Insurance Cars Companies

In the world of automotive insurance, the landscape is vast and complex, with numerous companies vying for market dominance. The insurance industry plays a pivotal role in safeguarding individuals and their vehicles, offering financial protection and peace of mind. This article delves into the realm of insurance for cars, exploring the key players, their unique offerings, and the impact they have on the market.

Unraveling the Insurance Landscape: A Comprehensive Overview

The car insurance market is a highly competitive arena, characterized by a diverse range of providers, each with its own strengths and target audience. From global giants to regional specialists, these companies employ various strategies to cater to the diverse needs of vehicle owners.

Industry Leaders and Their Strategies

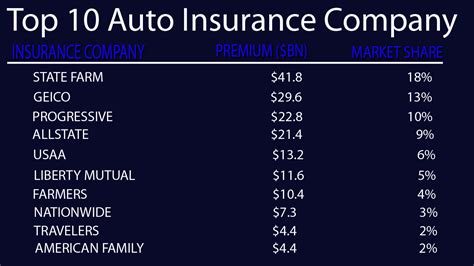

Among the big names in the industry, State Farm stands out as a prominent player. With a rich history spanning over a century, State Farm has established itself as a trusted brand, offering a comprehensive suite of insurance products. Their approach revolves around providing personalized coverage options and excellent customer service, catering to a wide spectrum of drivers.

In contrast, Geico has carved a niche for itself by targeting a specific demographic - the modern, tech-savvy driver. Geico's innovative use of technology, from its user-friendly online platform to its renowned gecko mascot, has captured the attention of a younger audience, solidifying its position as a top contender in the market.

Another industry leader, Progressive, has embraced a forward-thinking approach. Progressive's strategy revolves around continuous innovation, offering cutting-edge features such as usage-based insurance and real-time accident assistance. This commitment to technological advancement has not only attracted a loyal customer base but has also set a new standard for the industry.

Specialized Insurers: Niche Markets, Unique Offerings

While the big players dominate the market, it’s important to recognize the impact of specialized insurers. These companies focus on specific niches, providing tailored coverage that caters to unique needs.

Take, for instance, The General, a company that has positioned itself as the go-to insurer for high-risk drivers. With a focus on providing affordable coverage for those with less-than-perfect driving records, The General has become a lifeline for many individuals who might otherwise struggle to find adequate insurance.

Similarly, Esurance has made its mark by targeting environmentally conscious drivers. Esurance offers incentives and discounts for drivers who opt for eco-friendly vehicles, encouraging a shift towards sustainable transportation while providing comprehensive coverage.

| Company | Specialization |

|---|---|

| The General | High-Risk Drivers |

| Esurance | Eco-Friendly Vehicles |

Analyzing Coverage and Customer Experience

When evaluating insurance companies, it’s imperative to consider the breadth of coverage they offer and the overall customer experience they provide.

Coverage Options: A Comprehensive Breakdown

A reputable insurance company should offer a range of coverage options to cater to diverse needs. This includes liability coverage, which is a legal requirement in most states, as well as optional add-ons such as collision, comprehensive, and personal injury protection.

For instance, Allstate, a well-known insurer, provides an extensive range of coverage options, allowing customers to customize their policies to fit their specific requirements. From basic liability to comprehensive packages that include roadside assistance and rental car coverage, Allstate ensures that drivers can find a plan that suits their needs and budget.

Customer Experience: Beyond Policies

Beyond the coverage itself, the customer experience is a critical factor in choosing an insurance provider. This encompasses everything from the ease of purchasing a policy to the quality of customer support and claims handling.

Companies like USAA have earned a reputation for exceptional customer service. USAA, which caters primarily to military members and their families, understands the unique needs of this demographic and provides tailored support and resources. Their dedication to customer satisfaction has resulted in a loyal customer base and numerous industry accolades.

On the other hand, Liberty Mutual has invested heavily in digital transformation, offering a seamless online experience for policyholders. From quoting to claims filing, Liberty Mutual's user-friendly platform has simplified the insurance journey, making it more accessible and efficient for customers.

The Impact of Technology: Revolutionizing the Insurance Industry

In recent years, the insurance industry has undergone a digital transformation, with technology playing a pivotal role in shaping the future of automotive insurance.

Usage-Based Insurance: Rewarding Safe Driving

One of the most significant advancements is the introduction of usage-based insurance (UBI). Companies like Metromile have pioneered this concept, offering policies that are priced based on actual miles driven. This innovative approach not only encourages safer driving habits but also provides cost savings for low-mileage drivers.

Metromile's usage-based insurance model has been particularly beneficial for urban residents who drive less frequently or for short distances. By tracking mileage and driving behavior, Metromile can offer highly personalized rates, disrupting the traditional insurance model.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics have also made significant inroads into the insurance industry. Companies are leveraging these technologies to enhance risk assessment, improve claims processing, and provide personalized recommendations to customers.

For example, Root Insurance uses a mobile app and AI-powered driving tests to assess customers' driving skills. This data-driven approach allows Root to offer highly competitive rates to safe drivers, further incentivizing responsible behavior behind the wheel.

The Future of Insurance: Trends and Predictions

As we look ahead, several trends and innovations are poised to shape the future of automotive insurance.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) presents both challenges and opportunities for the insurance industry. As AV technology advances, insurers will need to adapt their coverage models to account for the reduced risk associated with driverless cars.

Companies like Arity, a mobility solutions provider, are already exploring this space. Arity is developing innovative insurance models that consider the unique risks and benefits associated with AVs, paving the way for a new era of automotive insurance.

Sustainable Insurance Practices

With growing environmental awareness, the insurance industry is also embracing sustainability. Insurers are beginning to offer incentives and discounts for eco-friendly practices, such as driving electric vehicles or adopting green commuting options.

For instance, Chubb, a leading global insurer, has introduced a program that rewards customers for reducing their carbon footprint. This initiative not only aligns with environmental goals but also encourages a shift towards more sustainable transportation choices.

How do insurance companies determine premiums for car insurance policies?

+Insurance companies use a variety of factors to calculate premiums, including the driver's age, driving record, vehicle type, and location. They also consider external factors like traffic and crime rates in the area.

What are some common discounts offered by insurance companies for car insurance?

+Common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies), and loyalty discounts for long-term customers. Some companies also offer discounts for specific occupations or educational achievements.

How can I find the best car insurance company for my needs?

+Research is key. Compare multiple insurance companies based on their coverage options, customer reviews, and financial stability. Consider your specific needs and priorities, such as comprehensive coverage, customer service, or cost-effectiveness.

In conclusion, the world of insurance for cars is a dynamic and ever-evolving landscape. From industry leaders to specialized insurers, each company brings its unique strengths and approaches to the market. As technology continues to advance and new trends emerge, the insurance industry will continue to adapt, ensuring that drivers have access to the protection and peace of mind they deserve.