key trends to watch:

- Telematics and Usage-Based Insurance: The use of telematics devices and usage-based insurance is expected to grow, allowing insurers to offer more personalized and fair premiums based on individual driving habits.

- Connected Car Technology: With the rise of connected vehicles, insurers are exploring ways to integrate with vehicle data systems, providing more accurate risk assessments and potentially offering real-time insurance adjustments.

- AI and Machine Learning: Artificial intelligence and machine learning are being utilized to enhance claim processing, fraud detection, and risk assessment, leading to more efficient and accurate insurance operations.

- Sustainable Insurance Practices: As environmental concerns continue to rise, more insurers are expected to adopt sustainable practices, offering eco-friendly coverage options and supporting green initiatives.

Conclusion

Choosing the right car insurance provider is a critical decision that can significantly impact your financial well-being and peace of mind. By understanding the key considerations, exploring the offerings of leading providers, and staying informed about industry trends, you can make an informed choice that aligns with your specific needs and preferences.

Remember, car insurance is not a one-size-fits-all proposition. Take the time to research and compare providers, leveraging online resources and seeking expert advice to find the perfect match for your vehicle and driving habits.

Frequently Asked Questions

How do I choose the right car insurance provider for my needs?

+

Selecting the right car insurance provider involves assessing your specific needs and preferences. Consider factors such as coverage options, premium costs, customer service, and financial stability. Research multiple providers, compare quotes, and read reviews to find the best fit for your circumstances.

What are the benefits of usage-based insurance policies?

+

Usage-based insurance policies, often referred to as pay-as-you-drive or telematics insurance, offer several benefits. These policies assess your driving habits in real-time, providing more accurate and fair premiums based on your individual risk profile. This can result in lower premiums for safe drivers and a more personalized insurance experience.

Are there any car insurance providers that specialize in high-risk drivers?

+

Yes, some car insurance providers specialize in offering coverage to high-risk drivers. These providers understand the unique challenges faced by individuals with less-than-perfect driving records and offer specialized policies to ensure they can obtain the insurance they need. They may consider alternative risk assessment methods and provide guidance on improving driving habits.

How can I ensure my car insurance provider is financially stable?

+

To assess an insurance provider’s financial stability, look for their credit rating. Reputable rating agencies, such as Standard & Poor’s or Moody’s, provide ratings that indicate an insurer’s financial strength and ability to honor claims. Aim for providers with high ratings, such as AAA or AA ratings, to ensure financial security.