Shop For Homeowners Insurance

As a homeowner, safeguarding your investment and your livelihood is paramount. Homeowners insurance serves as a vital tool to protect against financial losses due to various unforeseen events. In this comprehensive guide, we will delve into the world of homeowners insurance, exploring the essential aspects, the benefits it offers, and the crucial considerations to make when shopping for the right policy.

Understanding Homeowners Insurance

Homeowners insurance, often referred to as home insurance, is a contract between a homeowner and an insurance company. This contract, or policy, provides financial protection against damages to the home and its contents, as well as liability coverage for accidents or injuries that occur on the insured property.

The primary purpose of homeowners insurance is to offer peace of mind and financial security. It covers a wide range of perils, including fire, wind damage, theft, and liability claims. However, it's important to note that standard policies typically exclude certain events like floods and earthquakes, requiring separate coverage for such specific risks.

Moreover, homeowners insurance policies can be tailored to meet individual needs. Different coverage options and limits are available, allowing homeowners to customize their protection based on their unique circumstances and assets.

Benefits of Homeowners Insurance

Protection for Your Home and Belongings

The most apparent benefit of homeowners insurance is the protection it provides for your home and its contents. Whether it’s damage from a storm, a burst pipe, or a fire, having adequate coverage ensures that you can repair or replace your property without incurring significant financial strain.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Covers the physical structure of your home. |

| Personal Property Coverage | Protects your belongings, such as furniture, electronics, and clothing. |

| Additional Living Expenses | Provides coverage for temporary housing and other expenses if your home becomes uninhabitable due to a covered event. |

Liability Protection

Homeowners insurance also extends coverage to liability claims. This means that if someone is injured on your property or you are found legally responsible for causing harm or property damage to others, your insurance policy can provide financial protection.

Liability coverage typically includes legal defense costs and compensation for damages up to the policy limit. This aspect of homeowners insurance offers crucial protection against potentially devastating financial consequences.

Additional Perks

Beyond the core benefits, homeowners insurance policies often include additional perks that enhance the overall value of the coverage. These may include:

- Identity Theft Protection: Assistance and resources to help you recover from identity theft.

- Credit Monitoring: Services to monitor your credit report for any suspicious activity.

- Discounts: Potential savings through multi-policy discounts or loyalty programs.

- Loss Assessment Coverage: Protection for your share of costs related to damage to common areas in a condominium or homeowners association.

Key Considerations When Shopping for Homeowners Insurance

Assess Your Needs

Before diving into the world of homeowners insurance, take the time to assess your specific needs. Consider the following:

- Replacement Cost vs. Actual Cash Value: Decide whether you need coverage based on the replacement cost (what it would cost to rebuild your home) or actual cash value (the replacement cost minus depreciation).

- Dwelling Coverage: Ensure that your dwelling coverage limit aligns with the estimated cost to rebuild your home, taking into account local construction costs.

- Personal Property Coverage: Inventory your belongings and determine the appropriate coverage limit to replace them if needed.

- Liability Limits: Consider your assets and potential liabilities to choose an adequate liability coverage limit.

Research Insurers and Policies

Homeowners insurance is offered by numerous insurers, each with its own policies, coverage options, and pricing structures. Researching and comparing different providers is essential to finding the best fit for your needs.

Consider factors such as financial stability, customer service reputation, policy features, and any discounts or perks offered. Online reviews and ratings can provide valuable insights, but it's also beneficial to seek recommendations from trusted sources like friends, family, or financial advisors.

Understand Policy Exclusions and Limitations

While homeowners insurance provides comprehensive coverage, it’s crucial to understand what is not covered. Common exclusions include:

- Flood damage

- Earthquake damage

- Mold and mildew

- War and nuclear incidents

- Wear and tear or gradual deterioration

Some policies may also have limitations on certain high-value items, such as jewelry, art, or collectibles. If you have valuable possessions, consider additional coverage or specialized policies to ensure they are adequately protected.

Shop Around and Get Quotes

To find the best homeowners insurance policy for your needs, it’s essential to compare quotes from multiple insurers. Online comparison tools can be a convenient way to gather quotes, but it’s also advisable to reach out to individual insurers or insurance brokers for personalized quotes and advice.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional features or endorsements. Ensure that you understand the terms and conditions, including any potential exclusions or limitations, before making a decision.

Review and Update Your Policy Regularly

Your homeowners insurance policy should evolve with your life and circumstances. Review your policy annually to ensure that it still meets your needs. Consider factors such as changes in your home’s value, the cost of replacing your belongings, and any new additions or improvements to your property.

Life events, such as marriage, divorce, or the addition of a family member, can also impact your insurance needs. Regular policy reviews allow you to make necessary adjustments and ensure that you have the appropriate coverage at all times.

FAQ

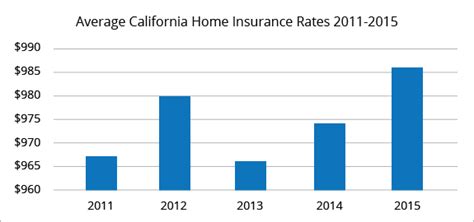

What is the average cost of homeowners insurance?

+The average cost of homeowners insurance can vary significantly based on factors such as location, home value, and coverage limits. According to industry data, the average annual premium in the United States is approximately 1,300. However, rates can range from 500 to $3,000 or more, depending on individual circumstances.

Do I need to insure my home for its full replacement cost?

+Insuring your home for its full replacement cost is generally recommended. This ensures that you have sufficient coverage to rebuild your home in the event of a total loss. However, some insurers may offer options for actual cash value coverage, which considers depreciation.

How often should I review my homeowners insurance policy?

+It is advisable to review your homeowners insurance policy annually or whenever there are significant changes to your home, such as renovations or additions. Regular reviews help ensure that your coverage remains adequate and up-to-date.