Dog Insurance

Dog insurance, also known as pet insurance, is a valuable tool for pet owners to safeguard their furry companions' health and well-being. In today's world, where veterinary care can be costly, having insurance coverage for your dog offers peace of mind and ensures that you can provide the best possible medical attention without financial strain. This comprehensive guide will delve into the intricacies of dog insurance, exploring its benefits, coverage options, and how it can protect your beloved canine friend.

Understanding Dog Insurance: A Necessary Investment

Dog insurance is a type of health insurance specifically designed for our canine companions. It operates similarly to human health insurance, providing financial coverage for veterinary expenses. By investing in dog insurance, pet owners can access a range of benefits that contribute to their dog's overall health and longevity.

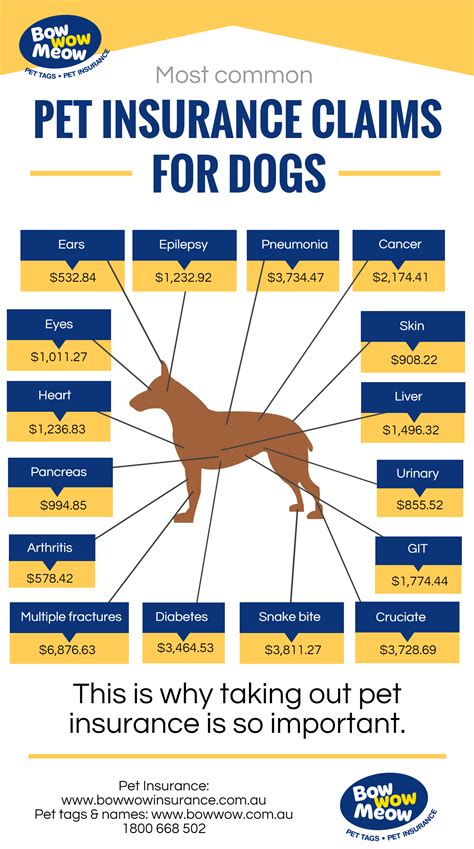

The Rising Costs of Veterinary Care

Over the past decade, the cost of veterinary care has increased significantly, outpacing the general inflation rate. This trend is primarily driven by advancements in veterinary medicine, which have led to more sophisticated treatments and procedures. As a result, pet owners are faced with increasingly expensive veterinary bills, especially when their dogs require specialized care or emergency treatment.

| Year | Average Veterinary Expenses per Dog |

|---|---|

| 2010 | $2,000 |

| 2015 | $2,500 |

| 2020 | $3,000 |

The above table illustrates the rising costs of veterinary care, with an average increase of $500 every five years. This steady rise underscores the importance of dog insurance, as it helps pet owners prepare for unexpected medical emergencies and ensures they can provide the necessary care without incurring substantial financial burdens.

The Benefits of Dog Insurance

Dog insurance offers a multitude of benefits that extend beyond financial protection. Here are some key advantages:

- Peace of Mind: Knowing that your dog's health is covered gives you the assurance to make the best decisions for their well-being without worrying about the financial implications.

- Early Detection and Treatment: Regular veterinary check-ups, often covered by insurance, allow for the early identification of health issues. This early intervention can lead to more effective and less costly treatments.

- Specialist Care Access: Some insurance plans cover specialist treatments, such as orthopedic surgeries or cancer therapies, which can be life-saving but costly.

- Emergency and Critical Care: Dog insurance provides crucial support during emergencies, ensuring you can access the necessary care without delay.

- Routine Care Coverage: Many plans cover routine expenses like vaccinations, dental care, and spaying/neutering, encouraging proactive healthcare for your dog.

Types of Dog Insurance Coverage

Dog insurance policies come in various forms, each offering different levels of coverage and benefits. Understanding the types of coverage available is essential to choosing the right plan for your dog's specific needs.

Accident-Only Coverage

Accident-only policies are the most basic form of dog insurance. They provide coverage for injuries sustained due to accidents, such as being hit by a car or falling from a height. These policies typically have lower premiums compared to more comprehensive plans but offer limited coverage.

Accident and Illness Coverage

As the name suggests, accident and illness coverage policies protect your dog against both accidental injuries and illnesses. This type of insurance is more comprehensive and provides coverage for a wider range of health issues, including chronic conditions and genetic disorders. While the premiums may be higher, it offers peace of mind for pet owners concerned about their dog's overall health.

Wellness Plans

Wellness plans are a relatively new addition to the dog insurance market. These plans focus on preventive care and routine procedures. They typically cover expenses such as annual check-ups, vaccinations, flea and tick treatments, and spaying/neutering. Wellness plans are ideal for pet owners who want to ensure their dog receives regular, essential healthcare but may not need extensive medical coverage.

Customizable Coverage

Some insurance providers offer customizable coverage, allowing pet owners to tailor their policies to their dog's specific needs. This flexibility is beneficial for dogs with pre-existing conditions or those who require specialized care. Pet owners can choose the level of coverage they require, including options for accident-only, accident and illness, or a combination of both.

Breed-Specific Coverage

Certain insurance companies also offer breed-specific coverage, recognizing that different dog breeds are predisposed to specific health conditions. These policies take into account the unique genetic predispositions of certain breeds, providing coverage for conditions that are more common among them. For example, a policy for a Labrador Retriever might include coverage for hip dysplasia, a common issue in this breed.

| Breed | Common Health Issues |

|---|---|

| Labrador Retriever | Hip Dysplasia, Elbow Dysplasia, Obesity |

| German Shepherd | Hip and Elbow Dysplasia, Degenerative Myelopathy |

| Poodle | Progressive Retinal Atrophy, Sebaceous Adenitis |

Choosing the Right Dog Insurance Plan

Selecting the appropriate dog insurance plan involves careful consideration of your dog's age, breed, and specific healthcare needs. Here are some factors to keep in mind when making your choice:

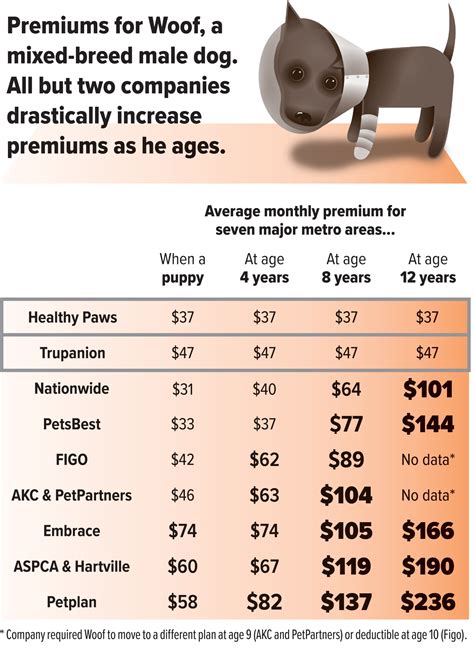

Age and Health History

The age of your dog is a crucial factor in determining the type of insurance coverage you should opt for. Puppies and younger dogs are generally healthier and may require less extensive coverage, making accident-only or wellness plans suitable options. On the other hand, older dogs or those with a history of health issues may benefit more from accident and illness coverage, which provides broader protection.

Breed-Specific Considerations

If your dog belongs to a breed that is prone to certain health conditions, it's advisable to choose a plan that covers these specific issues. Breed-specific coverage can provide peace of mind and ensure that your dog receives the necessary treatment without financial strain.

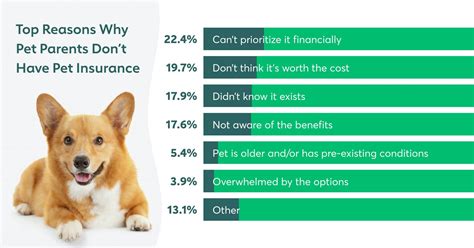

Pre-Existing Conditions

Most insurance providers will not cover pre-existing conditions, which are health issues that your dog had before the insurance policy was purchased. However, some companies offer policies that can include coverage for certain pre-existing conditions, although they may come with higher premiums.

Policy Exclusions

It's essential to review the policy exclusions carefully. Some common exclusions include pre-existing conditions, breeding-related issues, and behavioral problems. Understanding what is not covered by your chosen plan will help you make an informed decision and ensure you are not caught off guard by unexpected expenses.

Comparing Premiums and Deductibles

Premiums and deductibles are two critical components of dog insurance. Premiums are the regular payments you make to maintain your insurance coverage, while deductibles are the amount you pay out of pocket before the insurance kicks in. Compare these factors across different providers to find a plan that fits your budget and offers the coverage you need.

The Impact of Dog Insurance on Veterinary Care

Dog insurance has a significant impact on the veterinary care industry and pet owners alike. By providing financial support for veterinary services, insurance plans encourage pet owners to seek regular check-ups and early intervention, leading to better overall health for their dogs.

Improved Access to Veterinary Services

Dog insurance makes veterinary care more accessible to a wider range of pet owners. With the financial burden lifted, owners are more likely to bring their dogs for regular check-ups, which can lead to the early detection of health issues. This proactive approach to healthcare benefits both the dog and the veterinarian, as it allows for more effective treatment plans and better outcomes.

Enhancing Veterinary Practice Management

For veterinary practices, dog insurance can be a game-changer. It streamlines the billing process, as insurance companies handle the majority of administrative tasks, reducing the burden on veterinary staff. This efficiency allows practices to focus more on patient care and less on paperwork.

Encouraging Preventive Care

Dog insurance policies often include coverage for preventive care, such as vaccinations and routine check-ups. This incentive encourages pet owners to prioritize their dog's health and take a proactive approach to healthcare. By catching potential health issues early on, pet owners can save money in the long run and ensure their dog lives a longer, healthier life.

The Future of Dog Insurance

As the pet insurance industry continues to evolve, we can expect to see further innovations and improvements in dog insurance coverage. Here are some potential developments that may shape the future of dog insurance:

Advanced Technology Integration

The integration of advanced technology, such as telemedicine and wearables, is likely to play a significant role in the future of dog insurance. Telemedicine allows pet owners to consult with veterinarians remotely, offering convenience and accessibility. Wearable devices can monitor a dog's vital signs and activity levels, providing valuable data for early detection of health issues.

Personalized Coverage Options

Insurance providers may move towards offering more personalized coverage options based on individual dog's needs. This could involve analyzing a dog's genetic makeup to identify potential health risks and tailoring the insurance plan accordingly. Personalized coverage would ensure that pet owners receive the specific protection their dog requires.

Incentivizing Healthy Lifestyle Choices

In an effort to promote healthier lifestyles for dogs, insurance companies may introduce incentives for pet owners who adopt practices that contribute to their dog's well-being. This could include discounts for owners who maintain a healthy weight for their dog, provide regular exercise, or offer a species-appropriate diet.

Expanding Coverage for Chronic Conditions

As veterinary medicine advances, the treatment of chronic conditions becomes more sophisticated. Insurance providers may expand their coverage to include more comprehensive support for dogs with chronic illnesses, ensuring they can access the latest treatments and therapies without financial barriers.

Increased Collaboration with Veterinarians

Insurance companies and veterinarians may collaborate more closely to develop customized plans for individual dogs. By working together, they can create tailored coverage options that align with the specific needs of different breeds and individual health histories.

Frequently Asked Questions

Can I get insurance for my dog's pre-existing condition?

+Most insurance companies have policies that exclude pre-existing conditions. However, some providers offer plans that can cover certain pre-existing conditions, although these may come with higher premiums.

What is the average cost of dog insurance?

+The cost of dog insurance varies depending on factors such as the dog's age, breed, and the level of coverage. On average, accident-only policies can range from $10 to $20 per month, while accident and illness coverage can cost anywhere from $25 to $75 per month. Wellness plans typically fall in the range of $15 to $30 per month.

Does dog insurance cover routine care?

+Yes, many dog insurance plans include coverage for routine care, such as annual check-ups, vaccinations, and preventive treatments. Wellness plans, in particular, focus on these types of expenses.

How do I choose the right insurance provider for my dog?

+Researching and comparing different providers is essential. Consider factors like the level of coverage, policy exclusions, customer reviews, and the provider's reputation in the industry. It's also beneficial to consult with your veterinarian for recommendations.

Can I switch insurance providers if I'm not satisfied with my current plan?

+Yes, you can switch insurance providers if you find a plan that better suits your dog's needs or offers more favorable terms. However, it's important to note that pre-existing conditions may not be covered by the new provider, and there may be waiting periods before certain conditions are eligible for coverage.

Dog insurance is an invaluable tool for pet owners, providing financial security and peace of mind. By understanding the different types of coverage, choosing the right plan, and staying informed about industry developments, you can ensure your furry companion receives the best possible care throughout their life.