Cheep Auto Insurance

Finding affordable auto insurance is a common goal for many vehicle owners, and the market offers a wide range of options. In this comprehensive guide, we delve into the world of cheap auto insurance, exploring the factors that influence premiums, strategies to reduce costs, and the best practices for obtaining the most cost-effective coverage. With an informed approach, you can navigate the insurance landscape and secure a policy that provides the protection you need without breaking the bank.

Understanding Cheap Auto Insurance

Cheap auto insurance refers to policies that offer comprehensive coverage at a competitive and affordable rate. While the definition of cheap can vary based on individual circumstances and budgetary constraints, it generally involves securing the necessary insurance protection without incurring excessive costs. Achieving this balance requires a thoughtful approach, considering various factors that influence premium rates.

Factors Affecting Auto Insurance Premiums

The cost of auto insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. Understanding these factors is crucial for devising strategies to obtain cheap auto insurance. Here are some key considerations:

- Vehicle Type and Usage: The make, model, and year of your vehicle impact insurance costs. Additionally, the purpose for which you use your car, such as commuting, business, or pleasure, can affect your premium.

- Driver Profile: Your driving history, including accidents and traffic violations, is a significant factor. Insurers also consider your age, gender, and marital status when assessing risk.

- Location: The area where you reside and where your vehicle is primarily garaged influences insurance rates. Urban areas with higher accident rates and theft risks typically result in higher premiums.

- Coverage and Deductibles: The level of coverage you choose, including liability, collision, and comprehensive coverage, affects your premium. Additionally, selecting higher deductibles can lead to lower premiums.

- Insurance Provider and Policy Features: Different insurance companies offer varying rates and policy features. Some providers specialize in certain types of coverage or cater to specific demographics, making it essential to shop around for the best deal.

| Factor | Impact on Premiums |

|---|---|

| Vehicle Type and Usage | Higher-end vehicles and frequent usage can lead to increased premiums. |

| Driver Profile | Clean driving records and responsible driving habits often result in lower rates. |

| Location | Urban areas with higher accident and theft risks tend to have higher insurance costs. |

| Coverage and Deductibles | Opting for higher deductibles and tailored coverage can reduce premiums. |

| Insurance Provider | Comparing quotes from multiple providers ensures you find the most competitive rates. |

Strategies for Securing Cheap Auto Insurance

Achieving cheap auto insurance is not merely a matter of chance; it requires a strategic approach and a thorough understanding of the insurance landscape. Here are some effective strategies to help you secure the most affordable coverage:

Shop Around and Compare Quotes

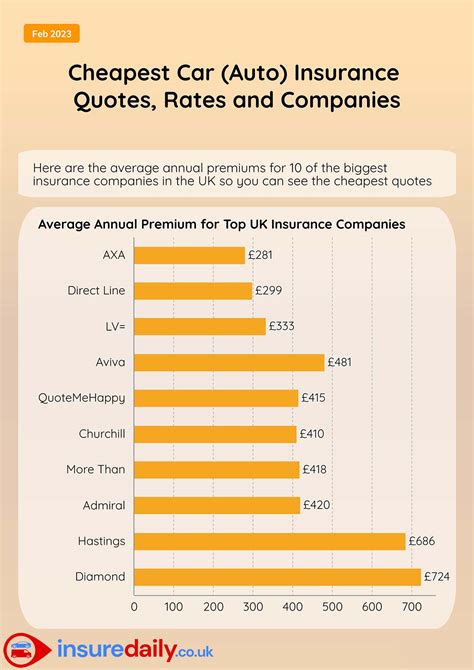

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so it’s essential to shop around to identify the most competitive offers. Online comparison tools and insurance brokerages can simplify this process, allowing you to quickly assess a range of quotes based on your specific needs.

Bundle Policies and Take Advantage of Discounts

Many insurance providers offer discounts when you bundle multiple policies with them. For instance, you can bundle your auto insurance with homeowners or renters insurance, or even life insurance, to potentially save on each policy. Additionally, inquire about other discounts you may qualify for, such as safe driver discounts, loyalty discounts, or discounts for completing defensive driving courses.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurers to assess your driving behavior and habits. By installing a tracking device or using an app to monitor your driving, these programs can provide more accurate assessments of your risk level. If you have a safe driving record and drive fewer miles, you may be eligible for lower premiums with usage-based insurance.

Improve Your Credit Score

Believe it or not, your credit score can impact your auto insurance premiums. Many insurers use credit-based insurance scoring to assess your financial responsibility and predict your likelihood of filing claims. Maintaining a good credit score can lead to lower insurance rates. If you have a low credit score, focus on improving it through responsible financial habits, as this can have a positive impact on your insurance costs over time.

Maintain a Clean Driving Record

Your driving record is a critical factor in determining your insurance premiums. A clean driving record, free from accidents and traffic violations, is highly favored by insurance companies. If you have a history of accidents or violations, consider taking a defensive driving course to improve your record and potentially qualify for lower rates. Additionally, ensure you adhere to traffic laws and drive responsibly to avoid future incidents that could impact your insurance costs.

Best Practices for Cheap Auto Insurance

Obtaining cheap auto insurance involves more than just finding the lowest premium. It’s essential to ensure you’re getting the coverage you need at a price that aligns with your budget. Here are some best practices to keep in mind when seeking cheap auto insurance:

Understand Your Coverage Needs

Before shopping for insurance, assess your coverage needs. Consider factors such as the value of your vehicle, the likelihood of accidents or theft in your area, and your personal financial situation. This evaluation will help you determine the appropriate level of coverage, including liability, collision, and comprehensive insurance, to protect yourself and your assets.

Research and Review Provider Reputation

When comparing insurance providers, it’s crucial to research their reputation and financial stability. Look for companies with a strong track record of customer satisfaction and prompt claim processing. Check online reviews and ratings to gauge their reliability and service quality. Additionally, ensure the provider is financially stable to guarantee they can honor your policy and pay out claims in the event of an accident.

Understand Policy Exclusions and Limitations

Cheap auto insurance policies may come with certain exclusions and limitations. Carefully review the policy terms and conditions to understand what is and isn’t covered. Pay attention to any deductibles, coverage limits, and exclusions that could impact your protection in the event of an accident or other incidents. Being aware of these details ensures you’re not caught off guard if you need to file a claim.

Regularly Review and Update Your Policy

Your insurance needs may change over time, so it’s essential to review your policy annually or whenever your circumstances change significantly. Factors such as a new vehicle, a move to a different location, or a change in marital status can impact your insurance requirements. Regularly reviewing your policy ensures it remains aligned with your needs and allows you to take advantage of any new discounts or coverage options that may become available.

The Future of Cheap Auto Insurance

The auto insurance landscape is continually evolving, driven by technological advancements and changing consumer needs. As we move forward, several trends and innovations are shaping the future of cheap auto insurance. Here’s a glimpse into what we can expect:

Telematics and Data-Driven Insurance

Telematics, the technology behind usage-based insurance, is expected to play an increasingly prominent role in determining insurance premiums. With the ability to collect real-time data on driving behavior, insurers can more accurately assess risk and offer personalized premiums. This data-driven approach may lead to more tailored and affordable insurance options for responsible drivers.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are transforming the insurance industry. These technologies can analyze vast amounts of data to identify patterns and predict risk more accurately. By leveraging AI, insurers can offer more precise pricing models, leading to potentially lower premiums for drivers with favorable risk profiles.

Autonomous Vehicles and Reduced Accidents

The widespread adoption of autonomous vehicles has the potential to revolutionize road safety. With advanced driver assistance systems and self-driving capabilities, the number of accidents is expected to decrease significantly. As a result, insurance premiums may gradually decline as the risk of accidents becomes less prevalent. However, this transition may take time, and the full impact on insurance costs is yet to be seen.

Increased Focus on Preventative Care

The insurance industry is recognizing the importance of preventative care and wellness initiatives. By encouraging safe driving habits and offering incentives for drivers to maintain their vehicles, insurers can reduce the likelihood of accidents and claims. This shift towards preventative measures could lead to more affordable insurance options for responsible drivers who take proactive steps to minimize risks.

The Rise of Insurtech and Digital Innovation

Insurtech, the intersection of insurance and technology, is driving significant innovation in the industry. Startups and established insurers are leveraging digital technologies to streamline processes, improve customer experiences, and offer more personalized insurance products. The continued adoption of digital tools and platforms is expected to enhance efficiency, reduce costs, and make insurance more accessible and affordable for consumers.

Can I Get Cheap Auto Insurance with a Poor Driving Record?

+While a poor driving record may limit your options for cheap auto insurance, it’s not impossible to find affordable coverage. Consider shopping around for providers who specialize in high-risk drivers or offer programs to help improve your driving record. Additionally, focus on improving your driving habits and taking steps to reduce your risk profile over time.

Are There Any Hidden Costs with Cheap Auto Insurance Policies?

+It’s important to thoroughly review the terms and conditions of any cheap auto insurance policy to understand any potential hidden costs. Some policies may have higher deductibles or exclusions that could result in unexpected expenses if you need to file a claim. Always read the fine print and clarify any uncertainties with your insurance provider.

How Can I Save Money on Auto Insurance if I’m a Young Driver?

+As a young driver, your insurance premiums are often higher due to your lack of driving experience. To save money, consider taking a defensive driving course, which may qualify you for a discount. Additionally, maintain a clean driving record and explore options for bundling your auto insurance with other policies, such as renters or life insurance, to potentially reduce costs.

What Are Some Common Mistakes to Avoid When Seeking Cheap Auto Insurance?

+When searching for cheap auto insurance, avoid common pitfalls such as choosing the first quote you receive without comparing other options. Additionally, be cautious of policies that offer extremely low premiums, as they may have significant exclusions or limitations. Always thoroughly review the coverage and terms before committing to a policy.