Reviews Progressive Insurance

When it comes to choosing an insurance provider, it's crucial to find a company that offers not only competitive rates but also exceptional service and coverage. Progressive Insurance has established itself as a prominent player in the industry, and in this comprehensive review, we will delve into its offerings, policies, and the overall customer experience to help you make an informed decision.

About Progressive Insurance

Progressive Insurance, with its headquarters in Mayfield Village, Ohio, is a leading insurance provider in the United States. Founded in 1937, Progressive has grown exponentially over the years, offering a wide range of insurance products and services to cater to various customer needs. The company prides itself on innovation, introducing industry-firsts such as the online policy quote, and has since expanded its reach to become one of the largest auto insurance companies in the nation.

Insurance Products and Services

Progressive Insurance offers a comprehensive suite of insurance products, ensuring that customers can find coverage tailored to their specific needs. Here’s an overview of their key offerings:

Auto Insurance

Progressive’s auto insurance policies are designed to provide comprehensive protection for vehicle owners. Their policies typically include liability coverage, collision coverage, comprehensive coverage, and personal injury protection (PIP) or medical payments coverage. Progressive also offers additional coverage options such as rental car reimbursement, gap coverage, and roadside assistance.

One unique feature of Progressive’s auto insurance is the Name Your Price® tool, which allows customers to set their desired price range and explore coverage options that fit within their budget. This innovative approach puts the customer in control of their insurance costs.

Home Insurance

Progressive’s home insurance policies offer protection for homeowners and renters. Their homeowner’s insurance covers the structure of the home, personal belongings, liability, and additional living expenses in case of a covered loss. Progressive also provides renters insurance, which covers personal property, liability, and additional living expenses if the insured’s rental unit becomes uninhabitable due to a covered event.

A notable feature of Progressive’s home insurance is the HomeQuote Explorer®, an online tool that helps customers estimate their home insurance costs based on various factors such as location, home value, and desired coverage limits.

Commercial Insurance

Progressive caters to small business owners with their commercial insurance policies. These policies provide coverage for business property, liability, business interruption, and other specific risks associated with running a business. Progressive offers customized coverage options to meet the unique needs of different industries and business types.

Life Insurance

Progressive also offers life insurance policies to help individuals and families secure their financial future. Their life insurance products include term life insurance, whole life insurance, and universal life insurance. These policies provide death benefit coverage and, in some cases, additional features such as cash value accumulation.

Additional Insurance Products

Progressive’s portfolio extends beyond the aforementioned policies. They also offer insurance for motorcycles, boats, ATVs, and RVs, ensuring that customers can find coverage for their recreational vehicles. Additionally, Progressive provides umbrella insurance, which provides excess liability coverage beyond the limits of other policies.

Pricing and Discounts

Progressive Insurance is known for its competitive pricing and various discounts that can help customers save on their insurance premiums. Here are some of the key pricing features and discount opportunities:

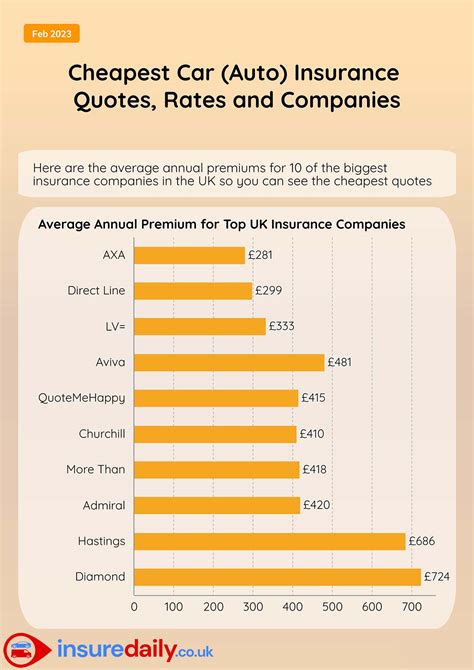

Competitive Pricing

Progressive strives to offer competitive rates for its insurance products. By leveraging technology and efficient processes, the company is able to provide cost-effective coverage options without compromising on quality. Progressive’s online quoting tools and comparison features allow customers to easily shop around and find the best value for their insurance needs.

Discounts

Progressive offers a wide range of discounts to help customers reduce their insurance premiums. These discounts include:

- Multi-Policy Discount: Customers who bundle their auto and home insurance policies with Progressive can often qualify for significant savings.

- Safe Driver Discount: Progressive rewards safe driving habits by offering discounts to drivers with clean records. This discount is based on the driver’s accident and violation-free history.

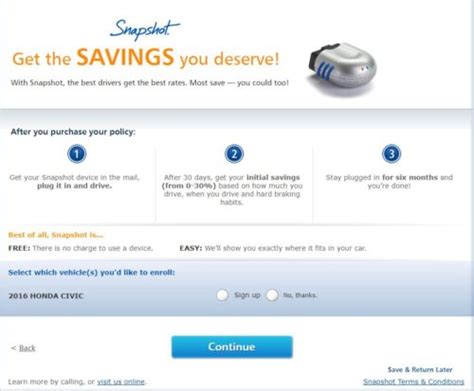

- Snapshot® Discount: Progressive’s usage-based insurance program, Snapshot®, allows customers to potentially save on their auto insurance premiums by sharing their driving data. The program analyzes driving habits such as hard braking, acceleration, and mileage to provide personalized discounts.

- Paperless Discount: Customers who opt for paperless billing and policy documents can receive a discount on their premiums, as this option helps reduce administrative costs for Progressive.

- Loyalty Discount: Progressive rewards long-term customers with loyalty discounts, acknowledging their continued trust and business.

- Homeowner Discount: Renters and homeowners may qualify for discounts when they insure their homes with Progressive.

- Good Student Discount: Progressive offers discounts to young drivers who maintain good grades in school, recognizing the correlation between academic achievement and responsible driving habits.

Claims Process and Customer Service

Progressive Insurance aims to provide a seamless and efficient claims process, ensuring that customers receive prompt assistance when they need it the most. Here’s an overview of their claims handling and customer service:

Claims Process

Progressive’s claims process is designed to be straightforward and accessible. Customers can report claims online, over the phone, or through the Progressive mobile app. The company’s claims adjusters work diligently to assess and process claims promptly, ensuring that customers receive the coverage and assistance they need.

Progressive offers various options for claim settlement, including direct payment, repair services, and reimbursement for covered losses. The company strives to make the claims process as stress-free as possible, providing regular updates and support throughout the process.

Customer Service

Progressive is committed to delivering exceptional customer service. Their customer support team is available 24⁄7, ensuring that customers can reach out for assistance at any time. Progressive offers multiple channels for customer service, including phone, email, live chat, and social media platforms, making it convenient for customers to connect with representatives.

Progressive’s customer service representatives are trained to provide personalized assistance, answering questions, offering policy guidance, and addressing any concerns that customers may have. The company’s focus on customer satisfaction is evident in its dedication to providing timely and helpful responses.

Customer Satisfaction and Reputation

Progressive Insurance has built a strong reputation in the industry, known for its customer-centric approach and commitment to providing quality service. Here’s an overview of Progressive’s customer satisfaction and industry standing:

Customer Satisfaction

Progressive consistently receives high customer satisfaction ratings. Independent review platforms and industry surveys often rank Progressive among the top insurance providers in terms of customer satisfaction. Customers appreciate Progressive’s innovative tools, competitive pricing, and efficient claims handling.

Progressive’s focus on customer education and transparency has also contributed to its positive reputation. The company provides resources and tools to help customers understand their insurance coverage, ensuring that they make informed decisions about their policies.

Industry Recognition

Progressive Insurance has received numerous accolades and industry recognition for its innovative practices and customer-centric approach. Some notable achievements include:

- Being named one of the “World’s Most Innovative Companies” by Fast Company magazine in 2020.

- Receiving the J.D. Power award for the highest customer satisfaction in the auto insurance claims segment in 2021.

- Earning recognition for its environmental initiatives, such as its commitment to reduce carbon emissions and promote sustainability.

- Being recognized for its workplace culture, including being named one of the “Best Places to Work” by several publications.

Conclusion

Progressive Insurance has established itself as a reliable and innovative insurance provider, offering a wide range of insurance products and services. With its competitive pricing, extensive discounts, and commitment to customer satisfaction, Progressive has become a popular choice for many individuals and businesses. The company’s focus on technology, innovation, and customer education sets it apart in the industry.

When considering Progressive for your insurance needs, it’s important to carefully review their policies, coverage options, and pricing to ensure they align with your specific requirements. Progressive’s online tools and resources can help you make informed decisions and find the best insurance solution for your situation.

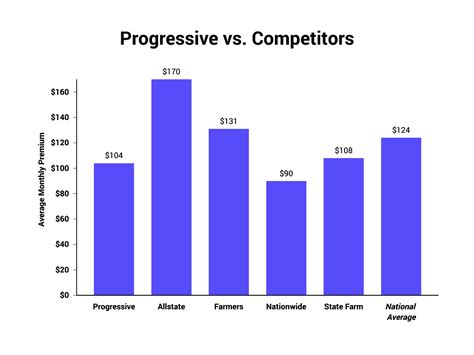

How does Progressive Insurance compare to other insurance providers in terms of pricing?

+Progressive Insurance is known for its competitive pricing and innovative tools like the Name Your Price® tool. While pricing can vary based on individual factors, Progressive often offers rates that are on par or better than many other insurance providers. It’s always recommended to compare quotes from multiple companies to find the best value for your specific needs.

What are some of the key features of Progressive’s auto insurance policies?

+Progressive’s auto insurance policies offer comprehensive coverage, including liability, collision, comprehensive, and medical payments coverage. They also provide additional options like rental car reimbursement, gap coverage, and roadside assistance. The Name Your Price® tool allows customers to set their desired price range and explore coverage options accordingly.

How does Progressive handle claims and customer service inquiries?

+Progressive has a dedicated and responsive claims team that works to process claims efficiently. Customers can report claims online, over the phone, or through the Progressive mobile app. Progressive offers multiple channels for customer service, including phone, email, live chat, and social media, ensuring that customers can receive assistance whenever needed.

What types of discounts does Progressive Insurance offer?

+Progressive offers a wide range of discounts, including multi-policy discounts for bundling auto and home insurance, safe driver discounts for accident-free records, Snapshot® discounts for sharing driving data, paperless discounts for opting for paperless billing, loyalty discounts for long-term customers, homeowner discounts for renters and homeowners, and good student discounts for young drivers with good grades.

How can I get a quote from Progressive Insurance?

+You can get a quote from Progressive Insurance by visiting their official website and using their online quoting tools. You can also call their customer service hotline or work with an independent insurance agent who represents Progressive to explore coverage options and receive personalized quotes.