Define Hmo Insurance

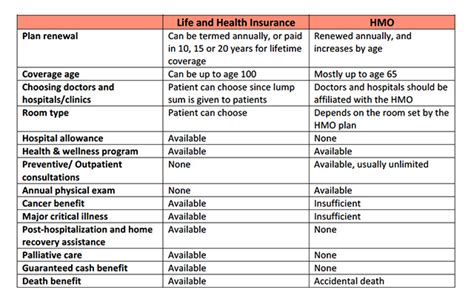

HMO insurance, or Health Maintenance Organization, is a type of healthcare coverage that offers a comprehensive and cost-effective approach to managing an individual's medical needs. It is a popular choice for those seeking an integrated and coordinated healthcare system, providing access to a network of healthcare providers who work together to ensure quality care. HMO plans are known for their focus on preventive care and the establishment of a primary care physician, who acts as a central point of contact and coordinates all aspects of the patient's healthcare journey.

Understanding the HMO Model

The HMO insurance model is built on the principle of managed care, which aims to deliver high-quality healthcare services while controlling costs. Under this model, the insurance company contracts with a network of healthcare providers, including doctors, hospitals, and specialists, to provide medical services to its members. This network is carefully selected and managed by the HMO, ensuring that patients receive care from qualified professionals.

A key aspect of HMO insurance is the requirement to choose a primary care physician (PCP). The PCP serves as the patient's first point of contact for any medical concern. They are responsible for providing routine care, diagnosing illnesses, and coordinating any necessary specialist referrals. This coordinated approach ensures that patients receive comprehensive and continuous care, with their medical history and needs well-managed.

The Role of Primary Care Physicians

Primary care physicians are a critical component of the HMO system. They are often family doctors, internists, or pediatricians who have a broad range of medical knowledge and are trained to handle a variety of health issues. The PCP acts as a gatekeeper, guiding patients through the healthcare system and ensuring they receive the right care at the right time.

When a patient requires specialist care, the PCP must provide a referral. This referral process helps control costs and ensures that patients receive appropriate care. Specialists within the HMO network work closely with the PCP to provide coordinated treatment, keeping the patient's best interests at the forefront.

| Key Features of HMO Insurance |

|---|

| Preventive Care Emphasis |

| Integrated Healthcare Services |

| Coordinated Specialist Referrals |

| Network of Pre-Negotiated Providers |

| Cost-Effective Healthcare Model |

HMO Insurance: Benefits and Considerations

HMO insurance offers several advantages, making it a preferred choice for many individuals and families. One of the key benefits is the focus on preventive care, which can help identify and address health issues early on, potentially reducing the need for more extensive and costly treatments later. Additionally, the coordinated care provided by the HMO network ensures that patients receive efficient and effective treatment, with their medical history and needs always in mind.

Key Benefits of HMO Insurance

- Affordable premiums and out-of-pocket expenses.

- Emphasis on preventive care and health maintenance.

- Coordinated care through a primary care physician.

- Access to a network of pre-negotiated healthcare providers.

- Potential for lower overall healthcare costs.

However, there are also some considerations to keep in mind when choosing an HMO plan. One potential drawback is the requirement to stay within the HMO network for most services. Out-of-network care is often not covered, and even when it is, it can be costly. Additionally, the referral process for specialists may be seen as a disadvantage by some, as it requires an extra step and can potentially delay necessary care.

Considerations for HMO Plans

- Limited choice of providers within the network.

- Potential delays in accessing specialist care.

- Out-of-network care may be costly or not covered.

- Dependence on a primary care physician for referrals.

- Less flexibility compared to other insurance types.

HMO Insurance: Real-World Performance

HMO insurance plans have demonstrated their effectiveness in delivering quality healthcare while managing costs. Numerous studies and patient testimonials highlight the benefits of the HMO model. For instance, a recent survey revealed that a majority of HMO members expressed satisfaction with their healthcare coverage, citing the convenience of coordinated care and the accessibility of their primary care physicians.

Success Stories and Testimonials

One patient, Ms. Smith, shared her positive experience with HMO insurance. She appreciated the ease of navigating the healthcare system with her PCP’s guidance and felt that the preventive care services, such as regular check-ups and screenings, gave her peace of mind. Mr. Johnson, another HMO member, highlighted the cost savings he experienced, especially with the pre-negotiated rates for various procedures and the absence of surprise medical bills.

These real-world experiences underscore the value of HMO insurance in providing accessible, coordinated, and cost-effective healthcare.

The Future of HMO Insurance

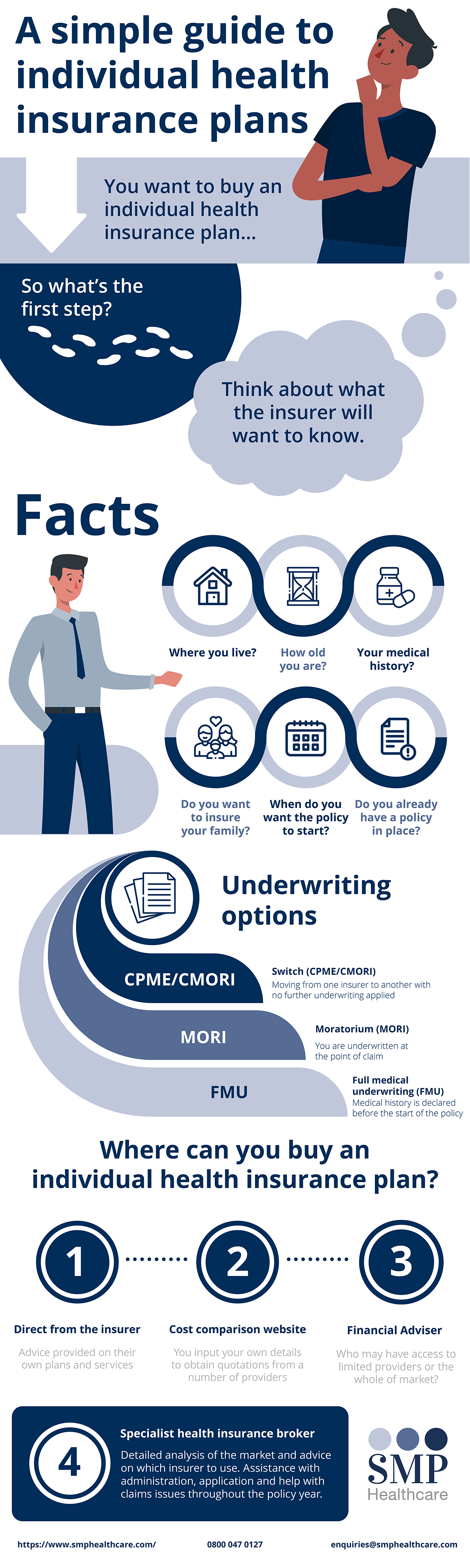

As the healthcare landscape continues to evolve, HMO insurance is expected to play a pivotal role in shaping the future of healthcare delivery. With its focus on preventive care and coordinated services, HMO plans are well-positioned to address the growing demand for accessible and affordable healthcare. Additionally, the increasing adoption of technology in healthcare, such as telemedicine and digital health records, further enhances the efficiency and convenience of HMO plans.

Future Implications and Innovations

Looking ahead, HMO insurance companies are exploring ways to further improve their services. This includes expanding their provider networks to offer even more choice and accessibility, as well as investing in innovative technologies to enhance the patient experience. The integration of artificial intelligence and machine learning could lead to more personalized and predictive healthcare, further elevating the quality of care provided by HMO plans.

In conclusion, HMO insurance offers a compelling model for healthcare coverage, providing accessible, coordinated, and cost-effective care. With its emphasis on preventive care and the integration of a primary care physician, HMO plans are well-suited to meet the diverse healthcare needs of individuals and families. As the healthcare industry continues to evolve, HMO insurance is poised to remain a key player in delivering quality healthcare services.

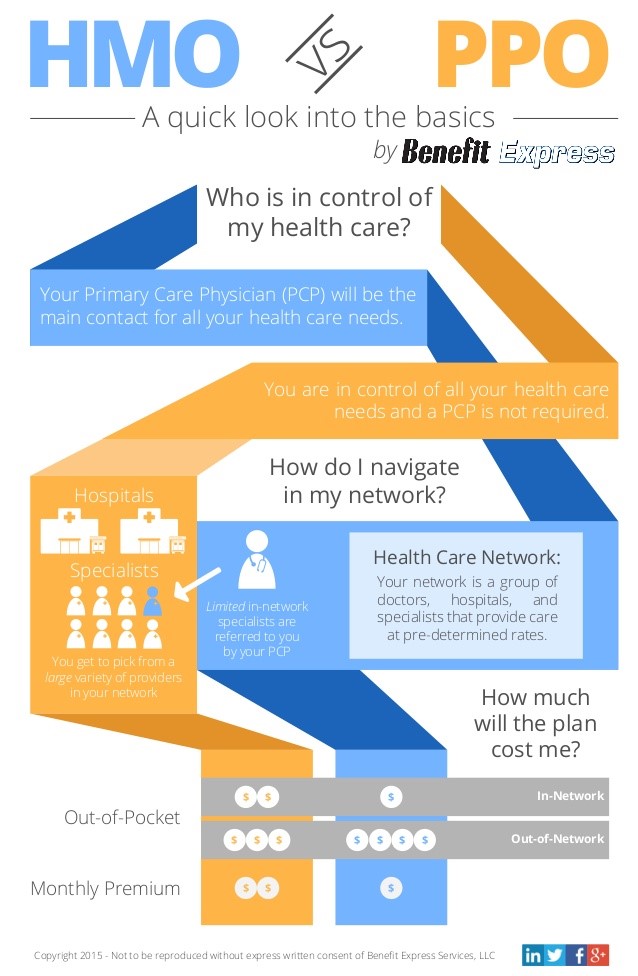

What is the difference between HMO and PPO insurance plans?

+HMO and PPO (Preferred Provider Organization) plans differ in their approach to healthcare coverage. HMO plans require members to choose a primary care physician and typically cover services within their network, while PPO plans offer more flexibility, allowing members to see any healthcare provider without a referral and often covering out-of-network care at a higher cost-sharing rate.

Can I switch my HMO plan if I’m not satisfied with my current network of providers?

+Yes, you can switch your HMO plan during the open enrollment period or if you experience a qualifying life event, such as a move or a change in family status. It’s important to review your options carefully and consider the network of providers and benefits offered by each plan before making a decision.

How does HMO insurance handle emergency care?

+In the event of an emergency, HMO insurance typically covers emergency care regardless of whether the provider is in-network or out-of-network. However, it’s important to notify your insurance company as soon as possible to ensure that any follow-up care is covered within your network.