Insurance By Allstate

In today's fast-paced and unpredictable world, having the right insurance coverage is more crucial than ever. With numerous insurance providers in the market, choosing the right one can be a daunting task. However, one name that stands out for its comprehensive coverage and exceptional customer service is Allstate Insurance Company. Known for its innovative approaches and commitment to meeting customer needs, Allstate has established itself as a trusted partner in the insurance industry. In this comprehensive guide, we will delve into the world of Allstate insurance, exploring its offerings, unique features, and why it might be the ideal choice for your insurance needs.

A Trusted Name in Insurance: Allstate’s Journey

Allstate Insurance Company, headquartered in Northbrook, Illinois, has a rich history spanning over 89 years (as of 2023). Founded in 1931, Allstate has grown from a small insurance provider to one of the leading names in the industry. Its journey has been marked by a relentless focus on innovation and a deep understanding of its customers’ evolving needs. Over the years, Allstate has consistently adapted its strategies to meet the changing dynamics of the insurance market, earning it a reputation for reliability and trustworthiness.

The company's initial focus was on auto insurance, recognizing the growing need for coverage as the automobile became an integral part of American life. With a vision to offer insurance that was accessible and comprehensive, Allstate quickly established itself as a go-to provider for many. As the years progressed, Allstate expanded its portfolio, offering a wide range of insurance products, including home, life, and business insurance. This diversification has allowed Allstate to cater to a broader customer base, providing tailored solutions for various insurance needs.

Allstate's success can be attributed to its customer-centric approach. The company understands that insurance is not a one-size-fits-all solution, and thus, it strives to provide personalized coverage that meets the unique needs of each customer. This commitment to customization has made Allstate a preferred choice for individuals and businesses seeking reliable insurance partners.

The Allstate Advantage: Comprehensive Coverage and Customer Care

Allstate’s insurance offerings are designed to provide comprehensive protection across a wide range of scenarios. Whether you’re looking for auto, home, or life insurance, Allstate has a suite of products tailored to your specific needs. Here’s a closer look at some of their key offerings:

Auto Insurance

Allstate’s auto insurance policies are renowned for their comprehensive coverage and competitive pricing. The company offers a range of options, from basic liability coverage to more comprehensive plans that include collision and comprehensive coverage, rental car reimbursement, and roadside assistance. Allstate’s Drivewise program, an innovative feature, uses telematics technology to monitor driving behavior, offering discounts to safe drivers.

Additionally, Allstate provides specialized coverage for high-value vehicles and classic cars, ensuring that collectors and enthusiasts have the protection they need. With a focus on customer education, Allstate offers resources and tools to help drivers understand their coverage and make informed decisions about their auto insurance needs.

Home Insurance

For homeowners, Allstate offers comprehensive home insurance policies that provide protection against a wide range of risks, including fire, theft, and natural disasters. Their policies can be customized to cover the specific needs of your home, whether it’s a single-family residence, a condominium, or a rental property. Allstate also provides coverage for personal belongings, offering peace of mind in the event of loss or damage.

Furthermore, Allstate's Homeowners Advantage® package includes additional benefits such as identity protection, liability coverage for personal injuries, and coverage for valuable items. This comprehensive approach ensures that homeowners have the protection they need to recover from unexpected events.

Life Insurance

Allstate’s life insurance offerings provide financial protection for your loved ones in the event of your passing. Their policies are designed to meet a variety of needs, from whole life insurance that provides lifetime coverage to term life insurance that offers protection for a specific period. Allstate’s life insurance policies can be customized to fit your budget and coverage needs, ensuring that your family’s future is secure.

In addition to traditional life insurance, Allstate also offers accidental death and dismemberment coverage, providing an added layer of protection in the event of an accident. This comprehensive approach to life insurance ensures that you have the peace of mind that comes with knowing your loved ones are protected.

Business Insurance

For small business owners, Allstate provides a range of business insurance solutions tailored to the unique needs of different industries. Their policies can cover a wide range of risks, including property damage, liability, and business interruption. Allstate’s business insurance experts work closely with business owners to understand their specific risks and craft a customized insurance plan that provides the protection they need to thrive.

Additionally, Allstate offers specialized coverage for professionals such as doctors, lawyers, and consultants, ensuring that their unique liability risks are adequately addressed. With a focus on helping businesses grow and succeed, Allstate's business insurance solutions provide the stability and protection that businesses need to navigate the unpredictable landscape of the modern marketplace.

The Allstate Experience: Exceptional Customer Service

What sets Allstate apart from its competitors is not just its comprehensive coverage, but also its exceptional customer service. Allstate understands that insurance is not just about policies and premiums; it’s about providing peace of mind and support during times of need. Their commitment to customer service is evident in several key areas:

Claims Handling

When it comes to claims, Allstate strives to make the process as smooth and stress-free as possible. Their claims team is known for its timely response and efficient handling of claims. Whether it’s an auto accident, a home damage claim, or a life insurance benefit, Allstate works diligently to ensure that customers receive the compensation they are entitled to in a timely manner. The company’s digital tools and resources further streamline the claims process, making it more convenient for customers.

Personalized Support

Allstate believes in providing personalized support to each of its customers. Their agents take the time to understand the unique needs and circumstances of their clients, offering tailored insurance solutions. This personalized approach ensures that customers receive coverage that truly meets their needs, providing the peace of mind that comes with knowing they are adequately protected.

Educational Resources

Allstate understands that insurance can be complex, and many customers may have questions or concerns about their coverage. To address this, the company provides a wealth of educational resources on its website and through its agents. These resources cover a wide range of topics, from understanding different types of insurance to tips on how to save on premiums. By providing this information, Allstate empowers its customers to make informed decisions about their insurance needs.

The Future of Insurance: Allstate’s Innovations

Allstate is not just a traditional insurance provider; it’s an innovator in the industry. The company is constantly exploring new technologies and approaches to enhance its services and better meet customer needs. Here are some of the innovative features and initiatives that set Allstate apart:

Digital Tools and Apps

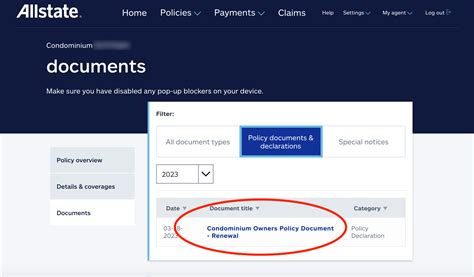

Allstate recognizes the importance of digital convenience in today’s world. Their website and mobile apps provide customers with easy access to their policies, allowing them to manage their coverage, make payments, and file claims from the comfort of their homes. These digital tools also offer real-time updates and notifications, ensuring that customers stay informed about their insurance status.

Telematics and Usage-Based Insurance

Allstate’s Drivewise program is a prime example of the company’s innovation in action. This program uses telematics technology to monitor driving behavior, offering discounts to safe drivers. By encouraging safer driving habits, Allstate not only helps reduce accidents but also provides customers with an opportunity to save on their auto insurance premiums.

Partnerships and Collaborations

Allstate understands the value of collaboration and has formed strategic partnerships to enhance its services. For instance, their partnership with SquareTrade provides customers with access to extended warranties and protection plans for their electronic devices and appliances. These partnerships broaden the scope of Allstate’s offerings, providing customers with a more comprehensive range of services.

Data-Driven Insights

Allstate leverages data analytics to gain valuable insights into customer needs and market trends. By analyzing data, the company can identify emerging risks and develop insurance products that address these challenges. This data-driven approach ensures that Allstate’s offerings remain relevant and responsive to the evolving needs of its customers.

Why Choose Allstate Insurance

Allstate Insurance Company stands out in the insurance landscape for several compelling reasons. Firstly, their comprehensive coverage ensures that customers have the protection they need across a wide range of scenarios. Whether it’s auto, home, life, or business insurance, Allstate provides tailored solutions that meet specific needs. Secondly, Allstate’s customer-centric approach is a key differentiator. The company understands that insurance is not just about policies; it’s about providing peace of mind and support. Their commitment to personalized service, timely claims handling, and educational resources sets them apart from competitors.

Furthermore, Allstate's innovative spirit is evident in their use of technology and data analytics. The company's digital tools and apps provide convenience and real-time access to insurance information, while initiatives like Drivewise encourage safer driving and offer premium discounts. Allstate's strategic partnerships also broaden their service offerings, providing customers with a more comprehensive range of protection options.

In an industry that is often characterized by complexity and confusion, Allstate shines as a beacon of clarity and reliability. Their focus on customer satisfaction, coupled with their innovative approaches, makes them a trusted partner for individuals and businesses seeking comprehensive insurance coverage. As the insurance landscape continues to evolve, Allstate is well-positioned to meet the challenges of the future, ensuring that their customers have the protection they need to navigate life's uncertainties with confidence.

How does Allstate’s Drivewise program work, and what are the benefits for customers?

+Allstate’s Drivewise program uses telematics technology to monitor driving behavior, including speed, braking, and time of day. Customers who sign up for Drivewise can receive discounts on their auto insurance premiums based on their safe driving habits. The program encourages safer driving and provides real-time feedback to help drivers improve their skills. It’s a win-win situation, as customers can save money while also becoming safer drivers.

What makes Allstate’s Homeowners Advantage® package unique, and how does it benefit homeowners?

+The Homeowners Advantage® package from Allstate offers a comprehensive range of benefits beyond traditional home insurance coverage. It includes identity protection, which safeguards homeowners against identity theft. It also provides liability coverage for personal injuries, covering legal expenses if someone is injured on the property. Additionally, the package includes coverage for valuable items, ensuring that high-value possessions are adequately protected. These added benefits provide homeowners with greater peace of mind and enhanced protection.

How does Allstate’s focus on customer education benefit its policyholders?

+Allstate’s commitment to customer education is a key aspect of their service. By providing educational resources and tools, Allstate empowers its policyholders to make informed decisions about their insurance needs. This includes understanding different types of coverage, learning about discounts and savings opportunities, and being aware of potential risks. With this knowledge, policyholders can tailor their insurance plans to their specific needs, ensuring they have the right coverage at the right price.