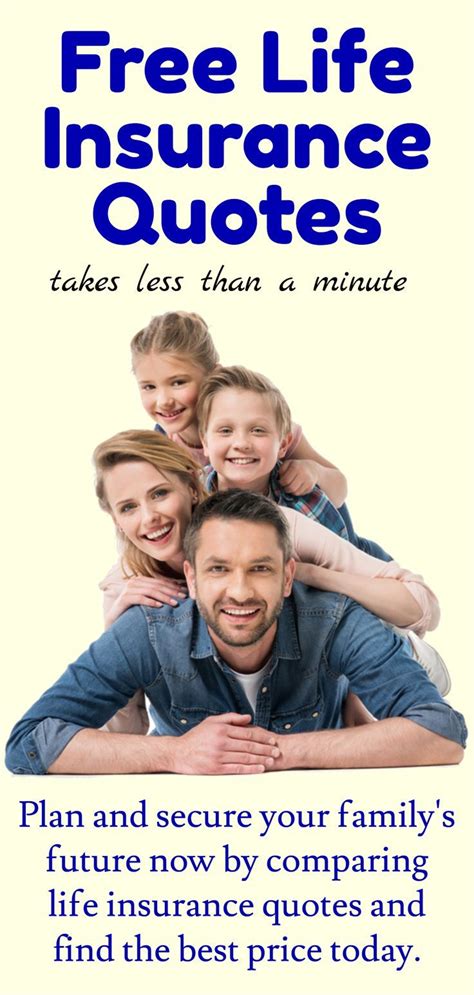

Free Life Insurance Quote

In the ever-evolving landscape of financial planning and security, life insurance stands as a cornerstone, offering individuals and families peace of mind and a safety net for their future. The process of securing life insurance, however, can be daunting, often fraught with complex terminology, numerous options, and a multitude of providers. This article aims to demystify the process, providing a comprehensive guide to obtaining a free life insurance quote, exploring the factors that influence premiums, and offering insights into the steps to secure the right coverage for your unique needs.

Understanding the Life Insurance Quoting Process

The quest for a free life insurance quote begins with an understanding of the fundamental principles that underpin this financial instrument. Life insurance, at its core, is a contract between an individual (the policyholder) and an insurance company. The policyholder agrees to pay a premium, typically on a monthly or annual basis, in exchange for a promise from the insurer to pay a specified amount (the death benefit) to the policyholder’s beneficiaries upon their death.

The quoting process is a crucial step in this journey, as it provides a snapshot of the cost of coverage based on an individual's unique circumstances and needs. It involves a detailed assessment of several key factors, each of which can significantly impact the premium.

Factors Influencing Life Insurance Premiums

Several variables play a pivotal role in determining the cost of life insurance. These include, but are not limited to:

- Age: Younger individuals generally enjoy lower premiums due to their lower risk of mortality.

- Health Status: Pre-existing medical conditions or lifestyle factors (e.g., smoking) can impact premium costs.

- Lifestyle and Hobbies: High-risk activities or occupations can lead to higher premiums.

- Family Health History: A family history of certain diseases can influence the premium.

- Coverage Amount: The higher the death benefit, the higher the premium.

- Term Length: Longer policy terms often result in higher premiums.

- Rider Add-ons: Additional benefits or riders, such as accidental death benefit, can increase the premium.

Each of these factors is carefully considered by insurance companies when generating a quote. It's important to note that while these factors provide a general framework, individual circumstances can lead to significant variations in premium costs.

Obtaining a Free Life Insurance Quote

Securing a free life insurance quote is a straightforward process, made simpler with the proliferation of online tools and resources. Here’s a step-by-step guide to obtaining a quote:

- Research and Compare Providers: Start by researching reputable life insurance providers. Look for companies with a solid financial rating, positive customer reviews, and a comprehensive range of coverage options.

- Utilize Online Quoting Tools: Most insurance providers offer online quoting tools that allow you to input your personal information and receive an instant quote. These tools provide a quick and convenient way to compare premiums and coverage options.

- Provide Accurate Information: When using online quoting tools, ensure that the information you provide is accurate and up-to-date. Inaccurate information can lead to incorrect quotes and potential issues when applying for coverage.

- Consider Multiple Quotes: Don't settle for the first quote you receive. Compare quotes from several providers to ensure you're getting the best value for your money. Different companies may have different underwriting guidelines, which can result in varying premiums for similar coverage.

- Understand the Quote: When you receive a quote, take the time to understand the details. This includes the coverage amount, term length, premium payment frequency, and any additional benefits or riders included in the policy.

- Ask Questions: If you have any doubts or need clarification on any aspect of the quote, don't hesitate to reach out to the insurance provider. Customer service representatives are there to assist and ensure you understand your coverage options.

The Role of Health Assessments

While online quoting tools provide a quick and convenient way to get an initial estimate, it’s important to note that the premium quoted may change based on the results of a health assessment. Many life insurance providers require a medical exam as part of the application process, particularly for policies with higher coverage amounts or for individuals with certain health conditions.

The health assessment typically involves a physical exam, blood and urine tests, and a review of your medical history. The results of these assessments can impact the final premium, potentially resulting in a higher or lower cost than the initial quote.

Analyzing and Choosing the Right Coverage

With multiple quotes in hand, the next step is to analyze and compare the options to choose the coverage that best aligns with your needs and budget. Here are some key considerations to guide your decision-making process:

- Coverage Amount: Ensure that the coverage amount is sufficient to meet your financial goals. This could include covering outstanding debts, providing for dependents, or ensuring a comfortable standard of living for your loved ones.

- Term Length: Consider the length of the policy term. Shorter terms may result in lower premiums, but keep in mind that you may need to renew the policy at a higher cost as you age.

- Rider Options: Evaluate any additional riders or benefits offered with the policy. While these can increase the premium, they may provide valuable coverage for specific needs, such as critical illness or accidental death.

- Financial Strength of the Insurer: Check the financial rating of the insurance provider. You want to ensure that the company is financially stable and able to pay out claims in the future.

- Customer Service and Reputation: Research the insurer's reputation and customer service record. You want to work with a company that provides excellent service and has a history of prompt claim settlement.

The Importance of Regular Reviews

Life insurance is not a one-time purchase. It’s essential to regularly review and update your coverage to ensure it continues to meet your needs. Life events such as marriage, the birth of a child, a significant change in financial status, or even a change in occupation can all impact your insurance needs.

Regular reviews allow you to adjust your coverage, add additional riders, or increase the coverage amount as necessary. They also provide an opportunity to reassess your premium payments and explore potential cost-saving measures.

Conclusion

Securing a free life insurance quote is the first step towards financial security and peace of mind. By understanding the factors that influence premiums and following the steps outlined above, you can navigate the quoting process with confidence. Remember, life insurance is a personal decision, and it’s crucial to choose a policy that provides adequate coverage at a premium that fits your budget.

For more information on life insurance and to explore a range of coverage options, visit [Provider Website]. Our team of experts is dedicated to helping you find the right coverage for your unique circumstances.

How accurate are online life insurance quotes?

+Online quotes provide a good estimate of the premium based on the information you provide. However, the final premium may vary based on the results of a health assessment and other factors. It’s important to understand that online quotes are estimates and not guarantees of the final premium.

What happens if I provide inaccurate information during the quoting process?

+Providing inaccurate information can lead to issues when applying for coverage. In some cases, it may result in a denied application or a higher premium than initially quoted. It’s crucial to provide accurate and up-to-date information to ensure the quote is as precise as possible.

Can I get life insurance if I have a pre-existing medical condition?

+Yes, many life insurance providers offer coverage for individuals with pre-existing medical conditions. However, the premium may be higher, and the coverage may be subject to certain limitations or exclusions. It’s important to disclose all pre-existing conditions during the quoting and application process.

What are some common rider options available with life insurance policies?

+Common rider options include accidental death benefit, waiver of premium, disability income rider, and critical illness rider. These riders can provide additional coverage for specific events or circumstances, but they typically come at an additional cost.

How often should I review my life insurance coverage?

+It’s recommended to review your life insurance coverage at least once a year, or whenever there is a significant change in your personal or financial circumstances. Regular reviews ensure that your coverage remains adequate and aligned with your needs.