Florida Automobile Insurance

In the sunshine state of Florida, automobile insurance is a critical aspect of road safety and financial protection for drivers. With its unique no-fault insurance system and diverse range of coverage options, Florida's auto insurance landscape is both intriguing and complex. This comprehensive guide aims to delve into the specifics of Florida automobile insurance, offering an expert analysis of its intricacies and providing valuable insights for drivers navigating this essential aspect of vehicle ownership.

Understanding Florida’s Auto Insurance Landscape

Florida’s automobile insurance market is shaped by a combination of state regulations and the diverse needs of its residents. The state’s no-fault insurance system, for instance, mandates that drivers carry Personal Injury Protection (PIP) coverage, which provides medical benefits for policyholders and their passengers regardless of who is at fault in an accident. This system aims to expedite the claims process and reduce litigation, but it also presents unique challenges and considerations for drivers.

Mandatory Coverage and Its Implications

The mandatory coverage requirements in Florida are a key aspect of its auto insurance landscape. As mentioned, PIP coverage is a must-have, with a minimum limit of 10,000. This coverage ensures that policyholders can access medical benefits quickly after an accident, covering a range of medical expenses such as doctor visits, hospital stays, and rehabilitation costs. Additionally, Florida requires drivers to carry Property Damage Liability (PDL) coverage with a minimum limit of 10,000. This coverage safeguards policyholders against claims arising from property damage they cause in an accident, such as damage to another vehicle or public property.

| Coverage Type | Minimum Limit | Description |

|---|---|---|

| Personal Injury Protection (PIP) | $10,000 | Covers medical expenses for policyholders and passengers. |

| Property Damage Liability (PDL) | $10,000 | Covers property damage caused by the policyholder. |

While these mandatory coverages provide a basic level of protection, they may not be sufficient for all drivers. For instance, the $10,000 PIP limit might not cover all medical expenses, especially in severe accidents. Similarly, the PDL limit might be inadequate for expensive vehicle repairs or property damage claims. This is where optional coverages come into play, allowing drivers to tailor their policies to their specific needs and financial circumstances.

Optional Coverages: Tailoring Your Protection

Florida’s auto insurance market offers a range of optional coverages that drivers can add to their policies. These coverages provide additional protection and can be crucial in specific situations. Here are some of the most common optional coverages available in Florida:

- Bodily Injury Liability (BIL): This coverage protects policyholders against claims arising from bodily injuries they cause in an accident. It covers medical expenses, pain and suffering, and lost wages for the injured party. The minimum limit in Florida is $10,000 per person and $20,000 per accident, but higher limits are recommended to provide more robust protection.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: UM coverage protects policyholders when involved in an accident with a driver who has no insurance or insufficient insurance. UIM coverage, on the other hand, provides protection when the at-fault driver's liability limits are insufficient to cover the policyholder's damages. These coverages are particularly important in Florida, where the mandatory coverage limits are relatively low.

- Collision Coverage: This coverage pays for damages to the policyholder's vehicle when involved in an accident, regardless of fault. It is an essential coverage for protecting against financial losses, especially for newer or more expensive vehicles.

- Comprehensive Coverage: Comprehensive coverage provides protection against damages to the policyholder's vehicle that are not caused by accidents. This includes damages from natural disasters, theft, vandalism, or collisions with animals. It is often paired with collision coverage to provide a comprehensive protection plan.

- Rental Car Reimbursement: This coverage provides reimbursement for rental car expenses when the policyholder's vehicle is being repaired after an insured loss. It ensures that policyholders can maintain their mobility during the repair process.

The choice of optional coverages depends on individual needs and risk tolerance. For instance, drivers who frequently travel long distances or drive in urban areas might benefit from higher BIL limits, while those who live in areas prone to natural disasters might find comprehensive coverage more valuable. It's essential to carefully consider these options and consult with insurance professionals to make informed decisions.

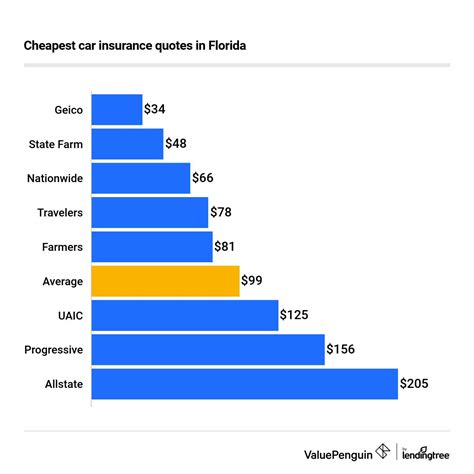

Performance Analysis: Insurers in Florida

Florida’s auto insurance market is highly competitive, with a diverse range of insurers offering a variety of coverage options and pricing structures. While the state’s no-fault system provides a basic level of protection for all drivers, the performance of individual insurers can vary significantly. Here, we delve into the performance analysis of some of the leading insurers in Florida, based on key metrics such as financial strength, customer satisfaction, and claim handling.

State Farm: A Trusted Leader

State Farm is one of the largest auto insurers in Florida and the United States as a whole. With a strong financial foundation and a long-standing reputation for reliability, State Farm consistently ranks highly in customer satisfaction surveys. The insurer offers a comprehensive range of coverages, including the mandatory PIP and PDL coverages, as well as a variety of optional coverages such as BIL, UM/UIM, collision, and comprehensive coverage.

State Farm's claim handling process is known for its efficiency and fairness. The insurer provides 24/7 claim support, ensuring policyholders can quickly report and resolve their claims. The company's mobile app also allows customers to track their claim status and access important policy information on-the-go. Additionally, State Farm offers a variety of discounts, including multi-policy discounts, good student discounts, and safe driver discounts, making its policies highly competitive in terms of pricing.

Geico: Convenience and Affordability

Geico is another prominent insurer in Florida, known for its convenient online and mobile services and competitive pricing. The insurer provides a user-friendly digital platform, allowing customers to manage their policies, report claims, and access policy information with ease. Geico’s app, in particular, is highly rated for its simplicity and functionality.

In terms of coverage, Geico offers all the mandatory and optional coverages required in Florida. The insurer is particularly known for its comprehensive UM/UIM coverage, which provides robust protection against uninsured and underinsured drivers. Geico also offers a range of discounts, including multi-policy discounts, military discounts, and good student discounts, making its policies highly affordable for many drivers.

Progressive: Innovation and Customization

Progressive is a leading insurer that stands out for its innovative approach to auto insurance. The company offers a wide range of coverage options and customizable policies, allowing drivers to tailor their protection to their specific needs. Progressive’s “Name Your Price” tool, for instance, lets customers choose their desired coverage and deductible, and the insurer then creates a policy to match.

In Florida, Progressive offers all the mandatory and optional coverages, with a particular focus on comprehensive and collision coverages. The insurer's "Snapshot" program is also worth noting. This program uses a small device installed in the policyholder's vehicle to track driving behavior, such as hard braking and acceleration. Based on this data, Progressive adjusts the policy premium, rewarding safe drivers with lower rates.

Allstate: Comprehensive Coverage and Claim Support

Allstate is a well-established insurer with a strong presence in Florida. The company offers a comprehensive range of coverages, including all the mandatory and optional coverages required in the state. Allstate’s “Accident Forgiveness” program is particularly noteworthy, as it ensures policyholders’ rates won’t increase after their first at-fault accident, providing added peace of mind.

Allstate's claim handling process is known for its efficiency and customer-centric approach. The insurer provides a dedicated claim specialist to each policyholder, ensuring personalized support throughout the claims process. Additionally, Allstate's "Good Hands Rescue" service offers roadside assistance, including towing, flat tire changes, and fuel delivery, providing valuable peace of mind for policyholders.

Comparative Analysis: Choosing the Right Insurer

When choosing an auto insurer in Florida, drivers should consider a range of factors, including coverage options, pricing, financial strength, and claim handling reputation. While State Farm, Geico, Progressive, and Allstate are all leading insurers with strong reputations, each has its own unique strengths and specialties. For instance, State Farm and Allstate might be preferred by drivers seeking a traditional, well-established insurer with a strong focus on customer service, while Geico and Progressive might appeal to those who value convenience, customization, and competitive pricing.

Ultimately, the choice of insurer should align with the driver's specific needs and preferences. It's essential to carefully review policy details, understand the coverage options, and consider the insurer's reputation for claim handling and customer satisfaction. Consulting with insurance professionals and comparing quotes from multiple insurers can also help drivers make informed decisions and find the best value for their auto insurance needs.

Future Implications and Industry Insights

The Florida auto insurance market is continually evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. As we look ahead, several key trends and developments are shaping the future of auto insurance in the state.

Technological Advancements: The Rise of Telematics and AI

The integration of technology into auto insurance is a significant trend shaping the industry. Telematics, the use of technology to monitor and analyze driving behavior, is becoming increasingly common. Insurers are using telematics data to offer usage-based insurance (UBI) policies, which provide personalized premiums based on an individual’s driving habits. This shift towards UBI is expected to continue, with more insurers adopting telematics technology to offer dynamic, data-driven premiums.

Artificial Intelligence (AI) is also playing a growing role in auto insurance. AI-powered systems are being used for various tasks, from streamlining the claims process to detecting fraud. For instance, AI can analyze large amounts of data to identify patterns and potential fraud indicators, helping insurers detect fraudulent claims more efficiently. Additionally, AI-powered chatbots and virtual assistants are enhancing customer service, providing quick and accurate responses to policyholder inquiries.

Regulatory Changes: Navigating the No-Fault System

Florida’s no-fault insurance system, while providing a basic level of protection for all drivers, has been a subject of ongoing debate and potential reform. The system’s effectiveness in reducing litigation and expediting the claims process has been questioned, leading to proposals for reform. Some of these proposals include raising the mandatory PIP and PDL limits, expanding the scope of coverages, and introducing more stringent regulations for uninsured drivers.

While the future of Florida's no-fault system remains uncertain, insurers and drivers alike are closely monitoring these regulatory changes. Insurers are adapting their strategies and coverage offerings to align with potential reforms, while drivers are encouraged to stay informed and understand the implications of these changes for their insurance needs.

Consumer Preferences: Personalized Protection and Digital Convenience

Consumer preferences are also evolving, with drivers seeking more personalized protection and digital convenience. The rise of online and mobile services has shifted consumer expectations, with many drivers now preferring digital platforms for managing their policies and accessing support. Insurers are responding to these preferences by enhancing their digital offerings, providing user-friendly apps and online portals for policy management and claim reporting.

Additionally, drivers are increasingly seeking customizable policies that align with their specific needs and risk profiles. The growing demand for personalized protection is leading insurers to offer more flexible coverage options and innovative tools, such as Progressive's "Name Your Price" program, to cater to these evolving preferences. By offering customizable policies and leveraging technology, insurers can better meet the diverse needs of Florida's drivers.

Conclusion: Navigating Florida’s Auto Insurance Landscape

Florida’s auto insurance landscape is a complex and dynamic environment, shaped by state regulations, consumer preferences, and technological advancements. Understanding the intricacies of this landscape is crucial for drivers seeking to navigate the state’s unique no-fault insurance system and tailor their protection to their specific needs. From mandatory coverages to optional enhancements, and from leading insurers to emerging trends, this comprehensive guide has provided an in-depth analysis of Florida automobile insurance.

By exploring the performance of leading insurers, analyzing their coverage options and claim handling processes, and delving into the future implications of technological advancements and regulatory changes, this article has offered valuable insights for drivers in Florida. Whether you're a seasoned driver or a newcomer to the state, this guide can serve as a valuable resource for understanding and managing your auto insurance needs. Stay informed, stay protected, and drive safely in the sunshine state.

Frequently Asked Questions

What is the minimum coverage required for auto insurance in Florida?

+The minimum coverage required in Florida is Personal Injury Protection (PIP) with a limit of 10,000 and Property Damage Liability (PDL) with a limit of 10,000. These coverages provide basic protection for medical expenses and property damage.

What are some common optional coverages in Florida auto insurance?

+Common optional coverages include Bodily Injury Liability (BIL), Uninsured/Underinsured Motorist (UM/UIM) Coverage, Collision Coverage, Comprehensive Coverage, and Rental Car Reimbursement. These coverages provide additional protection for various scenarios and can be crucial in specific situations.

How do I choose the right auto insurer in Florida?

+When choosing an auto insurer, consider factors such as coverage options, pricing, financial strength, and claim handling reputation. Review policy details, understand the coverage options, and consult with insurance professionals to find the best value for your needs. Leading insurers like State Farm, Geico, Progressive, and Allstate offer a range of options to suit different preferences.

What impact do technological advancements have on auto insurance in Florida?

+Technological advancements, such as telematics and AI, are shaping the future of auto insurance in Florida. Telematics data is used for usage-based insurance policies, offering personalized premiums based on driving behavior. AI is enhancing claim handling processes and customer service, providing more efficient and accurate support.

How can I stay informed about regulatory changes in Florida’s auto insurance market?

+Staying informed about regulatory changes is crucial for drivers in Florida. Engage with reputable insurance professionals and regularly review industry news and updates. Keep an eye on potential reforms to the no-fault system and understand how these changes might impact your insurance needs.