Insurance Car State Farm

Welcome to an in-depth exploration of State Farm Insurance, one of the most prominent names in the automotive insurance industry. With a rich history spanning over a century, State Farm has evolved to become a trusted provider, offering comprehensive coverage and innovative services to its policyholders. This article delves into the various facets of State Farm's car insurance offerings, from its unique features and benefits to its performance and future prospects.

State Farm’s Comprehensive Car Insurance Coverage

State Farm Insurance is renowned for its extensive car insurance coverage options, designed to cater to the diverse needs of its customers. Whether you’re a seasoned driver or a newly licensed teen, State Farm aims to provide tailored protection.

Core Coverage Options

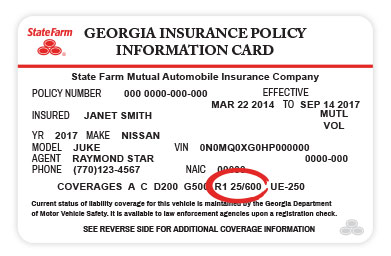

The core of State Farm’s car insurance coverage includes the standard options you’d expect from a leading insurer: liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects you financially if you’re found at fault in an accident, covering the costs of injuries and property damage to others. Collision coverage helps with the repair or replacement of your own vehicle after an accident, while comprehensive coverage extends to damages caused by non-collision events like theft, vandalism, or natural disasters.

State Farm also offers medical payments coverage, which can help cover medical expenses for you and your passengers after an accident, regardless of fault. Additionally, personal injury protection (PIP) is available in certain states, providing broader coverage for medical expenses, lost wages, and other related costs.

Specialized Coverages

Beyond the basics, State Farm provides a range of specialized coverages to enhance your protection. These include:

- Rental Car Coverage: This option provides reimbursement for rental car expenses while your vehicle is being repaired after an insured event.

- Roadside Assistance: State Farm's roadside assistance program offers 24/7 help for emergencies like towing, flat tire changes, and battery jumps.

- Glass Coverage: Comprehensive glass coverage means that State Farm will cover the cost of repairing or replacing your vehicle's glass, including windshields, without applying a deductible.

- Loan/Lease Payoff: If your car is totaled or stolen, this coverage helps pay off the remaining balance on your loan or lease, providing financial relief.

- Rideshare Coverage: Designed for rideshare drivers, this coverage extends your policy to include periods when you're logged into your rideshare app but haven't yet accepted a ride request.

State Farm’s Performance and Customer Experience

State Farm’s performance as an insurer is a key aspect in understanding its reputation and value. Here’s a breakdown of its key performance indicators and how it prioritizes customer experience.

Financial Stability and Ratings

State Farm’s financial stability is a cornerstone of its success and a key factor for potential policyholders. With a long history and a strong focus on financial prudence, State Farm has consistently maintained an excellent financial standing. This is reflected in its high ratings from leading industry rating agencies:

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A++ (Superior) |

| Standard & Poor's | AA- (Very Strong) |

| Moody's | Aaa (Exceptional) |

These ratings signify State Farm's ability to meet its financial obligations and provide stability for its policyholders.

Customer Satisfaction and Experience

State Farm understands that customer satisfaction is crucial in the competitive insurance market. The company has implemented various initiatives to enhance the customer experience, including:

- Digital Tools: State Farm offers a range of digital tools to simplify the insurance process. This includes an easy-to-use mobile app for policy management, claims tracking, and roadside assistance.

- Personalized Service: State Farm agents are known for their personalized approach, taking the time to understand each customer's unique needs and providing tailored coverage recommendations.

- Claims Handling: State Farm's claims process is designed for efficiency and customer convenience. Policyholders can initiate claims online or via the app, and the company's claims adjusters are known for their responsiveness and fair assessments.

- Discounts and Rewards: State Farm offers a variety of discounts to help policyholders save, including multi-policy discounts, safe driver discounts, and even discounts for good students.

Innovations and Future Prospects

State Farm is committed to staying ahead of the curve, investing in innovations that enhance its services and customer experience. Here’s a glimpse into some of its recent initiatives and future prospects.

Digital Transformation

State Farm has been at the forefront of digital transformation in the insurance industry. Its efforts have focused on creating a seamless, digital-first experience for customers, while also ensuring that its agents have the tools they need to provide personalized service.

One notable innovation is State Farm's partnership with Amazon's Alexa, allowing policyholders to manage their insurance using voice commands. This technology, along with other digital initiatives, has positioned State Farm as a leader in the digital insurance space.

Focus on Sustainability

State Farm is committed to environmental sustainability, and this commitment is reflected in its business practices and initiatives. The company has set ambitious goals to reduce its environmental impact, including a pledge to reduce its greenhouse gas emissions by 25% by 2025.

State Farm's sustainability initiatives extend to its products as well. The company offers discounts for electric vehicles and hybrid cars, encouraging policyholders to make more environmentally conscious choices.

Data-Driven Insights

State Farm leverages data analytics to gain insights into its business and improve its offerings. By analyzing vast amounts of data, the company can identify trends, optimize its products, and enhance its risk assessment capabilities.

For example, State Farm's Drive Safe & Save program uses telematics data to reward safe drivers with discounts. This innovative approach not only encourages safer driving behaviors but also provides policyholders with more personalized rates.

Conclusion: State Farm’s Continued Leadership

State Farm’s journey in the automotive insurance industry is a testament to its commitment to excellence. With a strong focus on financial stability, customer satisfaction, and innovation, State Farm has positioned itself as a leader in the market. As the company continues to adapt to changing consumer needs and market dynamics, its future looks bright.

Whether you're a loyal State Farm customer or considering them for your insurance needs, understanding the depth and breadth of their offerings can help you make informed decisions. With a rich history, a commitment to innovation, and a focus on customer experience, State Farm is well-positioned to continue its legacy of providing exceptional insurance services.

What makes State Farm’s car insurance unique?

+State Farm’s car insurance stands out for its comprehensive coverage options, including specialized coverages like rental car reimbursement and rideshare protection. Additionally, its focus on customer experience through digital tools and personalized service sets it apart.

How does State Farm ensure financial stability for its policyholders?

+State Farm maintains high financial strength ratings from leading agencies like AM Best, Standard & Poor’s, and Moody’s. These ratings signify the company’s ability to meet its financial obligations and provide stability for its policyholders.

What are some of State Farm’s recent innovations in the insurance space?

+State Farm has embraced digital transformation, partnering with Amazon’s Alexa for voice-enabled insurance management. It also focuses on sustainability, offering discounts for electric and hybrid vehicles, and utilizes data analytics to provide personalized rates through its Drive Safe & Save program.