List Of Auto Insurance Companies

The Comprehensive Guide to Auto Insurance Companies: Navigating Your Options

In the realm of automotive insurance, the market is vast and diverse, offering a multitude of choices to cater to the unique needs of drivers. This guide aims to demystify the process of selecting an auto insurance company by providing an in-depth analysis and comparison of some of the industry's leading players. By understanding the strengths, coverage options, and unique features of each provider, you can make an informed decision to secure the best protection for your vehicle.

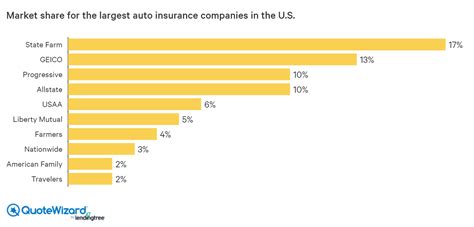

Understanding the Landscape: A Snapshot of Auto Insurance Companies

The auto insurance market is a competitive arena, with a range of companies vying for your business. From well-established, nationwide providers to regional insurers and even digital-first startups, the options are varied. Each company brings its own set of policies, coverage options, and pricing structures, reflecting the diverse nature of the industry. This section offers a bird's-eye view of the auto insurance landscape, highlighting key players and their distinctive features.

Nationwide Providers: Comprehensive Coverage and Brand Recognition

Nationwide auto insurance companies have a significant presence across the United States, offering extensive coverage options and a broad network of agents and repair facilities. Their policies often include a wide range of benefits and perks, such as rental car coverage, accident forgiveness, and roadside assistance. With a large customer base and a well-established reputation, these providers are a go-to choice for many drivers seeking reliable and comprehensive coverage.

- State Farm: A leading insurer known for its extensive agent network and personalized service. State Farm offers a range of coverage options, including rental car reimbursement and accident forgiveness.

- Geico: Geico is a well-known digital insurer offering competitive rates and a seamless online experience. Their policies often include emergency roadside service and rental car coverage.

- Progressive: Progressive is renowned for its innovative products, including usage-based insurance and gap coverage. Their Snapshot program rewards safe drivers with discounts.

Regional Insurers: Tailored Coverage for Local Needs

Regional auto insurance companies focus on specific geographic areas, allowing them to offer coverage tailored to the unique needs and regulations of those regions. They often have a deep understanding of local markets and can provide specialized coverage options that may not be available from national providers. Regional insurers can be an excellent choice for drivers seeking personalized service and coverage that aligns with local requirements.

- USAA: USAA is a prominent insurer serving military members, veterans, and their families. They offer competitive rates and a range of coverage options, including rental car coverage and roadside assistance.

- Esurance: Esurance is a regional insurer known for its digital-first approach and easy-to-use online platform. They provide coverage for a range of vehicles, including classic cars and motorcycles.

- Erie Insurance: Erie Insurance is a regional insurer with a strong focus on customer service and community involvement. They offer a range of coverage options, including accident forgiveness and rental car reimbursement.

Digital-First Insurers: Revolutionizing the Auto Insurance Industry

Digital-first auto insurance companies are transforming the industry with their innovative approaches and tech-driven solutions. These providers often offer simplified, streamlined processes, making it easy for customers to get quotes, purchase policies, and manage their accounts online or via mobile apps. They may also utilize data-driven algorithms to offer personalized coverage and competitive rates.

- Metromile: Metromile is a pioneer in usage-based insurance, offering policies that charge based on the number of miles driven. This innovative approach can result in significant savings for low-mileage drivers.

- Root Insurance: Root Insurance uses a mobile app to evaluate driving behavior and offer personalized rates. Their approach aims to reward safe drivers with lower premiums.

- Lemonade: Lemonade is a digital insurer known for its innovative use of AI and machine learning. They offer a seamless, app-based experience and are committed to giving back to the community through their social impact initiatives.

Comparing Coverage Options and Unique Features

When choosing an auto insurance company, it's essential to understand the range of coverage options and unique features offered by each provider. From liability coverage to comprehensive and collision insurance, each policy type plays a crucial role in protecting you and your vehicle. Additionally, insurers often offer a host of add-ons and perks that can enhance your coverage and provide peace of mind.

Liability Coverage: Protecting Others

Liability insurance is a fundamental component of any auto insurance policy. It covers the costs associated with bodily injury or property damage that you cause to others in an accident. Most states have minimum liability requirements, but it's often beneficial to carry higher limits to ensure adequate protection. Here's a breakdown of how some leading insurers approach liability coverage:

| Insurers | Liability Coverage Options |

|---|---|

| State Farm | Offers a range of liability limits, including high-limit options for additional protection. |

| Geico | Provides standard liability coverage with the option to increase limits for enhanced protection. |

| Progressive | Offers liability coverage with flexible limits and the option to add additional coverage for rental cars and temporary transportation. |

Collision and Comprehensive Coverage: Protecting Your Vehicle

Collision and comprehensive insurance are essential for safeguarding your vehicle from a range of potential risks. Collision coverage pays for repairs or replacement if your vehicle is damaged in an accident, while comprehensive coverage covers damage from non-collision events, such as theft, vandalism, or natural disasters.

- State Farm: Offers collision and comprehensive coverage with the option to customize your deductible.

- Geico: Provides both collision and comprehensive coverage, with the added benefit of rental car coverage for additional peace of mind.

- Progressive: Progressive's collision and comprehensive coverage includes the option for gap coverage, which can be crucial if your vehicle is totaled or stolen.

Add-Ons and Perks: Enhancing Your Coverage

Many auto insurance companies offer a range of add-ons and perks to enhance your coverage and provide additional benefits. These can include roadside assistance, rental car coverage, accident forgiveness, and more. Here's a glimpse at some of the unique add-ons offered by leading insurers:

| Insurers | Add-Ons and Perks |

|---|---|

| USAA | Offers rental car coverage, roadside assistance, and a unique "Deployed Military Personnel Discount" for active-duty members. |

| Esurance | Provides rental car reimbursement and accident forgiveness, as well as a unique "Diminishing Deductible" program that reduces your deductible over time. |

| Erie Insurance | Offers accident forgiveness, rental car coverage, and a unique "New Car Protection" endorsement that ensures your new vehicle's value is covered for its first year. |

The Impact of Technology: Shaping the Future of Auto Insurance

The auto insurance industry is undergoing a significant transformation driven by technological advancements. From usage-based insurance to AI-powered claims processing, technology is reshaping the way insurance is delivered and experienced. This section explores how technology is influencing the industry and what it means for the future of auto insurance.

Usage-Based Insurance: Rewarding Safe Driving

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that uses technology to monitor driving behavior and reward safe drivers with lower premiums. Insurers use telematics devices or smartphone apps to track factors like mileage, driving speed, and braking habits. This data is then used to calculate personalized insurance rates, providing an incentive for safer driving.

- Metromile: Metromile is a leader in usage-based insurance, offering policies that charge based on the number of miles driven. Their innovative approach has been particularly beneficial for low-mileage drivers, who can save significantly on their insurance premiums.

- Root Insurance: Root Insurance uses a mobile app to evaluate driving behavior and offer personalized rates. Their approach aims to create a fairer insurance system by rewarding safe drivers with lower premiums.

AI and Machine Learning: Streamlining Claims Processing

Artificial intelligence (AI) and machine learning are revolutionizing the claims process in the auto insurance industry. These technologies enable insurers to automate and streamline the handling of claims, reducing the time and resources required. AI can analyze vast amounts of data, including photos and videos of accidents, to quickly assess damage and determine liability. This not only speeds up the claims process but also enhances accuracy and efficiency.

- Lemonade: Lemonade is a digital insurer known for its innovative use of AI and machine learning. Their AI-powered claims handling system, Maya, can process and settle simple claims in minutes, providing an efficient and seamless experience for policyholders.

- Progressive: Progressive is leveraging AI to enhance its claims process, using machine learning algorithms to analyze photos and videos of accidents and estimate repair costs. This technology is designed to expedite the claims process and improve customer satisfaction.

Conclusion: Navigating the Auto Insurance Landscape

The auto insurance market offers a diverse range of choices, each with its own unique features and coverage options. From nationwide providers to regional insurers and digital-first startups, the competition is fierce, driving innovation and improved services. When selecting an auto insurance company, it's crucial to consider your specific needs and circumstances, compare coverage options and pricing, and evaluate the added benefits and perks offered by each provider.

Technology is playing an increasingly significant role in the auto insurance industry, from usage-based insurance that rewards safe driving to AI-powered claims processing that streamlines the claims experience. As the industry continues to evolve, staying informed about the latest advancements and trends will be key to making the right insurance choices.

Whether you're a seasoned driver or a first-time policyholder, understanding the auto insurance landscape and the options available is essential to ensuring you have the right coverage at the right price. With the right insurer and policy, you can drive with confidence, knowing you're protected against the unexpected.

How do I choose the right auto insurance company for my needs?

+Choosing the right auto insurance company involves assessing your specific needs and comparing coverage options, pricing, and unique features offered by each provider. Consider factors such as the level of coverage you require, any add-ons or perks that are important to you, and the reputation and financial stability of the insurer. It’s also beneficial to read reviews and seek recommendations from trusted sources to ensure you’re making an informed decision.

What are the key differences between nationwide and regional auto insurance providers?

+Nationwide auto insurance providers typically offer a broader range of coverage options and have a larger network of agents and repair facilities. They often have a strong brand presence and are well-known across the country. Regional insurers, on the other hand, focus on specific geographic areas and may offer coverage tailored to the unique needs and regulations of those regions. They often have a deep understanding of local markets and can provide specialized coverage options.

How does usage-based insurance work, and is it a good option for me?

+Usage-based insurance, or pay-as-you-drive insurance, uses technology to monitor driving behavior and reward safe drivers with lower premiums. Insurers use telematics devices or smartphone apps to track factors like mileage, driving speed, and braking habits. This data is then used to calculate personalized insurance rates. It can be a good option if you’re a safe driver and don’t drive frequently, as it can result in significant savings. However, it may not be suitable for high-mileage drivers or those with a history of accidents or violations.

What are some of the benefits of digital-first auto insurance companies?

+Digital-first auto insurance companies offer a range of benefits, including simplified, streamlined processes for getting quotes, purchasing policies, and managing accounts online or via mobile apps. They often utilize data-driven algorithms to offer personalized coverage and competitive rates. Additionally, they may provide innovative features like usage-based insurance and AI-powered claims processing, which can enhance the overall customer experience.