How Gap Insurance Works

Gap insurance, also known as guaranteed asset protection insurance, is a specialized type of coverage designed to protect vehicle owners from financial loss in specific situations. It fills the gap between the actual value of a vehicle and the amount owed on its financing or lease, providing crucial financial protection during challenging circumstances.

This insurance is particularly relevant in the automotive industry, where the rapid depreciation of vehicles can leave owners vulnerable. Gap insurance addresses this issue by ensuring that policyholders are not left with a significant financial burden if their vehicle is written off, stolen, or totaled in an accident. In this comprehensive guide, we will delve into the intricacies of gap insurance, exploring its workings, benefits, and considerations.

Understanding Gap Insurance

Gap insurance is an optional add-on to standard auto insurance policies. While standard auto insurance typically covers the market value of a vehicle, it often falls short of covering the entire amount owed on a loan or lease. This disparity, known as the “gap,” can leave vehicle owners liable for a substantial financial loss. Gap insurance steps in to bridge this gap, ensuring that policyholders are not left with a negative equity situation.

The need for gap insurance arises due to the rapid depreciation of new vehicles. As soon as a vehicle is driven off the dealership lot, its value begins to decline. This depreciation continues over the life of the vehicle, often outpacing the rate at which the loan or lease is paid off. As a result, many vehicle owners find themselves owing more on their loan or lease than their vehicle is worth.

Gap insurance is particularly beneficial for individuals who have financed or leased their vehicles. It provides peace of mind, ensuring that, in the event of a total loss, the policyholder is not held responsible for the difference between the vehicle's actual value and the outstanding loan or lease balance.

How Gap Insurance Works

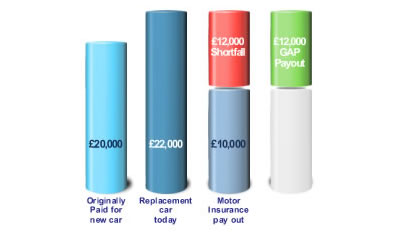

Gap insurance operates by providing coverage for the difference between the insured vehicle’s value and the amount owed on its financing or lease. This coverage is typically offered as an add-on to a standard auto insurance policy, with the policyholder paying an additional premium for this specialized coverage.

When a policyholder experiences a total loss, such as a severe accident or theft, the gap insurance kicks in. It covers the gap between the vehicle's actual cash value (ACV) and the remaining balance on the loan or lease. This ensures that the policyholder is not left with a substantial financial burden, as they are not responsible for paying off the negative equity.

The exact coverage provided by gap insurance can vary depending on the policy and the insurer. Some policies may cover the entire gap, while others may cover a portion of it. It's important for policyholders to carefully review their gap insurance policy to understand the specific coverage limits and exclusions.

Example Scenario

Let’s consider an example to illustrate how gap insurance works. Imagine a driver purchases a new car for 30,000 and finances it with a 60-month loan. After a few years, the vehicle's actual cash value has depreciated to 15,000, but the driver still owes 20,000 on the loan. In this scenario, if the vehicle is totaled in an accident, the standard auto insurance policy would cover the ACV of 15,000.

However, with gap insurance in place, the policyholder would not be left with a financial loss. The gap insurance would cover the difference between the ACV and the outstanding loan balance, ensuring that the policyholder is not held responsible for the $5,000 gap. This financial protection can be a significant relief for vehicle owners, as it prevents them from having to pay off a loan for a vehicle they no longer possess.

Benefits of Gap Insurance

Gap insurance offers several key benefits to vehicle owners:

- Financial Protection: The primary benefit of gap insurance is financial protection. It ensures that policyholders are not held liable for the difference between their vehicle's value and the outstanding loan or lease balance. This protection is especially crucial during the early years of vehicle ownership when depreciation is at its highest.

- Peace of Mind: Gap insurance provides peace of mind, knowing that, in the event of a total loss, the policyholder is not left with a significant financial burden. It eliminates the stress and worry associated with negative equity situations, allowing policyholders to focus on rebuilding their lives after an unfortunate incident.

- Affordable Coverage: Gap insurance is typically offered at a relatively low cost, making it an affordable option for vehicle owners. The additional premium for gap insurance is often a small price to pay for the financial protection it provides.

- Flexibility: Gap insurance policies can be customized to meet the specific needs of policyholders. They can choose the coverage limits and terms that best fit their financial situation and preferences.

Considerations and Limitations

While gap insurance offers valuable protection, it’s essential to consider certain limitations and factors:

- Policy Terms and Conditions: Policyholders should carefully review their gap insurance policy to understand the specific terms and conditions. This includes coverage limits, exclusions, and any restrictions or requirements. It's crucial to ensure that the policy aligns with the policyholder's needs and expectations.

- Vehicle Eligibility: Gap insurance may have restrictions on the types of vehicles it covers. Some policies may only be applicable to new vehicles or those within a certain age or mileage range. Policyholders should check the eligibility criteria before purchasing gap insurance.

- Policy Duration: Gap insurance policies typically have a specific duration, often tied to the loan or lease term. It's important to ensure that the gap insurance coverage aligns with the length of the financing or lease agreement to maintain continuous protection.

- Additional Coverage: Gap insurance is an add-on to standard auto insurance. Policyholders should ensure that they have adequate coverage for their vehicle, including liability, collision, and comprehensive insurance. Gap insurance should be considered as a complementary coverage to provide comprehensive protection.

Who Should Consider Gap Insurance

Gap insurance is particularly beneficial for individuals who fall into specific categories:

- New Vehicle Owners: Individuals who have recently purchased a new vehicle are at a higher risk of experiencing negative equity due to rapid depreciation. Gap insurance provides crucial protection during the early years of ownership, ensuring that they are not left with a substantial financial loss in the event of a total loss.

- Leased Vehicles: Those who have leased a vehicle should strongly consider gap insurance. Leased vehicles often have higher residual values, which can lead to a significant gap between the vehicle's value and the outstanding lease balance. Gap insurance bridges this gap, providing financial protection for lessees.

- Financed Vehicles with High Mileage: Vehicle owners who have financed a vehicle with a substantial amount of miles on the odometer may also benefit from gap insurance. As vehicles age, their value depreciates more rapidly, increasing the likelihood of negative equity. Gap insurance can provide financial protection in such situations.

Case Studies and Real-World Examples

Understanding the practical application of gap insurance can be enlightening. Let’s explore a couple of real-world scenarios where gap insurance played a crucial role:

Scenario 1: Totaled Vehicle

John purchased a new SUV for 40,000 and financed it through a local bank. After a year, the vehicle's actual cash value had depreciated to 30,000, but John still owed 35,000 on the loan. Unfortunately, John was involved in a severe accident, totaling his SUV. Without gap insurance, John would have been responsible for paying off the remaining 5,000 on the loan, despite no longer having the vehicle.

However, John had the foresight to purchase gap insurance. With this coverage in place, the gap insurance provider paid the difference between the SUV's actual cash value and the outstanding loan balance. John was relieved of the financial burden, and he could focus on purchasing a new vehicle without worrying about negative equity.

Scenario 2: Stolen Vehicle

Emily leased a luxury sedan for a three-year term. After two years, the vehicle was stolen from her driveway. At the time of the theft, the vehicle’s actual cash value was 35,000, but the outstanding lease balance was 40,000. Without gap insurance, Emily would have been liable for the $5,000 difference, even though the vehicle was no longer in her possession.

Fortunately, Emily had purchased gap insurance when she leased the vehicle. The gap insurance provider stepped in and covered the gap, ensuring that Emily was not held responsible for the negative equity. This financial protection allowed Emily to move forward with leasing a new vehicle without the added stress of a significant financial loss.

Conclusion

Gap insurance is a valuable tool for vehicle owners, providing crucial financial protection in situations where standard auto insurance may fall short. By understanding how gap insurance works, its benefits, and its limitations, policyholders can make informed decisions to safeguard their financial well-being. Whether it’s protecting against negative equity, providing peace of mind, or ensuring flexibility, gap insurance plays a vital role in the automotive insurance landscape.

Frequently Asked Questions

Is gap insurance mandatory for all vehicle owners?

+

Gap insurance is not mandatory, but it is highly recommended, especially for new vehicle owners and those who lease their vehicles. It provides crucial financial protection and peace of mind in situations where standard auto insurance may not cover the full value of the vehicle.

Can gap insurance be purchased at any time during vehicle ownership?

+

In most cases, gap insurance is most effective when purchased at the time of vehicle acquisition. However, some insurers may offer gap insurance at a later stage, although it may be subject to certain conditions and limitations.

Does gap insurance cover any type of vehicle loss or damage?

+

Gap insurance specifically covers the gap between the vehicle’s value and the outstanding loan or lease balance in cases of total loss, theft, or write-off. It does not cover partial damage or other types of incidents that do not result in a total loss.

How long does gap insurance coverage typically last?

+

Gap insurance coverage typically aligns with the loan or lease term. It is designed to provide protection for the duration of the financing or lease agreement, ensuring continuous coverage during the period of highest risk.