Health Insurance Plans In Florida

Florida, known for its sunny beaches and diverse population, presents a unique landscape when it comes to health insurance. With a large retiree community and a diverse range of residents, the state offers a wide array of health insurance plans tailored to meet the diverse needs of its citizens. Understanding the intricacies of these plans is essential for Floridians seeking comprehensive healthcare coverage.

Navigating the Health Insurance Landscape in Florida

The Sunshine State boasts a vibrant healthcare industry, providing an extensive selection of health insurance plans. From major medical plans to specialized coverage, Floridians have a plethora of options to choose from. However, navigating this landscape can be daunting, especially with the ever-evolving healthcare regulations and a myriad of insurance providers.

Major Medical Insurance Plans

Major medical insurance plans are the cornerstone of healthcare coverage in Florida. These plans offer comprehensive benefits, covering a wide range of medical services, including hospitalization, physician visits, prescription drugs, and preventive care. With a focus on providing financial protection during unforeseen medical events, these plans are designed to cover the bulk of medical expenses.

One notable feature of major medical plans in Florida is the availability of flexible deductibles and out-of-pocket maximums. This allows individuals to tailor their plans to their specific needs and financial situations. For instance, a younger, healthier individual may opt for a higher deductible plan, while an older adult with chronic conditions might prefer a plan with a lower deductible and more comprehensive coverage.

Furthermore, many major medical plans in Florida offer diverse network options, providing access to a wide range of healthcare providers. This ensures that individuals can choose the doctors and hospitals that best suit their preferences and needs. Additionally, these plans often include preventive care services at no additional cost, encouraging Floridians to stay on top of their health and well-being.

| Plan Type | Features |

|---|---|

| Bronze Plans | Lower premiums, higher deductibles |

| Silver Plans | Balanced premiums and deductibles |

| Gold Plans | Higher premiums, lower deductibles |

| Platinum Plans | Highest premiums, lowest deductibles |

Florida's major medical plans also offer prescription drug coverage, a vital component for many individuals. With the rising cost of medications, this coverage provides significant financial relief. Additionally, many plans include vision and dental benefits, further enhancing the overall health and well-being of Floridians.

Specialized Health Insurance Plans

In addition to major medical plans, Florida offers a range of specialized health insurance options to cater to specific needs. These plans include:

- Short-Term Health Insurance Plans: These plans provide temporary coverage for individuals facing a gap in their insurance coverage. With more limited benefits compared to major medical plans, they offer a cost-effective solution for short-term healthcare needs.

- Fixed Indemnity Plans: Fixed indemnity plans offer a set cash benefit for specific covered medical services. They provide flexibility and can be a valuable supplement to major medical coverage.

- Hospital Indemnity Plans: Hospital indemnity plans provide a fixed daily or weekly benefit for each day of hospitalization. This coverage ensures that individuals have financial support during extended hospital stays.

- Critical Illness Insurance: Critical illness insurance plans provide a lump-sum benefit upon the diagnosis of a specified critical illness. This coverage can help individuals manage the financial burden associated with serious health conditions.

- Accident-Only Insurance: Accident-only insurance plans cover medical expenses resulting from accidents. They offer a straightforward and affordable option for individuals seeking coverage for unexpected accidents.

These specialized plans, while offering focused coverage, are often used in conjunction with major medical plans to create a comprehensive healthcare portfolio. By combining these plans, Floridians can ensure they have the necessary protection for various healthcare scenarios.

The Impact of Medicare and Medicaid in Florida

Florida’s health insurance landscape is significantly influenced by Medicare and Medicaid, two federal programs that provide healthcare coverage to specific populations. Medicare, a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities, plays a crucial role in the state’s healthcare system.

Medicare in Florida

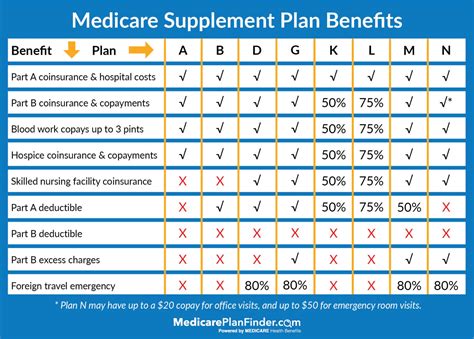

In Florida, Medicare is a popular choice for seniors and individuals with disabilities. With a diverse range of Medicare plans available, including Original Medicare (Parts A and B), Medicare Advantage plans (Part C), and Medicare Part D prescription drug plans, Floridians have the flexibility to choose the coverage that best suits their needs.

Original Medicare, a fee-for-service plan, covers a wide range of medical services and is widely accepted by healthcare providers across the state. Medicare Advantage plans, on the other hand, offer an alternative to Original Medicare, providing additional benefits such as vision, dental, and hearing coverage. These plans are administered by private insurance companies and often include prescription drug coverage as well.

Medicare Part D prescription drug plans are another crucial component of Medicare coverage in Florida. These plans help individuals manage the cost of prescription medications, ensuring they have access to the necessary treatments. With a variety of Part D plans available, Floridians can choose the plan that best aligns with their medication needs and preferences.

Medicaid in Florida

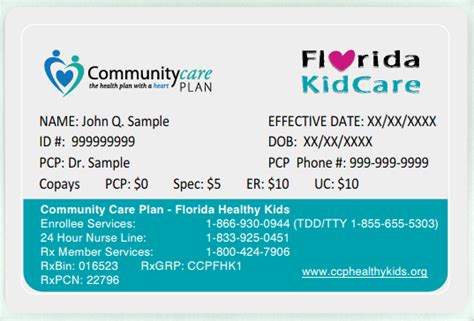

Medicaid, a joint federal and state program, provides healthcare coverage to low-income individuals and families in Florida. The program aims to ensure that those with limited financial means have access to essential medical services.

Florida's Medicaid program offers a comprehensive range of benefits, including hospital care, physician services, prescription drugs, and long-term care. The program's eligibility criteria consider factors such as income, assets, and family size, ensuring that those most in need receive the necessary healthcare coverage.

Additionally, Florida has expanded its Medicaid program, allowing more individuals to qualify for coverage. This expansion has been instrumental in improving access to healthcare for many Floridians, particularly those with lower incomes.

The Importance of Choosing the Right Health Insurance Plan

With a myriad of health insurance plans available in Florida, selecting the right plan is crucial for ensuring comprehensive and affordable healthcare coverage. The right plan should align with your specific healthcare needs, financial situation, and personal preferences.

Consider Your Healthcare Needs

Evaluate your current and potential future healthcare needs. Consider factors such as chronic conditions, prescription medications, and the likelihood of needing specialized medical services. For instance, if you have a chronic illness, a plan with comprehensive prescription drug coverage and access to specialized providers may be a better fit.

Assess Your Financial Situation

Your financial situation plays a significant role in choosing a health insurance plan. Consider your budget and the ability to pay premiums, deductibles, and out-of-pocket expenses. Plans with higher premiums but lower out-of-pocket costs may be more suitable for those with limited financial flexibility, while those with higher disposable income may opt for plans with lower premiums and higher deductibles.

Compare Plan Features and Benefits

Take the time to compare the features and benefits of different health insurance plans. Consider factors such as the size and quality of the provider network, prescription drug coverage, and additional benefits like vision and dental care. Look for plans that offer the coverage you need at a price that aligns with your budget.

Understand Plan Limitations and Exclusions

It’s crucial to understand the limitations and exclusions of any health insurance plan you’re considering. Review the plan’s summary of benefits and coverage to ensure that the services you require are covered. Be aware of any pre-existing condition limitations or exclusions, as well as any waiting periods before certain benefits become effective.

Navigating Open Enrollment and Special Enrollment Periods

In Florida, the annual Open Enrollment Period for individual and family health insurance plans typically runs from November 1st to December 15th. During this time, individuals can enroll in a new plan, switch plans, or make changes to their existing coverage. It’s important to note that missing the Open Enrollment Period may result in limited options for obtaining health insurance coverage.

However, Floridians may also qualify for a Special Enrollment Period (SEP) outside of the Open Enrollment Period. SEPs are granted under certain qualifying life events, such as losing other health coverage, getting married, or having a baby. These events allow individuals to enroll in a health insurance plan or make changes to their existing coverage outside of the standard Open Enrollment Period.

Qualifying Life Events for a Special Enrollment Period

Some common qualifying life events that trigger a Special Enrollment Period in Florida include:

- Losing health coverage due to job loss, retirement, or other circumstances

- Getting married

- Having a baby, adopting a child, or gaining legal custody of a child

- Moving to a new service area

- Gaining citizenship or lawful presence in the United States

- Certain changes in income or family size that affect eligibility for premium tax credits or cost-sharing reductions

It's important to note that the qualifying life event must occur during the year preceding the date of enrollment. Additionally, individuals have a limited time frame, typically 60 days from the date of the qualifying event, to enroll in a health insurance plan during a Special Enrollment Period.

The Future of Health Insurance in Florida

The future of health insurance in Florida is likely to be shaped by evolving healthcare regulations, technological advancements, and changing demographics. As the state continues to grow and diversify, the healthcare industry will need to adapt to meet the unique needs of its residents.

Emerging Trends in Health Insurance

Several emerging trends are expected to influence the future of health insurance in Florida. These include:

- Telehealth Services: The rise of telehealth services, which allow individuals to access healthcare remotely, is likely to continue. This trend offers convenience and improved access to healthcare, particularly for individuals in rural areas or those with limited mobility.

- Value-Based Care: Value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided, are gaining traction. These models aim to improve patient care while reducing healthcare costs.

- Personalized Medicine: With advancements in genetic testing and precision medicine, health insurance plans may increasingly incorporate personalized treatment approaches. This trend could lead to more targeted and effective healthcare solutions.

- Artificial Intelligence and Data Analytics: The use of artificial intelligence and data analytics in healthcare is expected to grow. These technologies can enhance the efficiency and accuracy of healthcare delivery, as well as improve risk assessment and predictive modeling.

Conclusion

Health insurance in Florida is a dynamic and ever-evolving landscape, offering a diverse range of plans to meet the unique needs of its residents. From major medical plans to specialized coverage, Floridians have the opportunity to choose the best fit for their healthcare journey. By staying informed, comparing plans, and understanding the evolving trends in healthcare, individuals can make empowered decisions to ensure comprehensive and affordable healthcare coverage.

What is the average cost of health insurance in Florida?

+

The average cost of health insurance in Florida can vary based on several factors, including age, location, and the specific plan chosen. As of recent data, the average monthly premium for a benchmark Silver plan in Florida is around 500 for an individual and 1,300 for a family. However, these costs can be significantly reduced with the help of premium tax credits, which are available to individuals and families with lower incomes.

How can I find the best health insurance plan for my needs in Florida?

+

Finding the best health insurance plan in Florida involves considering your unique healthcare needs, financial situation, and personal preferences. It’s essential to compare plans, review their coverage and benefits, and understand any limitations or exclusions. Utilizing resources like healthcare.gov or consulting with a licensed insurance agent can help you navigate the process and find the most suitable plan for your circumstances.

What are the penalties for not having health insurance in Florida?

+

As of 2019, there is no individual mandate or penalty for not having health insurance in Florida. However, it’s important to note that going without health insurance can result in significant financial risk if unexpected medical emergencies occur. Having health insurance provides peace of mind and ensures access to necessary healthcare services without the burden of high out-of-pocket costs.