Difference Between Term Life And Whole Life Insurance

Insurance, a fundamental aspect of financial planning, serves as a protective shield for individuals and their families. Among the various types of insurance, life insurance stands out as a crucial tool for providing financial security and peace of mind. Two primary types of life insurance, Term Life and Whole Life, each offer distinct advantages and cater to different needs. Understanding the nuances of these policies is essential for making informed decisions about your financial future.

Term Life Insurance: A Temporal Solution

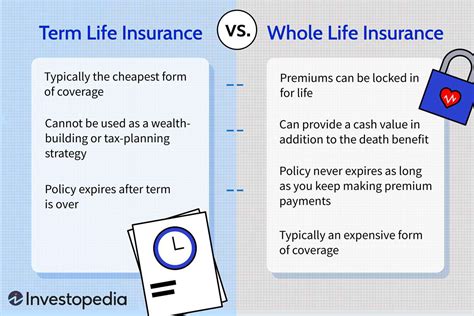

Term Life Insurance, as the name suggests, is a temporary form of life insurance. It provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policyholder pays a fixed premium, and in the event of their death, the beneficiaries receive a predetermined sum known as the death benefit.

Key Characteristics of Term Life Insurance

- Affordability: Term Life Insurance is often the most cost-effective option for young adults and families. The lower premiums make it an attractive choice for those on a budget.

- Flexibility: Policyholders can choose the coverage period based on their needs. For instance, a 30-year-old might opt for a 20-year term to cover their mortgage repayment period.

- Renewability: Most term policies offer the option to renew, but premiums may increase with age.

- No Cash Value: Term Life Insurance does not build cash value over time. It is purely a death benefit plan.

Real-World Example

Consider John, a 25-year-old with a young family. He purchases a 20-year term life insurance policy with a death benefit of 500,000. During this period, he pays an annual premium of 300. If John were to pass away within the 20-year term, his family would receive the $500,000 benefit, providing financial stability during a challenging time.

| Term Length | Death Benefit | Annual Premium |

|---|---|---|

| 10 Years | $250,000 | $200 |

| 20 Years | $500,000 | $350 |

| 30 Years | $750,000 | $550 |

Whole Life Insurance: A Permanent Solution

Whole Life Insurance, in contrast, is a permanent form of life insurance. It provides coverage for the policyholder’s entire life, as long as premiums are paid. This type of insurance offers more than just a death benefit; it also accumulates cash value over time, which can be accessed through policy loans or withdrawals.

Key Characteristics of Whole Life Insurance

- Lifetime Coverage: Whole Life Insurance ensures that your loved ones are protected, regardless of your age or health status at the time of death.

- Guaranteed Premiums: Premiums remain fixed throughout the policy, providing stability and predictability.

- Cash Value Growth: The policy accumulates cash value, which can be used for various financial needs, such as funding retirement or paying for a child’s education.

- Flexible Payment Options: Policyholders can choose to pay premiums for a specific period or for life.

Real-World Example

Emily, a 35-year-old professional, purchases a Whole Life Insurance policy with a death benefit of 1,000,000. She chooses to pay premiums for 20 years, after which the policy is fully paid-up. Over time, her policy accumulates cash value, which she can access as needed. If Emily were to pass away at any point, her beneficiaries would receive the full 1,000,000 death benefit.

| Death Benefit | Premium Payment Period | Annual Premium |

|---|---|---|

| $500,000 | Life of the Policy | $1,500 |

| $1,000,000 | 20 Years | $2,000 |

| $2,000,000 | 10 Years | $3,500 |

Comparative Analysis: Term Life vs. Whole Life

The choice between Term Life and Whole Life Insurance depends on individual financial goals and circumstances. Term Life is often recommended for those with short-term financial obligations, while Whole Life is more suitable for long-term financial planning and wealth accumulation.

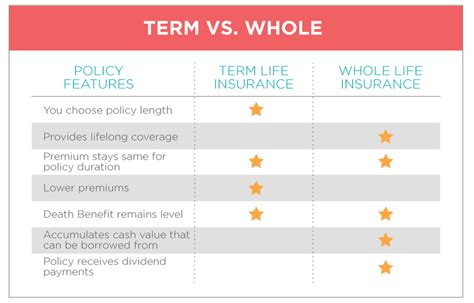

| Criteria | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Period | Temporary (10-30 years) | Lifetime |

| Premium Stability | Varies with age and health | Fixed premiums |

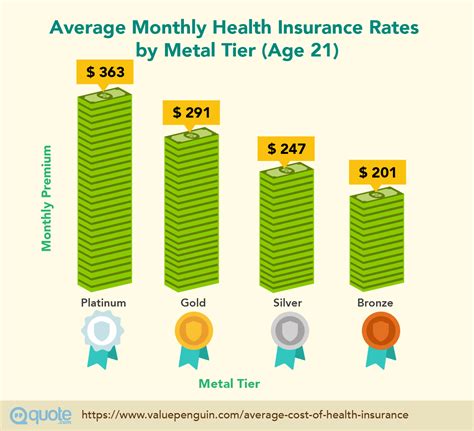

| Cost | Generally lower | Higher premiums |

| Cash Value | None | Accumulates over time |

| Flexibility | Renewable, but may be more expensive | Flexible payment options |

Future Implications

As individuals progress through different life stages, their financial needs and goals evolve. Term Life Insurance may be sufficient for younger adults with fewer financial responsibilities, while Whole Life Insurance can offer more comprehensive coverage and financial planning opportunities as one ages.

It's essential to review and reassess your insurance needs periodically to ensure your policies align with your changing circumstances. Consulting with a financial advisor can provide valuable insights and guidance in making informed decisions about your life insurance portfolio.

Conclusion

In the realm of financial planning, life insurance is a cornerstone of financial security. Understanding the differences between Term Life and Whole Life Insurance empowers individuals to make informed choices that align with their unique circumstances and goals. Whether it’s providing for dependent family members or accumulating wealth for the future, the right life insurance policy can be a powerful tool for achieving financial stability and peace of mind.

Can I convert my Term Life Insurance policy into a Whole Life policy?

+Yes, many Term Life Insurance policies offer a conversion option, allowing you to convert your term policy into a Whole Life policy without undergoing a new medical exam. However, the conversion process and its terms vary by insurer, so it’s essential to review your policy details carefully.

What happens if I outlive my Term Life Insurance policy period?

+If you outlive your Term Life Insurance policy period, the coverage expires, and you no longer have life insurance protection. However, some insurers offer a renewal option, allowing you to extend the term for a limited period. Renewal terms and conditions vary, so it’s crucial to understand your policy’s specifics.

How do I determine if Whole Life Insurance is a suitable investment vehicle for me?

+Whole Life Insurance can be a suitable investment vehicle if you prioritize long-term financial security and stability. The cash value component offers tax advantages and can be a valuable asset for retirement planning. However, it’s essential to consider your risk tolerance and financial goals when making this decision.