Car In Insurance Quotes

Car insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. The process of obtaining insurance quotes involves various factors that influence the final cost, making it an intricate and often confusing journey for many car owners. This comprehensive guide aims to demystify the process, shedding light on the key elements that impact car insurance quotes and offering valuable insights to help you navigate this essential aspect of automotive care.

Understanding Car Insurance Quotes

Car insurance quotes are estimates provided by insurance companies to outline the potential cost of coverage for a specific vehicle and driver. These quotes are highly personalized, taking into account a multitude of factors to assess the risk associated with insuring a particular individual and their vehicle. Understanding these factors is essential for drivers to make informed decisions about their insurance coverage and to potentially reduce costs.

Key Factors Influencing Car Insurance Quotes

Several key elements play a significant role in determining car insurance quotes. These factors are carefully evaluated by insurance providers to assess the level of risk associated with insuring a particular driver and vehicle. Here’s a breakdown of some of the most influential factors:

- Driver's Age and Experience: Younger drivers, particularly those under 25, often face higher insurance premiums due to their limited driving experience and higher perceived risk. Conversely, mature drivers with a long history of safe driving may benefit from lower rates.

- Vehicle Type and Value: The make, model, and age of your vehicle can impact insurance costs. High-performance cars, luxury vehicles, and those with expensive repair costs tend to have higher insurance premiums. Additionally, the value of your vehicle also plays a role, as insurers consider the cost of potential payouts in the event of a total loss.

- Driving Record: Your driving history is a critical factor in insurance quotes. A clean driving record with no accidents or violations can lead to more favorable rates. On the other hand, a history of accidents, traffic violations, or DUI convictions may result in significantly higher premiums or even difficulty in obtaining insurance coverage.

- Location and Usage: The area where you reside and use your vehicle can influence insurance costs. Urban areas with higher population density and traffic congestion often have higher rates due to increased accident risks. Similarly, if you primarily use your car for business purposes or long-distance travel, your insurance premiums may be higher.

- Coverage and Deductibles: The level of coverage you choose and your deductible amount also impact your insurance quotes. Comprehensive coverage, which includes protection against various risks like theft, vandalism, and natural disasters, typically comes with higher premiums. Opting for higher deductibles can lower your monthly premiums but means you'll pay more out-of-pocket in the event of a claim.

The Process of Obtaining Car Insurance Quotes

The journey to obtaining car insurance quotes typically involves several steps, each designed to gather the necessary information to provide an accurate estimate. Here’s a step-by-step guide to help you navigate the process:

Step 1: Research and Compare Insurance Providers

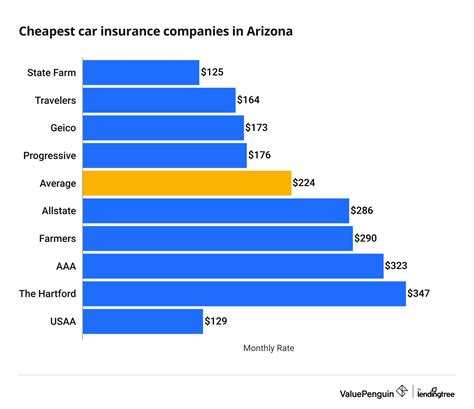

Before diving into the quote process, it’s essential to research and compare different insurance providers. Each insurer has its own set of criteria and pricing structures, so exploring multiple options can help you find the best fit for your needs and budget. Online resources, reviews, and recommendations from trusted sources can be valuable in this initial phase.

Step 2: Gather Necessary Information

To obtain accurate car insurance quotes, you’ll need to gather specific information about yourself and your vehicle. This includes personal details like your age, driving record, and address, as well as vehicle information such as make, model, year, and any modifications. Having this information readily available will streamline the quote process and ensure you receive precise estimates.

Step 3: Use Online Quote Tools or Contact Insurers Directly

Many insurance providers offer online quote tools that allow you to input your information and receive instant estimates. These tools provide a convenient way to compare rates and coverage options from the comfort of your home. Alternatively, you can contact insurance companies directly, either by phone or through their websites, to discuss your specific needs and obtain personalized quotes.

Step 4: Review and Analyze Quotes

Once you’ve obtained quotes from multiple insurers, it’s time to review and analyze the estimates. Compare the coverage levels, deductibles, and premium amounts to identify the best value for your money. Consider the financial stability and reputation of each insurer, as well as any additional perks or discounts they offer. Don’t forget to factor in the level of customer service and claims handling, as these aspects can be crucial in the event of an accident or other unforeseen circumstances.

Tips for Reducing Car Insurance Costs

While car insurance quotes are influenced by various factors beyond your control, there are still strategies you can employ to potentially reduce your insurance costs. Here are some practical tips to consider:

- Maintain a Clean Driving Record: A spotless driving record is one of the most effective ways to keep insurance costs down. Avoid traffic violations, practice defensive driving, and ensure you have adequate vehicle maintenance to reduce the risk of accidents.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premiums. However, it's essential to ensure you can afford the higher out-of-pocket expense in the event of a claim. Weigh the potential savings against the risk to make an informed decision.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same insurer. Many providers offer discounts for bundling multiple policies, resulting in significant savings over time.

- Explore Discounts: Insurance providers often offer various discounts to attract and retain customers. These discounts can include safe driver incentives, loyalty rewards, good student discounts, and even discounts for specific occupations or membership in certain organizations. Ask your insurer about available discounts and see if you qualify for any.

- Shop Around Regularly: Car insurance rates can fluctuate over time, so it's essential to shop around regularly. Compare quotes from different insurers every few years to ensure you're still getting the best deal. Even if you're satisfied with your current provider, exploring other options can help you identify potential savings opportunities.

Future Trends and Developments in Car Insurance

The car insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into some of the future trends and developments that are shaping the landscape of car insurance:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs reward safe drivers with lower premiums by analyzing their driving habits, such as speed, braking, and mileage. This technology is expected to become more prevalent, offering personalized insurance rates based on real-time data.

Autonomous Vehicles and Insurance Implications

The rise of autonomous vehicles is set to revolutionize the automotive industry, and its impact on car insurance is a topic of much discussion. As self-driving cars become more common, insurance models may shift to focus on vehicle manufacturers and technology providers, rather than individual drivers. This shift could lead to new insurance products and liability structures, potentially reducing the need for traditional car insurance as we know it.

Digital Transformation and Enhanced Customer Experience

The digital transformation of the insurance industry is already underway, with many insurers embracing online platforms and mobile apps to enhance the customer experience. This trend is expected to continue, with insurers investing in innovative technologies to streamline the quote and claims processes, offer personalized recommendations, and provide real-time assistance to policyholders.

Frequently Asked Questions (FAQ)

How often should I review my car insurance quotes?

+It’s recommended to review your car insurance quotes annually or whenever you experience significant life changes, such as a move to a new location, a change in marital status, or the addition of a teen driver to your policy. Regular reviews ensure you’re always getting the best value for your insurance needs.

Can I negotiate car insurance rates with providers?

+While car insurance rates are largely based on standardized formulas, you can still negotiate with providers to some extent. Highlighting your good driving record, safe vehicle modifications, or loyalty to the insurer may help you secure additional discounts or more favorable rates.

What impact does my credit score have on car insurance quotes?

+In many states, insurance providers use credit-based insurance scores to assess risk and determine premiums. Generally, individuals with higher credit scores tend to receive more favorable rates. Improving your credit score can potentially lead to lower insurance costs, so it’s worth considering as a long-term strategy.

Are there any government programs or discounts available for car insurance?

+Some states offer government-sponsored programs or discounts for specific groups of individuals, such as low-income households, seniors, or veterans. It’s worth exploring these options to see if you’re eligible for any additional savings on your car insurance.

Can I switch car insurance providers at any time?

+Yes, you can switch car insurance providers at any time. However, it’s essential to ensure you have continuous coverage to avoid gaps in protection. Notify your new insurer of your desired start date and provide proof of prior coverage to avoid any potential penalties or issues with your new policy.