Insurance Health Texas

Health insurance is an essential aspect of healthcare, providing individuals with access to medical services and financial protection. In the state of Texas, understanding the intricacies of health insurance is crucial for residents to make informed decisions about their coverage. This comprehensive guide aims to explore the unique aspects of Health Insurance in Texas, shedding light on the state's specific policies, options, and benefits available to its residents.

The Texas Health Insurance Landscape

Texas, known for its diverse population and vast geography, presents a unique challenge when it comes to health insurance. With a large uninsured population, the state has implemented various initiatives to improve access to healthcare. Let's delve into the key aspects of health insurance in Texas and uncover the options available to its residents.

Understanding the Texas Health Insurance Market

The Texas health insurance market operates under a unique set of regulations and policies. The state has chosen not to expand its Medicaid program under the Affordable Care Act (ACA), which has had significant implications for low-income residents seeking coverage. As a result, Texas has a robust individual market, with various insurers offering plans tailored to the state's specific needs.

One notable feature of the Texas market is the presence of the Health Insurance Marketplace, also known as the Health Insurance Exchange. This online platform, established under the ACA, allows individuals and small businesses to compare and purchase health insurance plans. It serves as a valuable resource for Texans seeking coverage, providing a centralized platform for plan comparison and enrollment.

Additionally, Texas has implemented its own High-Risk Pool, known as the Texas Health Insurance Risk Pool (THIRP). This program provides health insurance coverage to individuals with pre-existing conditions who may face challenges obtaining coverage in the traditional market. THIRP ensures that Texans with medical conditions have access to affordable healthcare options.

| Health Insurance Coverage in Texas | Data and Statistics |

|---|---|

| Uninsured Rate | 14.7% (as of 2021) |

| Median Income | $62,364 (as of 2021) |

| Average Annual Premium (Individual Market) | $6,500 (as of 2022) |

Health Insurance Options in Texas

Texans have a range of health insurance options to choose from, each catering to different needs and budgets. Let's explore the primary types of health insurance available in the Lone Star State.

Individual and Family Plans

Individual and family health insurance plans are a popular choice for Texans who do not have access to employer-sponsored coverage. These plans are purchased directly from insurance companies or through the Health Insurance Marketplace. With a wide variety of plan designs and networks, individuals can find options that fit their specific healthcare needs and preferences.

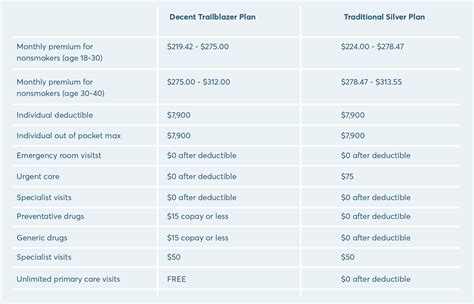

When selecting an individual plan, Texans should consider factors such as deductibles, copayments, coinsurance, and out-of-pocket maximums. Understanding these terms is crucial for managing healthcare costs effectively. Additionally, plan networks play a significant role, as they determine which healthcare providers and facilities are covered under the chosen plan.

| Key Factors in Individual Health Insurance Plans | Explanation |

|---|---|

| Deductible | The amount you pay out of pocket before your insurance coverage begins. |

| Copayment | A fixed amount you pay for a covered healthcare service, such as a doctor's visit or prescription medication. |

| Coinsurance | The percentage of costs you share with your insurance company after the deductible is met. |

| Out-of-Pocket Maximum | The maximum amount you will pay out of pocket for covered services in a year. |

Employer-Sponsored Health Insurance

Many Texans have the advantage of employer-sponsored health insurance, which is often a comprehensive and cost-effective option. Employers in Texas offer a range of health plans, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs). These plans typically provide access to a network of healthcare providers and facilities, offering employees and their families a variety of coverage options.

Employer-sponsored plans often come with additional benefits, such as dental, vision, and prescription drug coverage. They may also include wellness programs and incentives to encourage healthy lifestyles. Understanding the specific benefits and coverage provided by employer-sponsored plans is essential for making informed decisions about healthcare.

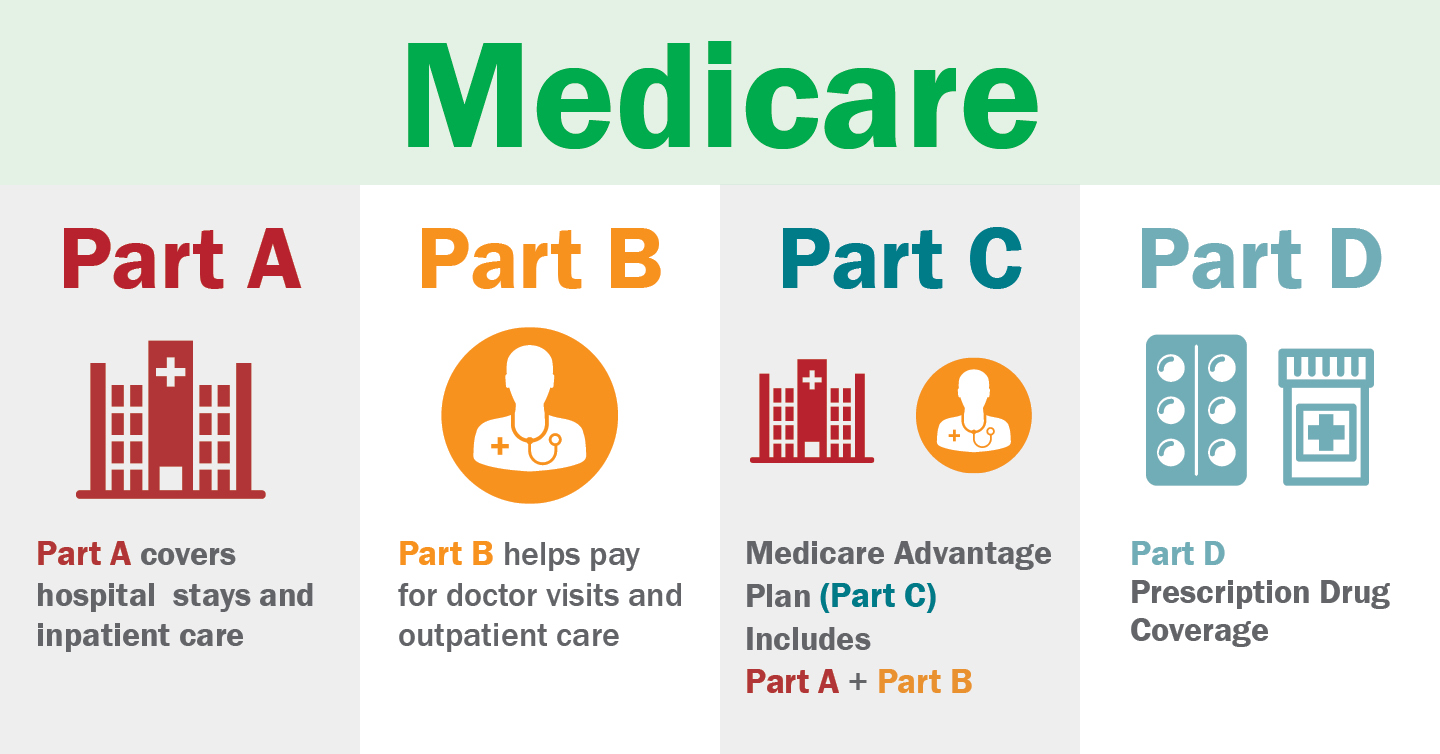

Medicaid and CHIP in Texas

Texas offers Medicaid and the Children's Health Insurance Program (CHIP) to eligible residents. These programs provide low-cost or no-cost health coverage to low-income families, pregnant women, and individuals with disabilities. Medicaid in Texas covers a range of services, including doctor visits, hospital stays, prescription drugs, and preventive care.

While Texas has not expanded its Medicaid program under the ACA, certain groups are still eligible for coverage, including children, pregnant women, and individuals with disabilities. CHIP, on the other hand, is specifically designed for children and provides comprehensive healthcare services, including regular check-ups, immunizations, and dental care.

Health Insurance Benefits and Considerations in Texas

Understanding the unique benefits and considerations of health insurance in Texas is crucial for residents to make informed choices. Let's explore some key aspects that impact the healthcare landscape in the state.

Prescription Drug Coverage

Prescription drug coverage is an essential component of health insurance plans in Texas. Many plans include formularies, which are lists of prescription drugs covered by the insurance company. These formularies are categorized into tiers, with different cost-sharing arrangements for each tier. Understanding the formulary and its tiers is crucial for managing prescription drug costs effectively.

Additionally, Texans should be aware of prior authorization requirements for certain prescription drugs. This process ensures that the drug is medically necessary and appropriate for the patient's condition. Prior authorization can add an extra layer of complexity to obtaining prescription medications, so it's important to understand the requirements and timelines involved.

Mental Health and Substance Abuse Coverage

Mental health and substance abuse coverage are critical components of a comprehensive health insurance plan. In Texas, insurance companies are required to provide coverage for mental health and substance abuse treatment, including inpatient and outpatient services. This coverage ensures that Texans have access to the necessary support and care for these often-stigmatized conditions.

However, it's important to note that the specific benefits and coverage limits for mental health and substance abuse treatment can vary between insurance plans. Texans should carefully review their policy documents to understand the extent of their coverage and any potential limitations or exclusions.

Maternity and Newborn Care

Maternity and newborn care are essential considerations for expectant parents in Texas. Many health insurance plans in the state offer coverage for prenatal care, delivery, and postpartum services. These plans typically include well-baby visits, immunizations, and newborn screening tests, ensuring the health and well-being of both mother and child.

Additionally, Texans should be aware of the maternity waiting period in certain health insurance plans. This period, typically lasting 10–12 months, requires that a woman be continuously enrolled in the plan before maternity-related benefits kick in. Understanding this waiting period is crucial for expectant parents to plan their insurance coverage accordingly.

Navigating Health Insurance in Texas

With a diverse range of health insurance options and unique state-specific considerations, navigating the health insurance landscape in Texas can be complex. However, by understanding the key aspects and taking advantage of available resources, Texans can make informed decisions about their coverage.

The Importance of Comparing Plans

Comparing health insurance plans is crucial for Texans to find the best fit for their needs and budget. The Health Insurance Marketplace, available at Healthcare.gov, provides a valuable tool for plan comparison. Texans can input their zip code, age, and household size to see a list of available plans and their estimated costs.

When comparing plans, it's essential to consider factors such as monthly premiums, deductibles, copayments, and covered services. Understanding the network of providers and facilities included in each plan is also crucial, as it determines where Texans can receive healthcare services.

Enrolling in Health Insurance

Enrolling in health insurance in Texas is a straightforward process, especially with the availability of the Health Insurance Marketplace. Texans can enroll during the Open Enrollment Period, which typically runs from November 1st to December 15th each year. During this time, individuals can select and enroll in a new health insurance plan or make changes to their existing coverage.

Outside of the Open Enrollment Period, Texans may qualify for a Special Enrollment Period if they experience certain life events, such as losing their job, getting married, or having a baby. These events trigger a 60-day window to enroll in or change health insurance plans.

FAQs about Health Insurance in Texas

What is the average cost of health insurance in Texas?

+The average cost of health insurance in Texas varies depending on factors such as age, location, and plan type. As of 2022, the average annual premium for an individual plan is around $6,500, while family plans can cost upwards of $15,000 per year.

Are there any state-specific tax credits or subsidies for health insurance in Texas?

+Texas does not offer state-specific tax credits or subsidies for health insurance. However, residents may qualify for federal tax credits and subsidies through the Health Insurance Marketplace if their income is within certain limits.

Can I use my Texas health insurance plan when traveling out of state?

+Some health insurance plans in Texas offer out-of-state coverage, allowing you to access healthcare services when traveling. However, it's important to check your specific plan's network and coverage limits to understand the extent of your coverage outside of Texas.

What happens if I miss the Open Enrollment Period for health insurance in Texas?

+If you miss the Open Enrollment Period, you may still be able to enroll in a health insurance plan if you qualify for a Special Enrollment Period due to a qualifying life event. Otherwise, you may have to wait until the next Open Enrollment Period to make changes to your coverage.

How can I find a healthcare provider that accepts my Texas health insurance plan?

+Most health insurance plans provide a directory of in-network healthcare providers on their websites. You can search for doctors, specialists, and facilities that accept your specific plan. Additionally, you can contact your insurance company's customer service to obtain a list of in-network providers in your area.

Health insurance in Texas offers a range of options and benefits to residents, ensuring access to necessary healthcare services. By understanding the unique aspects of the Texas health insurance market and taking advantage of available resources, Texans can make informed decisions about their coverage and navigate the healthcare system effectively.