Long Term Healthcare Insurance Cost

Long-term healthcare insurance is a crucial financial planning tool for individuals and families, providing coverage for extended medical care needs that often arise as we age. The cost of this insurance is a significant concern for many, as it can vary widely based on several factors. Understanding these costs and the factors influencing them is essential for making informed decisions about long-term healthcare planning.

Understanding Long-Term Healthcare Insurance Costs

Long-term healthcare insurance is designed to cover the expenses associated with extended medical care, such as assisted living, nursing home care, home healthcare, and adult day care. These policies offer financial protection against the high costs of long-term care, which can quickly deplete savings and retirement funds.

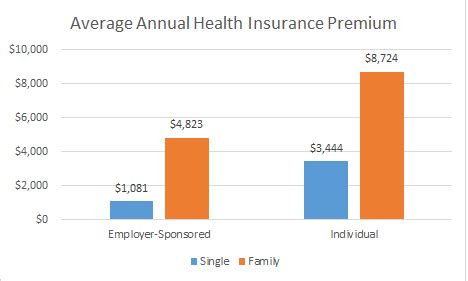

The premium for long-term healthcare insurance is typically paid annually or in monthly installments. The cost of the premium is influenced by various factors, and it's essential to consider these when evaluating the affordability and suitability of a particular policy.

Key Factors Influencing Long-Term Healthcare Insurance Costs

- Age of the Insured: One of the most significant factors is the age at which you purchase the policy. Generally, the younger you are when you buy the insurance, the lower the premiums. This is because younger individuals are considered less risky, as the chances of needing long-term care are lower at an earlier age.

- Health Status: Your current health condition also plays a vital role. If you have pre-existing health conditions or are at a higher risk of developing certain ailments, the premiums may be higher. Conversely, if you are in good health, you may qualify for lower rates.

- Coverage Options: The type and extent of coverage you choose will impact the cost. Policies can vary in the daily benefit amount, the benefit period (how long the policy will pay benefits), the elimination period (a waiting period before benefits begin), and the type of services covered. Each of these factors can influence the premium.

- Inflation Protection: Some policies offer inflation protection, which adjusts the benefits over time to account for rising healthcare costs. This feature can increase the initial premium but provides peace of mind that your coverage will keep pace with rising expenses.

- State of Residence: The cost of long-term care and, consequently, the insurance premiums can vary by state. States with higher costs of living or more extensive long-term care facilities may have higher premiums.

- Discounts and Multi-Policy Benefits: Insurers often offer discounts for purchasing long-term healthcare insurance along with other types of insurance, such as life or disability insurance. Additionally, some providers offer discounts for couples or for maintaining the policy over a certain number of years.

Illustrative Example of Premium Costs

To illustrate the variation in premium costs, consider the following example. John, a 55-year-old male in good health, is looking to purchase long-term healthcare insurance. He has several options:

| Insurance Provider | Daily Benefit Amount | Benefit Period (Years) | Elimination Period (Days) | Annual Premium |

|---|---|---|---|---|

| Provider A | $200 | 3 | 90 | $2,500 |

| Provider B | $150 | 5 | 180 | $3,000 |

| Provider C | $175 | 4 | 120 | $2,800 |

This example demonstrates how different providers and coverage options can result in significantly different premium costs. John would need to evaluate his financial situation, potential long-term care needs, and the trade-offs between daily benefit amounts, benefit periods, and elimination periods to make an informed decision.

Analyzing the Value of Long-Term Healthcare Insurance

When considering the cost of long-term healthcare insurance, it’s essential to weigh the premiums against the potential benefits. Long-term care can be incredibly expensive, and the costs can accumulate rapidly if you need extended care. The value of insurance lies in its ability to provide financial protection against these unforeseen expenses.

The Cost of Long-Term Care

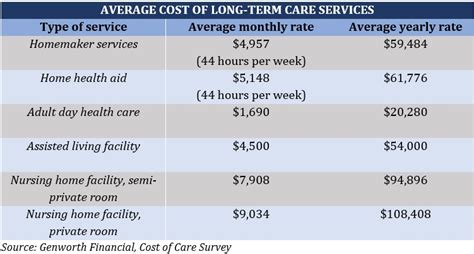

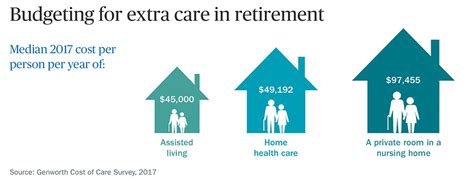

The actual cost of long-term care can vary widely based on the type of care required and the geographic location. Here’s a breakdown of some average costs:

- Nursing Home Care: The national median cost for a semi-private room in a nursing home is approximately $8,500 per month. This cost can be significantly higher in certain metropolitan areas.

- Assisted Living: The average cost of assisted living is around $4,500 per month, but this can also vary greatly based on the level of care needed and the location.

- Home Healthcare: Home healthcare costs can range from $20 to $25 per hour for basic care to over $100 per hour for more specialized care, such as nursing or therapy services. The average cost for 44 hours of care per week (a common benchmark) can be upwards of $2,000 per month.

These costs can quickly deplete savings, especially when care is needed for an extended period. For instance, a nursing home stay of just two years at the national median cost would amount to over $200,000. This is where long-term healthcare insurance can provide a safety net.

Benefits of Long-Term Healthcare Insurance

Long-term healthcare insurance offers several key benefits:

- Financial Protection: The primary benefit is financial security. With insurance, you can rest assured that the costs of long-term care will be covered, allowing you to maintain your standard of living and financial stability.

- Choice of Care: Insurance policies often provide flexibility in choosing the type of care and the care facility, giving you more control over your care options.

- Peace of Mind: Knowing that you have coverage in place can alleviate the stress and worry associated with the financial burden of long-term care.

- Family Support: Long-term care insurance can also benefit your family members. Without insurance, the financial burden of long-term care often falls on family, which can strain relationships and cause financial hardship.

Weighing the Costs and Benefits

When deciding whether long-term healthcare insurance is a worthwhile investment, it’s essential to consider your personal financial situation, your health and family history, and your future care needs. Here are some key points to consider:

- Evaluate your current savings and assets. Do you have sufficient financial reserves to cover potential long-term care expenses without depleting your retirement funds or other savings?

- Assess your health and family history. Are you or your family predisposed to certain health conditions that may require long-term care?

- Consider your lifestyle and preferences. Do you envision yourself requiring care in your own home or in a care facility? Understanding your preferences can help guide your insurance choices.

- Review the costs of long-term care in your area. Understanding the local costs can help you estimate the financial impact of potential care needs.

- Compare the premiums of different insurance policies with the potential benefits they offer. Work with an insurance professional to find the best fit for your needs and budget.

Long-term healthcare insurance is a complex topic, and the decision to purchase it should be made carefully. It's an essential component of comprehensive financial planning, especially as we age. By understanding the costs and benefits, you can make an informed decision that best suits your unique circumstances.

Future Trends and Considerations

The landscape of long-term healthcare insurance is evolving, and there are several trends and considerations to be aware of when planning for the future.

Changing Demographics and Care Needs

As the global population ages, the demand for long-term care is expected to increase significantly. This demographic shift will likely impact the cost and availability of long-term care services and, consequently, the insurance market. Insurers are already adapting their policies and pricing structures to accommodate these changing needs.

Technological Advances in Healthcare

Advancements in technology are also shaping the long-term care landscape. Telehealth services, remote monitoring, and wearable health devices are becoming more prevalent and can potentially reduce the need for certain types of long-term care. These technological innovations may influence the types of care covered by insurance policies and the associated costs.

Policy Innovations and Consumer Education

Insurance providers are continually innovating to meet the diverse needs of consumers. This includes offering more flexible policies, providing education and resources to help consumers understand their options, and developing new products that address specific care needs. Staying informed about these innovations can help you make more effective long-term care planning decisions.

Inflation and Economic Factors

Inflation and broader economic conditions can significantly impact the cost of long-term care and, by extension, insurance premiums. Inflation protection features in insurance policies can help mitigate the impact of rising healthcare costs, but they also come at a premium. It’s essential to stay informed about economic trends and how they may affect your long-term care planning.

Legislative and Regulatory Changes

Long-term care insurance is subject to various legislative and regulatory changes, which can impact policy availability, benefits, and costs. Staying updated on these changes is crucial for effective long-term care planning. For instance, some governments offer tax incentives or subsidies for long-term care insurance, which can make it more affordable for certain individuals.

In conclusion, understanding the costs and factors influencing long-term healthcare insurance is a critical step in financial planning. By weighing the premiums against the potential benefits and staying informed about future trends, you can make informed decisions that protect your financial well-being and provide peace of mind for the future.

How much does long-term healthcare insurance typically cost per month or year?

+The cost of long-term healthcare insurance varies widely and depends on several factors, including age, health status, coverage options, and the state of residence. On average, premiums can range from a few hundred dollars to over a thousand dollars per month. It’s essential to get quotes from multiple insurers to find the best rate for your specific circumstances.

Are there any tax benefits associated with long-term healthcare insurance premiums?

+Yes, in many countries, including the United States, there are tax advantages for long-term care insurance premiums. These premiums may be tax-deductible for certain individuals, particularly if the policy is part of a comprehensive long-term care plan. It’s always best to consult with a tax professional to understand the specific tax benefits available in your region.

Can I customize my long-term healthcare insurance policy to fit my specific needs and budget?

+Absolutely. Long-term healthcare insurance policies offer a range of customizable options to fit individual needs and budgets. You can choose the daily benefit amount, the benefit period (how long the policy will pay benefits), the elimination period (a waiting period before benefits begin), and the type of services covered. Working with an insurance agent can help you find the right balance between coverage and cost.