Can You Use Hsa For Health Insurance Premiums After Retirement

The Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals to set aside pre-tax funds for eligible medical expenses. It is designed to help individuals and families save for healthcare costs, offering a range of benefits and tax incentives. One common question that arises is whether HSA funds can be used to cover health insurance premiums after retirement. In this article, we will delve into this topic, exploring the rules, regulations, and strategies associated with using HSA funds for health insurance premiums in retirement.

Understanding Health Savings Accounts (HSAs)

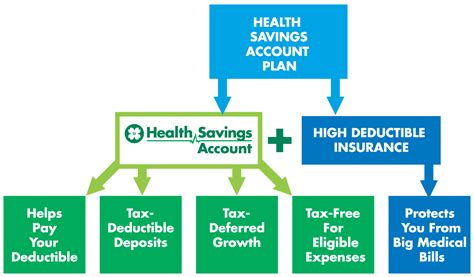

HSAs are a popular choice for individuals enrolled in High Deductible Health Plans (HDHPs). These accounts offer triple tax advantages: contributions are tax-deductible, investments grow tax-free, and withdrawals for qualified medical expenses are tax-free as well. To qualify for an HSA, you must meet certain requirements, including being enrolled in an HDHP and not being covered by other health insurance plans (with some exceptions for specific types of coverage). HSAs provide a way to save for healthcare costs while enjoying significant tax benefits.

HSA Eligibility and Contributions

Eligibility for an HSA is based on your health insurance coverage. You must have an HDHP, which typically has a higher deductible compared to traditional health plans. However, HDHPs also offer lower premiums, allowing you to save more in your HSA. The IRS sets annual contribution limits for HSAs, which vary based on whether you have individual coverage or family coverage. These limits are adjusted annually and provide a tax-efficient way to save for future healthcare needs.

| Year | Individual Coverage Limit | Family Coverage Limit |

|---|---|---|

| 2023 | $3,800 | $7,550 |

| 2024 | $3,950 | $7,900 |

These contribution limits offer individuals and families a tax-efficient way to prepare for future medical expenses, especially during retirement when healthcare costs can be significant.

Using HSA Funds for Health Insurance Premiums in Retirement

The ability to use HSA funds for health insurance premiums after retirement is a crucial consideration for individuals planning their healthcare finances. While HSAs offer flexibility in covering a wide range of qualified medical expenses, the rules regarding premium payments are more nuanced.

HSA Funds and Premium Payments

According to the IRS guidelines, HSA funds can be used to pay for health insurance premiums under certain circumstances. These include COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage, Medicare premiums, and health insurance premiums during a period of unemployment. However, using HSA funds for regular health insurance premiums, especially after retirement, is a more complex matter.

The key consideration is whether the individual is enrolled in an HDHP. If you maintain an HDHP throughout retirement, you can continue to use HSA funds to pay for premiums. This strategy allows you to preserve your retirement savings while leveraging the tax benefits of your HSA. However, if you switch to a traditional health plan or a Medicare Advantage plan, the rules change.

Transitioning to Medicare

When individuals turn 65, they become eligible for Medicare, the federal health insurance program for seniors. At this point, the rules regarding HSA usage change. While you can still use HSA funds to pay for Medicare premiums, you cannot contribute to your HSA once you are enrolled in Medicare Part C (Medicare Advantage) or Part D (prescription drug coverage). This means that your HSA contributions must be made before you enroll in these Medicare plans.

Additionally, if you decide to drop your HDHP and enroll in Original Medicare (Part A and Part B), you can no longer contribute to your HSA. However, you can continue to use the funds you have already saved in your HSA to cover qualified medical expenses, including Medicare premiums.

Strategies for Maximizing HSA Benefits in Retirement

To make the most of your HSA in retirement, consider the following strategies:

- Maintain HDHP Coverage: If possible, continue with an HDHP throughout retirement. This allows you to contribute to your HSA and use the funds for a wide range of qualified expenses, including premiums.

- Plan for Medicare Costs: If you anticipate enrolling in Medicare, plan your HSA contributions strategically. Aim to maximize your contributions before turning 65 to build a substantial balance for future healthcare needs.

- Use HSA for Qualified Expenses: Remember that HSA funds can be used for a variety of qualified medical expenses, not just premiums. This includes copayments, deductibles, and other out-of-pocket costs associated with Medicare.

- Consider Investment Options: HSAs offer investment opportunities, allowing your funds to grow tax-free. This can provide a significant boost to your retirement healthcare savings.

FAQs

Can I use my HSA to pay for regular health insurance premiums after retirement?

+It depends on your health insurance coverage. If you maintain an HDHP, you can continue using HSA funds for premiums. However, if you switch to a traditional health plan or Medicare Advantage, you may not be able to contribute to your HSA for premium payments.

What happens to my HSA contributions if I enroll in Medicare Part C or Part D?

+You cannot contribute to your HSA once you enroll in Medicare Part C (Medicare Advantage) or Part D (prescription drug coverage). However, you can continue to use the funds you have already saved to cover qualified medical expenses, including Medicare premiums.

Can I use HSA funds for other qualified medical expenses besides premiums?

+Absolutely! HSA funds can be used for a wide range of qualified medical expenses, including copayments, deductibles, and out-of-pocket costs associated with Medicare. This flexibility makes HSAs a powerful tool for managing healthcare costs.