Cheap Homeowner Insurance

When it comes to protecting your home and assets, homeowner insurance is an essential consideration. However, finding affordable coverage can be a daunting task. In this comprehensive guide, we delve into the world of cheap homeowner insurance, exploring strategies, insights, and practical tips to help you secure the best possible rates while maintaining comprehensive protection. Whether you're a seasoned homeowner or a first-time buyer, this article will provide you with the knowledge and tools to make informed decisions about your insurance coverage.

Understanding the Basics of Homeowner Insurance

Homeowner insurance, also known as home insurance or homeowners’ insurance, is a contract between a homeowner and an insurance company. It provides financial protection against a variety of risks, including damage to your home, theft, liability claims, and even additional living expenses if your home becomes uninhabitable due to an insured event.

The primary purpose of homeowner insurance is to safeguard your investment in your home and personal belongings. It offers peace of mind by ensuring that you can recover financially after a covered loss. However, with numerous insurance providers and varying policy options, finding the right coverage at an affordable price can be challenging.

Key Components of Homeowner Insurance Policies

- Dwelling Coverage: This covers the structure of your home, including the main building, attached structures like garages, and often includes damage caused by perils such as fire, wind, and hail.

- Personal Property Coverage: Protects your personal belongings, like furniture, electronics, and clothing, against theft, fire, and other specified risks.

- Liability Coverage: Provides protection if someone is injured on your property or if you are held legally responsible for an accident that causes property damage or bodily injury to others.

- Additional Living Expenses: In the event that your home becomes unlivable due to an insured incident, this coverage reimburses you for the cost of temporary housing and other related expenses.

- Medical Payments Coverage: Covers medical expenses for minor injuries sustained by visitors on your property, regardless of liability.

Strategies for Finding Cheap Homeowner Insurance

Securing cheap homeowner insurance requires a combination of research, comparison, and understanding of the factors that influence insurance rates. Here are some effective strategies to help you find the best deals:

Shop Around and Compare Quotes

One of the most crucial steps in finding cheap homeowner insurance is to shop around and compare quotes from multiple insurance providers. Insurance rates can vary significantly between companies, even for similar coverage levels. By obtaining quotes from at least three to five insurers, you can identify the most competitive rates in the market.

Use online comparison tools and insurance brokerages to streamline the process. These platforms allow you to input your details once and receive multiple quotes, making it easier to compare coverage options and prices.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,350 |

| Provider C | $1,100 |

Keep in mind that while price is important, you should also consider the coverage limits, deductibles, and policy exclusions when comparing quotes. Opt for a balance between affordability and adequate protection.

Boost Your Credit Score

Insurance companies often consider your credit score when calculating your insurance premium. A higher credit score can lead to lower insurance rates, as it indicates a lower risk of filing claims. Therefore, improving your credit score can be a key strategy to reduce your homeowner insurance costs.

- Review your credit report and dispute any inaccuracies.

- Pay your bills on time and reduce your credit card balances.

- Consider using a secured credit card to rebuild your credit history.

- Avoid opening multiple new credit accounts simultaneously.

By maintaining a strong credit profile, you can enhance your negotiating power with insurance providers and potentially secure better rates.

Bundle Your Policies

Many insurance companies offer bundled policies, which combine homeowner insurance with other types of coverage, such as auto insurance or renters insurance. By bundling your policies, you can often enjoy significant discounts on your overall insurance premiums.

For example, if you have multiple properties or own a rental property, consider purchasing a package policy that covers all your assets. Bundling can simplify your insurance management and save you money in the long run.

Raise Your Deductible

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your insurance premiums. This is because a higher deductible reduces the insurer’s risk and, consequently, the cost of your policy.

However, it's important to choose a deductible that you can comfortably afford in the event of a claim. Striking the right balance between a high deductible and financial feasibility is crucial.

Utilize Home Security Features

Installing home security systems and taking proactive measures to protect your home can result in lower insurance premiums. Insurance companies often offer discounts for homes equipped with security features such as:

- Burglar alarms

- Smoke detectors

- Sprinkler systems

- Surveillance cameras

- Reinforced doors and windows

By investing in these security enhancements, you not only improve the safety of your home but also demonstrate to insurers that you are taking steps to mitigate risks, potentially leading to cheaper insurance rates.

Tips for Maintaining Affordable Homeowner Insurance

Once you’ve secured cheap homeowner insurance, it’s essential to take steps to maintain those low rates over time. Here are some tips to help you keep your insurance premiums affordable:

Review Your Policy Regularly

Insurance policies and rates can change over time. It’s important to review your policy annually to ensure that your coverage remains adequate and that you’re not paying for unnecessary features. Regular reviews can help you identify opportunities to save money or make necessary adjustments.

Understand Policy Exclusions

Familiarize yourself with the exclusions in your homeowner insurance policy. These are specific risks or damages that are not covered by your insurance. By understanding what’s excluded, you can take steps to mitigate those risks or purchase additional coverage if necessary.

Make Home Improvements

Investing in home improvements that enhance the safety and resilience of your home can lead to lower insurance premiums. For example, upgrading your roof, reinforcing your foundation, or installing impact-resistant windows can reduce the risk of damage from storms or natural disasters.

Additionally, making your home more energy-efficient can qualify you for insurance discounts. Insurers often offer incentives for homeowners who adopt sustainable practices, as these homes are typically less costly to repair or rebuild.

Maintain a Clean Claims History

Insurance companies consider your claims history when determining your insurance rates. A clean claims record can lead to lower premiums over time. However, it’s important to strike a balance between making claims and managing your expenses.

Consider the cost of repairs and your deductible before filing a claim. Small claims that are close to or below your deductible may not be worth filing, as they can increase your insurance premiums in the future.

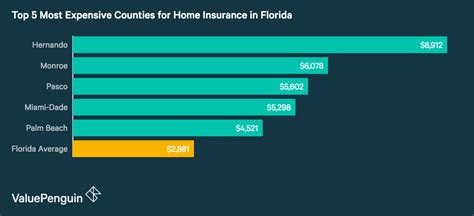

The Impact of Location on Homeowner Insurance Rates

Your location plays a significant role in determining your homeowner insurance rates. Insurance companies assess the risks associated with different areas, including the likelihood of natural disasters, crime rates, and the cost of rebuilding in the event of a loss.

Regional Differences in Insurance Rates

Insurance rates can vary widely between regions. For example, areas prone to hurricanes or earthquakes may have higher insurance premiums due to the increased risk of catastrophic damage. On the other hand, areas with lower crime rates and fewer natural disasters tend to have more affordable insurance rates.

When comparing insurance quotes, consider the regional differences and how they may impact your coverage. Some insurers may offer better rates in specific areas due to their understanding of local risks and their ability to provide tailored coverage.

Understanding Local Risk Factors

Insurance companies use risk assessment tools to evaluate the likelihood of various perils in your area. These tools consider factors such as:

- Proximity to bodies of water or flood-prone areas

- Wildfire risk

- Crime statistics

- Historical weather patterns

- Population density and infrastructure

Understanding the local risk factors can help you anticipate potential insurance challenges and take proactive measures to mitigate those risks. For example, if you live in an area prone to flooding, investing in flood insurance or taking steps to reduce flood risk on your property can be beneficial.

The Future of Homeowner Insurance: Emerging Trends

The homeowner insurance industry is constantly evolving, driven by technological advancements and changing consumer expectations. Here are some emerging trends that are shaping the future of homeowner insurance:

Digital Transformation

Insurance companies are increasingly adopting digital technologies to enhance the customer experience and streamline processes. Online quote comparisons, digital policy management, and mobile apps for filing claims are becoming standard features in the industry.

This digital transformation enables homeowners to access insurance information and services more conveniently, making it easier to shop for and manage their policies.

Data-Driven Underwriting

Insurance providers are leveraging advanced data analytics to assess risk and set insurance premiums more accurately. By analyzing vast amounts of data, including historical claims data, weather patterns, and even social media activity, insurers can better understand the risks associated with individual homes and neighborhoods.

This data-driven approach allows for more precise underwriting, potentially leading to more affordable insurance rates for low-risk homeowners.

Personalized Insurance Policies

The concept of personalized insurance is gaining traction, allowing homeowners to customize their coverage to fit their specific needs and circumstances. This approach recognizes that not all homeowners have the same risks or requirements, and it enables them to pay for the coverage they truly need.

For example, homeowners who live in areas with low crime rates may opt for lower liability coverage, while those with valuable artwork or jewelry may choose to add additional personal property coverage.

Sustainable and Green Home Incentives

As environmental concerns continue to rise, insurance companies are offering incentives for sustainable and green homes. These incentives reward homeowners who adopt eco-friendly practices and reduce their carbon footprint.

Insurance providers may offer discounts for homes with energy-efficient appliances, solar panels, or other sustainable features. By encouraging sustainable practices, insurers can reduce the environmental impact of homes and potentially lower the cost of claims associated with natural disasters.

Conclusion: Navigating the World of Cheap Homeowner Insurance

Securing cheap homeowner insurance requires a combination of research, understanding, and proactive strategies. By shopping around, comparing quotes, and implementing the tips outlined in this article, you can find affordable coverage that protects your home and belongings without breaking the bank.

Remember, finding the right homeowner insurance is an ongoing process. Regularly reviewing your policy, staying informed about emerging trends, and taking steps to mitigate risks can help you maintain affordable insurance rates over the long term. With the right approach, you can enjoy peace of mind knowing that your home is protected without sacrificing your financial goals.

What is the average cost of homeowner insurance in the United States?

+The average cost of homeowner insurance in the U.S. varies depending on factors such as location, property value, and coverage limits. According to recent data, the national average annual premium is approximately 1,200. However, rates can range from as low as 500 to over $3,000, highlighting the importance of shopping around for the best deal.

How can I lower my homeowner insurance deductible?

+Lowering your homeowner insurance deductible can be achieved by negotiating with your insurance provider. Some insurers offer programs or discounts that allow you to reduce your deductible over time, such as by maintaining a clean claims history or by enrolling in a loyalty program. However, keep in mind that a lower deductible may result in higher premiums, so it’s important to find the right balance for your financial situation.

Are there any government programs or grants to help with homeowner insurance costs?

+While government programs and grants for homeowner insurance are relatively rare, some states and local governments offer assistance programs for low-income homeowners. These programs often provide subsidies or discounts on insurance premiums, helping eligible homeowners afford adequate coverage. It’s worth researching any available programs in your area to see if you qualify.