How Much Is Private Mortgage Insurance

Private Mortgage Insurance (PMI) is an essential aspect of homeownership for many prospective buyers, especially those with a smaller down payment. Understanding the cost of PMI and how it can impact your overall mortgage expenses is crucial when planning for one of life's most significant financial commitments. In this comprehensive guide, we delve into the intricacies of PMI, providing you with the knowledge to make informed decisions about your mortgage journey.

The Role of Private Mortgage Insurance

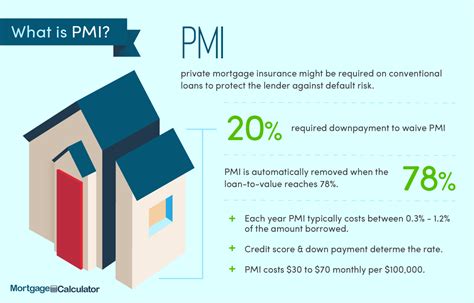

Private Mortgage Insurance is a safeguard for lenders, designed to protect them against potential losses in the event that a borrower defaults on their mortgage loan. It is typically required when the borrower’s down payment is less than 20% of the home’s purchase price. PMI serves as a financial assurance, enabling borrowers to secure a mortgage with a lower down payment while still offering the lender a layer of protection.

The introduction of PMI has opened doors for countless individuals and families to realize their dreams of homeownership. By mitigating the risk associated with a smaller down payment, lenders are more willing to extend mortgage offers, making the process more accessible and feasible for a broader range of buyers.

Understanding the Cost of PMI

The cost of Private Mortgage Insurance can vary significantly based on several factors, including the loan-to-value ratio, the borrower’s credit score, and the type of loan. Here’s a breakdown of the key elements that influence PMI pricing:

Loan-to-Value Ratio (LTV)

The LTV is a critical determinant of PMI cost. It represents the ratio of the loan amount to the appraised value of the property. A higher LTV generally indicates a greater risk for the lender, leading to a higher PMI premium. Conversely, a lower LTV can result in a more affordable PMI rate.

| LTV Range | PMI Premium (%) |

|---|---|

| 80% - 90% | 0.5% - 1.0% |

| 90% - 95% | 1.0% - 1.5% |

| 95% - 97% | 1.5% - 2.0% |

| 97% - 100% | 2.0% - 3.0% |

Note: These figures are approximate and can vary based on individual lender policies and market conditions.

Credit Score

Your credit score plays a significant role in determining the cost of PMI. Lenders consider borrowers with higher credit scores to be less risky, which can lead to a lower PMI premium. Conversely, borrowers with lower credit scores may face higher PMI costs.

| Credit Score Range | PMI Premium (%) |

|---|---|

| 760 and above | 0.5% - 1.0% |

| 700 - 759 | 1.0% - 1.5% |

| 640 - 699 | 1.5% - 2.5% |

| Below 640 | 2.5% - 3.5% |

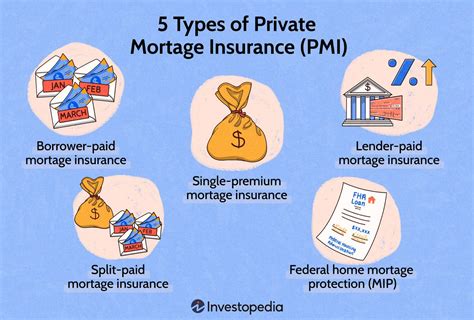

Loan Type

The type of mortgage loan you choose can also impact the cost of PMI. Conventional loans, for instance, often have more flexible PMI options compared to government-backed loans like FHA or VA loans. FHA loans, while offering more lenient down payment requirements, typically come with higher PMI costs.

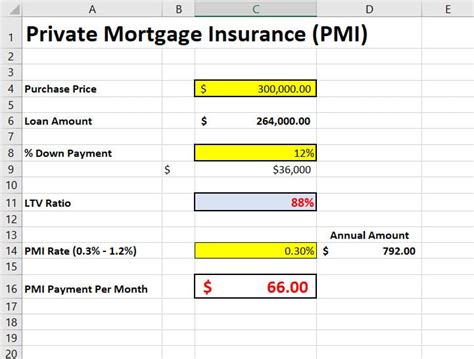

PMI Calculation

PMI premiums are typically calculated as a percentage of the loan amount. This percentage can vary based on the factors mentioned above. For instance, if you have a loan amount of 250,000 and a PMI premium of 1.0%, your annual PMI cost would be 2,500 (250,000 x 1.0% = 2,500). This amount is usually divided into monthly installments, adding to your mortgage payment.

Annual PMI Cost vs. Monthly Premium

It’s important to note that while PMI is often quoted as an annual cost, it is typically paid monthly. Lenders may present PMI as an annual percentage to simplify the understanding of the total cost over the year. However, it’s the monthly payment that is added to your mortgage bill each month.

Strategies to Reduce PMI Costs

While PMI is a necessary expense for many homebuyers, there are strategies to minimize its impact on your overall mortgage expenses. Here are some effective approaches:

Increase Your Down Payment

The most straightforward way to reduce PMI costs is by increasing your down payment. By contributing a larger portion of the purchase price upfront, you can lower your LTV and, consequently, your PMI premium. For instance, increasing your down payment from 5% to 10% can significantly reduce your PMI costs.

Improve Your Credit Score

A higher credit score can lead to a lower PMI premium. Focus on improving your creditworthiness by paying your bills on time, reducing your credit card balances, and maintaining a healthy credit utilization ratio. A small improvement in your credit score can result in substantial savings on your PMI expenses.

Shop Around for Lenders

Different lenders may offer varying PMI rates and terms. Shopping around and comparing offers can help you find the most favorable PMI options. Consider reaching out to multiple lenders and asking for quotes to ensure you’re getting the best deal.

Consider Alternative Loan Options

Depending on your financial situation and eligibility, you may explore alternative loan options that offer lower PMI costs. For instance, certain loan programs, like the HomeReady® loan from Fannie Mae, offer reduced PMI requirements for borrowers with lower incomes or those purchasing in underserved communities.

Build Equity Faster

The quicker you build equity in your home, the sooner you can request the removal of PMI. Making extra payments towards your mortgage principal or waiting for your home’s value to appreciate can help you reach the 20% equity threshold, at which point you may be eligible to cancel PMI.

When Can You Stop Paying PMI?

The good news is that PMI is not a lifelong commitment. There are several scenarios under which you can stop paying PMI and have it removed from your mortgage:

Reaching 20% Equity

Once you’ve built up 20% equity in your home, you can request the removal of PMI. This can be achieved through a combination of paying down your mortgage principal and home value appreciation. Lenders will typically require an appraisal to confirm your home’s value and assess your equity position.

Automated PMI Removal

For certain loan types, PMI is automatically removed once you reach a specific loan-to-value ratio, typically 78%. This removal is based on a predetermined schedule and doesn’t require any action on your part. However, it’s essential to verify with your lender that your loan qualifies for this automatic PMI cancellation.

PMI Cancellation Request

If you haven’t reached the 20% equity mark or the automatic PMI removal timeline, you can still request PMI cancellation. This is often possible if you can provide evidence of your home’s increased value through a new appraisal. Keep in mind that there may be fees associated with this process, and not all lenders will entertain such requests.

The Impact of PMI on Your Mortgage

Understanding the impact of PMI on your overall mortgage expenses is crucial for effective financial planning. Here’s a breakdown of how PMI can affect your mortgage journey:

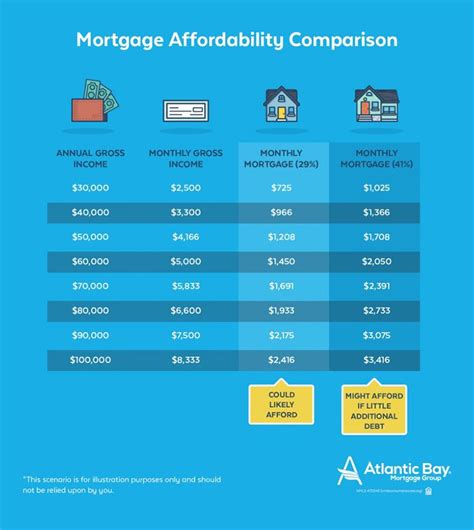

Monthly Mortgage Payments

PMI adds to your monthly mortgage payment. While the increase might seem minimal, over the life of your loan, it can add up to a significant amount. For instance, with a 250,000 loan and a 1.0% PMI premium, your monthly PMI cost would be approximately 208.33, which can substantially impact your monthly budget.

Total Loan Cost

Over the life of your loan, PMI can significantly increase the total cost. For a 30-year fixed-rate mortgage with a 4% interest rate, the total cost of the loan (including PMI) can be upwards of $500,000. This highlights the importance of considering PMI costs when evaluating the affordability of your mortgage.

Financial Flexibility

The inclusion of PMI in your mortgage payments can impact your financial flexibility. With a higher monthly payment, you might have less disposable income for other financial goals or emergencies. It’s essential to consider the long-term financial implications of PMI when planning your home purchase.

Future Implications and Industry Trends

The landscape of Private Mortgage Insurance is continually evolving, influenced by market conditions, regulatory changes, and consumer demands. Here are some key trends and future implications to consider:

Market Fluctuations

Market fluctuations, such as changes in interest rates or economic conditions, can impact the demand for PMI. During periods of economic uncertainty, the demand for PMI may increase as lenders seek additional protection. Conversely, in a stable economic climate, PMI costs might decrease as lenders feel more secure.

Regulatory Changes

Government regulations can significantly impact the PMI industry. Changes in regulations, such as those related to loan eligibility or cancellation requirements, can affect the cost and availability of PMI. Staying informed about regulatory updates is essential for borrowers and lenders alike.

Innovative PMI Solutions

The PMI industry is constantly evolving, with lenders and insurers introducing innovative solutions to meet the diverse needs of borrowers. These solutions may include more flexible PMI options, such as single-premium PMI or reduced PMI requirements for certain loan types. Keeping abreast of these innovations can provide borrowers with more affordable and tailored PMI options.

The Rise of Digital PMI

With the increasing digital transformation of the financial industry, PMI providers are also embracing digital solutions. This shift towards digital PMI can offer borrowers a more seamless and efficient experience, with faster processing times and more transparent pricing. Additionally, digital PMI platforms can provide borrowers with better insights into their PMI costs and options.

Conclusion

Private Mortgage Insurance is a vital component of the home buying process for many individuals and families. While it can add to the overall cost of your mortgage, it also opens doors to homeownership by providing lenders with the necessary assurance. By understanding the cost, impact, and strategies related to PMI, you can make more informed decisions about your mortgage journey.

As you embark on your home buying adventure, remember to explore all the available options, compare lenders, and consider the long-term financial implications. With the right knowledge and planning, you can navigate the complexities of PMI and secure a mortgage that aligns with your financial goals and aspirations.

How long do I have to pay PMI on my mortgage?

+The duration of PMI payments can vary based on several factors. Typically, you’ll continue paying PMI until you reach 20% equity in your home or until the loan-to-value ratio reaches a certain threshold, often 78%. After this point, PMI is automatically canceled, or you can request its removal by providing an updated appraisal.

Can I avoid PMI altogether?

+Yes, you can avoid PMI by making a down payment of at least 20% of the home’s purchase price. This reduces the loan-to-value ratio to a level where PMI is not required. However, for many homebuyers, saving up such a substantial down payment can be challenging, which is why PMI offers a more accessible route to homeownership.

Are there any disadvantages to PMI?

+While PMI provides an essential service by enabling homebuyers to secure a mortgage with a smaller down payment, it does come with some drawbacks. The additional cost of PMI can increase your monthly mortgage payments and total loan cost. Additionally, the process of canceling PMI can be complex and may require additional fees.

Can I get a refund if my PMI is canceled early?

+It depends on your lender and the terms of your mortgage. Some lenders may provide a refund for the unused portion of your PMI if it’s canceled early. However, this is not a standard practice, and you should review your loan agreement or consult with your lender to understand their specific policies.