What Is Travel Insurance

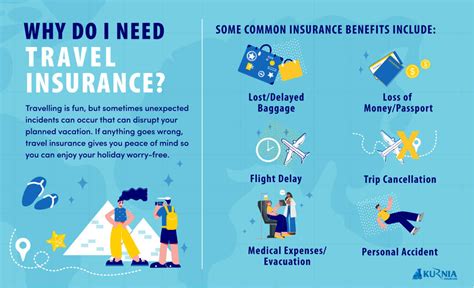

Travel insurance is an essential tool for anyone embarking on a journey, whether it's a leisurely vacation, a business trip, or an adventurous expedition. In an increasingly unpredictable world, it offers peace of mind and financial protection against a range of unforeseen circumstances that can disrupt your travel plans.

Understanding Travel Insurance

At its core, travel insurance is a contract between you and an insurance provider. By purchasing a travel insurance policy, you gain access to a range of benefits and services designed to safeguard your travel experience. These policies are tailored to address the unique risks and challenges associated with travel, from medical emergencies and trip cancellations to lost luggage and travel delays.

The primary purpose of travel insurance is to provide coverage for unexpected events that could impact your travel plans or cause financial strain. It acts as a safety net, ensuring that you are not left bearing the full financial burden of unforeseen circumstances. This is especially crucial when traveling abroad, where healthcare costs can be significantly higher, and local laws and regulations may differ from those at home.

Key Components of Travel Insurance

Travel insurance policies typically encompass a variety of coverages, each designed to address specific travel-related concerns. Here are some of the key components you can expect to find in a comprehensive travel insurance plan:

- Medical Expense Coverage: This is often the most critical aspect of travel insurance. It provides coverage for emergency medical treatment, hospitalization, and sometimes even dental care while you're away. It can also include evacuation and repatriation benefits if you need to be transported back home for medical reasons.

- Trip Cancellation and Interruption: These coverages protect your financial investment in the trip. If you need to cancel your trip due to a covered reason (e.g., illness, natural disaster, or travel advisory), trip cancellation coverage reimburses you for non-refundable expenses. Trip interruption coverage steps in if your trip is cut short unexpectedly, ensuring you're not left out of pocket for the unused portion of your trip.

- Baggage and Personal Belongings: Travel insurance often includes coverage for lost, stolen, or damaged luggage and personal items. This can provide a much-needed relief if your baggage goes missing or is delayed during your journey.

- Travel Delay: If your travel plans are disrupted due to delays, travel insurance can reimburse you for additional expenses such as accommodation and meals. This coverage is especially valuable when dealing with unforeseen delays caused by weather conditions or transportation issues.

- Emergency Assistance: Many travel insurance policies include 24/7 emergency assistance services. This means you have access to a dedicated team that can provide support and guidance in case of an emergency, helping with everything from finding a local doctor to arranging for alternative travel plans.

The specific coverages and limits offered by travel insurance policies can vary significantly depending on the provider and the type of plan you choose. It's crucial to carefully review the policy details and understand what is and isn't covered to ensure you have the right level of protection for your trip.

When to Consider Travel Insurance

Travel insurance is a wise consideration for any trip, regardless of its duration or destination. However, certain types of travel may warrant a more comprehensive policy. Here are some scenarios where travel insurance is particularly beneficial:

- International Travel: When traveling abroad, especially to destinations where healthcare costs are high or where you may not have access to your usual healthcare providers, travel insurance is essential. It ensures you have the necessary medical coverage and can also help with other travel-related issues, such as language barriers or unfamiliar local laws.

- Adventure Activities: If your trip involves high-risk activities like skiing, hiking in remote areas, or engaging in extreme sports, travel insurance with adventure sports coverage is a must. These policies are designed to cover the additional risks associated with these activities.

- Pre-Existing Medical Conditions: If you have a pre-existing medical condition, travel insurance can provide crucial coverage. Many policies offer coverage for medical emergencies related to pre-existing conditions, although it's important to declare these conditions when purchasing the policy.

- Expensive Trips: If you're planning an expensive vacation, such as a cruise, a luxury resort stay, or a multi-destination trip, travel insurance can protect your investment. It ensures that if something goes wrong, you won't be left with substantial financial losses.

Remember, travel insurance is not a one-size-fits-all solution. It's important to assess your individual needs and choose a policy that provides adequate coverage for your specific circumstances and travel plans.

How to Choose the Right Travel Insurance

With a myriad of travel insurance options available, selecting the right policy can be a daunting task. Here are some key considerations to guide you in choosing the best travel insurance for your needs:

- Coverage Levels: Evaluate the different coverage levels offered by various providers. Ensure the policy provides adequate coverage for medical expenses, trip cancellation, and other key areas relevant to your trip. Look for policies that offer coverage limits that align with your potential risks and needs.

- Pre-Existing Condition Coverage: If you have any pre-existing medical conditions, confirm that the policy provides coverage for them. Some policies may require you to purchase additional coverage or declare these conditions upfront.

- Adventure Sports Coverage: If your trip involves adventure activities, ensure the policy includes coverage for these specific risks. Not all policies cover high-risk activities, so it's essential to review the fine print.

- Policy Exclusions: Carefully read the policy exclusions to understand what isn't covered. Some common exclusions may include certain pre-existing conditions, hazardous activities, or travel to high-risk destinations. Ensure you're comfortable with the exclusions before committing to a policy.

- Customer Service and Claims Process: Consider the reputation and reliability of the insurance provider. Research their customer service ratings and reviews, and understand their claims process. You want to choose a provider that is responsive and efficient when it comes to processing claims.

- Price and Value: While price is an important factor, it shouldn't be the sole deciding factor. Compare policies based on the value they offer, taking into account the coverage limits, exclusions, and the overall reputation of the provider. A slightly more expensive policy may offer better value if it provides more comprehensive coverage.

By carefully considering these factors and reviewing multiple policies, you can make an informed decision and choose a travel insurance policy that provides the right level of protection for your trip.

Travel Insurance and Peace of Mind

At the heart of travel insurance is the promise of peace of mind. It allows you to focus on enjoying your trip, knowing that you have a robust safety net in place to handle any unexpected situations. Whether it’s a medical emergency, a lost passport, or a canceled flight, travel insurance provides the financial and logistical support needed to navigate these challenges.

Travel insurance is a critical component of responsible travel planning. By investing in a comprehensive policy, you can embark on your journey with confidence, secure in the knowledge that you are protected against a wide range of potential travel disruptions.

Remember, while travel insurance can't prevent unforeseen events from occurring, it can significantly reduce the stress and financial burden associated with these situations. It's an investment in your travel experience, ensuring that your journey is as enjoyable and worry-free as possible.

Future of Travel Insurance

As the travel industry continues to evolve, so too does the world of travel insurance. Insurers are increasingly adapting their policies to meet the changing needs and expectations of travelers. Here are some key trends and future implications to consider:

- Digitalization and Convenience: Travel insurance providers are embracing digital technologies to enhance the customer experience. This includes online policy management, mobile apps for easy access to policy details and emergency assistance, and streamlined claims processes. Expect continued digitalization to make travel insurance more accessible and user-friendly.

- Customizable Policies: To meet the diverse needs of travelers, insurers are offering more customizable policies. This allows travelers to tailor their coverage to their specific trip and personal needs, ensuring they only pay for the coverage they require.

- Increased Focus on Wellness: With a growing emphasis on wellness and health-conscious travel, insurers are expanding their medical coverage to include wellness-related benefits. This may include coverage for yoga retreats, spa treatments, or even alternative therapies.

- Sustainable Travel Initiatives: As sustainable and eco-friendly travel gains traction, insurers are exploring ways to support these initiatives. This could involve offering discounts or incentives for travelers who choose eco-friendly accommodations or activities, or even developing policies specifically for sustainable travel.

- Expanded Coverage for Digital Nomads: With the rise of remote work and digital nomadism, insurers are developing policies that cater to this new breed of traveler. These policies may include coverage for working-related expenses, such as co-working spaces or equipment rental, as well as extended stays in various locations.

As the travel industry adapts to changing trends and technological advancements, so too will travel insurance. The future of travel insurance promises increased flexibility, convenience, and customization, ensuring that travelers can obtain the protection they need for their unique journeys.

What are some common misconceptions about travel insurance?

+One common misconception is that travel insurance is only necessary for long trips or international travel. In reality, travel insurance can be beneficial for any trip, regardless of duration or destination. Another misconception is that travel insurance is expensive. While the cost of a policy can vary, many providers offer affordable options, especially when compared to the potential costs of an uninsured trip.

Can travel insurance cover COVID-19-related issues?

+Yes, many travel insurance policies now include coverage for COVID-19-related issues. This can include medical treatment for the virus, trip cancellation or interruption due to COVID-19, and even coverage for quarantine-related expenses. However, it’s important to carefully review the policy’s terms and conditions to understand the specific coverage offered.

How soon should I purchase travel insurance for my trip?

+It’s generally recommended to purchase travel insurance as soon as you book your trip. This ensures that you’re covered from the moment you make your travel arrangements. Some policies may also offer additional benefits if purchased within a certain timeframe, such as coverage for pre-existing conditions.

What should I do if I need to make a claim on my travel insurance policy?

+If you need to make a claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting documentation to support your claim. It’s important to keep all relevant receipts, reports, and other evidence to support your claim.