Medicare Gap Insurance

Welcome to an in-depth exploration of Medicare Gap Insurance, a crucial component of the American healthcare system. Medicare Gap Insurance, often referred to as Medigap, is designed to bridge the coverage gaps in original Medicare, ensuring that beneficiaries have comprehensive healthcare coverage without facing significant out-of-pocket expenses. This article aims to provide a comprehensive understanding of Medigap, its benefits, how it works, and its importance in the healthcare landscape.

Understanding Medicare Gap Insurance (Medigap)

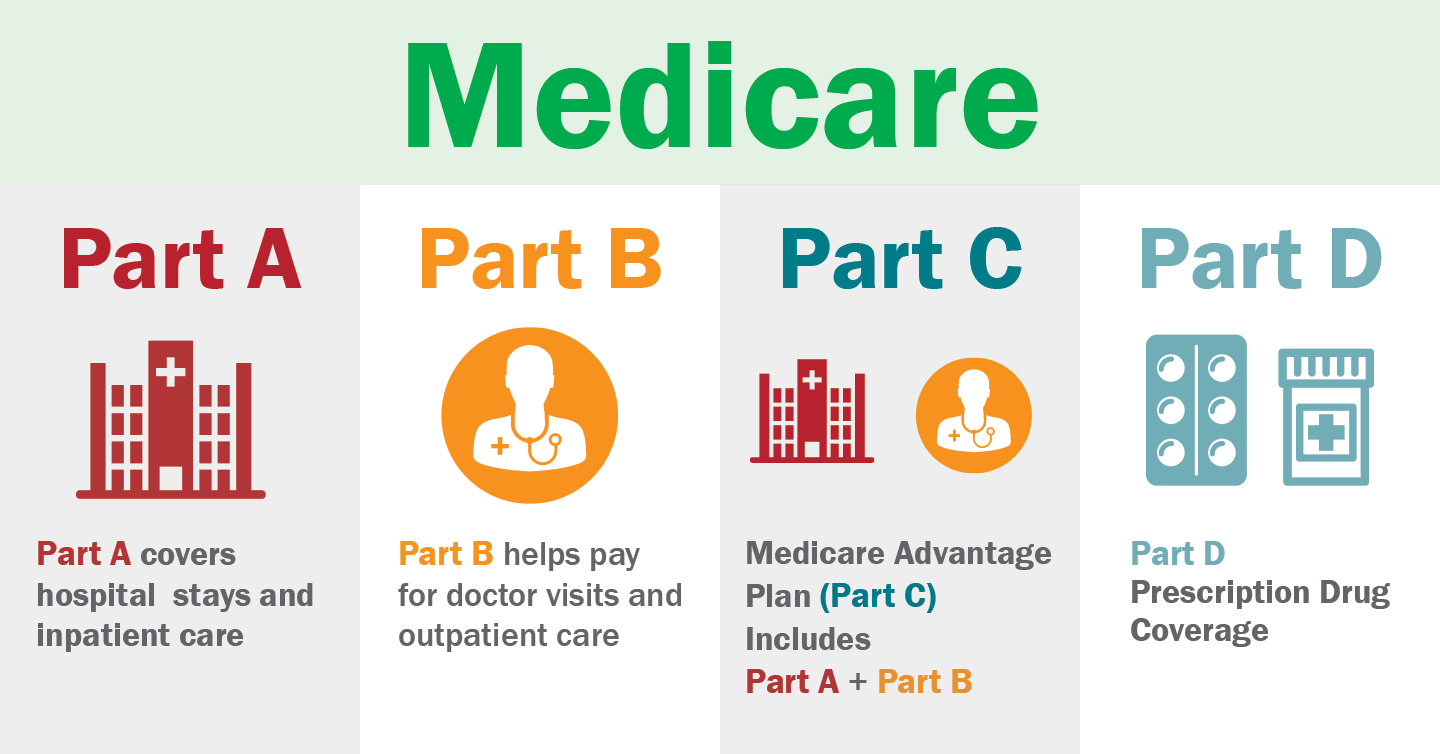

Medicare Gap Insurance, or Medigap, is a private insurance policy that complements Original Medicare (Parts A and B). It is designed to fill the gaps in coverage, known as gaps, that may arise from Original Medicare's standard benefits. These gaps can include deductibles, co-insurance, and co-payments, which can be significant financial burdens for many beneficiaries.

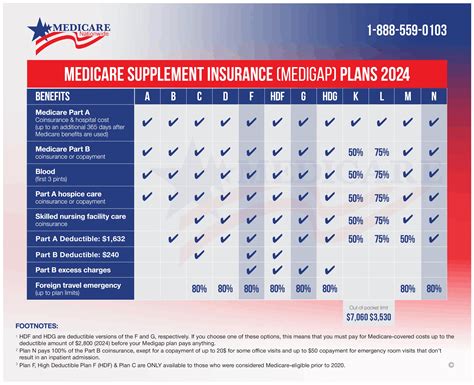

Medigap policies are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring that each plan offers a unique set of benefits. There are currently 10 standardized Medigap plans (Plans A through N), with each plan offering a different level of coverage and premium. The choice of plan depends on individual needs and budget considerations.

Here's a breakdown of some key Medigap plans and their benefits:

| Medigap Plan | Benefits |

|---|---|

| Plan A | Covers Part A deductible, Part B deductible, blood deductible, and skilled nursing care coinsurance. |

| Plan F | Offers the most comprehensive coverage, including all gaps in Original Medicare. It's particularly beneficial for those who anticipate frequent healthcare utilization. |

| Plan G | Similar to Plan F, but it doesn't cover the Part B deductible. It's a popular choice due to its balance between coverage and affordability. |

| Plan N | Provides coverage for Part A and B coinsurance, as well as some additional benefits. It may have copayments for office visits and other services. |

It's important to note that Medigap policies are guaranteed renewable, meaning your insurance company cannot cancel your policy as long as you pay your premiums. Additionally, you cannot be denied a Medigap policy based on pre-existing conditions or health status.

The Importance of Medigap

Medigap plays a vital role in ensuring that Medicare beneficiaries have access to the healthcare services they need without facing financial hardship. Here are some key reasons why Medigap is important:

Financial Protection

One of the primary benefits of Medigap is financial protection. Original Medicare has significant gaps in coverage, and these out-of-pocket expenses can quickly add up. Medigap helps to cover these costs, ensuring that beneficiaries can afford the care they require without depleting their savings or facing financial strain.

For instance, the Part A deductible for hospital stays in 2023 is $1,600. Without Medigap, beneficiaries would need to pay this amount out of pocket for each benefit period. Medigap plans can cover this deductible, providing a substantial financial relief.

Comprehensive Coverage

Medigap policies offer a range of coverage options, allowing beneficiaries to choose a plan that suits their specific needs. Whether it's covering the Part B deductible, providing foreign travel emergency coverage, or offering additional benefits, Medigap ensures that individuals have the flexibility to tailor their healthcare coverage.

Reduced Stress and Peace of Mind

Knowing that one's healthcare expenses are covered can significantly reduce stress and anxiety. Medigap takes away the worry of unexpected medical bills, allowing individuals to focus on their health and well-being without financial concerns.

How Medigap Works

Understanding how Medigap works is essential for making informed decisions about your healthcare coverage. Here's a step-by-step guide to how Medigap operates:

Enrollment

Medigap enrollment typically occurs during the Open Enrollment Period, which begins the month you turn 65 and are enrolled in Medicare Part B. During this time, you can purchase any Medigap plan without undergoing medical underwriting. This means you cannot be denied coverage or charged higher premiums based on your health status.

It's important to note that if you miss this initial enrollment period, you may still be able to purchase Medigap, but you may face medical underwriting, where the insurance company can deny coverage or charge higher premiums based on your health.

Coordination with Original Medicare

Medigap policies are designed to work alongside Original Medicare. When you receive healthcare services, your Original Medicare coverage pays first, and then your Medigap policy steps in to cover the remaining costs, depending on the specific benefits of your chosen plan.

For example, if you have a Medigap plan that covers the Part A deductible, and you're admitted to the hospital, your Original Medicare will cover a portion of the costs, and your Medigap policy will cover the remaining deductible amount, leaving you with little to no out-of-pocket expense.

Premium Payments

Medigap policyholders are responsible for paying monthly premiums to their insurance company. These premiums can vary based on the plan, the insurance company, and sometimes, the beneficiary's age or location. It's important to choose a plan that aligns with your budget and healthcare needs.

Claims Process

When you receive healthcare services, your healthcare provider will typically submit a claim to Original Medicare first. Once Medicare processes the claim, the provider will then submit a claim to your Medigap insurance company. The Medigap company will then pay the remaining costs covered by your specific plan.

Choosing the Right Medigap Plan

Selecting the appropriate Medigap plan is a crucial decision that requires careful consideration. Here are some factors to keep in mind when choosing a Medigap plan:

Health Status and Needs

Evaluate your current and future health needs. If you anticipate frequent healthcare utilization, a more comprehensive plan like Plan F or G might be suitable. On the other hand, if you're generally healthy and want basic coverage, a plan like Plan A or N could be a better fit.

Budget Considerations

Medigap premiums can vary significantly, so it's essential to consider your budget. While more comprehensive plans offer more coverage, they also come with higher premiums. Assess your financial situation and choose a plan that provides the necessary coverage without straining your finances.

Plan Availability

Not all Medigap plans are available in every state, and insurance companies may offer different plans in different regions. Research the plans available in your area and compare the benefits and premiums offered by multiple insurance companies.

Insurance Company Reputation

Choose a reputable insurance company with a solid track record in the industry. Look for companies with good financial stability and positive customer reviews. This ensures that your insurance provider will be there to support you when you need it most.

Future of Medicare Gap Insurance

The landscape of Medicare and Medigap is constantly evolving, with ongoing discussions and policy changes. Here are some key considerations for the future of Medigap:

Policy Changes and Reform

The Centers for Medicare & Medicaid Services (CMS) regularly reviews and updates Medicare policies, including Medigap. Keep an eye on any policy changes that may impact Medigap plans, such as the introduction of new standardized plans or adjustments to existing ones.

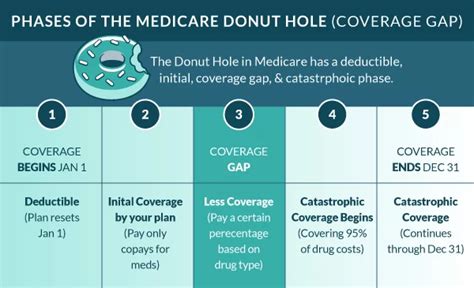

Rising Healthcare Costs

Healthcare costs continue to rise, which can impact both Original Medicare and Medigap premiums. Monitoring these trends is essential, as it may influence your decision to purchase or switch Medigap plans.

Medicare Advantage Plans

Medicare Advantage Plans (Part C) are an alternative to Original Medicare and Medigap. These plans often include additional benefits like prescription drug coverage and dental care. However, they may have more restrictions on provider choice and may not be suitable for everyone. Consider the pros and cons of Medicare Advantage Plans when evaluating your healthcare coverage options.

Technological Advancements

The healthcare industry is embracing digital innovations, and this can impact Medigap. Telehealth services, for instance, are becoming increasingly popular, and Medigap plans may adapt to cover these remote healthcare services.

Frequently Asked Questions (FAQ)

Can I have both Medigap and a Medicare Advantage Plan (Part C)?

+No, you cannot have both Medigap and a Medicare Advantage Plan simultaneously. These plans are designed to be alternatives to Original Medicare, and choosing one typically means giving up the other. It's important to carefully consider your needs and preferences when deciding between Medigap and Medicare Advantage.

What happens if I move to a different state with my Medigap plan?

+If you move to a different state, your Medigap plan may not be automatically portable. You'll need to check with your insurance company to see if they offer your plan in your new state. If not, you may need to enroll in a new Medigap plan, but you'll still have guaranteed issue rights, which means you cannot be denied coverage due to health reasons.

Are Medigap plans affected by the Affordable Care Act (ACA)?

+The Affordable Care Act (ACA) primarily focuses on improving access to healthcare and reducing costs for individuals and families. While Medigap plans are not directly affected by the ACA, the law has indirectly influenced the Medicare landscape. For example, the ACA has expanded access to preventive care services, which may impact Medigap coverage decisions.

Can I switch Medigap plans after my initial enrollment period?

+Yes, you can switch Medigap plans after your initial enrollment period, but it's important to understand the implications. If you're switching plans outside of your initial enrollment period, you may be subject to medical underwriting, which means the new insurance company can deny coverage or charge higher premiums based on your health status. Additionally, you may have to wait for a specific time period, such as the Annual Enrollment Period, to make the switch.

In conclusion, Medicare Gap Insurance, or Medigap, is a critical component of the Medicare system, providing essential financial protection and comprehensive coverage to beneficiaries. By understanding the various Medigap plans, their benefits, and how they work, individuals can make informed decisions to ensure they have the right healthcare coverage for their needs. Stay informed, evaluate your options, and choose the Medigap plan that best fits your healthcare journey.