Best Secondary Insurance Plans

In today's complex healthcare landscape, understanding the intricacies of insurance coverage is crucial. While primary insurance plans are often the first line of defense, exploring the benefits of secondary insurance plans can provide an additional layer of protection and financial security. This article aims to delve into the world of secondary insurance, offering a comprehensive guide to help individuals navigate this often-overlooked aspect of healthcare coverage.

Unraveling the Concept of Secondary Insurance

Secondary insurance plans, often referred to as supplemental or secondary medical coverage, play a vital role in filling the gaps left by primary insurance policies. While primary insurance typically covers the majority of medical expenses, it may not provide complete financial protection, especially in cases of complex or long-term healthcare needs.

Secondary insurance plans step in to cover the remaining costs, ensuring that individuals are not left with substantial out-of-pocket expenses. These plans can be particularly beneficial for those with high-deductible primary insurance or for families facing ongoing medical challenges.

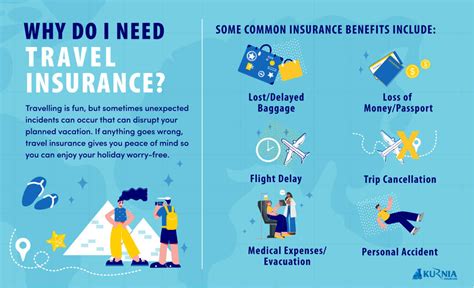

The Benefits of Secondary Insurance Plans

Secondary insurance plans offer a range of advantages, making them an essential consideration for anyone seeking comprehensive healthcare coverage.

Reduced Out-of-Pocket Costs

One of the primary benefits of secondary insurance is the significant reduction in out-of-pocket expenses. By covering costs not fully reimbursed by primary insurance, these plans alleviate the financial burden on individuals and families. This can be especially crucial for unexpected medical emergencies or chronic conditions that require ongoing treatment.

Enhanced Coverage for Specialized Care

Secondary insurance plans often provide coverage for specialized medical services that primary insurance may not fully cover. This includes areas such as mental health treatment, alternative therapies, or specific medical procedures. Having secondary insurance can ensure access to a wider range of healthcare options without compromising financial stability.

Peace of Mind for High-Risk Individuals

For individuals with pre-existing conditions or those at higher risk for certain medical issues, secondary insurance can offer a sense of security. These plans can provide additional coverage for preventive care, screenings, and treatments, ensuring that individuals receive the necessary care without worrying about excessive costs.

Flexible Coverage Options

Secondary insurance plans come in various forms, offering flexibility to cater to different needs. From vision and dental coverage to critical illness insurance, individuals can choose the specific areas where they require additional protection. This customizable approach ensures that secondary insurance plans are tailored to individual healthcare requirements.

Understanding the Different Types of Secondary Insurance

Secondary insurance plans encompass a range of options, each designed to address specific healthcare needs. Here’s an overview of some common types of secondary insurance:

Vision and Dental Insurance

Vision and dental insurance plans provide coverage for eye exams, glasses, contacts, and dental procedures. These plans are especially beneficial for individuals who require regular vision or dental care, ensuring that these essential services are accessible without breaking the bank.

Critical Illness Insurance

Critical illness insurance offers a financial safety net for individuals diagnosed with a specified critical illness, such as cancer, stroke, or heart disease. This type of insurance provides a lump-sum payment upon diagnosis, which can be used to cover treatment costs, living expenses, or any other financial needs during a challenging time.

Hospital Indemnity Insurance

Hospital indemnity insurance provides a fixed daily or weekly benefit amount for each day an individual is hospitalized. This coverage can help offset the indirect costs associated with hospitalization, such as transportation, childcare, or lost wages, ensuring that individuals can focus on their recovery without added financial stress.

Accident Insurance

Accident insurance plans provide coverage for injuries sustained in accidents, offering benefits for medical expenses, rehabilitation, and even lost wages. This type of insurance can be particularly valuable for individuals engaged in high-risk activities or those with active lifestyles.

Short-Term Medical Insurance

Short-term medical insurance plans offer temporary coverage for individuals between primary insurance plans or during periods of transition. These plans provide essential health benefits for a specified period, bridging the gap until more permanent coverage is established.

How to Choose the Right Secondary Insurance Plan

Selecting the appropriate secondary insurance plan involves careful consideration of individual needs and circumstances. Here are some key factors to keep in mind when making your choice:

Assess Your Healthcare Needs

Begin by evaluating your current and potential future healthcare requirements. Consider any pre-existing conditions, family health history, and the likelihood of requiring specialized care. This assessment will help you identify the specific areas where secondary insurance coverage can be most beneficial.

Review Your Primary Insurance Coverage

Understand the limitations and exclusions of your primary insurance plan. Identify the gaps in coverage and prioritize those areas when selecting a secondary insurance plan. This ensures that you are not duplicating coverage but rather filling the voids left by your primary insurance.

Compare Plan Options

Research and compare different secondary insurance plans, considering factors such as coverage limits, deductibles, and out-of-pocket expenses. Look for plans that offer the most comprehensive coverage for your specific needs while remaining within your budget.

Consider Customizable Plans

Explore secondary insurance plans that offer customizable options. These plans allow you to select the specific areas of coverage you require, ensuring that you are not paying for unnecessary benefits. Customization ensures that your insurance plan aligns perfectly with your unique healthcare needs.

Read the Fine Print

Before committing to a secondary insurance plan, carefully review the policy documents. Pay attention to the exclusions, waiting periods, and any pre-existing condition limitations. Understanding these details will help you avoid unexpected surprises and ensure that the plan meets your expectations.

Real-Life Examples: Secondary Insurance in Action

To illustrate the impact of secondary insurance plans, let’s explore a few real-life scenarios where these plans made a significant difference in individuals’ lives.

Case Study 1: Chronic Condition Management

Meet Sarah, a young professional diagnosed with a chronic autoimmune disease. Her primary insurance plan covers the majority of her medical expenses, but the cost of specialized medications and regular doctor visits quickly adds up. With a secondary insurance plan that offers coverage for prescription medications, Sarah is able to manage her condition without straining her finances.

Case Study 2: Unexpected Emergency

John, a single father, finds himself in a difficult situation when his daughter sustains a serious injury during a school sports event. The accident requires immediate hospitalization and surgical intervention. While his primary insurance covers the bulk of the costs, the secondary insurance plan steps in to cover the remaining expenses, ensuring that John can focus on his daughter’s recovery without worrying about mounting medical bills.

Case Study 3: Long-Term Care Needs

Emily, a retiree, has been managing a chronic illness for several years. As her condition progresses, she requires long-term care and frequent hospital visits. With a secondary insurance plan that provides hospital indemnity benefits, Emily receives a fixed daily amount during her hospitalizations, helping her cover the additional expenses associated with her extended stays.

The Future of Secondary Insurance: Innovations and Trends

The landscape of secondary insurance is evolving, with ongoing innovations and trends shaping the industry. Here’s a glimpse into the future of secondary insurance:

Digitalization and Convenience

Secondary insurance providers are increasingly embracing digital technologies to enhance the customer experience. From online enrollment and claims submission to mobile apps for policy management, the digitalization of secondary insurance processes is making coverage more accessible and convenient.

Integration with Primary Insurance

The future of secondary insurance lies in seamless integration with primary insurance plans. By working together, primary and secondary insurers can offer comprehensive coverage that addresses the full spectrum of healthcare needs. This integration ensures a more cohesive and efficient healthcare experience for policyholders.

Expanded Coverage for Emerging Health Issues

As healthcare advances, secondary insurance plans are expanding their coverage to include emerging health issues. This includes conditions related to environmental factors, mental health disorders, and new treatment modalities. By staying ahead of the curve, secondary insurance providers are ensuring that their plans remain relevant and effective in a rapidly changing healthcare landscape.

Personalized Coverage Options

The future of secondary insurance is poised towards personalized coverage options. With advancements in data analytics and artificial intelligence, insurers will be able to offer highly customized plans based on individual health profiles and needs. This level of personalization will ensure that policyholders receive the most suitable and beneficial coverage.

Conclusion: Navigating the World of Secondary Insurance

In a world where healthcare costs can be unpredictable, secondary insurance plans offer a vital layer of protection and financial security. By understanding the benefits and types of secondary insurance, individuals can make informed choices to safeguard their health and well-being. As the industry continues to innovate, the future of secondary insurance looks promising, with enhanced coverage options and improved accessibility.

As you embark on your journey towards comprehensive healthcare coverage, remember that secondary insurance plans are a valuable tool in your healthcare arsenal. With the right plan in place, you can navigate the complexities of healthcare with confidence and peace of mind.

Can I have multiple secondary insurance plans?

+Yes, it is possible to have multiple secondary insurance plans. This can be beneficial if you have specific needs or want to cover different aspects of your healthcare. However, it’s important to carefully review the terms and conditions of each plan to avoid duplicating coverage or conflicting benefits.

How do I know if my primary insurance has gaps that need to be filled by secondary insurance?

+Review your primary insurance policy carefully. Look for exclusions, limitations, and out-of-pocket expenses. Identify areas where your primary insurance may not provide sufficient coverage, such as specialized treatments or prescription medications. This will help you determine the specific gaps that can be addressed by secondary insurance.

Are there any tax benefits associated with secondary insurance plans?

+The tax implications of secondary insurance plans can vary depending on your location and the type of plan. In some cases, certain types of secondary insurance may be tax-deductible or eligible for tax credits. It’s advisable to consult a tax professional or seek guidance from insurance providers to understand the tax benefits specific to your situation.

Can secondary insurance plans be used for preventive care and wellness programs?

+Yes, many secondary insurance plans offer coverage for preventive care and wellness programs. These plans recognize the importance of proactive healthcare and may provide benefits for services such as annual check-ups, vaccinations, and health screenings. Check the specific terms of your plan to understand the extent of coverage for preventive care.

What should I do if I’m not satisfied with my secondary insurance plan?

+If you’re dissatisfied with your secondary insurance plan, it’s important to assess your needs and consider alternative options. Review the market for plans that better align with your healthcare requirements and budget. Remember to carefully compare coverage, benefits, and costs before making a switch.