Small Business And Insurance

In the world of entrepreneurship, small businesses are the backbone of many economies, driving innovation, creating jobs, and fostering local communities. However, the journey of a small business owner is often fraught with challenges, one of the most critical being insurance coverage. Understanding the complex world of insurance is essential for any business owner to protect their assets, mitigate risks, and ensure the longevity of their venture.

Navigating the Insurance Landscape: A Primer for Small Businesses

Insurance is a critical aspect of running a small business, providing a safety net against various unforeseen events that could otherwise cripple or even end a business. The right insurance coverage can safeguard your business assets, reputation, and even your personal finances. Here’s a comprehensive guide to help small business owners navigate the insurance landscape effectively.

Understanding Your Business Risks

The first step in securing the right insurance is understanding the unique risks your business faces. These risks can vary widely depending on your industry, business model, and location. For instance, a retail store owner might need to consider property damage, theft, and product liability, while a consulting firm might prioritize professional liability and cyber insurance.

Conduct a thorough risk assessment. Identify potential hazards that could impact your operations, employees, customers, or reputation. This assessment should be ongoing, as your business may evolve, introducing new risks or changing the nature of existing ones.

Consider factors like:

- Physical assets: buildings, equipment, inventory

- Employees: potential workplace injuries or illnesses

- Customers: product or service-related injuries or dissatisfaction

- Reputation: potential damage from negative publicity or legal issues

- Financial risks: loss of income due to business interruption

Common Insurance Policies for Small Businesses

While the specific insurance needs of a business can vary, there are several common types of policies that most small businesses should consider.

General Liability Insurance

This is a foundational insurance for most businesses, covering a wide range of potential risks. It protects your business against third-party claims of bodily injury, property damage, and personal and advertising injury. For instance, if a customer slips and falls in your store or sustains an injury from using your product, general liability insurance would cover the potential costs.

Professional Liability Insurance (Errors and Omissions Insurance)

Also known as Errors and Omissions (E&O) insurance, this policy is essential for businesses providing professional services. It covers legal costs and damages if your business is sued for alleged negligent acts, errors, or omissions in the services provided. For example, a web design firm could be sued if a client’s website goes down, causing them to lose revenue.

Product Liability Insurance

If your business manufactures, distributes, or sells products, product liability insurance is crucial. It protects you against claims resulting from defective products, including bodily injury or property damage caused by your product. This is particularly important for businesses in the manufacturing or retail sectors.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory in most states and provides coverage for employees who are injured or become ill due to their work. It covers medical expenses and a portion of lost wages. This insurance not only protects your employees but also shields your business from potential lawsuits related to workplace injuries.

Business Owner’s Policy (BOP)

A BOP is a cost-effective bundle of insurance coverages tailored for small businesses. It typically includes general liability insurance, property insurance, business interruption insurance, and other policies, depending on your needs. A BOP can provide comprehensive protection for a wide range of small business risks.

Tailoring Your Insurance Coverage

While these common insurance policies provide a good starting point, it’s crucial to tailor your coverage to the unique needs of your business. Consider the following factors when customizing your insurance portfolio:

- Industry-specific risks: Certain industries have unique risks. For example, a construction company might need contractor’s liability insurance, while a tech startup might require cyber liability insurance.

- Size and growth: As your business grows, your insurance needs may change. Regularly review your coverage to ensure it aligns with your current operations and future plans.

- Location: Your business location can impact your insurance needs. Natural disasters, crime rates, and local regulations can all influence the types of insurance you require.

- Unique business assets: If your business has unique assets, such as valuable equipment or intellectual property, you’ll need to ensure they’re adequately covered.

The Process of Securing Insurance

Once you’ve identified the insurance policies you need, the next step is to secure those policies. This process can involve several steps and considerations.

Choosing an Insurance Provider

There are numerous insurance providers, each offering a range of policies and services. When choosing an insurer, consider factors like:

- Financial strength: Ensure the insurer is financially stable and can meet their obligations in the event of a large claim.

- Policy offerings: Make sure the provider offers the specific policies you need and can tailor them to your business.

- Customer service: Opt for a provider with a strong reputation for customer service and claim handling.

- Industry expertise: Some insurers specialize in certain industries. Choosing one with expertise in your field can ensure you get the most appropriate coverage.

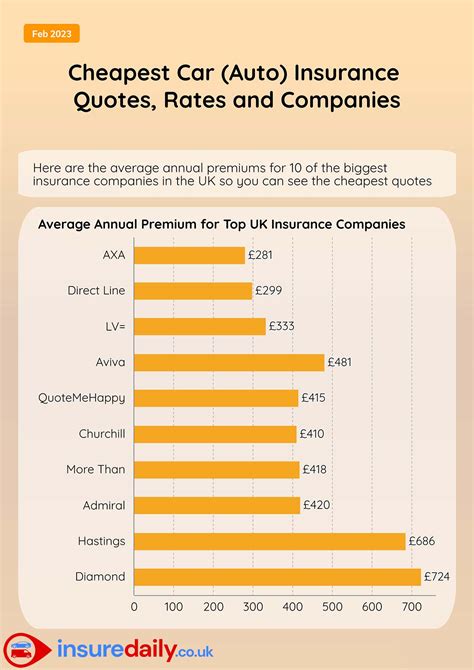

Obtaining Quotes and Comparing Policies

Obtaining quotes from multiple insurers can help you understand the market rates and find the best coverage for your business. When comparing policies, pay attention to:

- Coverage limits: Ensure the policy provides sufficient coverage for your needs. Higher limits generally offer better protection but can be more expensive.

- Deductibles: A higher deductible can lower your premium, but it means you’ll pay more out of pocket in the event of a claim.

- Exclusions: All policies have exclusions, which are specific risks or situations not covered. Understand these exclusions to ensure they don’t leave critical gaps in your coverage.

- Additional services: Some insurers offer value-added services like risk management resources or claim support.

Applying for and Purchasing Insurance

Once you’ve chosen a provider and policy, the application process typically involves providing detailed information about your business, including its size, operations, and potential risks. Be as accurate and comprehensive as possible in your application to avoid issues with your coverage later.

After your application is approved, you’ll receive your policy documents. Review these carefully to ensure they accurately reflect the coverage you discussed with your insurer. If there are any discrepancies, contact your insurer immediately.

Managing Your Insurance Portfolio

Securing insurance is just the beginning. Effective insurance management involves ongoing review and adjustment to ensure your coverage remains adequate and cost-effective.

Regular Reviews and Adjustments

Your insurance needs can change over time as your business evolves. Regularly review your insurance portfolio, ideally at least once a year or whenever significant changes occur in your business. This review should involve reassessing your risks and confirming that your current policies still provide adequate coverage.

If your business has grown or changed significantly, you may need to adjust your coverage. For instance, if you’ve expanded into a new market or added new products or services, you may need to add or modify your policies.

The Importance of Risk Management

While insurance provides a financial safety net, it’s even better to prevent losses from occurring in the first place. Implementing effective risk management strategies can help reduce the likelihood of incidents that would trigger insurance claims. This not only reduces your insurance costs but also improves your business operations.

Risk management strategies can include:

- Safety protocols: Implementing strict safety measures can reduce the risk of workplace injuries or property damage.

- Training and education: Training employees on safety procedures and educating customers about product use can mitigate risks.

- Cyber security measures: For businesses with digital operations, robust cyber security protocols can prevent data breaches and cyber attacks.

- Business continuity planning: Having a plan in place to continue operations during and after a disaster can reduce business interruption losses.

Claim Management and Prevention

Effective claim management is another critical aspect of insurance. When a claim occurs, it’s important to:

- Notify your insurer promptly: Most policies have specific time frames for reporting claims. Failure to notify your insurer within this timeframe could result in a claim denial.

- Provide detailed information: Be as thorough as possible when providing details about the claim. This helps your insurer understand the situation and process the claim more efficiently.

- Cooperate with the insurer: Work closely with your insurer to provide any additional information or documentation they may require.

- Implement preventive measures: After a claim, analyze the situation to identify areas where you can improve to prevent similar incidents in the future.

The Future of Small Business Insurance

The insurance landscape for small businesses is evolving, driven by technological advancements and changing consumer expectations. Here are some trends and innovations that are shaping the future of small business insurance.

Digital Transformation

The insurance industry is increasingly leveraging digital technologies to enhance customer experience and operational efficiency. This includes online policy management, digital claim processing, and the use of data analytics to offer more tailored coverage.

Small business owners can benefit from these digital advancements by:

- Purchasing insurance online: Many insurers now offer the ability to purchase policies directly through their websites, providing convenience and often lower costs.

- Utilizing digital tools for risk assessment: Online platforms and apps can help small business owners assess their risks and determine the appropriate insurance coverage.

- Managing policies digitally: Online portals allow business owners to view and manage their policies, track claims, and make payments.

Data-Driven Insurance

Advanced data analytics and artificial intelligence are transforming the way insurance is priced and delivered. Insurers are now able to analyze vast amounts of data to more accurately assess risks and price policies.

For small businesses, this means:

- More tailored coverage: Insurers can offer policies that are more closely aligned with a business’s unique risks and needs.

- Pay-as-you-go insurance: Some insurers are offering policies where the premium is based on actual usage, such as the number of miles driven for a delivery business.

- Improved risk management: Data-driven insights can help small businesses better understand and manage their risks.

Collaborative Insurance Models

Traditional insurance models are being challenged by innovative collaborative models, such as peer-to-peer insurance and mutual insurance. These models leverage community or group resources to provide insurance coverage, often at a lower cost.

Small businesses might find these models appealing due to:

- Community support: These models often foster a sense of community and shared responsibility.

- Cost savings: By cutting out the middleman, these models can offer more affordable premiums.

- Customized coverage: Collaborative models can be tailored to the specific needs of a community or industry.

In Conclusion

Navigating the complex world of insurance is a critical aspect of running a successful small business. By understanding your risks, choosing the right insurance policies, and effectively managing your coverage, you can protect your business, mitigate losses, and ensure its long-term viability. As the insurance landscape continues to evolve, staying informed and adapting to new trends and technologies will be key to ensuring your business remains adequately protected.

How much does small business insurance typically cost?

+The cost of small business insurance can vary widely depending on several factors, including the type of business, its location, the specific policies purchased, and the business’s size and risk profile. As a general guideline, small businesses can expect to pay anywhere from a few hundred to several thousand dollars per year for basic coverage. However, more specialized or high-risk businesses may pay significantly more.

What happens if I don’t have insurance and my business suffers a loss?

+If your business suffers a loss and you don’t have the appropriate insurance coverage, you may be responsible for paying for the damages out of your own pocket. This can be financially devastating, especially for small businesses that may not have the capital to cover unexpected expenses. It’s always recommended to have adequate insurance to protect your business and your personal finances.

How often should I review my insurance coverage?

+It’s a good practice to review your insurance coverage at least once a year or whenever significant changes occur in your business. Regular reviews ensure that your coverage remains adequate and that you’re not paying for unnecessary policies. They also provide an opportunity to identify new risks or coverage needs that may have arisen.