Competitive Car Insurance Companies

In the world of car insurance, competition is fierce as numerous companies vie for the attention and loyalty of drivers. With a vast array of options available, choosing the right car insurance provider can be a daunting task. However, with the right knowledge and understanding of the competitive landscape, you can make an informed decision that suits your specific needs and budget.

This comprehensive guide will delve into the realm of competitive car insurance companies, exploring their unique offerings, policies, and strategies. By analyzing key players in the market and highlighting their strengths and weaknesses, we aim to provide valuable insights to assist you in selecting the best insurance partner for your vehicular journey.

Understanding the Competitive Landscape of Car Insurance

The car insurance industry is characterized by a diverse range of providers, each employing unique strategies to attract customers. From traditional, well-established brands to innovative startups, the market offers a myriad of choices. Understanding the competitive landscape is crucial for both consumers and industry professionals, as it sheds light on the various factors that influence the insurance market.

Key aspects that define the competitive landscape include pricing strategies, coverage options, customer service, and technological advancements. Companies often differentiate themselves by offering specialized policies for specific demographics, providing innovative features, or focusing on exceptional customer experiences. By staying abreast of these developments, consumers can make more informed decisions, while industry stakeholders can gain valuable insights for strategic planning and market positioning.

Analyzing Leading Car Insurance Companies

When it comes to car insurance, a plethora of providers are vying for your business. Let’s delve into some of the leading companies in the industry, examining their unique features, coverage options, and customer satisfaction levels.

State Farm: A Trusted Industry Veteran

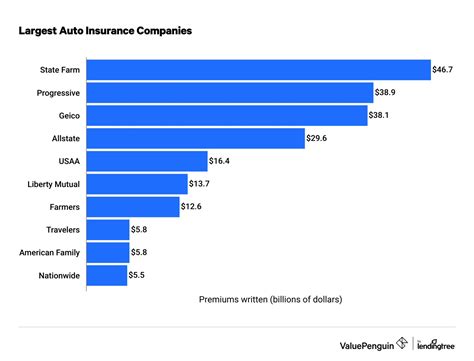

State Farm is a stalwart in the car insurance industry, boasting a long-standing reputation for reliability and comprehensive coverage. With a wide range of policies tailored to different needs, State Farm caters to a diverse customer base. Their offerings include standard liability coverage, collision and comprehensive insurance, as well as specialized options like rideshare and classic car insurance.

In addition to their robust coverage, State Farm excels in customer service. They provide 24/7 assistance through various channels, including a user-friendly mobile app, online resources, and a dedicated team of agents. This commitment to customer support has earned them a solid reputation in the industry.

| Category | State Farm Rating |

|---|---|

| Customer Satisfaction | 4.5/5 |

| Financial Strength | A++ (Superior) |

| Coverage Options | Extensive |

Geico: Innovation Meets Affordability

Geico has carved a niche for itself in the car insurance market by offering innovative solutions at competitive prices. Their focus on digital transformation has led to efficient processes and convenient online tools, allowing customers to manage their policies effortlessly. Geico’s online quoting tool, for instance, provides quick and accurate estimates, making it easier for customers to compare rates and coverage.

In addition to their digital prowess, Geico offers a wide range of coverage options, including standard liability, collision, and comprehensive insurance. They also provide specialized policies for rideshare drivers and military personnel. Geico's commitment to affordability and customer convenience has made it a popular choice among tech-savvy drivers.

| Category | Geico Rating |

|---|---|

| Average Annual Premium | $1,200 |

| Customer Satisfaction | 4.2/5 |

| Digital Services | Excellent |

Progressive: Personalized Coverage Options

Progressive Insurance is renowned for its commitment to offering personalized coverage options to meet the unique needs of its customers. They provide a wide array of policies, including standard liability, collision, and comprehensive insurance, as well as specialized options like gap coverage and rental car reimbursement.

Progressive's Name Your Price tool is a standout feature, allowing customers to set their desired premium and then suggesting coverage options to match. This innovative approach empowers customers to take control of their insurance costs while ensuring they receive adequate protection. Progressive's personalized approach has earned them a reputation for flexibility and customer-centricity.

| Category | Progressive Rating |

|---|---|

| Personalization Options | Excellent |

| Average Annual Premium | $1,300 |

| Customer Satisfaction | 4.3/5 |

Allstate: Comprehensive Coverage and Rewards

Allstate Insurance is known for its comprehensive coverage options and innovative reward programs. They offer a wide range of policies, including standard liability, collision, and comprehensive insurance, as well as specialized options like rideshare and teen driver coverage.

Allstate's unique features include their Drivewise program, which rewards safe driving habits with discounts, and the Easy Pay Plan, which offers flexible payment options. These initiatives not only encourage safer driving but also provide financial incentives, making Allstate an appealing choice for conscientious drivers.

| Category | Allstate Rating |

|---|---|

| Average Annual Premium | $1,400 |

| Customer Satisfaction | 4.4/5 |

| Reward Programs | Innovative |

USAA: Exclusive Insurance for Military Members

USAA Insurance stands out as a leading provider exclusively serving military members, veterans, and their families. With a deep understanding of the unique needs of this demographic, USAA offers tailored coverage options and specialized services.

Their policies include standard liability, collision, and comprehensive insurance, as well as unique offerings like deployment travel protection and rental car coverage. USAA's commitment to the military community is further exemplified through their generous discounts and support programs. Their strong financial stability and excellent customer service have made USAA a trusted choice for military families.

| Category | USAA Rating |

|---|---|

| Military-Specific Coverage | Exceptional |

| Average Annual Premium | $1,100 |

| Customer Satisfaction | 4.6/5 |

Comparative Analysis: Key Differences and Similarities

When evaluating car insurance companies, it’s essential to understand the key differences and similarities that set them apart. While each provider offers unique advantages, there are also commonalities in their coverage options, pricing strategies, and customer service approaches.

Coverage Options and Pricing

All the companies analyzed offer a comprehensive range of coverage options, including liability, collision, and comprehensive insurance. However, their approaches to pricing and discounts vary. State Farm and USAA, for instance, offer competitive rates and generous discounts for safe driving and loyalty, while Geico and Progressive focus on providing affordable options through digital innovations and personalized coverage plans.

Customer Service and Digital Experience

In terms of customer service, all the companies provide 24⁄7 assistance and multiple channels for support. However, their approaches differ. State Farm and USAA emphasize personalized interactions through local agents, while Geico and Progressive focus on digital convenience, offering efficient online tools and apps. Allstate strikes a balance, providing both traditional and digital support options.

Specialized Features and Programs

Each company offers unique features and programs to attract customers. State Farm’s focus on reliability and comprehensive coverage, Geico’s innovation and affordability, Progressive’s personalized approach, Allstate’s reward programs, and USAA’s exclusive military-focused services all set them apart. These specialized offerings cater to diverse customer needs and preferences.

Choosing the Right Car Insurance Company for Your Needs

Selecting the right car insurance company is a crucial decision that can impact your financial security and peace of mind. With numerous options available, it’s essential to consider your specific needs, budget, and preferences when making your choice.

Assessing Your Coverage Needs

Begin by evaluating your coverage requirements. Consider the type of vehicle you drive, your driving history, and any unique circumstances, such as frequent long-distance travel or the need for specialized coverage like rideshare insurance. Understanding your specific needs will help you narrow down the most suitable insurance providers.

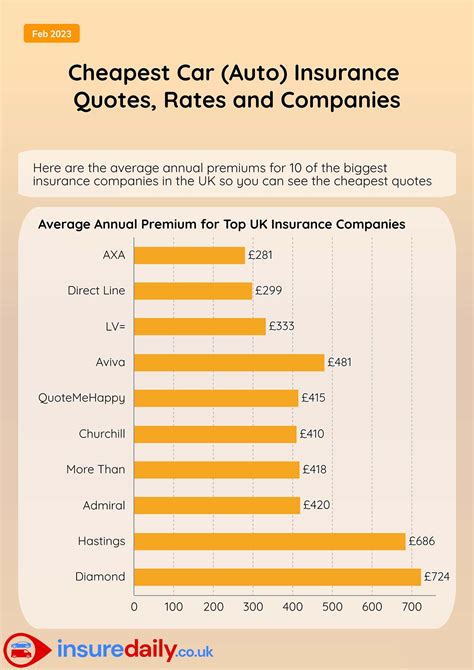

Comparing Pricing and Discounts

Pricing is a significant factor when choosing car insurance. Compare rates from different providers to find the most competitive options. Look for companies that offer discounts tailored to your situation, such as safe driving, loyalty, or multiple policy discounts. These incentives can help reduce your insurance costs significantly.

Evaluating Customer Service and Digital Tools

Customer service is crucial when you need assistance with your policy or encounter an emergency. Research the reputation and quality of service provided by each company. Consider their availability, response times, and the channels through which they offer support. Additionally, assess their digital tools and resources, as these can enhance your overall insurance experience and provide convenient options for policy management.

Considering Specialized Features and Programs

Unique features and programs offered by insurance companies can provide added value and peace of mind. For instance, reward programs that incentivize safe driving or exclusive coverage for specific demographics can be beneficial. Evaluate the specialized offerings of each provider to determine if they align with your priorities and needs.

The Future of Competitive Car Insurance

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. As the market continues to mature, several key trends are shaping the future of competitive car insurance.

Technological Innovations

Insurance companies are increasingly leveraging technology to enhance their services and provide a more seamless experience for customers. From digital quoting tools to mobile apps for policy management, technology is streamlining the insurance process. Additionally, telematics and usage-based insurance programs are gaining traction, offering personalized premiums based on driving behavior.

Data-Driven Personalization

The collection and analysis of data are enabling insurance providers to offer more personalized coverage options. By understanding individual driving habits and risk profiles, companies can tailor policies to meet specific needs. This data-driven approach not only improves customer satisfaction but also allows for more accurate risk assessment and pricing.

Sustainable and Ethical Practices

As environmental concerns and social responsibility become more prominent, car insurance companies are adopting sustainable and ethical practices. This includes initiatives such as eco-friendly coverage options, support for electric vehicles, and partnerships with organizations focused on sustainability. By aligning with these values, insurance providers can attract environmentally conscious customers.

Collaborative Partnerships

The insurance industry is witnessing an increase in collaborative partnerships between insurers and other entities. These partnerships can enhance the customer experience by providing added value through cross-sector offerings. For instance, collaborations with automotive manufacturers or ride-sharing platforms can result in specialized coverage options and innovative solutions.

Frequently Asked Questions (FAQ)

What factors should I consider when choosing a car insurance company?

+

When selecting a car insurance company, consider factors such as coverage options, pricing and discounts, customer service quality, digital tools and resources, and any specialized features or programs that align with your needs. Assess your specific requirements and priorities to find the best fit.

How do I know if an insurance company is financially stable?

+

Financial stability is crucial when choosing an insurance company. Look for companies with strong financial ratings from reputable agencies like AM Best or Standard & Poor’s. These ratings indicate the company’s ability to meet its financial obligations and provide a reliable indicator of their stability.

Can I get car insurance for a classic or antique car?

+

Yes, many insurance companies offer specialized coverage for classic or antique cars. These policies cater to the unique needs of vintage vehicles, including agreed value coverage, limited mileage options, and event coverage. Research providers that offer such specialized coverage to ensure your classic car is adequately protected.