Homeowner Insurance Near Me

When it comes to safeguarding your home and possessions, having the right homeowner's insurance is crucial. With countless options available, finding the best coverage near you can be a daunting task. This comprehensive guide aims to demystify the process, providing you with expert insights and practical steps to secure the ideal homeowner's insurance policy tailored to your unique needs.

Understanding Homeowner’s Insurance: A Comprehensive Overview

Homeowner’s insurance, often referred to as home insurance, is a vital financial safeguard for homeowners. It provides coverage for various risks, including damage to your home, its contents, and liability for injuries that occur on your property. The primary purpose is to offer financial protection and peace of mind, ensuring you’re not left vulnerable to the potentially devastating financial consequences of unforeseen events.

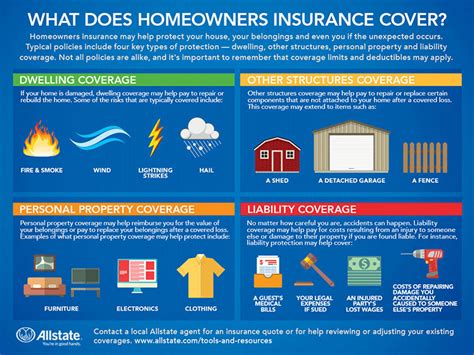

The coverage provided by homeowner's insurance policies can vary significantly, depending on the specific plan and the provider. Generally, policies cover:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and any attached fixtures.

- Personal Property Coverage: This provides protection for your belongings, such as furniture, electronics, and clothing, in case of theft, damage, or loss.

- Liability Coverage: This aspect of the policy safeguards you against lawsuits and medical bills if someone gets injured on your property.

- Additional Living Expenses: In the event your home becomes uninhabitable due to a covered incident, this coverage helps cover temporary living expenses.

- Optional Coverages: Many policies offer additional coverage options, such as flood or earthquake insurance, which are crucial in areas prone to these natural disasters.

Understanding the intricacies of homeowner's insurance is essential to ensure you select a policy that adequately protects your investment and lifestyle. By grasping the fundamental coverage types, you can make informed decisions and tailor your policy to your unique needs.

Finding the Right Homeowner’s Insurance Near You

Locating the ideal homeowner’s insurance policy requires a thoughtful and strategic approach. Here’s a comprehensive guide to help you navigate the process effectively:

Assess Your Needs and Risks

Before diving into policy comparisons, take the time to assess your unique needs and potential risks. Consider the following factors:

- Value of Your Home: Evaluate the current market value of your home, as this will determine the appropriate amount of coverage you need.

- Replacement Cost: Estimate the cost of rebuilding your home from scratch. This is crucial for ensuring you have adequate coverage in case of a total loss.

- Personal Belongings: Make an inventory of your belongings, including their value, to determine the level of personal property coverage required.

- Liability Risks: Assess the potential liability risks associated with your property, such as pool or trampoline ownership, which may increase your liability coverage needs.

- Natural Disasters: Research the likelihood of natural disasters in your area, such as floods, hurricanes, or earthquakes, to determine if additional coverage is necessary.

By thoroughly assessing your needs and potential risks, you can make informed decisions about the type and extent of coverage required, ensuring you're not underinsured or overpaying for unnecessary protections.

Research and Compare Providers

With a clear understanding of your needs, it’s time to research and compare homeowner’s insurance providers. Here are some key steps to consider:

- Check Provider Reputation: Research the reputation and financial stability of potential providers. Look for reviews and ratings from trusted sources to ensure the company is reputable and reliable.

- Compare Coverage Options: Different providers offer varying coverage options and add-ons. Compare policies side by side to ensure you're getting the best combination of coverage and value.

- Assess Customer Service: Consider the provider's customer service reputation. You want a company that is responsive, helpful, and efficient in handling claims and providing assistance.

- Explore Discounts: Many providers offer discounts for various reasons, such as loyalty, bundle packages, or safety features in your home. Research and inquire about potential discounts to reduce your premium.

- Read Policy Fine Print: Don't forget to read the fine print of each policy. Understanding the exclusions and limitations is crucial to ensure you're not unknowingly left without coverage for certain risks.

Taking the time to research and compare providers is a critical step in finding the best homeowner's insurance policy. It ensures you're not only getting adequate coverage but also the best value for your money.

Obtain Quotes and Make an Informed Decision

Once you’ve narrowed down your options, it’s time to obtain quotes from the shortlisted providers. Here’s how to approach this process effectively:

- Provide Accurate Information: When requesting quotes, ensure you provide accurate and detailed information about your home, its value, and your coverage needs. Inaccurate information can lead to unexpected issues later on.

- Compare Quotes Side by Side: Create a spreadsheet or use an online tool to compare quotes side by side. Evaluate the coverage limits, deductibles, and overall cost to find the best value.

- Inquire About Discounts: Don't hesitate to ask providers about potential discounts. Many companies offer loyalty discounts, bundle discounts, or discounts for certain safety features in your home.

- Consider Policy Flexibility: Look for policies that offer flexibility in terms of coverage limits and deductibles. This can help you customize your policy to your changing needs and budget.

- Read Reviews and Testimonials: Check online reviews and testimonials from current and past customers. This can provide valuable insights into the provider's service quality and claim handling process.

By obtaining multiple quotes and thoroughly comparing them, you can make an informed decision about which homeowner's insurance policy offers the best combination of coverage, value, and service.

Understanding Policy Details and Fine Print

Once you’ve selected a policy, it’s crucial to thoroughly understand its details and fine print. Here’s what to focus on:

- Coverage Limits: Ensure you understand the maximum amount the policy will pay out for different types of claims. This includes limits for dwelling coverage, personal property, and liability.

- Deductibles: Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Understand how deductibles work and consider whether a higher deductible is suitable for your budget and risk tolerance.

- Exclusions and Limitations: Every policy has exclusions and limitations. It's crucial to understand what risks are not covered, as well as any specific limitations or restrictions within the policy.

- Policy Riders: Riders are additional coverages or endorsements that can be added to your policy. Understand the options available and whether any are necessary to ensure you have adequate coverage for your unique circumstances.

- Claim Process and Timeframe: Familiarize yourself with the claim process and the expected timeframe for handling claims. This ensures you know what to expect and can take appropriate action if a claim needs to be filed.

Taking the time to understand the policy details and fine print is crucial to ensure you're fully protected and aware of any potential limitations or exclusions. It also ensures you can make informed decisions about any necessary adjustments to your coverage.

Maximizing Your Homeowner’s Insurance Coverage

Once you’ve secured your homeowner’s insurance policy, there are several strategies you can employ to maximize your coverage and potentially reduce your premium:

Safety and Security Upgrades

Implementing safety and security upgrades in your home can not only enhance your peace of mind but also lead to significant discounts on your insurance premium. Here are some upgrades to consider:

- Smoke Detectors: Install smoke detectors in every bedroom, outside each sleeping area, and on every level of your home. Some providers offer discounts for hardwired or interconnected smoke detectors.

- Fire Extinguishers: Ensure you have fire extinguishers readily accessible in your home, especially in the kitchen and garage. Many providers offer discounts for having multiple extinguishers and proper training on their use.

- Sprinkler Systems: Installing a sprinkler system can significantly reduce the risk of fire damage and may lead to substantial insurance discounts.

- Security Systems: Investing in a monitored security system can deter burglars and provide an added layer of protection. Many providers offer discounts for homes with security systems, especially those with fire and burglary alarms.

- Storm Shutters: In areas prone to hurricanes or severe storms, installing storm shutters can protect your home from wind damage. Some providers offer discounts for this type of protection.

By implementing these safety and security upgrades, you not only enhance the protection of your home and belongings but also potentially reduce your insurance premium, making it a win-win situation.

Regular Home Maintenance

Proper home maintenance is not only essential for the longevity of your property but can also impact your insurance coverage and premium. Here are some maintenance practices to consider:

- Roof Inspection: Regularly inspect your roof for any signs of damage, such as missing or damaged shingles, and address any issues promptly. Many providers offer discounts for well-maintained roofs, as they are a crucial line of defense against weather-related damage.

- Gutter Cleaning: Keep your gutters clean and free of debris to prevent water damage and ice dams. Clogged gutters can lead to water backup, which can cause significant damage to your roof and foundation.

- Plumbing and Electrical Systems: Regularly inspect and maintain your plumbing and electrical systems to prevent leaks and electrical fires. Address any issues promptly to avoid potential hazards and costly repairs.

- Landscaping: Maintain your landscaping to prevent tree branches from coming into contact with your home, which can lead to damage during storms. Keep shrubs and bushes trimmed to reduce the risk of fire spreading from neighboring properties.

- Home Improvement Projects: Consider undertaking home improvement projects that can enhance your home's energy efficiency and safety. Many providers offer discounts for energy-efficient upgrades, such as insulation, solar panels, or high-efficiency HVAC systems.

By committing to regular home maintenance, you can not only extend the life of your home but also potentially qualify for insurance discounts, making it a worthwhile investment in the long run.

Bundle Your Policies

Bundling your insurance policies with the same provider is a strategic way to maximize your coverage and potentially save money. Here’s how it works:

- Auto and Home Insurance: By bundling your auto and home insurance policies with the same provider, you can often secure significant discounts on both policies. This is because providers reward loyalty and appreciate the reduced administrative burden of handling multiple policies for the same customer.

- Additional Policies: Consider adding other insurance policies, such as life insurance or umbrella liability insurance, to your bundle. Many providers offer additional discounts when you have multiple policies with them, further reducing your overall insurance costs.

- Multi-Policy Discounts: Inquire about multi-policy discounts when bundling your insurance. These discounts can add up, making your overall insurance coverage more affordable and providing additional peace of mind.

- Review Your Policies Regularly: It's important to review your bundled policies periodically to ensure they still meet your needs and provide the best value. As your life and circumstances change, you may need to adjust your coverage or explore other providers to find the best fit.

Bundling your insurance policies is a smart financial move that can save you money and simplify your insurance management. However, it's essential to regularly review your policies to ensure they remain aligned with your changing needs and provide the best possible coverage.

Common Pitfalls to Avoid in Homeowner’s Insurance

While homeowner’s insurance is a crucial safeguard, there are common pitfalls that homeowners should be aware of to ensure they’re not left vulnerable. Here are some key pitfalls to avoid:

Underinsurance and Overinsurance

Finding the right balance between underinsurance and overinsurance is crucial. Underinsurance occurs when your coverage limits are too low to adequately protect your home and belongings, leaving you vulnerable to significant out-of-pocket expenses in the event of a claim. On the other hand, overinsurance can lead to unnecessarily high premiums and wasted money.

To avoid these pitfalls, ensure you assess your coverage needs accurately and regularly review your policy to align it with any changes in your home's value or your personal belongings.

Neglecting Policy Updates

Your homeowner’s insurance policy should reflect your current circumstances and needs. Failing to update your policy when necessary can leave you with inadequate coverage or unnecessary expenses.

Regularly review your policy and make updates as needed. This includes updating your home's value, making any necessary adjustments to your coverage limits, and informing your provider of any significant changes to your home or its contents.

Not Reading the Fine Print

The fine print of your homeowner’s insurance policy can contain crucial information about coverage limitations, exclusions, and claim procedures. Failing to read and understand these details can lead to unpleasant surprises when filing a claim.

Take the time to thoroughly read and understand your policy. If you have any questions or concerns, don't hesitate to reach out to your insurance provider for clarification. It's better to be fully informed upfront than to face unexpected issues later on.

Assuming All Risks Are Covered

Homeowner’s insurance policies typically cover a wide range of risks, but it’s important to understand that not all risks are covered. Common exclusions include flood, earthquake, and certain types of water damage. Assuming that your policy covers all risks can lead to costly misconceptions.

Carefully review your policy's exclusions and limitations. If you live in an area prone to specific risks, such as floods or earthquakes, consider purchasing additional coverage to ensure you're fully protected.

Conclusion: Securing Your Home’s Future

Homeowner’s insurance is an essential safeguard for your home and possessions, providing financial protection and peace of mind. By understanding the coverage options, researching providers, and obtaining quotes, you can find the best policy to suit your unique needs. Remember to regularly review and update your policy to ensure it remains aligned with your changing circumstances.

By taking a proactive approach to homeowner's insurance, you can secure the future of your home and protect your investment. With the right coverage, you can rest easy knowing that you're prepared for whatever life throws your way.

Frequently Asked Questions

What is the average cost of homeowner’s insurance?

+The average cost of homeowner’s insurance varies depending on factors such as location, the value of your home, and the coverage limits you choose. Nationally, the average cost for homeowner’s insurance is around 1,300 per year, but this can range from as low as 500 to over $3,000 annually, depending on your specific circumstances.

How can I lower my homeowner’s insurance premium?

+There are several strategies to lower your homeowner’s insurance premium. These include implementing safety and security upgrades in your home, such as smoke detectors and security systems, which can lead to significant discounts. Regular home maintenance, including roof inspections and gutter cleaning, can also qualify you for discounts. Additionally, bundling your insurance policies with the same provider can result in substantial savings.

What happens if I file a claim with my homeowner’s insurance?

+When you file a claim with your homeowner’s insurance, the process typically involves the following steps: notifying your insurance provider, providing details about the incident and any damages, and submitting supporting documentation such as photos or estimates. The insurance provider will then assess the claim, determine the extent of coverage, and either approve or deny the claim. If approved, they will provide you with the necessary funds to repair or replace the damaged property.