Fire Insurance In California

In the sunny state of California, where wildfires and natural disasters are an ever-present reality, fire insurance stands as a crucial safeguard for homeowners and businesses alike. With its diverse landscapes and unique climate, California poses distinct challenges when it comes to protecting properties from the ravages of fire. This article delves deep into the world of fire insurance, exploring its intricacies, benefits, and challenges specific to the Golden State.

The Importance of Fire Insurance in California

California’s fire season, an annual period of heightened wildfire risk, has become increasingly severe in recent years. This phenomenon is largely attributed to climate change, prolonged droughts, and the accumulation of dry vegetation. As a result, the risk of devastating wildfires has intensified, posing significant threats to communities and properties across the state.

Fire insurance serves as a vital tool for California residents to safeguard their homes and businesses from the financial devastation that can follow a wildfire. It provides coverage for damage or loss caused by fires, offering peace of mind and financial security during challenging times. With the right fire insurance policy, policyholders can ensure that they have the resources to rebuild and recover, even in the face of catastrophic events.

Understanding Fire Insurance Policies in California

Fire insurance policies in California are designed to offer comprehensive protection against fire-related incidents. These policies typically cover a wide range of perils, including wildfires, structural fires, and even smoke damage. However, it’s important to note that the coverage and terms of fire insurance policies can vary significantly between insurance providers and the specific needs of the policyholder.

When selecting a fire insurance policy, it's crucial to carefully review the policy's terms and conditions. Some policies may offer additional coverage options, such as protection against ashfall, which can cause significant damage to properties during and after a wildfire. Policyholders should also consider the policy's deductibles and the specific exclusions it may have, as these can impact the overall coverage and financial protection provided.

Key Considerations for California Residents:

- Wildfire-Specific Coverage: Ensure your policy explicitly covers wildfires and includes provisions for evacuation expenses and temporary living arrangements.

- Replacement Cost vs. Actual Cash Value: Understand the difference between these coverage options. Replacement cost coverage ensures you receive the full amount needed to rebuild your home, while actual cash value may provide less due to depreciation.

- Additional Living Expenses: Look for policies that cover additional living expenses if you need to relocate temporarily due to a fire.

- Personal Property Coverage: Verify that your policy covers the replacement of personal belongings lost in a fire, including clothing, furniture, and electronics.

Challenges and Considerations for California’s Fire Insurance Market

The unique challenges posed by California’s fire landscape have significant implications for the state’s insurance market. Here are some key considerations:

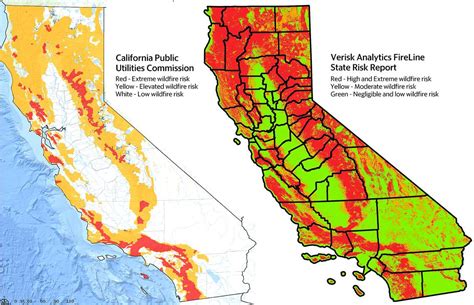

Wildfire Risk Zones

California’s Insurance Commissioner has designated certain areas as “very high fire hazard severity zones.” These zones are considered high-risk areas for wildfires, and insurance companies often impose higher premiums or even deny coverage in these regions. Policyholders residing in or near these zones may face challenges in obtaining affordable fire insurance.

| Very High Fire Hazard Severity Zones | Number of Zones |

|---|---|

| Statewide | 25,000 |

Rate Increases and Policy Cancellations

In recent years, insurance companies have responded to the increased wildfire risks by adjusting their policies. This has led to significant rate increases and, in some cases, policy cancellations for residents in high-risk areas. Such actions have left many Californians struggling to find affordable fire insurance options.

Community Resilience Programs

To mitigate the challenges posed by rising insurance costs and coverage limitations, California has implemented community resilience programs. These initiatives aim to reduce wildfire risks through proactive measures such as vegetation management, firebreak creation, and community education. By participating in these programs, residents can potentially lower their insurance premiums and enhance their overall fire preparedness.

State-Sponsored Insurance Programs

Recognizing the struggles faced by residents in high-risk areas, the state of California has established the California FAIR Plan and the California Joint Insurance Underwriting Association (JUA). These programs provide insurance coverage for properties that are deemed uninsurable by private insurance companies due to their high fire risk. While these programs offer a safety net, they typically come with higher premiums and more limited coverage options.

The Future of Fire Insurance in California

As California continues to grapple with the growing threat of wildfires, the landscape of fire insurance is likely to evolve. Here are some potential future developments:

Technological Advancements

The insurance industry is exploring the use of advanced technologies to better assess and manage wildfire risks. This includes the utilization of satellite imagery, remote sensing, and predictive analytics to identify high-risk areas and develop more accurate risk models. These advancements could lead to more precise insurance rates and improved coverage options.

Community-Based Solutions

There is a growing emphasis on community-based solutions to wildfire risk management. This involves collaborative efforts between residents, local governments, and insurance companies to implement effective wildfire prevention and mitigation strategies. By fostering a sense of collective responsibility, communities can reduce their overall wildfire risk and potentially negotiate better insurance terms.

Policy Innovation

Insurance companies are likely to continue innovating their policies to better serve the unique needs of California residents. This may include the development of more comprehensive wildfire coverage options, as well as the integration of additional benefits such as post-wildfire recovery assistance and mental health support.

Government Initiatives

The state of California is committed to addressing the challenges posed by wildfires. Ongoing government initiatives focus on enhancing wildfire prevention and response capabilities, as well as providing support for affected communities. These efforts can potentially reduce the overall wildfire risk and create a more favorable insurance environment for residents.

Conclusion

Fire insurance is an indispensable tool for California residents seeking to protect their properties and financial well-being from the risks posed by wildfires. While the challenges in the fire insurance market are significant, there are promising developments on the horizon. By staying informed, actively participating in community resilience programs, and advocating for innovative insurance solutions, Californians can work towards a more resilient and secure future.

What should I do if my insurance company cancels my fire insurance policy due to wildfire risk?

+If your insurance company cancels your policy, it’s important to act swiftly. Contact your insurance agent or broker to discuss your options. They may be able to help you find alternative coverage or guide you through the process of obtaining insurance through state-sponsored programs like the California FAIR Plan or the California JUA. Additionally, consider reaching out to other insurance providers to inquire about their policies and rates.

How can I reduce my fire insurance premiums in California?

+There are several strategies to potentially reduce your fire insurance premiums. First, ensure that your home or business is well-maintained and meets all safety standards. This includes regularly clearing vegetation and maintaining fire-resistant landscaping. Additionally, consider investing in fire-resistant building materials and installing fire safety features like sprinkler systems. These proactive measures can demonstrate your commitment to fire prevention and potentially lower your insurance costs.

What should I do after a wildfire to file an insurance claim?

+After a wildfire, it’s crucial to act promptly to file an insurance claim. Take photos or videos of the damage to your property and make a detailed list of your lost or damaged belongings. Contact your insurance company as soon as possible to initiate the claims process. They will guide you through the necessary steps, which may include providing documentation and working with adjusters to assess the extent of the damage.