Marketplace Medical Insurance Plans

In today's healthcare landscape, understanding the intricacies of medical insurance plans is crucial, especially when navigating online marketplaces. This comprehensive guide aims to shed light on the diverse range of plans available, their unique features, and how they can cater to various individual needs. From cost-sharing arrangements to premium subsidies, we'll explore the key elements that make each plan distinct and help consumers make informed choices. Join us as we delve into the world of marketplace medical insurance plans, offering expert insights and real-world examples to empower your healthcare decisions.

Exploring the Diverse Landscape of Marketplace Medical Insurance Plans

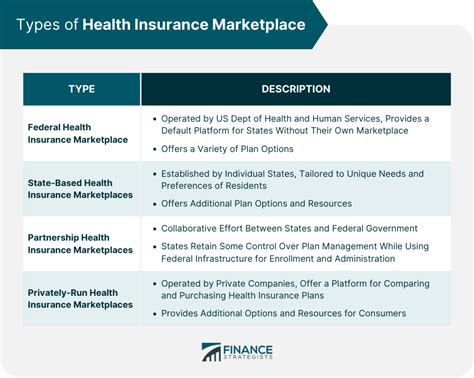

The realm of healthcare insurance is vast and complex, especially when considering the various options available through online marketplaces. These marketplaces, often government-run or private exchanges, offer a plethora of plans tailored to meet the diverse needs of individuals and families. Understanding the nuances of these plans is essential to making informed decisions about one’s healthcare coverage.

Types of Marketplace Medical Insurance Plans

Marketplace medical insurance plans can be broadly categorized into several types, each with its own set of characteristics and benefits. Here’s an overview of the most common types:

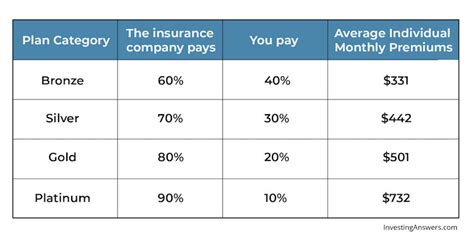

- Bronze Plans: These plans typically have the lowest premiums but higher deductibles and out-of-pocket costs. They are ideal for individuals who are generally healthy and don’t anticipate frequent medical expenses.

- Silver Plans: Offering a balance between premiums and out-of-pocket costs, silver plans are a popular choice. They often come with a moderate deductible and provide cost-sharing for certain services.

- Gold Plans: Known for their comprehensive coverage, gold plans usually have higher premiums but lower out-of-pocket costs. They are suitable for those with chronic conditions or who anticipate regular medical care.

- Platinum Plans: As the name suggests, these plans offer the highest level of coverage with the lowest out-of-pocket costs. However, they come with the highest premiums, making them a luxury choice for those who can afford it.

- Catastrophic Plans: Designed for young adults and those under 30, catastrophic plans have low premiums and high deductibles. They provide coverage for major medical events but may not cover routine care.

Understanding Cost-Sharing and Premium Subsidies

A critical aspect of marketplace medical insurance plans is the concept of cost-sharing. This refers to the split of healthcare expenses between the insurer and the policyholder. Plans may have different cost-sharing arrangements, such as deductibles, copayments, and coinsurance. For instance, a plan with a high deductible may require the policyholder to pay a larger portion of their medical bills before the insurance coverage kicks in.

Additionally, premium subsidies play a significant role in making insurance more affordable. These subsidies, available to eligible individuals and families, can reduce the cost of monthly premiums. The amount of subsidy depends on factors like income, family size, and the cost of insurance in the local area. Premium subsidies are a key incentive for many to enroll in marketplace plans.

Real-World Examples and Case Studies

Let’s delve into some real-world examples to better understand how marketplace medical insurance plans work in practice. Consider the case of a healthy young professional, John, who resides in a metropolitan area. With a limited budget for healthcare, John opts for a Bronze plan, paying a low premium each month. However, when he sustains a minor injury and requires medical attention, he discovers that his out-of-pocket costs are substantial due to the high deductible associated with his plan.

On the other hand, Sarah, a middle-aged individual with a pre-existing condition, chooses a Gold plan. Despite a higher premium, Sarah's plan offers more comprehensive coverage, reducing her out-of-pocket expenses when she needs regular medical treatment. The cost-sharing arrangement in her plan provides peace of mind, knowing that her financial burden is minimized.

| Plan Type | Premium (Monthly) | Deductible | Out-of-Pocket Limit |

|---|---|---|---|

| Bronze | $300 | $6,000 | $7,500 |

| Silver | $350 | $3,000 | $5,000 |

| Gold | $500 | $2,000 | $4,000 |

| Platinum | $700 | $1,500 | $3,000 |

Analyzing the Performance and Value of Marketplace Medical Insurance Plans

When it comes to marketplace medical insurance plans, evaluating their performance and value is essential for consumers. This section delves into the metrics and factors that influence the overall quality and cost-effectiveness of these plans, providing insights to help individuals make informed choices.

Assessing Plan Performance Metrics

To understand the effectiveness of marketplace medical insurance plans, several performance metrics come into play. These metrics offer a comprehensive view of how well a plan delivers on its promises and caters to its policyholders’ needs. Here are some key metrics to consider:

- Claim Satisfaction Rate: This metric measures policyholders’ satisfaction with the claims process. A high claim satisfaction rate indicates that the plan efficiently processes and pays out claims, ensuring a positive experience for its members.

- Network Adequacy: The network of healthcare providers associated with a plan is crucial. A plan with a robust network ensures policyholders have access to a wide range of high-quality medical services without excessive out-of-network costs.

- Member Retention Rate: High member retention is a positive indicator of a plan’s overall performance. It suggests that policyholders are satisfied with the coverage and services offered, leading them to renew their policies year after year.

- Quality of Care Measures: Plans should prioritize the quality of care their members receive. This includes assessing patient outcomes, patient satisfaction, and the plan’s ability to manage chronic conditions effectively.

- Cost of Care: While cost is a significant factor, it’s essential to analyze the overall cost of care, including premiums, deductibles, copays, and other out-of-pocket expenses. Plans with lower overall costs may provide better value, especially for those with frequent medical needs.

Evaluating Value and Cost-Effectiveness

Determining the value and cost-effectiveness of marketplace medical insurance plans involves a nuanced analysis. It’s not solely about the lowest premium but rather about finding the plan that offers the best balance between coverage, quality of care, and financial considerations. Here are some factors to consider:

- Coverage Limits and Exclusions: Carefully review the plan’s coverage limits and exclusions. Some plans may have restrictive coverage for certain conditions or treatments, which could lead to unexpected out-of-pocket expenses.

- Prescription Drug Coverage: For those who rely on prescription medications, ensuring comprehensive drug coverage is crucial. Plans with robust drug coverage and competitive pricing can significantly impact overall healthcare costs.

- Preventive Care Benefits: Marketplace plans often offer preventive care services at little to no cost. These benefits, such as annual check-ups, screenings, and immunizations, can help identify and manage health issues early on, potentially reducing future healthcare costs.

- Chronic Condition Management: Plans that specialize in managing chronic conditions can be highly valuable for individuals with long-term health needs. These plans often provide specialized care teams and resources to help manage conditions effectively.

- Premium Stability: While premiums can fluctuate from year to year, plans with a history of stable premiums may offer more predictability in budgeting. It’s essential to consider not just the current premium but also the plan’s historical trend.

Case Study: Evaluating Value in Marketplace Plans

Let’s consider a hypothetical case study to illustrate the evaluation process. Imagine a family with two young children seeking a marketplace medical insurance plan. They prioritize comprehensive coverage and access to a wide range of healthcare services. After comparing several plans, they narrow their options based on the following factors:

- Plan A: Offers a robust network of providers, including specialists and hospitals, ensuring easy access to care. However, it has slightly higher premiums and a modest deductible.

- Plan B: Provides competitive premiums and a lower deductible but has a more limited network, potentially requiring out-of-network visits for certain services.

In this scenario, the family opts for Plan A, valuing the extensive network and the peace of mind it provides. While the premiums are slightly higher, the plan's performance metrics, including high member satisfaction and quality of care, make it a worthwhile investment for their healthcare needs.

Navigating the Future of Marketplace Medical Insurance Plans

As we look ahead, the landscape of marketplace medical insurance plans is poised for evolution and innovation. The ongoing advancements in healthcare technology, changing consumer preferences, and policy reforms are shaping the future of these plans. This section explores the emerging trends and potential transformations that could redefine the marketplace insurance experience.

Emerging Trends and Innovations

The marketplace medical insurance industry is witnessing a wave of innovative trends that aim to enhance the consumer experience and improve overall healthcare outcomes. Here are some notable developments:

- Digital Health Solutions: The integration of digital health technologies is revolutionizing how marketplace plans engage with their members. Telehealth services, mobile apps for managing health records and prescriptions, and digital tools for chronic condition management are becoming increasingly common, offering convenience and improved access to care.

- Value-Based Care Models: Shifting from a fee-for-service model, some marketplace plans are embracing value-based care. This approach focuses on the quality and outcomes of care, rewarding providers for delivering efficient and effective treatment. It encourages preventive care and coordinated management of chronic conditions, potentially reducing overall healthcare costs.

- Consumer-Centric Designs: Recognizing the importance of consumer satisfaction, marketplace plans are adopting more consumer-centric designs. This includes personalized plan options, simplified enrollment processes, and enhanced member engagement through educational resources and wellness programs.

- Network Expansion and Collaboration: Plans are expanding their networks to include a broader range of providers, ensuring policyholders have access to diverse healthcare services. Additionally, collaborations between plans and healthcare providers are fostering more efficient care coordination and integrated treatment plans.

- Artificial Intelligence and Analytics: AI and advanced analytics are being leveraged to improve risk assessment, predict healthcare needs, and optimize plan design. These technologies enable plans to offer more tailored coverage and identify cost-saving opportunities.

Potential Future Developments and Implications

Looking ahead, several potential developments could significantly impact the future of marketplace medical insurance plans. These transformations have the potential to enhance accessibility, affordability, and overall consumer satisfaction:

- Universal Coverage Initiatives: The push for universal healthcare coverage may lead to more comprehensive and accessible marketplace plans. This could involve expanding Medicaid eligibility, implementing public option plans, or other initiatives to ensure that more individuals have affordable insurance options.

- Increased Competition: As more players enter the marketplace, competition may drive down costs and improve plan offerings. Increased competition could also lead to more specialized plans, catering to specific demographics or health needs.

- Expanded Subsidies and Support: Policy reforms may result in expanded premium subsidies and financial assistance for eligible individuals and families. This could make marketplace plans more affordable, especially for those with lower incomes.

- Integrated Care Models: The integration of physical and mental healthcare services, along with social support, could become a standard feature of marketplace plans. This holistic approach to healthcare aims to address the multifaceted needs of individuals, promoting overall well-being.

- Data-Driven Personalization: With advancements in data analytics, marketplace plans may offer increasingly personalized coverage. Plans could adapt to individual health needs, providing tailored benefits and resources based on each member’s unique healthcare journey.

FAQ - Frequently Asked Questions

What is the difference between marketplace medical insurance plans and traditional insurance plans?

+Marketplace medical insurance plans are typically offered through government-run or private exchanges, providing a range of options for individuals and families. Traditional insurance plans, on the other hand, are often employer-sponsored or purchased directly from insurance companies. Marketplace plans often come with premium subsidies and cost-sharing reductions, making them more affordable for certain individuals.

How can I determine which marketplace plan is best for me?

+Assessing your healthcare needs and financial situation is key. Consider factors like your expected healthcare expenses, the plan’s network of providers, and any specific benefits you require. Comparing multiple plans based on these factors will help you choose the one that aligns with your needs and budget.

Are there any limitations or exclusions I should be aware of when choosing a marketplace plan?

+Yes, it’s essential to review the plan’s coverage limits and exclusions. Some plans may have restrictions on certain procedures, treatments, or medications. Understanding these limitations can help you avoid unexpected out-of-pocket costs or denied claims.

Can I change my marketplace plan during the year if my needs change?

+Generally, marketplace plans have specific enrollment periods. However, qualifying life events, such as marriage, birth of a child, or loss of other health coverage, may allow you to make changes outside of these periods. It’s important to review the guidelines and understand your options for plan changes.

How can I stay informed about changes and updates to marketplace medical insurance plans?

+Staying updated on marketplace plan changes is crucial. You can subscribe to newsletters or follow trusted healthcare websites and blogs. Additionally, attending community events or webinars related to healthcare insurance can provide valuable insights and keep you informed about the latest developments.