Hartford Group Insurance

The Hartford Group Insurance is a prominent player in the insurance industry, offering a comprehensive range of insurance products and services to individuals and businesses across the United States. With a rich history spanning over a century, The Hartford has established itself as a trusted name in the industry, known for its financial stability, innovative products, and customer-centric approach.

This journal-style article aims to delve into the world of The Hartford Group Insurance, exploring its origins, key offerings, notable achievements, and its impact on the insurance landscape. By examining its unique features and strategies, we can gain insights into the success and longevity of this renowned insurance provider.

A Legacy of Innovation and Trust: The Hartford’s Journey

The Hartford’s story began in 1810, when a group of visionary individuals recognized the need for reliable insurance coverage in the bustling city of Hartford, Connecticut. Led by a team of prominent citizens, including the renowned author and publisher, Mark Twain, The Hartford Fire Insurance Company was established. Over the years, the company expanded its offerings, branching out into various insurance sectors, including property, casualty, and life insurance.

The Hartford's commitment to innovation and customer satisfaction has been a driving force behind its success. Throughout its history, the company has introduced numerous groundbreaking products and services, adapting to the evolving needs of its customers. From introducing one of the first automobile insurance policies in the early 1900s to developing cutting-edge digital tools for policy management, The Hartford has consistently stayed ahead of the curve.

Key Milestones and Achievements

The Hartford’s journey has been marked by significant milestones and achievements that have solidified its position as a leading insurance provider:

- 1904: The Hartford became one of the first insurance companies to offer workers' compensation insurance, providing protection to employees and businesses alike.

- 1958: The company expanded its reach by introducing a new line of business insurance products, catering to the unique needs of small and medium-sized enterprises.

- 1986: Recognizing the growing importance of environmental concerns, The Hartford launched specialized environmental insurance policies, addressing the risks associated with pollution and environmental damage.

- 2001: In response to the events of 9/11, The Hartford introduced the first-of-its-kind Terrorism Risk Insurance Act, providing coverage for acts of terrorism and offering much-needed support to businesses and individuals.

- 2019: The Hartford's commitment to sustainability was showcased with the launch of its Climate Change Risk Management Solution, helping businesses assess and mitigate climate-related risks.

These milestones not only highlight The Hartford's adaptability but also its ability to anticipate and address emerging risks and opportunities.

Comprehensive Insurance Solutions: Meeting Diverse Needs

The Hartford Group Insurance understands that every individual and business has unique insurance requirements. As such, the company has developed an extensive portfolio of insurance products and services tailored to meet these diverse needs.

Personal Insurance

For individuals and families, The Hartford offers a comprehensive range of personal insurance options, including:

- Auto Insurance: Providing coverage for cars, motorcycles, and other vehicles, with customizable options to suit various driving needs.

- Homeowners Insurance: Protecting homeowners from a wide range of risks, including damage to property, liability claims, and additional living expenses.

- Renters Insurance: Offering essential coverage for renters, safeguarding their belongings and providing liability protection.

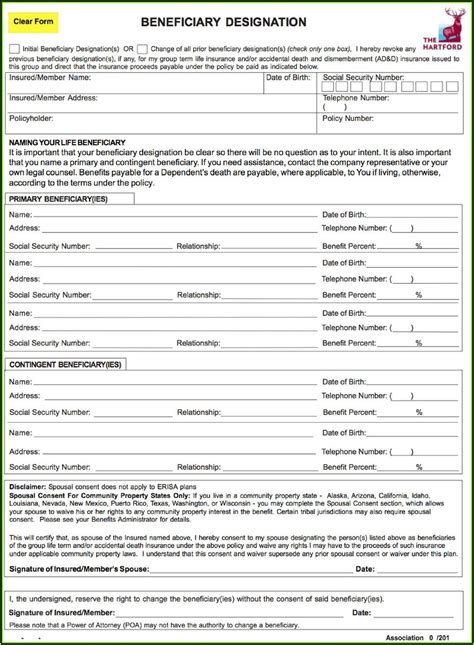

- Life Insurance: A range of life insurance products, including term life, whole life, and universal life insurance, to help individuals and families secure their financial future.

- Annuities: Retirement planning solutions that offer guaranteed income streams and tax benefits.

Business Insurance

The Hartford’s business insurance offerings are designed to protect companies of all sizes and across various industries. Some key products include:

- Commercial Property Insurance: Coverage for physical assets, including buildings, equipment, and inventory, helping businesses recover from losses due to fire, theft, or natural disasters.

- General Liability Insurance: Protecting businesses from third-party claims, including bodily injury, property damage, and advertising injuries.

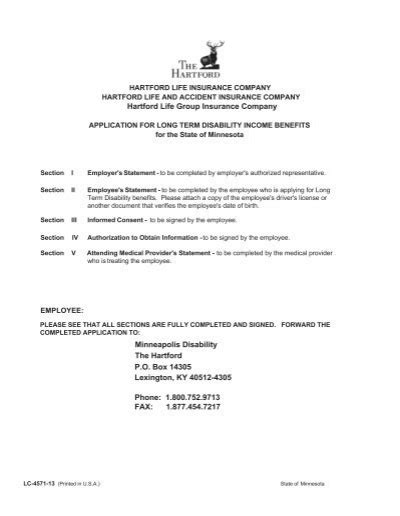

- Workers' Compensation: Providing coverage for medical expenses and lost wages for employees injured on the job, ensuring compliance with state regulations.

- Business Owners Policy (BOP): A cost-effective solution that combines property, liability, and business interruption coverage, tailored to small and medium-sized businesses.

- Professional Liability Insurance: Specialized coverage for professionals such as doctors, lawyers, and consultants, protecting against claims of negligence or errors.

Digital Innovation: Enhancing the Customer Experience

The Hartford recognizes the importance of technology in delivering exceptional customer experiences. Over the years, the company has invested significantly in digital innovation, introducing a range of tools and platforms to streamline the insurance process and enhance customer satisfaction.

Online Quoting and Policy Management

Customers can now easily obtain insurance quotes online, compare options, and purchase policies directly through The Hartford’s user-friendly website. The online platform also allows policyholders to manage their policies, make payments, and access important documents anytime, anywhere.

Mobile Apps

The Hartford’s mobile apps, available for both iOS and Android devices, offer additional convenience. Policyholders can file claims, access digital ID cards, and receive real-time updates on the status of their claims, ensuring a seamless and efficient experience.

Digital Claims Processing

The Hartford’s digital claims processing system has revolutionized the way claims are handled. By leveraging advanced technology, the company can expedite the claims process, providing faster resolutions and minimizing the impact of losses on customers.

| Digital Innovation | Description |

|---|---|

| Online Quoting | Allows customers to obtain quotes and purchase policies digitally. |

| Policy Management | Enables policyholders to manage their policies, make payments, and access documents online. |

| Mobile Apps | Provides convenient access to policy information, claim filing, and digital ID cards. |

| Digital Claims Processing | Streamlines the claims process, offering faster resolutions and improved customer satisfaction. |

Community Engagement and Social Responsibility

Beyond its core insurance offerings, The Hartford actively engages in community initiatives and social responsibility programs. The company understands the importance of giving back and making a positive impact on society.

The Hartford’s Community Involvement

The Hartford supports various charitable organizations and initiatives, focusing on areas such as education, disaster relief, and veteran support. The company’s employees are encouraged to participate in volunteer programs, fostering a culture of community involvement.

Diversity and Inclusion

The Hartford is committed to fostering a diverse and inclusive workplace. The company recognizes the value of diverse perspectives and experiences, and its efforts in this regard have been recognized through numerous awards and certifications.

Environmental Sustainability

With a focus on environmental sustainability, The Hartford has implemented various initiatives to reduce its environmental footprint. The company has set ambitious goals to achieve net-zero emissions and promote sustainable practices across its operations.

Financial Strength and Stability

The Hartford’s financial strength and stability are among its key strengths. The company has consistently maintained a strong financial position, earning high ratings from leading credit rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s.

Investment in Research and Development

The Hartford’s commitment to innovation extends to its investment in research and development. The company continuously explores new technologies and trends, ensuring it remains at the forefront of the insurance industry.

Risk Management Expertise

With a team of experienced risk management professionals, The Hartford provides valuable insights and guidance to its customers. The company’s risk management services help businesses identify and mitigate potential risks, ensuring they are well-prepared for any challenges that may arise.

Conclusion: The Hartford’s Enduring Legacy

As The Hartford Group Insurance continues to evolve and adapt to the changing landscape of the insurance industry, its legacy of innovation, trust, and customer-centricity remains intact. With a rich history spanning over two centuries, the company has demonstrated its ability to stay ahead of the curve and meet the evolving needs of its customers.

Through its comprehensive insurance offerings, digital innovations, and commitment to community and social responsibility, The Hartford has solidified its position as a leading insurance provider. As the company looks to the future, it can be certain that its legacy of excellence will continue to inspire and benefit generations to come.

How can I obtain a quote for The Hartford’s insurance products?

+You can easily obtain a quote for The Hartford’s insurance products by visiting their official website and using the online quoting tool. Simply provide the necessary information, and you’ll receive a personalized quote based on your specific needs and circumstances.

What sets The Hartford apart from other insurance providers?

+The Hartford’s commitment to innovation, financial stability, and customer satisfaction sets it apart. The company’s extensive product portfolio, digital innovations, and focus on community involvement make it a trusted partner for individuals and businesses seeking comprehensive insurance coverage.

How does The Hartford support small businesses with their insurance needs?

+The Hartford offers specialized insurance products and services tailored to the unique needs of small businesses. From business owners policies (BOPs) to professional liability insurance, The Hartford provides cost-effective solutions to protect small businesses and help them thrive.

What is The Hartford’s approach to environmental sustainability?

+The Hartford recognizes the importance of environmental sustainability and has implemented various initiatives to reduce its environmental footprint. The company has set ambitious goals for net-zero emissions and promotes sustainable practices across its operations.

How can I contact The Hartford for further information or assistance?

+You can reach out to The Hartford through their official website, where you’ll find contact information and a range of resources. Additionally, you can connect with their customer service team via phone or email for personalized assistance.