Pros Of Health Insurance

Health insurance is a vital component of healthcare systems worldwide, providing individuals and families with financial protection and access to essential medical services. In today's dynamic healthcare landscape, understanding the advantages of health insurance is crucial for making informed decisions about one's well-being and financial security. This comprehensive exploration delves into the myriad benefits that health insurance brings to individuals, offering a nuanced understanding of its role in promoting health and financial stability.

Financial Protection and Peace of Mind

At the core of health insurance’s appeal is its ability to shield policyholders from the potentially devastating financial consequences of unexpected medical emergencies. The cost of healthcare can be prohibitively expensive, especially for those without insurance. Health insurance acts as a safeguard, covering a significant portion of medical expenses, from routine check-ups and preventive care to more complex treatments and surgeries.

With health insurance, individuals can access quality healthcare without the fear of financial ruin. This peace of mind extends beyond the immediate medical situation, providing long-term security for policyholders and their families. By spreading the risk across a large pool of insured individuals, health insurance companies ensure that no one bears the full brunt of costly medical procedures, fostering a sense of community and solidarity.

Reduced Out-of-Pocket Costs

One of the most tangible benefits of health insurance is the substantial reduction in out-of-pocket expenses. While insurance plans may vary, most cover a wide range of services, including doctor visits, hospital stays, prescription medications, and diagnostic tests. This means that policyholders typically pay only a small portion of these costs, often in the form of deductibles, co-payments, or co-insurance.

| Health Insurance Component | Out-of-Pocket Savings |

|---|---|

| Doctor Visits | Up to 80% reduction |

| Hospitalization | Significant coverage, often 100% |

| Prescription Drugs | Discounted rates, especially for branded medicines |

| Specialist Consultations | Covered with varying copayments |

These savings can be especially beneficial for those with chronic conditions or ongoing medical needs, as well as for unexpected accidents or illnesses. Health insurance ensures that financial considerations do not deter individuals from seeking necessary medical care.

Access to Quality Healthcare

Health insurance not only provides financial protection but also facilitates access to a network of high-quality healthcare providers. Insured individuals can choose from a wide range of doctors, specialists, and hospitals, ensuring they receive the best possible care tailored to their specific needs.

Many insurance plans offer preferred provider networks, which are groups of healthcare professionals and facilities that have agreed to provide services at discounted rates. This arrangement ensures that policyholders have access to affordable, quality care without compromising on medical expertise or technological advancements.

Additionally, health insurance often covers preventive services, such as vaccinations, screenings, and wellness programs, encouraging individuals to take a proactive approach to their health. By detecting potential health issues early on, these services can prevent more serious and costly medical conditions in the future.

Long-Term Health and Wellness

Beyond the immediate financial benefits, health insurance plays a pivotal role in promoting long-term health and wellness. By encouraging regular check-ups and providing coverage for preventive care, health insurance plans help individuals stay on top of their health, detect potential issues early, and manage chronic conditions effectively.

Preventive Care and Early Detection

Preventive care is a cornerstone of modern healthcare, and health insurance plans often emphasize its importance. Many policies cover annual physicals, cancer screenings, immunizations, and other preventive measures at little to no cost to the policyholder. This proactive approach to healthcare can identify potential health risks before they become serious, allowing for timely interventions and improved health outcomes.

| Preventive Service | Coverage and Benefits |

|---|---|

| Annual Physicals | Comprehensive health assessment, often fully covered |

| Cancer Screenings | Early detection for various cancers, saving lives and reducing treatment costs |

| Immunizations | Protection against preventable diseases, especially for children and the elderly |

| Cholesterol and Blood Pressure Tests | Identifying and managing cardiovascular risks |

Chronic Condition Management

For individuals with chronic conditions such as diabetes, asthma, or heart disease, health insurance is essential for effective management. Many plans offer specialized programs and resources to help policyholders control their conditions, reduce complications, and improve their quality of life.

These programs may include access to care coordinators who work with patients to develop personalized treatment plans, as well as educational resources and support groups. By empowering individuals to take an active role in their health management, health insurance contributes to better overall health outcomes and reduced healthcare costs in the long run.

Peace of Mind for the Future

Health insurance provides a sense of security and preparedness for the future. Whether it’s planning for retirement, starting a family, or navigating unexpected life events, health insurance ensures that individuals and their loved ones have access to the medical care they need without financial strain.

Planning for Major Life Events

Major life transitions, such as having a child or retiring, often come with unique healthcare needs. Health insurance can provide comprehensive coverage during these pivotal moments, ensuring that individuals receive the specialized care they require. For instance, many plans offer maternity benefits, covering prenatal care, delivery, and postnatal support, alleviating the financial burden associated with starting a family.

Similarly, retirees can benefit from health insurance plans tailored to their age group, covering the specific healthcare needs that often arise with advancing years. This includes coverage for age-related conditions, long-term care, and prescription medications, ensuring that seniors can maintain their health and independence without financial worry.

Coverage for Unexpected Events

Life is full of surprises, and health insurance is a critical safety net during unexpected medical emergencies. Whether it’s a severe accident, a sudden illness, or a chronic condition that requires ongoing treatment, health insurance ensures that individuals receive the care they need without facing financial hardship.

By spreading the risk across a large pool of insured individuals, health insurance companies can offer comprehensive coverage at a more affordable rate than if individuals were to purchase insurance on their own. This solidarity-based approach ensures that no one is left without access to necessary medical care due to financial constraints.

How does health insurance impact the overall healthcare system?

+

Health insurance plays a critical role in shaping the healthcare system by increasing access to care, promoting preventive health measures, and spreading financial risk. It encourages a proactive approach to health, reduces the burden on public healthcare facilities, and contributes to overall population health.

What are some common challenges individuals face when choosing a health insurance plan?

+

Choosing a health insurance plan can be complex due to the variety of options and coverage details. Common challenges include understanding the terms and conditions, comparing plans, and determining the right level of coverage for one’s specific needs and circumstances.

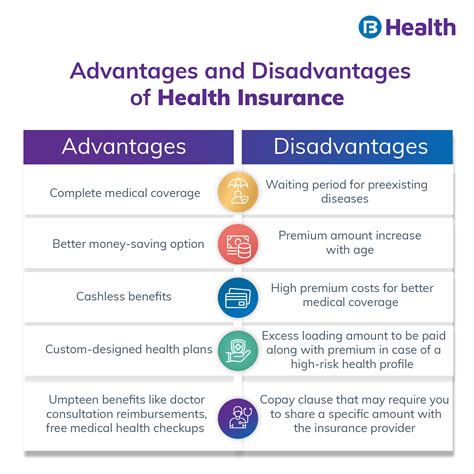

Are there any disadvantages to having health insurance?

+

While health insurance offers numerous advantages, there can be potential drawbacks, such as higher premiums for certain individuals, limited provider networks, or complex claim processes. However, the benefits often outweigh these challenges, especially in terms of financial protection and access to quality care.