Best Cheap Pet Insurance

Pet insurance is an essential aspect of responsible pet ownership, offering financial protection and peace of mind for unexpected veterinary costs. However, finding the best pet insurance that suits your budget can be challenging, as the market offers a wide range of plans with varying coverage and costs. In this comprehensive guide, we will explore the top cheap pet insurance options, providing you with the knowledge to make an informed decision and ensure the well-being of your furry companion.

Understanding Cheap Pet Insurance

When searching for affordable pet insurance, it's crucial to strike a balance between cost and coverage. While premium plans may offer extensive benefits, they often come with higher monthly premiums. Cheap pet insurance plans prioritize affordability without compromising essential coverage, ensuring that pet owners can access necessary veterinary care without breaking the bank.

Here are some key factors to consider when evaluating cheap pet insurance options:

- Coverage Limits: Assess the maximum amount the insurance provider will pay out for a specific illness or injury. Some plans have annual or lifetime limits, while others offer unlimited coverage.

- Reimbursement Rate: This indicates the percentage of approved veterinary costs that the insurance company will reimburse. Common rates range from 70% to 100%, with higher rates often associated with more expensive plans.

- Deductibles and Co-pays: Deductibles are the amount you must pay out-of-pocket before the insurance coverage kicks in. Co-pays, on the other hand, are the fixed amounts you pay for each claim. Lower deductibles and co-pays generally mean higher monthly premiums.

- Waiting Periods: Most pet insurance plans have waiting periods for specific conditions or treatments. Understanding these waiting periods is crucial to avoid surprises when filing claims.

- Additional Benefits: Some cheap pet insurance plans offer extra perks, such as routine care coverage, wellness exams, or prescription medication reimbursement. These additional benefits can provide significant value without increasing the monthly premium.

Top Cheap Pet Insurance Options

Now, let's delve into some of the most reputable and affordable pet insurance providers on the market. These options have been carefully selected based on their comprehensive coverage, competitive pricing, and positive customer reviews.

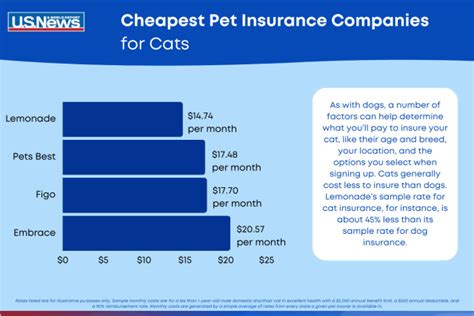

1. Lemonade Pet Insurance

Lemonade Pet Insurance stands out for its innovative approach and commitment to providing affordable coverage. With Lemonade, you can choose from three different plan options: Essential, Preferred, and Premier. Each plan offers varying levels of coverage and customization to suit your needs and budget.

Here's a breakdown of Lemonade Pet Insurance's key features:

- Coverage Options: Lemonade offers coverage for accidents, illnesses, and routine care, including vaccinations, dental cleanings, and spaying/neutering.

- Reimbursement Rates: Lemonade's reimbursement rates range from 70% to 90%, depending on the plan you choose. You can also customize your plan to include a higher reimbursement rate for an additional cost.

- Deductibles: Lemonade allows you to select a deductible that aligns with your budget, ranging from $100 to $1,000.

- Wellness Coverage: Lemonade's plans include an optional Wellness Package that covers routine care and preventive treatments, providing additional peace of mind.

- Discounts: Lemonade offers discounts for multiple pets and military personnel, making their plans even more affordable.

Lemonade Pet Insurance is known for its excellent customer service and user-friendly online platform, making it a top choice for pet owners seeking affordable and comprehensive coverage.

2. ASPCA Pet Insurance

ASPCA Pet Insurance, backed by the well-known American Society for the Prevention of Cruelty to Animals, offers a range of affordable plans tailored to different budgets. Their plans provide comprehensive coverage for accidents, illnesses, and even some chronic conditions.

Key features of ASPCA Pet Insurance include:

- Coverage Options: ASPCA offers two primary plan options: Whole Pet With Wellness and Urgent Care. The Whole Pet plan provides coverage for accidents, illnesses, and wellness care, while the Urgent Care plan focuses on emergency and urgent care situations.

- Reimbursement Rates: ASPCA's reimbursement rates are typically 80% or 90%, allowing you to choose the level of coverage that suits your financial situation.

- Deductibles: ASPCA allows you to select deductibles ranging from $100 to $500, providing flexibility in your monthly premium.

- Wellness Coverage: The Whole Pet plan includes an optional Wellness Rewards add-on, which covers routine care and preventive treatments, including vaccinations and flea/tick control.

- Additional Benefits: ASPCA Pet Insurance offers a 24/7 pet helpline, providing veterinary advice and support when needed.

ASPCA Pet Insurance is a reliable and affordable option, ensuring that your pet receives the necessary care without straining your finances.

3. Embrace Pet Insurance

Embrace Pet Insurance is another reputable provider known for its affordable plans and excellent customer satisfaction. Embrace offers a simple and straightforward approach to pet insurance, making it an attractive option for budget-conscious pet owners.

Here's an overview of Embrace Pet Insurance's key features:

- Coverage Options: Embrace provides coverage for accidents, illnesses, and hereditary conditions, ensuring comprehensive protection for your pet.

- Reimbursement Rates: Embrace offers reimbursement rates of 70%, 80%, or 90%, depending on your chosen plan. You can also customize your plan to include a higher reimbursement rate.

- Deductibles: Embrace allows you to select a deductible ranging from $100 to $500, giving you control over your monthly premium.

- Wellness Coverage: Embrace's Wellness Rewards program covers routine care, including vaccinations, flea/tick prevention, and dental cleanings, providing an additional layer of financial protection.

- Discounts: Embrace offers discounts for multiple pets and early enrollment, making their plans even more cost-effective.

Embrace Pet Insurance's commitment to transparency and customer satisfaction makes it a top choice for pet owners seeking affordable coverage without sacrificing quality.

Factors to Consider When Choosing Cheap Pet Insurance

When selecting a cheap pet insurance plan, it's essential to consider your pet's specific needs and your financial situation. Here are some additional factors to keep in mind:

- Breed-Specific Risks: Some breeds are prone to certain health conditions. Researching breed-specific risks can help you choose a plan that provides adequate coverage for your pet's unique needs.

- Pre-Existing Conditions: Most pet insurance plans exclude coverage for pre-existing conditions. Ensure that you understand the policy's definition of a pre-existing condition and consider enrolling your pet in insurance early to avoid potential exclusions.

- Age and Health of Your Pet: Younger and healthier pets often have lower insurance premiums. However, it's crucial to consider the long-term benefits of insurance, as veterinary costs tend to increase with age.

- Routine Care Coverage: If you're seeking coverage for routine care, ensure that the plan includes this option or provides add-ons for preventive treatments.

- Customer Reviews: Read reviews from other pet owners to gauge the insurance provider's reputation, claim processing efficiency, and overall customer satisfaction.

Performance Analysis and Real-World Examples

To further illustrate the value of cheap pet insurance, let's examine a few real-world scenarios and the potential financial impact of unexpected veterinary costs.

| Scenario | Cost Without Insurance | Cost With Insurance |

|---|---|---|

| Accidental Injury (Broken Leg) | $3,000 | $1,200 (with 80% reimbursement) |

| Emergency Surgery (Bloat) | $5,000 | $2,000 (with 60% reimbursement) |

| Chronic Condition (Allergies) | $1,500/year | $600/year (with 70% reimbursement) |

As these examples demonstrate, pet insurance can significantly reduce the financial burden of unexpected veterinary expenses. Even with cheap pet insurance plans, the savings can be substantial, ensuring that you can provide the necessary care for your beloved pet without compromising your financial stability.

Future Implications and Trends

The pet insurance industry is constantly evolving, and several trends are shaping the future of affordable pet coverage. Here are some key developments to watch out for:

- Increased Digitalization: Pet insurance providers are embracing digital technologies, offering convenient online platforms for policy management, claim submissions, and real-time communication with veterinarians.

- Wellness and Preventive Care Focus: Many insurance companies are expanding their coverage to include routine care and preventive treatments, recognizing the importance of proactive healthcare for pets.

- Personalized Plans: Insurance providers are offering more customizable plans, allowing pet owners to choose the level of coverage and benefits that align with their specific needs and budgets.

- Integration with Veterinary Care: Some insurance companies are partnering with veterinary practices to streamline the claim process and provide integrated care, ensuring a seamless experience for pet owners.

- Discounts and Rewards: Insurance providers are introducing loyalty programs, discounts for multiple pets, and other incentives to encourage pet owners to maintain insurance coverage.

Conclusion

Cheap pet insurance is an invaluable investment for pet owners, offering financial protection and peace of mind. With the right plan, you can ensure that your furry companion receives the necessary veterinary care without straining your finances. Whether you choose Lemonade Pet Insurance, ASPCA Pet Insurance, or Embrace Pet Insurance, you can rest assured that your pet's well-being is covered, allowing you to focus on the joy of pet ownership.

Frequently Asked Questions

What is the average cost of cheap pet insurance plans?

+The average monthly premium for cheap pet insurance plans ranges from 20 to 50, depending on factors such as the age and breed of your pet, coverage limits, and chosen deductible.

Do cheap pet insurance plans cover pre-existing conditions?

+Most cheap pet insurance plans do not cover pre-existing conditions. However, it’s essential to review the policy’s definition of a pre-existing condition and consider enrolling your pet early to avoid potential exclusions.

How do I choose the right deductible for my cheap pet insurance plan?

+When selecting a deductible, consider your financial situation and the potential veterinary costs you may incur. A higher deductible can result in a lower monthly premium, but it means you’ll pay more out-of-pocket before insurance coverage kicks in.

Can I switch to a different cheap pet insurance provider if I’m not satisfied with my current plan?

+Yes, you can switch pet insurance providers at any time. However, it’s essential to understand the waiting periods and potential exclusions associated with new plans. Carefully review the terms and conditions of the new provider to ensure a smooth transition.

What additional benefits should I look for in a cheap pet insurance plan?

+Look for plans that offer optional add-ons or wellness coverage for routine care, including vaccinations, flea/tick prevention, and dental cleanings. These additional benefits can provide significant value without increasing your monthly premium significantly.