Minimum Car Insurance Coverage

When it comes to car insurance, understanding the minimum coverage requirements is essential for every driver. While the specific regulations vary from state to state, knowing the basic guidelines and their implications can help you make informed decisions about your automotive insurance coverage. In this comprehensive guide, we will delve into the world of minimum car insurance coverage, exploring the legal requirements, potential risks, and strategies to ensure adequate protection.

The Basics of Minimum Car Insurance Coverage

Minimum car insurance coverage refers to the legal minimum amount of liability insurance that drivers must carry to legally operate a vehicle on public roads. These requirements are established by individual state laws and are designed to protect both the policyholder and other drivers in the event of an accident. While the exact details can differ significantly, the fundamental components of minimum coverage generally include:

- Liability Coverage: This is the cornerstone of minimum car insurance coverage. It protects you against financial losses if you cause an accident that results in bodily injury or property damage to others. Liability coverage typically includes both bodily injury liability (BIL) and property damage liability (PDL) coverage.

- Bodily Injury Liability (BIL): BIL coverage pays for the medical expenses, lost wages, and other related costs incurred by individuals injured in an accident caused by you. The minimum BIL limits vary by state, but they often range from $25,000 to $100,000 per person and $50,000 to $300,000 per accident.

- Property Damage Liability (PDL): PDL coverage covers the cost of repairing or replacing the property damaged in an accident for which you are at fault. This includes vehicles, structures, and other types of property. The minimum PDL limits typically range from $10,000 to $50,000.

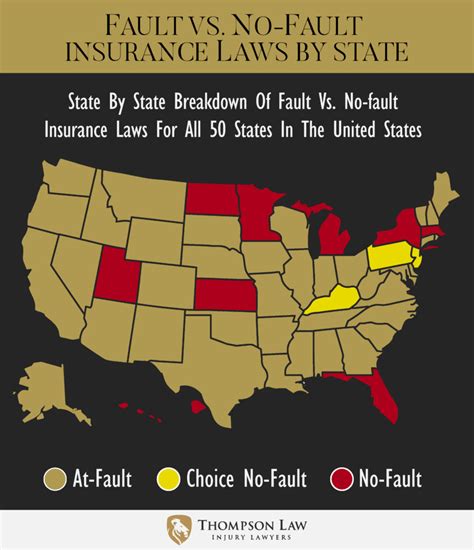

- Additional Coverages: Some states may require additional types of coverage as part of the minimum requirements. For instance, personal injury protection (PIP) or medical payments (MedPay) coverage might be mandated to cover the medical expenses of the policyholder and their passengers, regardless of fault.

State-Specific Minimum Car Insurance Coverage Requirements

Given the diverse legal landscape across the United States, it’s crucial to understand the specific minimum car insurance coverage requirements in your state. Here’s a brief overview of the liability limits in some of the most populous states:

| State | Bodily Injury Liability (per person) | Bodily Injury Liability (per accident) | Property Damage Liability |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| Illinois | $25,000 | $50,000 | $20,000 |

| Ohio | $25,000 | $50,000 | $25,000 |

| Pennsylvania | $15,000 | $30,000 | $5,000 |

Note that these are simplified versions of the requirements and may not account for all the nuances of each state's insurance laws. It's always advisable to consult the official resources or speak with an insurance professional to obtain accurate and up-to-date information for your specific state.

Understanding the Risks of Minimum Coverage

While adhering to the legal minimum car insurance coverage requirements is a necessary step to maintain compliance with the law, it’s essential to recognize the potential risks associated with carrying only the bare minimum coverage. Here are some key considerations:

Inadequate Protection in Severe Accidents

In the event of a serious accident, the medical expenses, property damage costs, and legal fees can easily surpass the minimum liability limits. If you are found at fault, you could be personally responsible for paying these excess costs out of pocket. This could lead to significant financial strain and potentially ruinous consequences.

Limited Coverage for Personal Injuries

Minimum coverage often provides limited protection for personal injuries sustained by the policyholder and their passengers. This means that in the event of an accident, you might have to rely heavily on your health insurance or pay out of pocket for medical expenses that exceed the policy limits.

Potential for Increased Premiums

Opting for the minimum coverage can sometimes result in higher insurance premiums. Insurance companies may perceive drivers who carry only the minimum coverage as higher risk, which could lead to increased rates. It’s a delicate balance between affordability and adequate protection.

Strategies for Enhancing Your Car Insurance Coverage

Given the potential drawbacks of carrying only the minimum car insurance coverage, it’s prudent to explore strategies to enhance your protection. Here are some approaches to consider:

Increase Liability Limits

One of the most straightforward ways to improve your coverage is to increase your liability limits. By opting for higher limits, you can provide more substantial protection for yourself and others in the event of an accident. This strategy can significantly reduce your financial exposure and provide peace of mind.

Consider Additional Coverages

Beyond the minimum requirements, there are several optional coverages that can enhance your overall protection. These might include:

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-collision incidents like theft, vandalism, natural disasters, or hitting an animal.

- Collision Coverage: Collision coverage pays for the repair or replacement of your vehicle if you're involved in an accident, regardless of fault.

- Rental Car Reimbursement: If you frequently need a rental car, this coverage can provide financial assistance for the cost of renting a vehicle while yours is being repaired.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto insurance with homeowners or renters insurance. This can be an effective way to save money while ensuring comprehensive coverage for your assets.

Explore Discounts and Savings

Insurance providers often offer various discounts to policyholders. These might include safe driver discounts, good student discounts, loyalty discounts, or even discounts for installing safety features in your vehicle. Be sure to inquire about these options to potentially lower your insurance premiums.

The Bottom Line

Minimum car insurance coverage is a legal requirement, but it’s important to understand that it may not provide sufficient protection in the event of an accident. By exploring the state-specific requirements, understanding the potential risks, and implementing strategies to enhance your coverage, you can ensure that you and your loved ones are adequately protected on the road. Remember, when it comes to car insurance, it’s always better to be safe than sorry.

Can I drive with only the minimum car insurance coverage?

+Yes, you can drive with only the minimum car insurance coverage, as it is the legal requirement set by your state. However, it’s important to understand that minimum coverage may not provide sufficient protection in certain situations, especially if you’re involved in a severe accident.

Are there any states with no minimum car insurance requirements?

+No, all states in the U.S. have some form of minimum car insurance requirements. However, the specific limits and coverages can vary significantly from state to state.

How can I find out the minimum car insurance requirements for my state?

+You can consult your state’s Department of Motor Vehicles (DMV) website or contact your local DMV office. They will provide you with the specific requirements and any additional information you need to comply with the law.

What happens if I’m involved in an accident and my liability limits are exceeded?

+If your liability limits are exceeded in an accident, you could be personally liable for the excess costs. This means you might have to pay out of pocket for the additional damages, which can be financially devastating. That’s why it’s often recommended to carry higher liability limits to provide better protection.