Car Insurance Australia

Navigating the world of car insurance in Australia can be a complex task for any motorist. With a wide range of providers, coverage options, and unique challenges posed by the diverse Australian landscape, understanding the ins and outs of car insurance is crucial for protecting your vehicle and yourself on the road. This comprehensive guide aims to demystify the process, providing an in-depth analysis of the Australian car insurance market and offering practical insights to help you make informed decisions.

Understanding the Australian Car Insurance Landscape

Australia’s car insurance market is characterized by a diverse range of providers, from major multinational insurance companies to local, niche insurers. This variety ensures that motorists have a wide array of options to choose from, each with its own unique policies, coverage options, and pricing structures.

The coverage options in Australia are extensive and often tailored to meet the specific needs of different motorists. Standard comprehensive car insurance policies cover a range of perils, including theft, fire, storm, hail, and accident damage. Many providers also offer additional coverages, such as windscreen and window glass replacement, hire car benefits, and cover for personal belongings inside the vehicle.

However, the diversity of the Australian landscape also presents unique challenges. From the rugged outback to the bustling city streets, the risks faced by motorists vary greatly. As such, insurance providers often employ sophisticated risk assessment models to determine premiums, taking into account factors such as the driver’s age, gender, location, driving history, and the make and model of the vehicle.

Key Considerations for Choosing Car Insurance

When selecting a car insurance policy in Australia, there are several key factors to consider to ensure you receive the right coverage at a competitive price.

Coverage Options

Understanding the coverage options available is crucial. While comprehensive insurance is often the most popular choice, offering a wide range of protections, there are also cheaper options available, such as third-party property insurance and fire and theft insurance. These policies provide more limited coverage, making them ideal for motorists who are looking to save money or who have older vehicles.

Excess and Premiums

Excess, or the amount you pay towards a claim, is an important consideration. While higher excess amounts can reduce your premiums, they also mean you’ll pay more out of pocket if you need to make a claim. It’s important to strike a balance between excess and premiums that suits your financial situation and risk tolerance.

Additional Benefits

Many insurance providers offer additional benefits to enhance their policies. These can include roadside assistance, hire car coverage, windscreen repair or replacement, and even cover for personal belongings inside your vehicle. While these benefits can be useful, it’s important to weigh them against the increased cost of the policy to ensure they provide value for money.

Claims Process and Customer Service

The claims process and the quality of customer service offered by an insurance provider are crucial considerations. A straightforward, efficient claims process can make a big difference if you ever need to make a claim. Researching and reading reviews about an insurer’s claims handling and customer service can provide valuable insights into their overall performance and reliability.

Comparing Insurance Providers

With so many insurance providers in Australia, comparing policies and providers is essential to find the best value for your needs.

Online Comparison Tools

Online comparison websites can be a great starting point for comparing car insurance policies. These tools allow you to input your details and preferences, and then provide a list of policies and providers that match your criteria. While these tools can be a useful starting point, it’s important to delve deeper into the specific policies and providers to ensure you’re getting the right coverage and value.

Direct vs Broker

You can choose to purchase car insurance directly from an insurance provider or through a broker. Brokers can offer a more personalized service, providing advice and guidance to help you find the right policy. However, purchasing directly from an insurance provider can often be cheaper, as brokers typically charge a fee for their services.

Policy Exclusions

It’s important to carefully read the policy exclusions of any insurance policy you’re considering. These exclusions detail the situations or events that aren’t covered by the policy. By understanding the exclusions, you can ensure that the policy provides the coverage you need and avoid any unexpected gaps in coverage.

The Future of Car Insurance in Australia

The Australian car insurance market is continually evolving, driven by technological advancements and changing consumer expectations.

Technological Innovations

The use of telematics and connected car technology is growing in Australia, offering motorists the opportunity to tailor their insurance policies to their individual driving habits. These technologies can provide more accurate risk assessments, leading to fairer premiums for motorists.

Increasing Focus on Customer Experience

Insurance providers are increasingly recognizing the importance of a positive customer experience. This includes streamlining the claims process, providing efficient and friendly customer service, and offering additional benefits and services to enhance the overall customer journey.

Regulatory Changes

The Australian insurance market is also influenced by regulatory changes, such as the introduction of the General Insurance Code of Practice and the Insurance Contracts Act. These regulations aim to protect consumers and ensure fair practices in the insurance industry.

Conclusion

Car insurance in Australia is a complex but essential aspect of being a responsible motorist. By understanding the key considerations, comparing policies and providers, and staying informed about the latest developments in the market, you can make informed decisions to protect yourself and your vehicle on the road.

How do I choose the right car insurance provider for me?

+When selecting a car insurance provider, consider your specific needs and preferences. Assess the coverage options, excess amounts, additional benefits, and the reputation of the insurer for customer service and claims handling. It’s also beneficial to compare quotes from multiple providers to ensure you’re getting the best value.

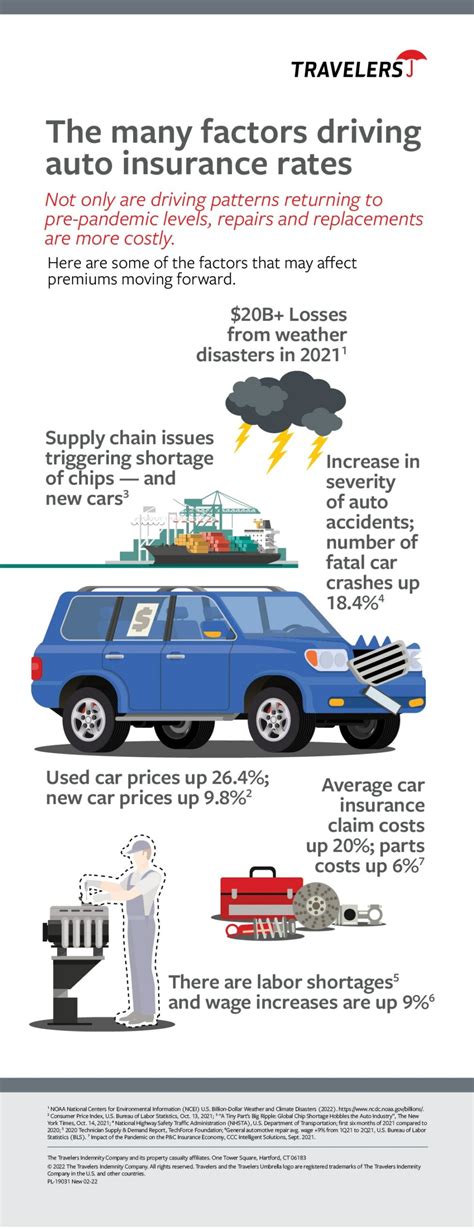

What factors influence the cost of car insurance premiums in Australia?

+The cost of car insurance premiums in Australia is influenced by a range of factors, including the driver’s age, gender, location, driving history, and the make and model of the vehicle. Other factors that can impact premiums include the level of coverage chosen, any additional benefits added to the policy, and the excess amount selected.

How can I reduce the cost of my car insurance premiums?

+To reduce the cost of your car insurance premiums, consider increasing your excess amount, as this can lead to lower premiums. You can also compare quotes from multiple providers to find the best value. Additionally, maintaining a clean driving record and taking advantage of any discounts or loyalty programs offered by insurers can help lower your premiums.

What should I do if I need to make a car insurance claim?

+If you need to make a car insurance claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing details of the incident, any supporting documentation, and potentially arranging for an inspection or assessment of the damage. It’s important to cooperate fully with the insurer during the claims process.

Can I switch car insurance providers in Australia?

+Yes, you can switch car insurance providers in Australia. If you’re unhappy with your current insurer or have found a better deal elsewhere, you can cancel your existing policy and take out a new one with a different provider. Just ensure you understand any cancellation fees or conditions that may apply to your current policy.