Insurance Quotes Car Home

In the realm of insurance, understanding quotes is crucial for individuals and businesses alike. This comprehensive guide will delve into the world of insurance quotes, specifically focusing on car and home insurance. By exploring the factors that influence quotes, the process of obtaining them, and the various options available, we aim to empower readers with the knowledge to make informed decisions about their insurance coverage.

Unraveling the Complexity of Insurance Quotes

Insurance quotes are the estimates provided by insurance companies to potential customers, outlining the cost of coverage for a specific policy. These quotes are tailored to the individual’s or business’s unique circumstances and needs. In the context of car and home insurance, quotes are determined by a myriad of factors, each playing a significant role in the overall cost.

Factors Influencing Car Insurance Quotes

When it comes to car insurance, quotes are influenced by a combination of personal, vehicle, and geographical factors. Here’s a breakdown of the key considerations:

- Driver’s Profile: Insurance companies assess the driver’s age, gender, driving record, and years of experience. Younger drivers and those with a history of accidents or traffic violations often face higher premiums.

- Vehicle Type: The make, model, and year of the vehicle are crucial. Certain vehicles may be more expensive to insure due to their repair costs or susceptibility to theft.

- Coverage Options: The level of coverage desired, such as liability-only or comprehensive coverage, impacts the quote. Additional options like rental car coverage or roadside assistance can also affect the price.

- Location: The area where the vehicle is primarily driven and garaged matters. Urban areas with higher traffic and crime rates may result in higher quotes.

- Usage: How the vehicle is used, whether for commuting, business, or pleasure, can influence the quote. High-mileage vehicles or those used for commercial purposes may be subject to higher rates.

Home Insurance Quotes: A Comprehensive Overview

Home insurance quotes are equally complex, taking into account the value of the home, its location, and the level of coverage desired. Here are the key factors:

- Home Value: The replacement cost of the home, including its structure and contents, is a primary consideration. Higher-value homes typically require more extensive coverage and, consequently, higher premiums.

- Location: Similar to car insurance, the geographical location of the home plays a significant role. Areas prone to natural disasters, such as hurricanes or earthquakes, may have higher insurance costs.

- Coverage Options: Homeowners can choose from various coverage types, including basic coverage for the structure and personal belongings, or more comprehensive options that cover additional expenses like temporary housing during repairs.

- Deductibles: Opting for higher deductibles can lower the premium, as it reduces the insurer’s financial exposure. However, it’s essential to choose a deductible that aligns with the homeowner’s financial capabilities.

- Home Improvements: Upgrades like security systems, fire-resistant materials, or impact-resistant windows can lead to lower insurance quotes, as they mitigate potential risks.

The Process of Obtaining Insurance Quotes

Securing insurance quotes involves a straightforward yet detailed process. Here’s a step-by-step guide:

- Research Insurance Providers: Start by identifying reputable insurance companies that offer the type of coverage you need. Online reviews and recommendations from trusted sources can be valuable in this initial phase.

- Gather Necessary Information: Prepare the details required for the quote, such as personal information, vehicle details (for car insurance), or home specifications (for home insurance). Accuracy is crucial to obtain an accurate quote.

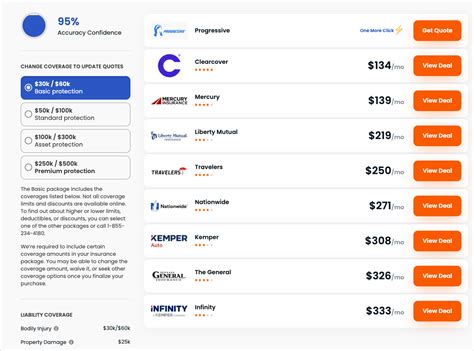

- Compare Quotes: Obtain quotes from multiple insurance providers to compare prices and coverage options. This step allows you to identify the best value for your specific needs.

- Assess Coverage Limits: Review the policy limits and deductibles to ensure they align with your desired level of protection. Consider your financial capabilities and the potential risks you want to mitigate.

- Understand Exclusions: Pay close attention to the exclusions outlined in the policy. These are situations or events that are not covered by the insurance, and understanding them can prevent surprises in the event of a claim.

- Choose the Right Provider: Based on your research and comparisons, select the insurance provider that offers the best combination of price, coverage, and customer service.

Tips for Optimizing Insurance Quotes

To get the most out of your insurance quotes, consider the following strategies:

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as combining car and home insurance. This can lead to significant savings.

- Increase Deductibles: Opting for higher deductibles can lower your premium, but ensure you can afford the deductible in the event of a claim.

- Explore Discounts: Insurance companies often provide discounts for various reasons, such as good driving records, safety features in vehicles, or home security systems. Inquire about available discounts to lower your premium.

- Review Regularly: Insurance needs can change over time. Regularly review your policies and quotes to ensure they still meet your requirements and to identify potential savings opportunities.

The Future of Insurance Quotes

The insurance industry is continuously evolving, and the way quotes are determined is no exception. With advancements in technology, insurers are increasingly utilizing data analytics and machine learning to refine their risk assessment processes. This trend is expected to continue, leading to more accurate and personalized quotes.

Additionally, the rise of telematics and usage-based insurance is transforming the car insurance landscape. Telematics devices installed in vehicles can track driving behavior, offering discounts to safe drivers. Usage-based insurance, on the other hand, calculates premiums based on actual miles driven, providing flexibility to those with low-mileage vehicles.

In the realm of home insurance, the focus is shifting towards resilience and sustainability. Insurers are developing policies that encourage homeowners to adopt eco-friendly practices and reinforce their homes against natural disasters. This not only benefits the environment but also leads to potential premium reductions.

| Insurance Type | Future Trends |

|---|---|

| Car Insurance | Telematics and Usage-Based Insurance |

| Home Insurance | Sustainability and Resilience-Focused Policies |

Frequently Asked Questions

What is the difference between car insurance quotes and home insurance quotes?

+

Car insurance quotes primarily focus on the vehicle, driver, and usage, while home insurance quotes center around the value of the home, its location, and the desired level of coverage. Both types of quotes are influenced by unique factors but serve the purpose of protecting valuable assets.

How can I reduce my insurance premiums?

+

To lower your insurance premiums, consider increasing your deductibles, bundling multiple policies, and exploring available discounts. Regularly reviewing your coverage and staying informed about industry trends can also lead to potential savings.

Are there any online tools to compare insurance quotes?

+

Yes, there are numerous online platforms and comparison websites that allow you to enter your details once and receive multiple quotes from different insurance providers. These tools streamline the quote comparison process, making it more efficient.

Understanding insurance quotes is a critical step towards safeguarding your assets and financial well-being. By familiarizing yourself with the factors that influence quotes and exploring the various options available, you can make informed decisions and secure the coverage that best suits your needs.