Quotes Insurance Car

When it comes to car insurance, having the right coverage is essential to protect yourself and your vehicle. Obtaining quotes for insurance is a crucial step in ensuring you get the best policy for your needs. This article aims to provide an in-depth guide on how to navigate the process of getting car insurance quotes, offering insights and tips to help you make informed decisions.

Understanding Car Insurance Quotes

Car insurance quotes are personalized estimates provided by insurance companies, detailing the cost of coverage for your specific vehicle and circumstances. These quotes consider various factors to determine the risk associated with insuring you, ultimately influencing the premium you pay. Understanding the quote process is the first step towards securing the most suitable and cost-effective car insurance.

Factors Influencing Car Insurance Quotes

A multitude of factors come into play when insurance providers calculate quotes. These include your driving history, with a clean record often leading to lower premiums. The make and model of your vehicle also matter; certain cars may be more expensive to insure due to their repair costs or safety ratings. Your age, gender, and location are other significant factors, as they can impact the likelihood of accidents or claims. Additionally, coverage types and policy limits you choose will affect the overall quote.

| Factor | Description |

|---|---|

| Driving History | Previous accidents, violations, and claims impact your risk profile. |

| Vehicle Type | Make, model, and age of your car influence repair and replacement costs. |

| Demographics | Age, gender, and location can affect the likelihood of accidents. |

| Coverage Types | Different levels of liability, collision, and comprehensive coverage affect premium. |

The Process of Obtaining Car Insurance Quotes

Getting car insurance quotes has become more accessible and convenient with online tools and comparison websites. Here’s a step-by-step guide to help you navigate the process effectively.

Step 1: Gather Necessary Information

Before requesting quotes, ensure you have the following information readily available: your driver’s license number, vehicle registration, make and model of your car, mileage driven annually, and details about any previous insurance policies you’ve held.

Step 2: Utilize Online Comparison Tools

Online comparison platforms allow you to quickly and easily obtain multiple quotes from different insurers. These tools often provide a comprehensive breakdown of the coverage, deductibles, and premium costs, making it simple to compare policies side by side. Some well-known comparison websites include InsuranceQuotes.com, Compare.com, and TheZebra.com.

Step 3: Contact Insurance Providers Directly

While online comparisons are convenient, it’s also beneficial to reach out to insurance companies directly. This allows you to ask specific questions, clarify any uncertainties, and potentially negotiate better rates. Many insurers offer quotes over the phone or through their official websites.

Step 4: Consider Additional Discounts

Insurance providers often offer various discounts to attract customers. These can include safe driver discounts, multi-policy discounts (if you bundle your car insurance with other policies like home or life insurance), student discounts (for good grades), and loyalty discounts for long-term customers. Make sure to inquire about these potential savings when requesting quotes.

Analyzing and Comparing Car Insurance Quotes

Once you’ve obtained a handful of quotes, it’s crucial to analyze and compare them to find the best value. Here are some key aspects to consider during this process.

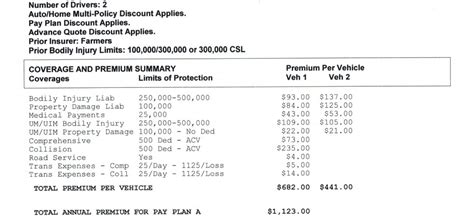

Coverage Types and Limits

Ensure that the quotes you receive cover the types of insurance you require. This typically includes liability coverage (for bodily injury and property damage you cause to others), collision coverage (for damage to your vehicle in an accident), and comprehensive coverage (for non-collision incidents like theft, vandalism, or natural disasters). Compare the policy limits to ensure they align with your needs.

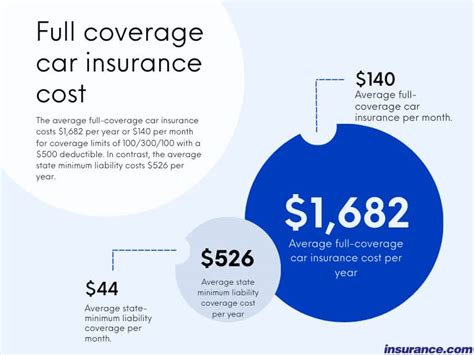

Premium Costs and Payment Options

Examine the annual or monthly premium costs carefully. While a lower premium might be tempting, ensure that it doesn’t compromise the coverage you need. Also, consider the payment options offered; some insurers provide flexible payment plans or allow for one-time annual payments.

Deductibles and Out-of-Pocket Expenses

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible can lead to a lower premium, but it’s important to ensure you can afford the deductible in the event of a claim. Consider your financial situation and choose a deductible that aligns with your comfort level.

Additional Benefits and Perks

Beyond the standard coverage, some insurance providers offer additional benefits like rental car reimbursement, accident forgiveness (which can prevent your rates from increasing after an at-fault accident), or roadside assistance. These perks can be valuable, especially if you frequently travel or are concerned about unexpected expenses.

Making the Final Decision

After analyzing and comparing quotes, it’s time to make your decision. Choose the insurance provider that offers the best combination of coverage, cost, and additional benefits. Don’t forget to review the policy documents thoroughly before finalizing your decision.

How often should I review my car insurance quotes and policy?

+It’s a good practice to review your car insurance quotes and policy annually, especially when your policy is up for renewal. This allows you to stay up-to-date with any changes in your circumstances, such as a cleaner driving record, a new vehicle, or moving to a different location, which may impact your premium.

Can I get a car insurance quote without providing my personal information?

+Some online comparison websites allow you to obtain initial quotes without providing sensitive personal information. However, to get an accurate quote from an insurance provider, you will need to disclose details such as your driving history and vehicle information.

What should I do if I’m unhappy with my current car insurance provider?

+If you’re dissatisfied with your current car insurance provider, you have the right to shop around for a new policy. Obtain quotes from different insurers and compare them to find a better fit. Be sure to understand the cancellation process and any fees associated with switching providers.